Circular No. 02/2000/TT-BTC of January 5, 2000, guiding the reimbursement of VAT on goods and services purchased by domestic organizations with foreign humanitarian aid money đã được thay thế bởi Circular No. 122/2000/TT-BTC of December 29th, 2000, on value added tax providing guidelines for implementation of Decree 79/2000/ND-CP of the Government dated 29 December 2000 making detailed provisions for implementation of Law on Value Added Tax (VAT). và được áp dụng kể từ ngày 01/01/2001.

Nội dung toàn văn Circular No. 02/2000/TT-BTC of January 5, 2000, guiding the reimbursement of VAT on goods and services purchased by domestic organizations with foreign humanitarian aid money

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 02/2000/TT-BTC |

Hanoi, January 5, 2000 |

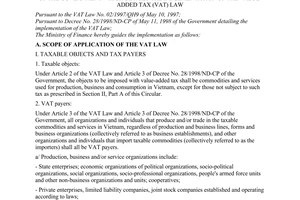

CIRCULAR

GUIDING THE REIMBURSEMENT OF VAT ON GOODS AND SERVICES PURCHASED BY DOMESTIC ORGANIZATIONS WITH FOREIGN HUMANITARIAN AID MONEY

Pursuant to the Value Added

Tax (VAT) Law;

Pursuant to the Government’s

Decree No. 28/1998/ND-CP of May 11, 1998 detailing the implementation of the

VAT Law;

Pursuant to the Prime Minister’s

Decision No. 28/1999/QD-TTg of February 23, 1999 issuing the Regulation on the

management and use of aid of foreign non-governmental organizations;

On the basis of the Prime Minister’s opinion in Document No. 4065/VPCP-KTTH of

September 6, 1999 of the Government Office;

The Ministry of Finance hereby guides the reimbursement of VAT on goods and

services purchased by domestic organizations with humanitarian aid money of

foreign governments as follows:

I. SUBJECTS ENTITLED TO VAT REIMBURSEMENT

Domestic organizations assigned to directly receive, manage and use humanitarian and emergency relief aid money donated by foreign non-governmental organizations to purchase of goods and services subject to VAT on the Vietnamese market, that have paid VAT recorded in the supplier’s goods or service sale invoices, shall be reimbursed the paid VAT amounts by the tax agency.

II. PROCEDURES FOR VAT REIMBURSEMENT

Every month, for cases where a domestic organization uses the aid money source to purchase goods and/or services regularly in many months; or

After each purchase of goods and/or services, for cases where a domestic organization purchases goods and/or services in batch or shipment not regularly every month;

The domestic organization shall send a dossier requesting VAT reimbursement to the tax agency (the provincial/municipal Tax Department) of the locality where it is headquartered. Such a dossier consists of:

+ An official dispatch requesting the reimbursement of the VAT amount already paid for goods and/or services purchased with the humanitarian aid money of a foreign non-governmental organization(s), clearly stating the name of the domestic organization and its bank deposit account;

+ The list of invoices of goods and/or services purchased with the foreign non-governmental organization’s humanitarian aid money (according to form No. 03/GTGT issued together with the Finance Ministry’s Circular No. 89/1998/TT-BTC OF June 27, 1998);

+ The copy of the aid approval decision of the competent authority (the Prime Minister, a minister, a People’s Committee president, the head of a ministerial-level agency or an agency attached to the Government, the head of a mass organization) as prescribed in Article 5, Decision No. 28/1998/QD-TTg.

+ The written certification of the Finance Ministry’s Committee for Management of Aid Reception regarding the aid of the foreign non-governmental organization, clearly stating the name of the donating organization, the aid value, the agency receiving and managing the aid money, the name of the seller that sells the goods and/or services to the domestic organization that receives and manages the aid money;

Within 15 days from the date of receipt of the domestic organization’s dossier requesting the VAT reimbursement, the tax agency shall have to examine the dossier and reimburse VAT to the domestic organization. Where it is necessary to examine, verify and/or supplement... the dossier, the maximum time limit is 30 days. After the examination, if the procedures have been completed and necessary conditions met, and the determination of the VAT amount to be reimbursed, the director of the Tax Department shall make a decision on tax reimbursement.

The State Treasury shall have to carry out the procedures for reimbursing tax amount to the domestic organization within three days after receiving the tax reimbursement decision and the VAT payment authorization letter sent by the tax agency.

III. IMPLEMENTATION PROVISIONS

The VAT amounts shall be reimbursed from the VAT reimbursement fund. Domestic organizations that are reimbursed tax amounts must use such tax amounts for the right humanitarian and emergency relief purposes

Tax reimbursement-requesting domestic organizations shall be responsible for the accuracy of the declared data related to the determination of the reimbursed tax amounts, must keep invoices and vouchers on the purchase of goods and/or services eligible for tax reimbursement according to the regulations. All cases of mistakes or use of the reimbursed tax amounts for wrong purposes, if detected through examination by the tax agency, shall be handled and all tax arrears must be paid and, depending on the nature and seriousness of the violations, shall be also administratively sanctioned or examined for penal liability as prescribed by law.

The VAT reimbursement guided in this Circular shall be applicable to cases where goods and services have been purchased by domestic organizations with the source of humanitarian aid money since January 1st, 1999.

|

|

FOR THE MINISTER OF FINANCE |