Decision no. 110/2001/QD/BTC of October 31, 2001 on amending, supplementing names and tax rates of commodity items of heading no. 2710 in the preferential import tariff đã được thay thế bởi Decision No. 110/2003/QD-BTC of July 25, 2003, promulgating the preferential import tariffs. và được áp dụng kể từ ngày 01/09/2003.

Nội dung toàn văn Decision no. 110/2001/QD/BTC of October 31, 2001 on amending, supplementing names and tax rates of commodity items of heading no. 2710 in the preferential import tariff

|

THE MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 110/2001/QD/BTC |

Hanoi, October 31, 2001 |

DECISION

ON AMENDING, SUPPLEMENTING NAMES AND TAX RATES OF COMMODITY ITEMS OF HEADING NO. 2710 IN THE PREFERENTIAL IMPORT TARIFF

THE MINISTER OF FINANCE

Pursuant to the Government’s Decree No.15/CP

dated March 2, 1993 on the tasks, powers and State management responsibilities of

the ministries and ministerial-level agencies;

Pursuant to the Government Government’s Decree No.178/CP dated October 28, 1994

on the tasks, powers and organizational structure of the Ministry of Finance;

Pursuant to the tax rate bracket specified in the Import Tariff for the list of

taxable commodity groups, promulgated together with Resolution

No.63/NQ-UBTVQH10 dated October 10, 1998 of the Xth National

Assembly Standing Committee;

Pursuant to Article 1 of the Government’s Decree No.94/1998/ND-CP dated

November 17, 1998, which details the implementation of the Law Amending and

Supplementing a Number of Articles of Export Tax and Import Tax Law

No.04/1998/QH10 dated May 20, 1998;

At the proposal of the General Director of Tax,

DECIDES:

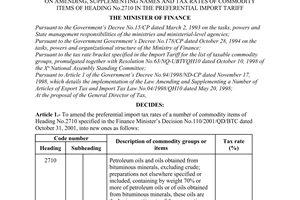

Article 1.- To amend the preferential import tax rates of a number of commodity items of Heading No.2710 specified in the Finance Minister’s Decision No.107/2001/QD/BTC dated October 18, 2001, into new ones as follows:

|

Code number |

Description of commodity groups or items |

Tax rate (%) |

||

|

Heading |

Subheading |

|||

|

2710 |

|

|

Petroleum oils and oils obtained from bituminous minerals, excluding crude; preparations not elsewhere specified or included, containing by weight 70% or more of petroleum oils or of oils obtained from bituminous minerals, these oils are the basic constituents of the preparations |

|

|

|

|

|

- Gasoline of all kinds: |

|

|

2710 |

00 |

11 |

-- Aircraft gasoline |

15 |

|

2710 |

00 |

12 |

-- Solvent gasoline |

10 |

|

2710 |

00 |

19 |

-- Gasoline of other kinds |

70 |

|

2710 |

00 |

20 |

- Diesel |

25 |

|

2710 |

00 |

30 |

- Fuel oil |

0 |

|

2710 |

00 |

40 |

- Jet fuel (TC1, ZA1...) |

25 |

|

2710 |

00 |

50 |

- Kerosene of common type |

20 |

|

2710 |

00 |

60 |

- Naphtha, Reformate and other preparations for mixing gasoline |

70 |

|

2710 |

00 |

70 |

- Condensate and similar preparations |

45 |

|

2710 |

00 |

90 |

- Others |

10 |

Article 2.- This Decision takes effect and applies to import goods declarations already submitted to the customs offices from November 2, 2001. The previous stipulations, which are contrary to this Decision, are now all annulled.

|

|

P.P THE

MINISTER OF FINANCE |