Decree No. 189/2013/ND-CP amendments No 59/2011/ND-CP transformation into joint-stock companies đã được thay thế bởi Decree 126/2017/ND-CP on conversion from state owned enterprises into joint-stock companies và được áp dụng kể từ ngày 01/01/2018.

Nội dung toàn văn Decree No. 189/2013/ND-CP amendments No 59/2011/ND-CP transformation into joint-stock companies

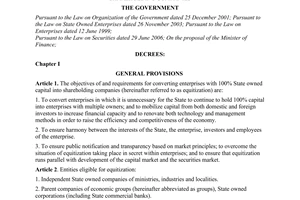

THE GOVERNMENT | SOCIALIST REPUBLIC OF VIET NAM |

No. 189/2013/ND-CP | Hanoi, November 20, 2013 |

DECREE

AMENDMENTS AND SUPPLEMENTS TO SOME ARTICLES OF DECREE NO 59/2011/ND-CP DATED JULY 18, 2011 OF THE GOVERNMENT ON TRANSFORMATION OF WHOLLY STATE-OWNED ENTERPRISES INTO JOINT-STOCK COMPANIES

Pursuant to the Law on Organization of the Government dated December 25, 2001;

Pursuant to the Law on Enterprises dated November 29, 2005;

Pursuant to the Securities Law dated June 29, 2006;

At the proposal of the Minister of Finance,

Government issued Decree amending and supplementing some articles of Decree No. 59/2011/ND-CP on transformation of wholly state-owned enterprises into joint-stock companies.

Article 1: Amendments to some articles of Decree No. 59/2011/ND-CP on transformation of wholly state-owned enterprises into joint-stock companies as follows:

1. Clause 7 of Article 14 is amended as follows:

“7. Equitization of Parent companies of state economic groups or state corporations, parent companies in a parent company - subsidiaries relationship with public service providers (hospitals, schools, institutes) will be handled as follows:

a) In case equitized enterprises continue taking over, it is needed to carry out valuation included in equitized enterprise value.

b) In case equitized enterprises do not takeover, it is needed to send a report to the Prime Minister for consideration and decision to transfer to the relevant ministries to implement socialization as prescribed by law. The procedures for transformation must comply with the law. While pending the transformation, the governing ministries, People's Committees of provinces continue exercising the right to represent the state capital in these units.

2. Clause 3 Article 22 is amended as follows:

3. The agency competent to decide the equitization plan shall select a valuation consultancy organization to provide consultancy on the enterprise valuation as follow:

a) For valuation consultancy contract which is not worth more than 03 billion, the competent authority may appoint a valuation consultancy organization in the list published by the Ministry of Finance instead of holding a bidding; in case bidding is necessary, a bidding shall be organized to select an organization under the provisions of the bidding law.

b) For valuation consultancy contracts not specified in Point a Clause 3 of this Article, the agency competent to decide the equitization plan shall hold a bidding to select an organization providing consultancy and valuation services under regulations”

3. Point b, Clause 1, Article 26 is amended as follows:

b/ It is unable to sell its shares within 18 months from the time of enterprise valuation, except for particular cases decided by the Prime Minister.

4. Clause 1, Article 27 is amended as follows:

“Article 27. State audit of equitized enterprises

1. Objects and scope of audit:

Based on the determined enterprise value for equitization determined by the consultancy organization and opinions of the agency competent to valuate enterprises (hereinafter referred to as valuating agency), before valuation, the State Audit shall audit such value and settle financial matters of:

- Parent companies of state economic groups.

- Parent companies of State corporations and single-member limited liability companies when requested by the Prime Minister.

5. Clause 4 is added to Article 28:

“4. In some cases (the time of equitization does not coincide with the time of inventory, finalization of accounting books, financial statement, large-sized enterprises, entities with large debts), by the time of the valuation business, some debts (receivable, payable) having full records have not been compared and certified in accordance with the provisions of Article 15 and Article 16 of this Decree, the Member Council of the equitized enterprise has to clearly explain the content of debts, define responsibility of collectives and individuals for debt comparison before the equitized enterprise is granted business registration certificates for the first time and send a report to the valuating agency to consider and decide according to values which are tracking on accounting books; it is also required to disclose the debts in the decision to approve the business value as well as the equitization plan as a basis for shares auction. At the time when the equitized enterprise is granted the first enterprise registration certificate, upon making a financial statement for handover from the wholly state-owned enterprises to the joint-stock company, if these debts are not compared and confirmed, they will be dealt with as follows:

a) The debts payable that have been compared by the enterprise without identifiable creditors shall be recorded as a corresponding increase in state capital, and the new joint-stock company shall keep and monitor the documents to fulfill the obligation to repay its debts when creditors require. Pursuant to relevant documents, legal materials and requirements of creditors, the new joint-stock company shall repay its debts and record them as cost incurred during the period;

b) In case the enterprise has followed procedures for debt comparison without being able to compare them, it is required to attribute responsibility of relevant collectives and individuals for compensation. Value of the remaining debt (after offsetting the compensation of individuals, groups, provision for bad debts) shall be aggregated with operating cost of the equitized enterprise. New joint-stock company shall keep and monitor the records for debt collection.

6. Article 31 is amended as follows:

Article 31. Value of land use rights (hereinafter referred to as land value)

1. For all land areas which is managed and used by an equitized enterprise as grounds for building its working offices and transaction offices; building production and business establishments; land for agricultural production, forestry, aquaculture or salt making (including land allocated by the State with or without collection of land levy), the equitized enterprise may make a land use plan and submit it to a competent agency for consideration and decision. Such land use plan must comply with regulations on rearrangement or handling of houses and land under the Prime Minister’s decisions and be sent to the People’s Committee of the province prior to the enterprise valuation.

2. For land areas of equitized enterprises which have been allocated land and on which land levy has been paid or lawfully received to be used for building houses for sale and building infrastructure for transfer or for lease, it is required to re-determine the land value to be included in the value of the enterprise as follows:

a) Land price used for determining the land value which is included in the value of the equitized enterprise is the price which approximates the price for transfer of land with similar purposes on the market determined by the People's Committee of the province (in the locality in which the enterprise has the allocated land area) but is not lower than the land prices imposed and announced by the People's Committees of provinces and at the time closest to the time of inclusion of the land price in the equitized enterprise value under the land law.

b) The positive difference between the re-determined land value specified at Point a Clause 2 of this Article and that recorded in accounting books (if any) shall be recorded as an increase in the state capital in the equitized enterprise.

In case the re-determined land value is lower than the actual cost of land recorded in accounting books, the land price currently recorded by the enterprise shall be used.

In case an enterprise changes the use purpose of its allocated land, an additional amount must be paid for the difference in land value resulting from the change in accordance with land law.

3. Land areas allocated to an enterprise, including land areas for production and provision of public services and facilities (parks, greeneries, bus stations, irrigation works, etc.), which are exempt from land levy under the land law, may be excluded when determining the land value to be included in the equitized enterprise value. Land areas used for public works with a safety corridor under the land law may also be excluded under the competent authority’s decisions. Equitized enterprises shall manage and use these land areas for the intended purposes and in line with provisions of the law on land.

The Ministry of Natural Resources and Environment shall provide instructions on determination of land area not included in enterprise value mentioned in this Article.

4. For land area allocated to the enterprise and has been used by the enterprise as capital contribution to establishment of a new legal entity, the agency competent to approve the equitization plan shall:

a) Transfer it to another wholly state-owned enterprise as a partner if accepted by other inventors in the new legal entity.

b) Include it in the value of the equitized enterprise in accordance with Article 33 of this Decree.

5. In other cases of land allocation decided by the Prime Minister's, it is required to determine the land value to be included in the enterprise value according to the principles specified in Clause 2 of this Article.

6. The enterprise equitized shall rent the remaining land area (after removing land area prescribed in Clauses 2, 3, 4 and 5 of this Article) for a certain period under provisions of the land law and is not required to include the value of the geographical advantage in the enterprise value under the following specific provisions:

a/ For leased land area of which the land rent is paid annually, the enterprise is allowed to continue paying land rent under the current laws and shall not include land rent in its value.

b/ Enterprises that had paid land rent in lump sum for the whole land lease term before the effective date of the Land Law 2003 shall re-determine the leased land value at the land rent rate at the time of equitization for the remaining land rent term to be included in the enterprise value. The positive difference arising due to the re-determination of the value of leased land shall be recorded as an increase in the state capital in the equitized enterprise.

c/ In case an enterprise that have been allocated land or lawfully received land to conduct its production and business operations is now leasing land, such enterprise must complete procedure for switching to land lease under the provisions of the law on land and submit it to equitization-deciding agencies, and local land management agencies. The value of the remaining allocated land at the time of determining the enterprise value is the land rent paid in advance for a certain period of time according to the market leasing rates at the time the enterprise completes procedure for leasing land at the local regulatory body.

7. The People’s Committees of provinces and centrally run cities (hereinafter referred to as provinces) shall:

a) Within 30 working days from the receipt of complete dossiers, the People’s Committees of provinces have to give official opinions on land plots which the enterprise will further use after the equitization and the land price which serves as a basis for valuation prescribed in point a Clause 2 this Article.

b/ In case the enterprise’s land use proposal is not conformable with the local planning and the land is not used for permissible purposes decided by a competent state agency in charge of rearrangement and handling of state-owned houses and land, the enterprise shall return the land to the State for being used for other purposes and the People’s Committees of provinces shall cooperate with the agency competent to decide the equitization plan to handle such land under regulations.

c/ After 30 working days from the receipt of complete dossiers if the People’s Committee of the province gives no official opinions on the land price under Point a, Clause 2 of this Article, the agency competent to decide the equitized enterprise value shall apply the latest land price announced by the People’s Committee of the province under the land law for calculating and determining the equitized enterprise value; and concurrently publicize the temporary calculation of this land value in the equitization plan.

When allocating land, the People’s Committees of provinces shall review and officially determine the obligation to pay land levy on the allocated land at the price which approximates the price for transfer of land with similar purposes on the market at the time of land allocation. Equitized enterprises shall remit this levy amount to the state budget this (including also the difference between the officially determined amount and the temporarily calculated one, if any) in order to be granted land use right certificates or to sign land lease contracts under the current land law.

d/ The People’s Committees of provinces shall request functional agencies to instruct equitized enterprises to complete the procedures for signing land lease contracts and applying for certificates of land use right, ownership of houses and other property on land under the provisions of current law of the land.

7. Point a Clause 4 Article 49 as follows is amended as follows:

“- To direct equitized enterprises according to equitization plan which has been approved be the Prime Minister:

+ To proactively prepare materials and legal documents about the business assets (including houses, land); land use plan after equitization; inventory of assets, debt comparison at the time the financial statements are created under the provisions of law.

+ To plan for equitization progress (including timelines for each step) and submit it to the agency competent to decide equitization for approval. In case the equitization progress is not carried out, the enterprise’s executive board is considered to fail to discharge their duties.”

Article 2: Implementation

1. The enterprises having completed the equitization or proceeding equitization (enterprise value has been determined and announced by competent authorities) before the effective date of this Decree shall continue receiving allocated land, leasing land, and calculating land value under approved plans, and are not regulated by Clauses 2, 3, 4, 5 and 6 of Article 31, which is amended in clause 6 of Article 1 of this Decree

2. The enterprises that have included the value of the geographical advantage of allocated land in the enterprise value and have recorded an increase in state capital in the enterprise when determining enterprise value for equitization, which is announced by the competent authorities under regulations before the Decree 59/2011/ND-CP became effective, may deduct the value of the geographical advantage from the land rent payable. Enterprises equitized pursuant to Decree No. 109/207/ND-CP without geographical advantage may apply Decree No. 59/207/ND-CP without obligation to add geographical advantage and adjust State capital in the enterprises.

Article 3. Effect and responsibility for implementation:

1. This Decree takes effect on January 15, 2014.

2. The Ministry of Finance, Ministry of Natural Resources and Environment; the State Audit and heads of other related agencies, within the ambit of their respective functions and tasks, are responsible for providing guidance on the implementation of this Decree.

3. Ministers, heads of ministerial-level agencies or government-attached agencies, chairpersons of People’s Committees of provinces, members’ councils of state economic groups and corporations established under decisions of the Prime Minister are responsible for implementing this Decree.-

| ON BEHALF OF THE GOVERNMENT |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft, for reference only. LawSoft is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft always welcome your comments