Decision no. 12/2006/QD-BTC of March 03, 2006 adjusting the preferential import tax rates of a number of accessories and spare parts of electric and refrigerating products for domestic use đã được thay thế bởi Decision No. 39/2006/QD-BTC of July 28, 2006, promulgating the export tariff and the preferential import tariff. và được áp dụng kể từ ngày 15/09/2006.

Nội dung toàn văn Decision no. 12/2006/QD-BTC of March 03, 2006 adjusting the preferential import tax rates of a number of accessories and spare parts of electric and refrigerating products for domestic use

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 12/2006/QD-BTC |

Hanoi, March 03, 2006 |

DECISION

ADJUSTING THE PREFERENTIAL IMPORT TAX RATES OF A NUMBER OF ACCESSORIES AND SPARE PARTS OF ELECTRIC AND REFRIGERATING PRODUCTS FOR DOMESTIC USE

THE MINISTER OF FINANCE

Pursuant

to Law No. 45/2005/QH11 of June 14, 2005, on Import Tax and Export Tax;

Pursuant to the National Assembly Standing Committee’s Resolution No.

977/2005/NQ-UBTVQH11 of December 13, 2005, promulgating the Export Tariff

according to the list of taxable commodity groups and the tax rate bracket for

each commodity group and the Preferential Import Tariffs according to the list

of taxable commodity groups and the preferential tax rate bracket for each

commodity group;

Pursuant to the Government’s Decree No. 86/2002/ND-CP of November 5, 2002,

defining the functions, tasks, powers and organizational structures of

ministries and ministerial-level agencies;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, tasks, powers and organizational structure of the Ministry of

Finance;

Pursuant to the Government’s Decree No. 149/2005/ND-CP of December 8, 2005,

detailing the implementation of the Law on Import Tax and Export Tax;

At the proposal of the director of the Tax Policy Department,

DECIDES:

Article 1.- To amend the preferential import tax rates of a number of accessories and spare parts of electric and refrigerating products for domestic use specified in the Finance Minister’s Decision No. 110/2003/QD-BTC of July 25, 2003, which were amended in Decision No. 90/2004/QD-BTC of November 25, 2004, into new ones provided for in the lists enclosed herewith.

Article 2.- This Decision takes effect and applies to customs declarations of imported goods registered with customs offices 15 days after its publication in “CONG BAO.”

|

|

FOR THE MINISTER OF FINANCE |

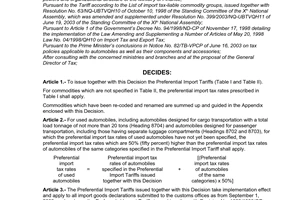

APPENDIX 1

LIST OF AMENDED PREFERENTIAL TAX RATES OF A NUMBER OF SPARE

PARTS AND ACCESSORIES OF ELECTRIC AND REFRIGERATING PRODUCTS FOR DOMESTIC USE

SPECIFIED IN THE PREFERENTIAL IMPORT TARIFFS (TABLE I)

(Issued together

with the Finance Minister’s Decision No. 12/2006/QD-BTC of March 3, 2006)

|

Code |

Descriptions |

Tax rate (%) |

||

|

2903 |

|

|

Halogenated derivatives of hydrocarbons |

|

|

|

|

|

‑ Saturated chlorinated derivatives of acyclic hydrocarbons: |

|

|

2903 |

11 |

|

- - Chloromethane (methyl chloride) and chloroethane (ethylhloride): |

|

|

2903 |

11 |

10 |

- - - Methyl chloride used in the manufacture of herbicides |

5 |

|

2903 |

11 |

90 |

- - - Other |

5 |

|

2903 |

12 |

00 |

- - Dichloromethane (methylene chloride) |

0 |

|

2903 |

13 |

00 |

- - Chloroform (trichloromethane) |

0 |

|

2903 |

14 |

00 |

- - Carbon tetrachloride |

5 |

|

2903 |

15 |

00 |

- - 1,2‑Dichloroethane (ethylene dichloride) |

5 |

|

2903 |

19 |

|

- - Other: |

|

|

2903 |

19 |

10 |

- - - 1,1,1-trichloroethane (methyl chloroform) |

5 |

|

2903 |

19 |

90 |

- - - Other |

5 |

|

|

|

|

‑ Unsaturated chlorinated derivatives of acyclic hydrocarbons: |

|

|

2903 |

21 |

|

- - Vinyl chloride (chloroethylene): |

|

|

2903 |

21 |

10 |

- - - Vinyl chloride monomer (VCM) |

0 |

|

2903 |

21 |

90 |

- - - Other |

5 |

|

2903 |

22 |

00 |

- - Trichloroethylene |

5 |

|

2903 |

23 |

00 |

- - Tetrachloroethylene (perchloroethylene) |

5 |

|

2903 |

29 |

00 |

- - Other |

5 |

|

2903 |

30 |

|

- Fluorinated, brominated or iodinated derivatives of acyclic hydrocarbons: |

|

|

2903 |

30 |

10 |

- - Iodoform |

5 |

|

2903 |

30 |

20 |

- - Methyl bromide |

0 |

|

2903 |

30 |

90 |

- - Other |

5 |

|

|

|

|

‑ Halogenated derivatives of acyclic hydrocarbons containing two or more different halogens: |

|

|

2903 |

41 |

00 |

- - Trichlorofluoromethane |

5 |

|

|

|

|

‑ Halogenated derivatives of acyclic hydrocarbons containing two or more different halogens: |

|

|

2903 |

41 |

00 |

- - Trichlorofluoromethane |

5 |

|

2903 |

42 |

00 |

- - Dichlorodifluoromethane |

5 |

|

2903 |

43 |

00 |

- - Trichlorotrifluoroethanes |

5 |

|

2903 |

44 |

00 |

- - Dichlorotetrafluoroethanes and chloropentafluoroethane |

5 |

|

2903 |

45 |

|

- - Other derivatives perhalogenated only with fluorine and chlorine: |

|

|

2903 |

45 |

10 |

- - - Chlorotrifluoromethane |

5 |

|

|

|

|

- - - Derivatives of ethane: |

|

|

2903 |

45 |

21 |

- - - - Pentachlorofluoroethane |

5 |

|

2903 |

45 |

22 |

- - - - Tetrachlorodifluoroethane |

5 |

|

|

|

|

- - - Derivatives of propane: |

|

|

2903 |

45 |

31 |

- - - - Heptachlorofluoropropanes |

5 |

|

2903 |

45 |

32 |

- - - - Hexachlorodifluoropropanes |

5 |

|

2903 |

45 |

33 |

- - - - Pentachlorotrifluoropropanes |

5 |

|

2903 |

45 |

34 |

- - - - Tetrachlorotetrafluoropropanes |

5 |

|

2903 |

45 |

35 |

- - - - Trichloropentafluoropropanes |

5 |

|

2903 |

45 |

36 |

- - - - Dichlorohexafluoropropanes |

5 |

|

2903 |

45 |

37 |

- - - - Chloroheptafluoropropanes |

5 |

|

2903 |

45 |

90 |

- - - Other |

5 |

|

2903 |

46 |

00 |

- - Bromochlorodifluoromethane, bromotrifluoromethane and dibromotetrafluoroethanes |

5 |

|

2903 |

47 |

00 |

- - Other perhalogenated derivatives |

5 |

|

2903 |

49 |

|

- - Other: |

|

|

2903 |

49 |

10 |

- - - Derivatives of methane, ethane or propane, halogenated only with fluorine and chlorine |

5 |

|

2903 |

49 |

20 |

- - - Derivatives of methane, ethane or propane, halogenated only with fluorine and bromine |

5 |

|

2903 |

49 |

90 |

- - - Other |

5 |

|

|

|

|

‑ Halogenated derivatives of cyclanic, cyclenic or cycloterpenic hydrocarbons: |

|

|

2903 |

51 |

00 |

- - 1, 2, 3, 4, 5, 6‑Hexachlorocyclohexane |

5 |

|

2903 |

59 |

00 |

- - Other |

5 |

|

|

|

|

‑ Halogenated derivatives of aromatic hydrocarbons: |

|

|

2903 |

61 |

00 |

- - Chlorobenzene, o‑dichlorobenzene and p‑dichlorobenzene |

5 |

|

2903 |

62 |

00 |

- - Hexachlorobenzene and DDT (1,1, 1‑trichloro‑2,2‑bis (p‑chlorophenyl ethane) |

5 |

|

2903 |

69 |

00 |

- - Other |

5 |

|

8414 |

|

|

Air or vacuum pumps, air or other gas compressors and fans; ventilating or recycling hoods incorporating a fan, whether or not fitted with filters |

|

|

8414 |

10 |

|

- Vacuum pumps: |

|

|

8414 |

10 |

10 |

- - Electrically operated |

10 |

|

8414 |

10 |

20 |

- - Not electrically operated |

10 |

|

8414 |

20 |

00 |

- Hand‑ or foot‑operated air pumps |

20 |

|

8414 |

30 |

|

- Compressors of a kind used in refrigerating equipment: |

|

|

|

|

|

- - Having capacity exceeding 21 kW per hour or more; having displacement per revolution 220 cubic centimeter or more: |

|

|

8414 |

30 |

11 |

- - - For air conditioning machines |

0 |

|

8414 |

30 |

19 |

- - - Other |

0 |

|

|

|

|

- - Other: |

|

|

8414 |

30 |

91 |

- - - For air conditioning machines |

0 |

|

8414 |

30 |

99 |

- - - Other |

0 |

|

8414 |

40 |

00 |

- Air compressors mounted on a wheeled chassis for towing |

5 |

|

|

|

|

‑ Fans: |

|

|

8414 |

51 |

|

- - Table, floor, wall, window, ceiling or roof fans, with a self‑contained electric motor of an output not exceeding 125 W: |

|

|

8414 |

51 |

10 |

- - - Table fans and box fans |

50 |

|

8414 |

51 |

20 |

- - - Wall fans and ceiling fans |

50 |

|

8414 |

51 |

30 |

- - - Floor fans |

50 |

|

8414 |

51 |

90 |

- - - Other |

50 |

|

8414 |

59 |

|

- - Other: |

|

|

8414 |

59 |

10 |

- - - Of a capacity not exceeding 125 kW |

20* |

|

8414 |

59 |

90 |

- - - Other |

10* |

|

8414 |

60 |

00 |

- Hoods having a maximum horizontal side not exceeding 120 cm |

30 |

|

8414 |

80 |

|

- Other: |

|

|

|

|

|

- - Hoods having a maximum horizontal side exceeding 120 cm |

|

|

8414 |

80 |

11 |

- - - Fitted with filter |

5 |

|

8414 |

80 |

12 |

- - - Not fitted with filter, for industrial use |

5 |

|

8414 |

80 |

19 |

- - - Not fitted with filter, other than for industrial use |

5 |

|

8414 |

80 |

20 |

- - Blowers and the like |

5 |

|

8414 |

80 |

30 |

- - Free piston generators for gas turbines |

5 |

|

|

|

|

- - Compressors other than those of subheading 8414.30 and 8414.40: |

|

|

8414 |

80 |

41 |

- - - Gas compression modules for use in oil drilling operations |

5 |

|

8414 |

80 |

42 |

- - - Compressors for automotive air-conditioners |

10 |

|

8414 |

80 |

43 |

- - - Sealed units for air conditioning units |

10 |

|

8414 |

80 |

49 |

- - - Other |

10 |

|

|

|

|

- - Air pumps: |

|

|

8414 |

80 |

51 |

- - - Electrically operated |

10 |

|

8414 |

80 |

59 |

- - - Not electrically operated: |

5 |

|

|

|

|

- - Other |

|

|

8414 |

80 |

91 |

- - - Electrically operated |

10 |

|

8414 |

80 |

99 |

- - - Not electrically operated |

5 |

|

8414 |

90 |

|

- Parts: |

|

|

|

|

|

- - Of electrically operated equipment: |

|

|

8414 |

90 |

11 |

- - - Of pumps or compressors |

0 |

|

8414 |

90 |

12 |

- - - Of subheadings 8414.10 and 8414.40 |

0 |

|

8414 |

90 |

12 |

- - - Of subheadings 8414.60 |

10 |

|

8414 |

90 |

14 |

- - - Of subheadings 8414.30, 8414.80 |

0 |

|

8414 |

90 |

19 |

- - - Other |

30 |

|

|

|

|

- - Of non-electrically operated equipment: |

|

|

8414 |

90 |

91 |

- - - Of subheadings 8414.10 and 8414.40 |

0 |

|

8414 |

90 |

92 |

- - - Of subheading 8414.20 |

10 |

|

8414 |

90 |

93 |

- - - Of subheadings 8414.30 and 8414.80 |

0 |

|

8414 |

90 |

99 |

- - - Other |

30 |

|

8415 |

|

|

Air conditioning machines, comprising a motor‑driven fan and elements for changing the temperature and humidity, including those machines in which the humidity cannot be separately regulated |

|

|

8415 |

10 |

|

- Window or wall types, self‑contained or “split-system”: |

|

|

8415 |

10 |

10 |

- - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

10 |

20 |

- - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

10 |

30 |

- - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

10 |

40 |

- - Of an output exceeding 52.75 kW |

20 |

|

8415 |

20 |

00 |

- Of a kind used for persons, in motor vehicles |

30 |

|

|

|

|

- Other: |

|

|

8415 |

81 |

|

- - Incorporating a refrigerating unit and a valve for reversal of the cooling/heat cycle (reversible heat pumps): |

|

|

|

|

|

- - - For use in aircraft: |

|

|

8415 |

81 |

11 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

81 |

12 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

81 |

13 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

81 |

14 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - For use in railway rolling stock: |

|

|

8415 |

81 |

21 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

81 |

22 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

81 |

23 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

81 |

24 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - For use in road vehicles: |

|

|

8415 |

81 |

31 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

81 |

32 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

81 |

33 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

81 |

34 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - Other: |

|

|

8415 |

81 |

91 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

81 |

92 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

81 |

93 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

81 |

94 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

8415 |

82 |

|

- - Other, incorporating a refrigerating unit : |

|

|

|

|

|

- - - For use in aircraft: |

|

|

8415 |

82 |

11 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

82 |

12 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

82 |

13 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

82 |

14 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - For use in railway rolling stock: |

|

|

8415 |

82 |

21 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

82 |

22 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

82 |

23 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

82 |

24 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - For use in road vehicles: |

|

|

8415 |

82 |

31 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

82 |

32 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

82 |

33 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

82 |

34 |

- - - - Of an output exceeding 52.75 kW: |

20 |

|

|

|

|

- - - Other |

|

|

8415 |

82 |

91 |

- - - - Of an output not exceeding 21.10 kW |

50 |

|

8415 |

82 |

92 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

50 |

|

8415 |

82 |

93 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

82 |

94 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

8415 |

83 |

|

- - Not incorporating a refrigerating unit: |

|

|

|

|

|

- - - For use in aircraft: |

|

|

8415 |

83 |

11 |

- - - - Of an output not exceeding 21.10 kW |

30 |

|

8415 |

83 |

12 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

30 |

|

8415 |

83 |

13 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

83 |

14 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - For use in railway rolling stock: |

|

|

8415 |

83 |

21 |

- - - - Of an output not exceeding 21.10 kW |

30 |

|

8415 |

83 |

22 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

30 |

|

8415 |

83 |

23 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

83 |

24 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - For use in road vehicles: |

|

|

8415 |

83 |

31 |

- - - - Of an output not exceeding 21.10 kW |

30 |

|

8415 |

83 |

32 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

30 |

|

8415 |

83 |

33 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

83 |

34 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

|

|

|

- - - Other: |

|

|

8415 |

83 |

91 |

- - - - Of an output not exceeding 21.10 kW |

30 |

|

8415 |

83 |

92 |

- - - - Of an output exceeding 21.10 kW but not exceeding 26.38 kW |

30 |

|

8415 |

83 |

93 |

- - - - Of an output exceeding 26.38 kW but not exceeding 52.75 kW |

20 |

|

8415 |

83 |

94 |

- - - - Of an output exceeding 52.75 kW |

20 |

|

8415 |

90 |

|

- Parts: |

|

|

|

|

|

- - Of machines of an output not exceeding 21.10 kW: |

|

|

8415 |

90 |

11 |

- - - For use in aircraft or railway rolling stock |

3 |

|

8415 |

90 |

12 |

- - - Chassis or cabinets, welded and painted |

3 |

|

8415 |

90 |

19 |

- - - Other: |

3 |

|

|

|

|

- - Of machines of an output exceeding 21.10 kW but not exceeding 26.38 kW: |

|

|

8415 |

90 |

21 |

- - - For use in aircraft or railway rolling stock |

3 |

|

8415 |

90 |

22 |

- - - Chassis or cabinets, welded and painted |

3 |

|

8415 |

90 |

29 |

- - - Other |

3 |

|

|

|

|

- - Of machines of an output exceeding 26.38 kW but not exceeding 52.75 kW: |

|

|

8415 |

90 |

31 |

- - - For use in aircraft or railway rolling stock |

3 |

|

8415 |

90 |

32 |

- - - Chassis or cabinets, welded and painted |

3 |

|

8415 |

90 |

39 |

- - - Other |

3 |

|

|

|

|

- - Of machines of an output exceeding 52.75 kW: |

|

|

8415 |

90 |

91 |

- - - For use in aircraft or railway rolling stock |

3 |

|

8415 |

90 |

92 |

- - - Chassis or cabinets, welded and painted |

3 |

|

8415 |

90 |

99 |

- - - Other |

3 |

|

8418 |

|

|

Refrigerators, freezers and other refrigerating or freezing equipment, electric or other; heat pumps other than air conditioning machines of heading 84.15 |

|

|

8418 |

10 |

|

- Combined refrigerator‑freezers, fitted with separate external doors: |

|

|

8418 |

10 |

10 |

- - Household type |

50 |

|

8418 |

10 |

90 |

- - Other |

3 |

|

|

|

|

‑ Refrigerators, household type: |

|

|

8418 |

21 |

00 |

- - Compression‑type |

50 |

|

8418 |

22 |

00 |

- - Absorption‑type, electrical |

50 |

|

8418 |

29 |

00 |

- - Other |

50 |

|

8418 |

30 |

|

- Freezers of the chest type, not exceeding 800 litters capacity: |

|

|

8418 |

30 |

10 |

- - Not exceeding 200 litters capacity |

30 |

|

8418 |

30 |

20 |

- - Exceeding 200 litters but not exceeding 800 litters capacity |

20 |

|

8418 |

40 |

|

- Freezers of the upright type, not exceeding 900 litters capacity: |

|

|

8418 |

40 |

10 |

- - Not exceeding 200 litters capacity |

40 |

|

8418 |

40 |

90 |

- - Exceeding 200 litters but not exceeding 900 litters capacity |

20 |

|

8418 |

50 |

|

- Other refrigerating or freezing chests, cabinets, display counters, show‑cases and similar refrigerating or freezing furniture |

|

|

|

|

|

- - Not exceeding 200 litters capacity: |

|

|

8418 |

50 |

11 |

- - - Suitable for medical use |

10 |

|

8418 |

50 |

19 |

- - - Other |

40 |

|

|

|

|

- - Exceeding 200 litters capacity: |

|

|

8418 |

50 |

21 |

- - - Suitable for medical use |

5 |

|

8418 |

50 |

22 |

- - - Refrigerating chambers |

20 |

|

8418 |

50 |

29 |

- - - Other |

20 |

|

|

|

|

‑ Other refrigerating or freezing equipment; heat pumps: |

|

|

8418 |

61 |

|

- - Compression type units whose condensers are heat exchangers: |

|

|

8418 |

61 |

10 |

- - - Water chillers with a refrigerating capacity exceeding 21.10 kW; refrigerating equipment with a refrigerating capacity of 10 tons or more and cooling to 200C or more; evaporative condensers, having a heating radiation of 30,000 kg calories per hour or more for refrigerating equipment; evaporators of the fin type, having the distance between the fins of 4 mm or more; evaporator of the plate freezer type or the contact freezer type |

15 |

|

8418 |

61 |

90 |

- - - Other |

0 |

|

8418 |

69 |

|

- - Other: |

|

|

8418 |

69 |

10 |

- - - Beverage coolers |

15 |

|

8418 |

69 |

20 |

- - - Water chillers having refrigerating capacities of 100 tons and above or exceeding 21.10 kW |

15 |

|

8418 |

69 |

30 |

- - - Other water coolers |

15 |

|

8418 |

69 |

40 |

- - - Heat pumps of a kind normally not for domestic use |

15 |

|

8418 |

69 |

50 |

- - - Scale ice-maker units |

5 |

|

8418 |

69 |

90 |

- - - Other |

15 |

|

|

|

|

‑ Parts: |

|

|

8418 |

91 |

|

- - Furniture designed to receive refrigerating or freezing equipment: |

|

|

8418 |

91 |

10 |

- - - For goods of subheading 8418.10, 8418.21.00, 8418.22.00, 8418.29.00, 8418.30 or 8418.40 |

3 |

|

8418 |

91 |

90 |

- - - Other |

3 |

|

8418 |

99 |

|

- - Other: |

|

|

8418 |

99 |

10 |

- - - Evaporators and condensers |

0 |

|

8418 |

99 |

20 |

- - - Cabinets and doors, welded and painted |

3 |

|

8418 |

99 |

30 |

- - - Parts of water chillers with a refrigerating capacity exceeding 21.10 kW; parts of evaporators of the fin type having the distance between the fins of 4 mm or more |

0 |

|

8418 |

99 |

40 |

- - - Aluminum roll bonds for subheadings 8418.10.10, 8418.21, 8418.22 and 8418.29 |

0 |

|

8418 |

99 |

90 |

- - - Other |

0 |

|

8419 |

|

|

Machinery, plant or laboratory equipment, whether or not electrically heated (excluding furnaces, ovens and other equipment of heading 85.14), for the treatment of materials by a process involving a change of temperature such as heating, cooking, roasting, distilling, rectifying, sterilizing, pasteurizing, steaming, drying, evaporating, vaporizing, condensing or cooling, other than machinery or plant of a kind used for domestic purposes; instantaneous or storage water heaters, non‑electric |

|

|

|

|

|

‑ Instantaneous or storage water heaters, non‑electric: |

|

|

8419 |

11 |

|

- - Instantaneous gas water heaters: |

|

|

|

|

|

- - - For domestic use: |

|

|

8419 |

11 |

11 |

- - - - Of copper |

10 |

|

8419 |

11 |

19 |

- - - - Other |

10 |

|

8419 |

11 |

90 |

- - - Other |

10 |

|

8419 |

19 |

|

- - Other: |

|

|

|

|

|

- - - For domestic use: |

|

|

8419 |

19 |

11 |

- - - - Of copper |

10 |

|

8419 |

19 |

19 |

- - - - Other |

10 |

|

8419 |

19 |

90 |

- - - Other |

10 |

|

8419 |

20 |

00 |

- Medical, surgical or laboratory sterilizers |

0 |

|

|

|

|

‑ Dryers: |

|

|

8419 |

31 |

|

- - For agricultural products: |

|

|

|

|

|

- - - Electrically operated: |

|

|

8419 |

31 |

11 |

- - - - Evaporators |

0 |

|

8419 |

31 |

19 |

- - - - Other: |

0 |

|

|

|

|

- - - Not electrically operated |

|

|

8419 |

31 |

21 |

- - - - Evaporators |

0 |

|

8419 |

31 |

29 |

- - - - Other |

0 |

|

8419 |

32 |

|

- - For wood, paper pulp, paper or paperboard: |

|

|

|

|

|

- - - Electrically operated: |

|

|

8419 |

32 |

11 |

- - - - Evaporators |

0 |

|

8419 |

32 |

19 |

- - - - Other |

0 |

|

|

|

|

- - - Not electrically operated: |

|

|

8419 |

32 |

21 |

- - - - Evaporators |

0 |

|

8419 |

32 |

29 |

- - - - Other |

0 |

|

8419 |

39 |

|

- - Other: |

|

|

|

|

|

- - - Electrically operated: |

|

|

8419 |

39 |

11 |

- - - - Machinery for the treatment of materials by a process involving heating, for the manufacture of Printed Circuit Board (PCB) / Printed Wiring Board (PWB) or Printed Circuit Assembly (PCA) [ITA/2 (AS2)] |

0 |

|

8419 |

39 |

19 |

- - - - Other |

0 |

|

8419 |

39 |

20 |

- - - Not electrically operated |

0 |

|

8419 |

40 |

|

- Distilling or rectifying plant: |

|

|

8419 |

40 |

10 |

- - Electrically operated |

0 |

|

8419 |

40 |

20 |

- - Not electrically operated |

0 |

|

8419 |

50 |

|

- Heat exchange units: |

|

|

8419 |

50 |

10 |

- - Cooling towers |

3 |

|

8419 |

50 |

20 |

- - Condensers for air conditioners for motor vehicles |

10 |

|

8419 |

50 |

30 |

- - Other condensers for air conditioners |

3 |

|

8419 |

50 |

40 |

- - Other, electrically operated |

3 |

|

8419 |

50 |

90 |

- - Other, not electrically operated |

3 |

|

8419 |

60 |

|

- Machinery for liquefying air or other gases: |

|

|

8419 |

60 |

10 |

- - Electrically operated |

0 |

|

8419 |

60 |

20 |

- - Not electrically operated |

0 |

|

|

|

|

‑ Other machinery, plant and equipment: |

|

|

8419 |

81 |

|

- - For making hot drinks or for cooking or heating food: |

7 |

|

|

|

|

- - - Electrically operated: |

|

|

8419 |

81 |

11 |

- - - - Cooking ranges |

30 |

|

8419 |

81 |

19 |

- - - - Other |

30 |

|

|

|

|

- - - Not electrically operated: |

|

|

8419 |

81 |

21 |

- - - - Cooking ranges |

30 |

|

8419 |

81 |

29 |

- - - - Other |

30 |

|

8419 |

89 |

|

- - Other: |

|

|

|

|

|

- - - Electrically operated: |

|

|

8419 |

89 |

11 |

- - - - Evaporators for air-conditioning machines for motor vehicles |

0 |

|

8419 |

89 |

12 |

- - - - Chemical vapor deposition apparatus for semiconductor production [ITA1/B-114]; apparatus for rapid heating of semiconductor wafers [ITA1/B-162] |

0 |

|

8419 |

89 |

13 |

- - - - Machinery for the treatment of material by a process involving heating, for the manufacture of PCB/PWBs or PCAs [ITA/2(AS2)] |

0 |

|

8419 |

89 |

14 |

- - - - Chemical vapor deposition apparatus for flat panel display production [(ITA/2)(AS2)] |

0 |

|

8419 |

89 |

19 |

- - - - Other |

0 |

|

8419 |

89 |

20 |

- - - Not electrically operated |

0 |

|

8419 |

90 |

|

- Parts: |

|

|

|

|

|

- - Of electrically operated articles: |

|

|

8419 |

90 |

11 |

- - - Parts of chemical vapor deposition apparatus for semiconductor production [ITA1/B-115]; parts of apparatus for rapid heating of semiconductor wafers [ITA1/B-164] |

0 |

|

8419 |

90 |

12 |

- - - Parts of machinery for the treatment of materials by a process involving heating, for the manufacture of PCB/PWBs or PCAs [ITA/2(AS2)] |

0 |

|

8419 |

90 |

13 |

- - - Parts of chemical vapor deposition apparatus for flat panel display production [(ITA/2)(AS2)] |

0 |

|

8419 |

90 |

14 |

- - - Casings for cooling towers of subheading 8419.50.10 |

0 |

|

8419 |

90 |

15 |

- - - Of machinery and plant, of a kind use for non-domestic purpose |

0 |

|

8419 |

90 |

19 |

- - - Other |

0 |

|

|

|

|

- - Of non-electrically operated articles: |

|

|

8419 |

90 |

21 |

- - - Casings for cooling towers of subheading 8419.50.10 |

0 |

|

8419 |

90 |

22 |

- - - For goods of subheadings 8419.11.11 and 8419.19.11 |

0 |

|

8419 |

90 |

23 |

- - - For goods of subheadings 8419.11.19 and 8419.19.19 |

0 |

|

8419 |

90 |

24 |

- - - Of machinery and plant, of a kind use for non-domestic purpose |

0 |

|

8419 |

90 |

29 |

- - - Other |

0 |

|

8450 |

|

|

Household or laundry‑type washing machines, including machines which both wash and dry |

|

|

|

|

|

‑ Machines, each of a dry linen capacity not exceeding 10 kg: |

|

|

8450 |

11 |

|

- - Fully‑automatic machines: |

|

|

8450 |

11 |

10 |

- - - Each of a dry linen capacity not exceeding 6 kg |

40 |

|

8450 |

11 |

20 |

- - - Each of a dry linen capacity exceeding 6 kg |

40 |

|

8450 |

12 |

|

- - Other machines, with built‑in centrifugal drier: |

|

|

8450 |

12 |

10 |

- - - Each of a dry linen capacity not exceeding 6 kg |

40 |

|

8450 |

12 |

20 |

- - - Each of a dry linen capacity exceeding 6 kg |

40 |

|

8450 |

19 |

|

- - Other: |

|

|

8450 |

19 |

10 |

- - - Each of a dry linen capacity not exceeding 6 kg |

40 |

|

8450 |

19 |

20 |

- - - Each of a dry linen capacity exceeding 6 kg |

40 |

|

8450 |

20 |

00 |

- Machines, each of a dry linen capacity exceeding 10 kg |

40 |

|

8450 |

90 |

|

- Parts: |

|

|

8450 |

90 |

10 |

- - Of goods of subheading 8450.20 |

3 |

|

8450 |

90 |

20 |

- - Of goods of subheading 8450.11, 8450.12 or 8450.19 |

3 |

|

8485 |

90 |

90 |

- - Other |

0 |

|

8501 |

|

|

Electric motors and generators (excluding generating sets) |

|

|

8501 |

10 |

|

- Motors of an output not exceeding 37.5W |

|

|

8501 |

10 |

11 |

- - - Stepper motors |

30 |

|

8501 |

10 |

12 |

- - - Spindle motors |

30 |

|

8501 |

10 |

19 |

- - - Other |

30 |

|

|

|

|

- - Other motors including universal (AC/DC) motors: |

|

|

8501 |

10 |

91 |

- - - Stepper motors |

30 |

|

8501 |

10 |

92 |

- - - Spindle motors |

30 |

|

8501 |

10 |

99 |

- - - Other |

30 |

|

8501 |

20 |

|

- Universal AC/DC motors of an output exceeding 37.5 W: |

|

|

8501 |

20 |

10 |

- - Of an output not exceeding 1 kW |

30 |

|

8501 |

20 |

20 |

- - Of an output exceeding 1 kW |

30 |

|

|

|

|

‑ Other DC motors; DC generators: |

|

|

8501 |

31 |

|

- - Of an output not exceeding 750 W: |

|

|

8501 |

31 |

10 |

- - - Motors |

30 |

|

8501 |

31 |

20 |

- - - Generators |

30 |

|

8501 |

32 |

|

- - Of an output exceeding 750 W but not exceeding 75 kW: |

|

|

|

|

|

- - - Motors: |

|

|

8501 |

32 |

11 |

- - - - Of an output not exceeding 10 kW |

10 |

|

8501 |

32 |

12 |

- - - - Of an output exceeding 10 kW but not exceeding 37.5 kW |

10 |

|

8501 |

32 |

19 |

- - - - Of an output exceeding 37.5 kW |

5 |

|

|

|

|

- - - Generators: |

|

|

8501 |

32 |

21 |

- - - - Of an output not exceeding 10 kW |

10 |

|

8501 |

32 |

22 |

- - - - Of an output exceeding 10 kW but not exceeding 37.5 kW |

10 |

|

8501 |

32 |

29 |

- - - - Of an output exceeding 37.5 kW |

5 |

|

8501 |

33 |

|

- - Of an output exceeding 75 kW but not exceeding 375 kW: |

|

|

8501 |

33 |

10 |

- - - Motors |

0 |

|

8501 |

33 |

20 |

- - - Generators |

0 |

|

8501 |

34 |

|

- - Of an output exceeding 375 kW: |

|

|

8501 |

34 |

10 |

- - - Motors |

0 |

|

|

|

|

- - - Generators: |

|

|

8501 |

34 |

21 |

- - - - DC generators of an output 10,000 kW or more |

0 |

|

8501 |

34 |

29 |

- - - - Other |

0 |

|

8501 |

40 |

|

- Other AC motors, single‑phase: |

|

|

8501 |

40 |

10 |

- - Of an output not exceeding 1 kW |

30* |

|

8501 |

40 |

20 |

- - Of an output exceeding 1 kW |

5 |

|

|

|

|

‑ Other AC motors, multi‑phase: |

|

|

8501 |

51 |

00 |

- - Of an output not exceeding 750 W |

30* |

|

8501 |

52 |

|

- - Of an output exceeding 750 W but not exceeding 75 kW: |

|

|

8501 |

52 |

10 |

- - - Of an output not exceeding 1 kW |

10* |

|

8501 |

52 |

20 |

- - - Of an output exceeding 1 kW but not exceeding 37.5 kW |

10* |

|

8501 |

52 |

30 |

- - - Of an output exceeding 37.5 kW |

0 |

|

8501 |

53 |

00 |

- - Of an output exceeding 75 kW |

0 |

|

|

|

|

‑ AC generators (alternators): |

|

|

8501 |

61 |

|

- - Of an output not exceeding 75 kVA: |

|

|

8501 |

61 |

10 |

- - - Of an output not exceeding 12.5 kVA |

30 |

|

8501 |

61 |

20 |

- - - Of an output exceeding 12.5 kVA |

30 |

|

8501 |

62 |

00 |

- - Of an output exceeding 75 kVA but not exceeding 375 kVA |

10 |

|

8501 |

63 |

00 |

- - Of an output exceeding 375 kVA but not exceeding 750 kVA |

0 |

|

8501 |

64 |

|

- - Of an output exceeding 750 kVA: |

|

|

8501 |

64 |

10 |

- - - Generators of an output 10,000 kVA or more |

0 |

|

8501 |

64 |

90 |

- - - Other |

0 |

|

|

|

|

|

|

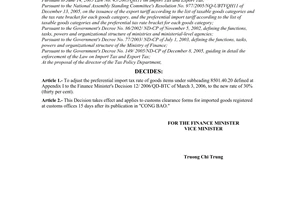

APPENDIX II

LIST OF AMENDED TAX RATES OF A NUMBER OF COMMODITY GROUPS OF SPARE PARTS AND ACCESSORIES OF ELECTRIC AND REFRIGERATING PRODUCTS FOR DOMESTIC USE, SPECIFIED IN THE PREFERENTIAL IMPORT TARIFFS (TABLE II)

|

Ordinal number |

Descriptions |

Code |

Tax rate (%) |

|

1 |

2 |

3 |

4 |

|

1 |

DC electric motors used for commodity items of headings 8415, 8418 and 8450 |

8501.40.10; 8501.51.00; 8501.52.10 |

5 |