Circular No. 126/2004/TT-BTC of December 24th, 2004, providing guidelines for implementation of Decree 187/2004/ND-CP of The Government dated 16 November 2004 on conversion of state owned companies into shareholding companies. đã được thay thế bởi Circular No. 146/2007/TT-BTC of December 6, 2007, guiding the settlement of a number of financial matters upon the transformation of enterprises with 100% state capital into joint-stock companies under the Governments Decree No. 109/2007/ND-CP of June 26, 2007. và được áp dụng kể từ ngày 02/01/2008.

Nội dung toàn văn Circular No. 126/2004/TT-BTC of December 24th, 2004, providing guidelines for implementation of Decree 187/2004/ND-CP of The Government dated 16 November 2004 on conversion of state owned companies into shareholding companies.

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC

OF VIET NAM

|

|

No. 126/2004/TT-BTC |

Hanoi, December 24th, 2004

|

CIRCULAR

PROVIDING GUIDELINES FOR IMPLEMENTATION OF DECREE 187-2004-ND-CP OF THE GOVERNMENT DATED 16 NOVEMBER 2004 ON CONVERSION OF STATE OWNED COMPANIES INTO SHAREHOLDING COMPANIES

To implement Decree 187-2004-ND-CP of the Government dated 16 November 2004 on Conversion of State Owned Capital into Shareholding Companies (hereinafter referred to as Decree 187-2004-ND-CP), the Ministry of Finance provides the following guidelines on financial issues:

I. GENERAL PROVISIONS

1. This Circular shall apply to State owned companies which undergo equitization as stipulated in article 2 of Decree 187-2004-ND-CP and Decision 155-2004-QD-TTg of the Prime Minister of the Government dated 24 August 2004 issuing the criteria and lists of classification of State owned companies and independent cost accounting member companies of State owned corporations (hereinafter referred to as enterprises).

2. Enterprises which satisfy all the conditions for equitization must still have State capital (excluding the value of land use rights) after dealing with financial issues in accordance with Section II of this Circular.

Enterprises which do not satisfy all the conditions for equitization shall be subject to other forms of restructuring in compliance with the laws; they shall not be provided with additional State owned capital for equitization.

3. Prior to equitization, the enterprise must deal with all outstanding financial issues in accordance with the applicable laws.

During equitization, the enterprise shall continue to deal with outstanding financial issues in accordance with Section II of this Circular until the date of official conversion into a shareholding company.

4. The body making the decision on equitization specified in article 40 of Decree 187-2004- ND-CP shall establish a steering committee for equitization in order to assist the body making the decision on equitization in directing and organizing the implementation of equitization.

5. Enterprises shall select a form of equitization specified in article 3 of Decree 187-2004- ND-CP. Any enterprises which have a requirement to raise additional capital for investment and development shall issue additional shares.

6. The date of valuation of an enterprise as the date of closing books of account and preparing financial statements in order to valuate the enterprise shall be:

- The end of the most recent quarter prior to the date of the decision on equitization but it shall not be earlier than six months prior to the date of announcement of a value of the enterprise in the case of utilization of the asset method to valuate an enterprise.

- The end of the most recent year prior to the date of the decision on equitization but it shall not be earlier than nine months prior to the time of announcement of a value of the enterprise in the case of utilization of the discounted currency flow method to valuate an enterprise.

7. The steps relating to equitization shall be taken in accordance with the procedures issued with this Circular (Appendix 1).

II. DEALING WITH FINANCIAL ISSUES UPON EQUITIZATION

A. INVENTORY AND CLASSIFICATION OF ASSETS AND DEBTS

Upon receipt of a decision on equitization from the competent body, an enterprise shall be responsible for organizing an inventory and classification of assets which the enterprise was currently managing and using at the date of evaluation of the enterprise in accordance with the following provisions:

1. Inventory and classification of assets:

1.1 The inventory shall correctly determine the quantity and quality of the actual assets currently used by the enterprise; count cash in hand and verify balances in bank deposit accounts at the date of valuation of the enterprise; determine any excess or deficit of assets and cash in comparison with the books of account and clarify the reasons for the excess or deficit.

1.2 The assets in the inventory shall be classified into the following groups:

(a) Assets of the enterprise which are required to be used.

(b) Assets of the enterprise which are not required to be used, idle stock, assets awaiting liquidation in accordance with the decision of the representative of the owner of State owned capital in the enterprise.

(c) Assets formed from reward and welfare funds (if any).

(d) Assets leased to outsiders, supplies and goods held on trust, materials received for processing, goods received to sell as an agent, and goods held on bailment.

2. Verification, confirmation and classification of debts, and preparation of a detailed list of each type of debt shall be carried out in accordance with the following provisions:

2.1. Debts payable:

Analysing clearly debts which have not yet fallen due, overdue debts, interest payable and debts payable which are not required to be paid.

Debts payable which are not required to be paid due to the creditor (dissolved or bankrupt enterprise, deceased creditor) no longer existing or due to the creditor not attending to verify its claim despite [the debts] having been overdue.

2.2. Debts receivable:

(a) Analysing clearly debts receivable which are recoverable and which are irrecoverable.

Debts receivable which are irrecoverable must be supported by adequate evidence that they are irrecoverable in accordance with the applicable State regulations on dealing with outstanding debts.

(b) Checking all economic contracts to calculate items paid in advance to suppliers of goods and services which were included fully in costs of business such as rent for housing or land, purchase price of goods, premiums paid for long-term insurance and salaries or wages etc. so that they are included in the value of the enterprise undergoing equitization in accordance with article 11.3 of Decree 187-2004-ND-CP.

3. Organization of an assessment and valuation of its assets which are required to be used in accordance with Part A of Section III of this Circular.

4. State owned commercial banks, apart from the implementation of the above provisions, shall:

4.1. Carry out an inventory and verification of loans provided to clients and monies deposited by clients, certificates of savings (securities, bonds, treasury notes) as follows:

(a) Detailed inventory of each item on the basis of books of account.

(b) Verification and confirmation of the balance of deposits in cases of clients being a legal entity; verification of each file of a loan and confirmation with creditors about amounts of money which the bank still owes.

(c) With respect to savings, monies deposited by individuals and certificates of savings, no verification with clients shall be required, but a verification shall be conducted on the basis of kept cards. In a number of specific cases (where the amount of a deposit is large or there is a difference between data shown in books of account and in the kept card), a verification shall be conducted directly with respective clients.

4.2. Verification of assets being credit outstanding debt (including off-balance sheet liabilities) shall be conducted as follows:

(a) Preparation of a list of clients which incur a credit outstanding debt, credit outstanding debts of respective clients and details of each credit line contract on the basis of the credit file of each client.

(b) Verification of data specified in credit files on the basis of the data in books of account of the commercial bank; verification of the credit outstanding debt with each client in order to obtain the confirmation of such credit outstanding debt from the client.

Where there is a difference between data in the credit file and in books of account and the confirmation from the client, the commercial bank must clarify the reasons for the difference and fix the liability on any relevant organizations and individuals so that they shall be dealt with in accordance with the applicable State regulations.

4.3. Classification of outstanding debts receivable which satisfy all conditions for disposal in accordance with guidelines provided by the State Bank of Vietnam.

B. DEALING WITH FINANCIAL [ISSUES]

1. Before valuation of an enterprise

1.1. Assets:

Based on the results of the inventory and classification of assets, the enterprise shall deal with its assets in accordance with article 10 of Decree 187-2004-ND-CP, including:

(a) With respect to any excess or deficit of assets, the enterprise shall analyse clearly the reasons therefor and deal with them as follows:

- In cases of missing assets, shall fix the liability on any organization or individual to pay compensation in accordance with the applicable regulations; account for the value of missing assets in the business results after deducting the compensation.

- Excess assets shall be recorded as an increase in State owned capital if the reasons for such excess are unable to be clarified and the owner of the assets is unable to be identified.

(b) Assets not required to be used, idle stock or assets awaiting liquidation, upon obtaining a written approval from the representative of the owner of State owned capital, shall be dealt with as follows:

- Liquidation or disposal: the director of the enterprise shall be responsible for directing the liquidation or disposal of the assets in accordance with the applicable laws.

Any revenue from and expenses for the liquidation or disposal of the assets shall be accounted for in income and expenses of the enterprise.

- Such assets shall be transferred to another entity in accordance with the decision of the representative of the owner of capital. If they are transferred to an entity outside a ministry, locality or corporation, an agreement with the representative of the owner of capital as the recipient shall be required.

Based on the minutes of hand-over of assets, the enterprises delivering or receiving the assets shall record a capital increase or decrease on the basis of the book value recorded by the transferor. Where the transferee does not accept the price shown in the books of account of the transferor, both parties shall agree on a price for transfer. Any difference compared to the price shown in the books of account shall be accounted for in the business results of the enterprise.

- Any assets not required to be used, idle stock or assets awaiting liquidation which have not yet been dealt with up until the date of valuation of the enterprise shall not be included in the value of the enterprise. The enterprise shall continue to deal with such assets [during the period] prior to issuance of a decision on a value of the enterprise. If there are any assets which have yet been dealt with at the time of issuance of the decision on a value of the enterprise, the enterprise shall be responsible for preserving and transferring such assets to a company specializing in the purchase and sale of debts and idle stock from enterprises for disposal in accordance with the applicable regulations. The company specializing in the purchase and sale of debts and idle stock from enterprises shall not resell such assets to the enterprise.

(c) Assets belonging to welfare works which were funded by reward and welfare funds shall be dealt with in accordance with article 10.3 of Decree 187-2004- ND-CP.

(d) The valuation and distribution of shareholding among employees with respect to assets used in production and business being investments funded by the reward and welfare funds shall be subject to article 10.4 of Decree 187-2004- ND-CP. The shareholding to be divided amongst employees shall be calculated on the basis of the average auction price1.

(dd) Welfare assets which were funded by the State budget or by capital sourced from the State budget shall be included in the value of the enterprise undergoing equitization if it continues to use such assets.

1.2. Debts receivable:

Debts receivable shall be dealt with in accordance with clauses 1, 2 and 3 of article 11 of Decree 187-2004-ND-CP, including:

(a) With respect to debts receivable for which there are adequate documents evidencing that such debts receivable are irrecoverable in accordance with the applicable State regulations on dealing with outstanding debts, [the enterprise] shall clarify the reasons therefor and fix the liability on any organization or individual to pay compensation in accordance with the applicable regulations.

If any losses remain after such recoveries, the enterprise shall use the reserve for bad debts to off-set them. If the above source is insufficient, the deficiency shall be accounted for in business costs of the enterprise.

(b) With respect to other overdue debts receivable, the enterprise shall continue to claim recovery of them or sell them to a company specializing in the purchase and sale of debts and idle stock from enterprises but shall not directly sell debts to debtors. Any losses from the sale of debts shall be accounted for in business costs.

(c) With respect to items paid by the enterprise in advance to suppliers of goods and services such as rent for housing or land, purchase price of goods and wages, where such items have been fully accounted for in business costs, the enterprise shall verify and account for them as a decrease in costs corresponding to the portion of goods or services which has not yet been supplied or period of lease which has not yet been realized and account for them as an increase in costs paid in advance (or costs awaiting allocation).

1.3. Debts payable:

The principles of dealing with debts payable shall be performed in accordance with article 12 of Decree 187-2004-ND-CP, including:

(a) Debts payable which are not required to be paid shall be accounted for as an increase in State owned capital.

(b) Tax and State Budget debts shall be dealt with as follows:

Where [such debts] are unable to be paid because [the enterprise incurred] losses, the enterprise shall prepare an application file for rescheduling or writing off debts to a maximum extent of losses accumulated up to the date of valuation of the enterprise in accordance with the applicable laws.

Where an enterprise satisfies all the conditions for writing off debts and has performed all procedures and submitted an application file for writing off debts, but up until the date of valuation of the enterprise, it has not yet received a decision writing off the debts, the competent body making the decision on valuation of the enterprise shall consider and temporarily deduct debts or losses in order to value the enterprise.

The enterprise shall be responsible for continuing to co-ordinate with the financial authority in dealing with them. Upon obtaining a decision on such matter from the Ministry of Finance, where there is any difference compared to the temporarily deducted debts, the enterprise shall record it as an adjustment in financial statements at the date of official conversion into a shareholding company.

(c) With respect to overdue debts being loans provided by State owned commercial banks and the Development Assistance Fund:

- Where overdue debts are unable to be paid because [the enterprise incurred] losses, the enterprise shall carry out the procedures for application for rescheduling, freezing, or writing off debts in accordance with the applicable laws.

State owned commercial banks and the Development Assistance Fund may consider and write off debts being unpaid loan interest (including capitalized interest) at a level not exceeding the amount of remaining losses (after dealing with tax and State Budget debts).

With the maximum period of twenty (20) working days from the date of receipt of the file from the enterprise, the lending commercial banks and the Development Assistance Fund shall notify the enterprise in writing of their opinion on dealing with debts. Where no opinion on dealing with debts from the creditors has been received up until the date of valuation of the enterprise, the enterprise shall be allowed to temporarily exclude debts being [unpaid] loan interest which are requested to be written off from the value of the enterprise for the purpose of equitization. Upon obtaining a decision writing off debts, where there is any difference compared to the debts temporarily excluded from the value, the enterprise shall record it as an adjustment in financial statements before official conversion into a shareholding company.

- Overdue debts being principal which can not be written off shall be dealt with as follows:

+ The enterprise shall perform all the procedures for transfer of them to a shareholding company for repayment.

+ It shall agree with commercial banks being creditors on conversion of the debts into capital contribution.

+ It shall co-ordinate with commercial banks being creditors and the Development Assistance Fund to deal with the debts by way of selling debts to a company specializing in the purchase and sale of debts and idle stock from enterprises at an agreed price.

(d) With respect to any overdue debts being guaranteed foreign loans, the enterprise and the guarantor shall negotiate with the creditors a plan for dealing with [such debts] in accordance with the laws on control of foreign loans and loan repayments.

(dd) An enterprise shall be responsible to pay fully any social insurance or staff debts prior to conversion into a shareholding company in order to ensure that employees will receive their benefits.

(e) The conversion of debts payable (including debts payable to employees) into capital contribution in an equitized enterprise shall comply with State regulations on the right to purchase initial shares and the right of the State to hold controlling shares in enterprises. The price of shares shall be fixed through an auction.

1.4. Reserves, profits and losses:

Reserves for reduction of price of goods in stock, for bad debts, for reduction of value of securities, for exchange rate differences and for retrenchment allowances and financial reserves and profits and losses shall be dealt with in accordance with article 13 of Decree 187-2004-ND-CP, including:

(a) The balance in reserves for reduction of price of goods in stock shall be used to cover any reduction of prices of goods in stock (including the reductions of prices due to re-valuation of goods in stock at the date of valuation of the enterprise) and the remainder shall be accounted for in the business results of the enterprise.

(b) The balance in reserves for bad debts shall be used to cover debts receivable which are irrecoverable and the remainder shall be accounted for in the business results of the enterprise.

(c) The balance in reserves for reduction of value of securities shall be used to cover any reduction of the actual value of securities and the remainder shall be accounted for in the business results of the enterprise.

(d) The balance in reserves for exchange rate differences shall be used to cover exchange rate differences incurred and the remainder shall be accounted for in the business results of the enterprise.

(dd) The reserves for retrenchment allowances (to which full contributions are made in accordance with the stipulated regime) shall be used to pay allowances to employees who are retrenched during the equitization process and if not so paid up until the date of official conversion into a shareholding company, then the remainder shall be accounted for in the business results of the enterprise.

(e) Reserves for risks and professional reserves:

- The balance in reserves for risks of State owned commercial banks shall be dealt with in accordance with guidelines provided by the State Bank of Vietnam and the Ministry of Finance.

- The balance in professional reserves of insurers shall be dealt with in accordance with guidelines provided by the Ministry of Finance.

(g) The balance in financial reserves shall be used to off-set losses (if any) and cover damage to assets (including the book value of assets not required to be used or awaiting liquidation which is not included in the value of the enterprise) and irrecoverable debts and the remainder shall be paid into the portion of State owned capital in the enterprise.

(h) The profits generated shall be used to off-set previous years' losses (if any) and cover damage to assets (including the book value of assets not required to be used, assets awaiting liquidation which are not included in the value of the enterprise), reduction of the value of assets, and irrecoverable debts and the remainder shall be distributed in accordance with the applicable regulations.

(i) Financial reserves and pre-tax profits shall be used to cover losses incurred by the enterprise. If the enterprise lacks [such reserves] then it shall take measures to write off the State budget debts and debts to State owned commercial banks in accordance with Part B.1.3 of Section II of this Circular.

If after applying all the above measures an enterprise undergoing equitization still suffers a loss, the body making the decision on valuation of the enterprise shall consider a reduction in the portion of State owned capital.

1.5. Long-term investment capital in other enterprises such as joint venture capital contribution, associated ventures, shareholding capital contribution, capital contribution to establishment of limited liability companies and other forms of long- term investment shall be dealt with in accordance with article 14 of Decree 187-

2004-ND-CP, including:

(a) Where the enterprise inherits the joint venture [capital contribution], the value of joint venture capital contribution shall be included in the value of the enterprise in accordance with article 20 of Decree 187-2004-ND-CP.

(b) Where the enterprise does not inherit the joint venture [capital contribution] the competent body making the decision on equitization shall consider and deal with as follows:

- Sell the capital contribution made by the enterprise to another partner/entity or to other investors. The selling price must be close to the market price, but shall not be lower than the value of the portion of capital contribution shown in the audited financial statements as at the most recent date prior to the date of sale.

- Transfer them to another enterprise to act as partner/entity upon agreement with the other joint venture party(ies).

- If the enterprise and the joint venture party(ies) agree to terminate the joint venture contract, it shall be dealt with in accordance with the applicable laws for dealing with financial issues in respect of State owned companies upon termination of operation of joint venture enterprises.

1.6. Reward funds and welfare funds:

(a) Any cash balance in reward funds and welfare funds shall be distributed to employees named on the list of the regular employees of the enterprise at the date of the decision on equitization for the purpose of purchase of shares. After reaching agreement with the labour union, the director of an enterprise shall decide the distribution.

(b) Where the enterprise paid out more than the funds in the reward and welfare funds, [any excessive payment] shall be deducted from the actual value of assets currently being used for production or business and being investments funded by the reward and welfare funds. After so deducted, any deficit shall be dealt with as follows:

- The enterprise shall recover payments which were made directly to employees named on the list of the regular employees of the enterprise at the date of the decision on equitization prior to sales of shares at incentive rates.

- With respect to other payments such as payments disapproved [by the authority], gifts; payments to retrenched employees or to employees who ceased working prior to the date of the decision on equitization, the enterprise shall report to the body making the decision on valuation of the enterprise in order to deal with such payments as irrecoverable debts.

2. The period from the date of valuation of an enterprise to the date of official conversion into a shareholding company.

2.1. The period for dealing with financial issues within these two dates shall not exceed six months from the date of announcement of a value of the enterprise.

2.2. Upon obtaining the decision announcing its value, the enterprise shall be responsible for:

(a) Correcting its books of account and balance sheet in accordance with the stipulated State accounting regime.

(b) Preserving and handing over debts and assets excluded when determining the value of the enterprise (accompanied by relevant documents) to a company specializing in the purchase and sale of debts and idle stock from enterprises within a maximum period of thirty (30) days.

(c) Accounting fully for equitization costs arising.

2.3. Within thirty (30) days after official conversion into a shareholding company, the enterprise shall prepare financial statements as at the date of issuance of a business registration certificate and submit them to the managing body in accordance with the laws on financial management regime of enterprises.

Within thirty (30) days from the date of receipt of the financial statements, the competent body making the decision on evaluation of the enterprise shall inspect and deal with financial issues arising in the period between the two dates; re- determine the value of the portion of State owned capital and make a decision on adjustment of State owned capital in the enterprise; conduct the handover between the enterprise and a shareholding company; and send the result of the re-valuation of the enterprise to the Ministry of Finance.

2.4. The difference between the actual value of the portion of State capital as at the date of conversion of a State owned company into a shareholding company and the actual value of the portion of State capital as at the date of valuation of the enterprise shall be dealt with in accordance with article 25 of Decree 187-2004-ND- CP. If the difference is a decrease (including business losses), an enterprise shall clarify the objective and subjective reasons for it before dealing with it, including:

(a) The difference being a decrease due to objective reasons means a loss caused by natural calamities and enemy-inflicted destruction; change in State policies or change in the international market and other events of force majeure.

(b) Losses in other cases shall be fixed as having been caused by subjective reasons. The body making the decision on equitization shall not select individuals who are responsible for the difference being a decrease to act as a representative for the portion of State capital contribution in the shareholding company.

3. Hand-over of assets and capital

Based on the decision on adjustment of the value of the enterprise as at the date of business registration for conversion into a shareholding company, the steering committee for equitization shall direct the enterprise to correct its books of account, to prepare a file for hand-over and conduct the hand-over between the enterprise and the shareholding company.

3.1. The file for hand-over shall comprise:

(a) The file for valuation of the enterprise and decision announcing the value of the enterprise.

(b) Financial statements and tax finalization report as at the date of official conversion into a shareholding company.

(c) The decision of the competent body on the value of the enterprise as at the date of conversion into a shareholding company.

(d) The minutes of hand-over of assets and capital monies prepared on the date of hand-over.

3.2. Persons participating in the hand-over shall comprise:

(a) A representative of the line ministry or the people's committee of a province or city under central authority and a representative of the Ministry of Finance (in cases of equitization of the whole of a corporation).

(b) A representative of the corporation, the chairman of the board of management (in cases of equitization of a member enterprise of the corporation), the director and chief accountant of the State owned company as representatives of the transferor.

(c) The chairman of the board of management, director, chief accountant and representative of the trade union of the shareholding company as representatives of the transferee.

3.3. The minutes shall be signed by all persons participating in the hand-over and specify:

(a) Current status of assets, capital and workforce at the date of hand-over.

(b) Rights and obligations which the shareholding company continues to take over.

(c) Existing issues which are the responsibility of the shareholding company to continue to resolve.

III. METHODS OF VALUATION OF AN ENTERPRISE A. ASSET METHOD

1. The asset method is a method of valuation of an enterprise on the basis of evaluation of the actual value of all existing assets of the enterprise at the date of valuation of the enterprise.

2. This method shall apply to enterprises undergoing equitization, except for enterprises subject to the discounted currency flow method as stipulated in Part B.2 of Section III of this Circular.

3. The book value of an enterprise shall be the total value of all assets shown in the balance sheet of the enterprise.

The book value of the portion of State owned capital in the enterprise shall be the book value of the enterprise minus (-) debts payable, balances in reward and welfare funds and balance in the professional funding source (if any).

4. The actual value of an enterprise shall be the actual value of all existing assets of the enterprise at the date of valuation of the enterprise, including the profitability of the enterprise.

4.1 The actual value of the enterprise shall not include:

(a) Value of leased or borrowed assets, of assets received as joint venture capital contribution and of joint assets;

(b) Value of assets not required to be used, idle assets and assets awaiting liquidation;

(c) Debts receivable which are irrecoverable;

(d) Expenses of unfinished capital construction works in abeyance prior to the date of valuation of the enterprise in accordance with a decision of the authority;

(dd) Long-term investments in other enterprises which the competent body decides to transfer to another party;

(e) Assets belonging to welfare works funded by reward and welfare funds and residences of staff of the enterprise.

4.2. Bases for determination of the actual value of an enterprise at the date of valuation of the enterprise shall include:

(a) Data shown in books of account of the enterprise;

(b) Quantity and quality of actual assets in the inventory and classification;

(c) Technical functions of assets, need of utilization and market price;

(d) Value of land use rights and profitability of the enterprise (geographical position, goodwill of the enterprise, designs, trade names etc.)

5. Determination of the actual value of assets:

The actual value of assets shall be determined in Vietnamese Dong. Assets which are accounted for in foreign currency shall be converted into Vietnamese dong at the average trading exchange rate on the inter-bank foreign exchange market published by the State Bank at the date of valuation of the enterprise.

5.1. With respect to assets in kind:

(a) Only the assets of the enterprise which it continues to use shall be re-valued.

(b) The actual value of an asset shall be calculated by way of multiplying its market original price and its residual quality at the date of valuation.

In which:

- The market price is:

+ The current purchase or selling price of a brand-new asset in the market plus costs of transportation and installation (if any). In the case of special assets which are not circulating in the market, the purchase price of a brand-new asset of the same type made in the same country, or of assets of similar output or function shall be used. Where no equivalent assets are available, the book value of the assets shall be used.

+ The unit prices for capital construction and investment costs stipulated by the competent body shall apply to assets being products of capital construction. Where no relevant regulations are available, the value shown in the finalization report for the construction works as approved by the authorized body shall be used.

In the case of construction works which were completed within a three year period prior to valuation of the enterprise, the value shown in the finalization report for the construction works which was approved by the authorized body shall be used.

- The quality of an asset shall be determined as a percentage of quality of the brand-new asset of the same type when purchased or when investment and construction was first implemented in compliance with the State regulations on conditions for safety of its operation and use and product quality and the environmental hygiene for which guidelines were provided by ministries responsible for respective economic-technical branches. Where such State regulations are not available, quality of an valued asset shall not be less than 20%.

(c) With respect to fixed assets whose value has been depreciated to recover full capital, or work tools and apparatus serving administration whose value has been fully allocated into business costs, but the company undergoing equitization continues to use them, they shall be re-valued in order to include them in the value of the enterprise in accordance with Part A.5.1(b) of Section III of this Circular.

5.2. Assets in cash including cash, deposits and valuable papers (namely securities, bonds etc.) of an enterprise shall be determined as follows:

(a) On the basis of the minutes of cash-count in the case of cash.

(b) As the balances confirmed and certified by banks in the case of deposits.

(c) As the market price for trading in the case of valuable papers or as their par value if no trading is conducted.

5.3. Debts receivable which are included in the value of an enterprise shall be determined as the actual balance shown in the books of account in accordance with Part B.1.2 of Section II of this Circular.

5.4. Costs for unfinished works including costs of investment in capital construction, for production or business and professional costs shall be determined as the actual costs shown in the books of account.

5.5. Assets used as long or medium term security deposits or escrow deposits shall be determined as the actual balance shown in the account books which have been verified and certified.

5.6. Any intangible assets (if any) shall be determined at their residual value shown in the account books. The value of land use rights shall be determined in accordance with Part A.6 of Section III of this Circular.

5.7. Value of business advantages

The value of a business advantage shall be included in the value of an enterprise undergoing equitization in accordance with article 19.3 of Decree 187-2004-ND-CP and shall be calculated in accordance with the following formula:

|

Value of business advantage of an enterprise |

= |

Book value of the portion of State owned capital at the date of valuation |

X { |

Average after-tax profit ratio on State owned capital in the last three years prior to the date of valuation of an enterprise |

- |

Interest rate on Government bonds with a term of 10 year or more at the most recent time prior to the date of valuation of an enterprise |

} |

In which:

|

Average after-tax profit ratio on State owned capital in the last three years prior to the time of valuation of an enterprise |

= |

Average after-tax profit in the three most recent years prior to the date of valuation of an enterprise |

= |

100% |

|

State owned capital as shown in the account books in the three most recent years prior to the date of valuation of an enterprise |

5.8. Value of long-term investment capital of an enterprise in other enterprises shall be determined in accordance with article 20 of Decree 187-2004-ND-CP.

6. Value of land use rights

The value of land use rights which will be included in the value of an enterprise shall be calculated in accordance with articles 19.1 and 19.2 of Decree 187-2004-ND-CP, including:

6.1 In the case of the enterprise selecting the form of land lease:

(a) if it currently leases land, the value of land use rights shall not be included in the value of the enterprise; the shareholding company will continue to sign the land lease contract in accordance with the law and manage and use [the land] for the proper purpose and shall not be allowed to sell [the land].

(b) Where [the enterprise] has received an allocated area of land and paid a land use fee to the State Budget or purchased land use rights from other individuals or entities but now it selects the form of land lease, only expenses used to increase the use value of the land and the value of assets on the land such as expenses paid for compensation, for site clearance, for site levelling and so forth shall be included in the value of the enterprise.

6.2. Where the enterprise selects the form of land allocation with collection of land use fees, the value of land use rights which shall be included in the value of the enterprise shall be determined as follows:

(a) With respect to any areas of land currently leased by the enterprise: the value of land use rights which is included in the value of the enterprise shall be calculated at the price stipulated by the provincial people's committee and shall not accounted for as an increase in [the portion of] State owned capital in the enterprise but shall be accounted as a payment to the State Budget. The shareholding company shall make such payment to the State Budget for issuance of a certificate of land use right. The order and procedures for land allocation, payment of land use fees and issuance of certificates of land use right shall be performed in accordance with the Law on Land and legal instruments providing guidelines for implementation of the Law on Land.

(b) With respect to any areas of land which have been allocated to the enterprise and for which the enterprise has paid a land use fee to the State Budget, the value of land use rights shall be re-calculated at the price stipulated by the provincial people's committee. Any difference between the re-calculated value of land use rights and the book value shall be included in the actual value of the portion of State owned capital in the enterprise.

7. Actual value of the portion of State owned capital in an enterprise:

The actual value of the portion of State owned capital in an enterprise shall be the total actual value of the enterprise minus (-) actual debts payable, the balance in the welfare and reward funds, and the balance of the professional funding sources (if any) of which actual debts payable shall be the total value of payable debts of the enterprise minus (-) debts which are not required to be paid.

8. Actual value of a corporation:

In cases of equitization of the whole of a corporation, apart from implementation of the general provisions, the following guidelines shall be performed:

8.1. With respect to corporations in which the State makes the decision on investment and establishment:

(a) The actual value of the whole of a corporation shall comprise the actual value of all assets of the office of the corporation (including dependent cost accounting entities), independent cost accounting member companies and professional entities (if any).

(b) The actual value of the portion of State owned capital in the whole of a corporation shall comprise the actual value of the portion of State owned capital in the office of the corporation, in independent cost accounting member companies and professional entities (if any).

8.2. With respect to corporations invested in and established by companies:

(a) The actual value of the whole of a corporation for equitization shall be the actual value of all existing assets of the parent company.

(b) The actual value of State owned capital shall be the actual value of State owned capital in the parent company.

8.3. The valuation of a State owned corporation shall be carried out in accordance with Part A of Section III of this Circular. Attention should be paid to the following points:

(a) Capital of the corporation in an one member limited liability company which was converted from a member company of the corporation or established by the corporation shall be treated as a long-term investment of the corporation as stipulated in article 20 of Decree 187-2004-ND-CP.

(b) Value of business advantage of the corporation shall comprise the value of business advantage of the office of the corporation and of independent cost accounting member companies.

Profits and State owned capital for calculation of profit ratio shall be determined in accordance with Decree 199-2004-ND-CP of the Government dated 7 December 2004 issuing Regulations on Financial Management of Enterprises and Management of Portion of State Owned Capital Invested in Other Enterprises and legal instruments of the Ministry of Finance providing guidelines.

B. DISCOUNTED CURRENCY FLOW METHOD

1. The discounted currency flow method (DCF) is the method of valuation of an enterprise on the basis of the profitability of the enterprise in the future.

2. This method shall apply to enterprises engaged in main line business in the industries being financial, banking, commercial or consultancy services, construction design, information technology, or technology transfer; and which have an average after-tax profit ratio on State owned capital in the last five years prior to equitization higher than the interest rate on Government bonds with a term of 10 years or more at the most recent time prior to the date of valuation of the enterprise.

3. Bases for determination of the actual value of an enterprise:

3.1. Financial statements of the enterprise in the last five consecutive years prior to valuation of the enterprise.

3.2. Plans for manufacturing or trading activities of the enterprise for three to five years after conversion into a shareholding company.

3.3. The rate of interest paid in advance on Government bonds with a term of 10 years or more at the most recent time prior to the date of valuation of the enterprise and the cash flow discount coefficient of the enterprise.

3.4. Value of land use rights with respect to allocated areas of land.

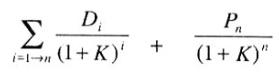

4. The actual value of the portion of State owned capital in the enterprise shall be determined as follows:

|

Actual value of the portion of |

= |

|

± |

Difference between values of the right to use allocated areas of land |

In which:

Difference between values of land use rights shall be determined in accordance with Part

A.6.2(b) of Section III of this Circular.

|

Di |

: is the present value of the dividend for the nth year |

|

(1 + K)i |

|

Pn |

is the present value of the portion of State owned capital in the nth year |

|

(1 + K)n |

i: is the order of the years continuing after the year of valuation of the enterprise (i: 1→ n).

Di: is the after-tax profit used to pay dividends in the nth year.

n: is the number of future years selected (from 3 to 5 years).

Pn: is the value of the portion of State owned capital in the nth year and calculated according to the following formula:

|

Pn = |

Dn+1 |

|

K-g |

Dn+1: is the after-tax profit used to pay forecast dividends for the nth + 1 year.

K: is the necessary rate of discount or rate of capital return [required by] investors when they purchase shares and is calculated according to the following formula:

K = Rf + Rp

Rf: is the ratio of profit earned from non-risk investments which is calculated at the rate of interest paid in advance on Government bonds with a term of 10 years or more at the most recent time prior to the date of valuation of the enterprise.

Rp: is the ratio of additional charge for risk upon investing in shares of companies in Vietnam, which is determined in accordance with the Table of indices for additional charges for risk of international securities in the annual publication on price assessment2, or by valuation companies for each enterprise, but it shall not exceed the ratio of profit earned from non-risk investments (Rf).

g: is the annual growth rate of dividends and is determined as follows:

g = b x R

In which:

b: is the ratio of after-tax profit retained to supplement capital.

R: is the average after-tax profit ratio on owner’s equity in future years.

5. Actual value of an enterprise at the date of valuation shall be determined in accordance with the discounted cash flow method as follows:

|

Actual value of an enterprise |

= |

Actual value of the portion of State owned capital |

+ |

Actual debts payable |

+ |

Balance in the welfare and reward funds |

+ |

Balance of professional funding sources |

In which:

The actual debts payable shall be total debt shown in the books of account minus (-) the value of debts which are not required to be paid plus (+) the value of the right to use any newly allocated area of land (which is determined in accordance with Part A.6.2(a) of Section III of this Circular).

6. The increase in State owned capital being the difference between the actual value and the book value [of State owned capital] shall be treated as a business advantage of the enterprise, and determined as an intangible fixed asset and depreciated in accordance with the applicable State regulations.

7. With respect to corporations and commercial banks which satisfy all the conditions for determining the value of an enterprise in accordance with the discounted currency flow method, profits and State owned capital shall be determined in accordance with the applicable laws on financial management with respect to State owned corporations and commercial banks.

(An example is set out in Appendix 2 to this Circular). C. OTHER METHODS

In addition to the two methods of valuation of the enterprise specified in Parts A and B of Section III of this Circular, the body making the decision on valuation of the enterprise and valuation organizations shall be allowed to use other methods of valuation upon written agreement with the Ministry of Finance.

IV. ORGANIZATION OF THE VALUATION OF AN ENTERPRISE

1. Selection of methods of valuation:

The principles of selection of a method of holding a valuation of an enterprise shall be performed as specified in article 23 of Decree 187-2004-ND-CP.

1.1. If an enterprise has a book value of assets of less than thirty (30) billion Vietnamese dong then it shall conduct its own valuation or hire a consultancy organization specializing in valuation to value the enterprise.

Where the enterprise conducts its own valuation, it must carry it out in accordance with Sections II and III of this Circular.

1.2. In the case of an enterprise having a book value of assets of thirty (30) billion Vietnamese dong or more or the office of a corporation (in cases of equitization of the whole of a corporation)3, it must hire a valuation organization to value the enterprise.

2. Hire of valuation organizations

2.1. Valuation organizations shall include auditing companies, securities companies, price evaluation organizations and investment banks with the function and capacity to make the valuation.

2.2. A valuation organization shall ensure the following standards and conditions:

(a) Perform the valuation function as stated in its business registration certificate or investment licence.

(b) Subject to its line business, ensure the conditions and standards provided by the applicable laws.

(c) Not have the same owner or any economic relation with the enterprise being valued such as capital contribution [to a business cooperation], to a joint venture or equity.

(dd) Not conduct any auditing for the enterprise being valued.

(dd) Not commit any breach of professional duty as provided by the laws.

2.3. Before the thirty first day of December each year, the Ministry of Finance shall publish a list of valuation organizations satisfying all the conditions and standards for valuation of enterprises for the subsequent year. A list of organizations with the function and capacity to make valuations for year 2005 is published in Appendix 3 to this Circular.

Where an organization with the function to make valuations commits a breach of the law, it shall be temporarily removed from the list and shall be returned to the list upon remedy of its breach.

2.4. Based on the list of valuation organizations published on an annual basis, the steering committee for equitization shall decide to select a valuation organization and shall be responsible for its selection.

2.5. Based on the selection made by the steering committee, the director of the enterprise shall sign a contract with the valuation organization in which the following items shall be specified:

(a) Method of valuation.

(b) The maximum period for performance shall not exceed sixty (60) days in cases of equitization of the whole of a corporation; and thirty (30) days in other cases.

(c) Responsibilities of the enterprise to perform works relating to the valuation such as inventory, classification of assets, dealing with financial issues, preparation of a production and business plan, provision of relevant documents etc. and responsibility for provided data and documents.

(d) Responsibilities of the valuation organization to perform in accordance with the regulations on valuation; to complete by the deadline specified in the signed contract and reach the result of the valuation in accordance with the law.

(e) Payment of fees for valuation shall be made upon obtaining a decision announcing the value of the enterprise.

2.6. During performance of the equitization plan, the valuation organization shall be responsible for co-ordinating with the enterprise to explain items relating to the valuation.

3. Files for valuation of an enterprise

3.1. The valuation organization making the valuation of an enterprise shall, in conjunction with the enterprise, prepare a file for valuation of the enterprise, comprising:

(a) Financial statements and report on tax finalization of the enterprise at the date of valuation.

(b) The report on results of the inventory and valuation of assets of the enterprise.

(c) The minutes of valuation of the enterprise (Appendices 4 and 5).

(d) Copies of detailed files on any outstanding issues which should be dealt with upon valuation of the enterprise.

(dd) Other necessary documents (depending on which method of valuation is to be used).

3.2. The steering committee for equitization shall be responsible for verifying the valuation results and reporting them to the body making the decision on valuation of the enterprise and the Ministry of Finance.

4. Decision and announcement of the valuation of an enterprise:

4.1. Within five working days from the date of receipt of the evaluation report and the file for evaluation of the enterprise, the body making the decision on valuation of the enterprise shall decide and announce the value of the enterprise (Appendix 6a).

4.2. Up until the date of official conversion of the enterprise into a shareholding company, the body making the decision on valuation of the enterprise shall deal finally with any financial issues in accordance with Part B.2 of Section II of this Circular and decide to adjust the value of the enterprise.

V. INITIAL SALE OF SHARES A. SHARE PURCHASERS AND SHARE STRUCTURE

1. Share purchasers:

1.1. Employees named on the list of the regular employees at the date of the decision on equitization.

1.2. Strategic investors referred to in article 26.2 of Decree 187-2004-ND-CP approved by the body making the decision on equitization.

1.3. Other domestic and foreign investors participating in a public auction in accordance with article 4 of Decree 187-2004-ND-CP.

2. Initial share structure:

2.1. The quantity of shares which the State shall hold shall be determined in accordance with the equitization plan and shall be adjusted on the basis of the result of the sale of shares at the date prior to the date of official conversion into a shareholding company decided by the body making the decision on equitization.

2.2. The quantity of shares for sale at incentive rates shall be specified as follows:

(a) Selling shares to employees of the enterprise up to a maximum of one hundred (100) shares for each year of employment in the State sector at a price which is reduced by forty (40) per cent compared to the average auction price4.

(b) Selling shares to strategic investors up to a maximum of twenty (20) per cent of the quantity of shares for sale at a price which is reduced by twenty (20) per cent compared to the average auction price5.

(c) The total value of incentives being reductions of prices (which is calculated on the basis of the par value) granted to employees and to strategic investors shall not exceed the portion of State owned capital in the enterprise after deducting the value of shares held by the State and equitization expenses in accordance with the limits.

2.3. The initial shares to be sold at a publicly announced price to investors (including shares purchased additionally to incentive shares by strategic investors and employees) shall be the remaining quantity of shares after share sales at the incentive rates but shall not be less than twenty (20) per cent of charter capital. In the case of [such quantity of shares] being less than twenty (20) per cent of charter capital, the matter shall be dealt with as follows:

(a) Additional shares shall be issued in order to increase the charter capital to the appropriate level.

(b) The quantity of shares which the State shall hold shall be reduced to the appropriate level.

(c) The quantity of shares for sale at incentive rates shall be adjusted to the appropriate level.

2.4. The total quantity of initial shares shall be the charter capital of the enterprise divided by the par value of a share (being 10,000 Dong).

(a) The quantity of shares for sale shall be the total quantity of initial shares minus (-) the quantity of shares which the State shall hold.

(b) The quantity of shares for sale at a publicly announced price shall be the quantity of shares to be sold minus (-) the quantity of shares for sale at incentive rates to employees and strategic investors.

B. HOLDING INITIAL SHARE AUCTION

1. The method of auction:

1.1. Auction directly at the enterprise in the case of the total value of shares for sale by auction of one billion Vietnamese dong or less shall be held by the steering committee for equitization.

1.2. Auction at an intermediary financial organization in the case of the value of shares for sale by auction above one billion Vietnamese dong to ten (10) billion dong and one billion Vietnamese dong or less if so required. The steering committee for equitization shall select and co-ordinate with an intermediary financial organization to hold the auction.

1.3. Auction at a Securities Trading Centre in the case of the total value of shares for sale by auction above ten (10) billion dong and ten (10) billion dong or less if so required. The steering committee for equitization shall select and co-ordinate with a Securities Trading Centre or an intermediary financial organization to hold the auction.

The steering committee for equitization shall register directly with or hire a intermediary financial organization to register for an auction at a Securities Trading Centre (in Hanoi or Ho Chi Minh City).

1.4. In the case of an enterprise in a remote area which is unable to select any intermediary financial organization to take on the sale of shares as stipulated in clauses 1.2 and 1.3 of Part B of Section V of this Circular, the body making the decision on equitization shall notify the Ministry of Finance of the matter for guidance for resolution.

2. Responsibilities of the relevant parties to the share sale auction:

2.1. The steering committee for equitization shall perform the following tasks:

(a) To report an equitization plan (Appendix 6b) to the body making the decision on equitization for approval, including a reserve price which shall be used as the basis for the auction.

(b) To finalize information relating to equitization (Appendix 7).

(c) To submit documents relating to equitization and an application register for an auction (Appendix 8) to a Securities Trading Centre (in the case of sale via a Securities Trading Centre) or sign a contract with an intermediary financial organization in the case of sale via intermediary financial organizations.

(d) To co-ordinate with the body conducting the auction to make a public announcement of information relating to the enterprise and the auction to investors no later than twenty (20) days before the date on which the auction is conducted.

(dd) To gather and report the result of the sale auction.

2.2. The body conducting the auction (the enterprise, or an intermediary financial organization, or a Securities Trading Centre) shall perform the following tasks:

(a) To request the steering committee for equitization and the enterprise to provide full documents and information on equitization as stipulated.

(b) To notify the steering committee for equitization and the enterprise of the time and place where the auction is to be held.

(c) To make a public announcement at the enterprise, at the place where the auction will be conducted, and on five consecutive issues of a central daily and a newspaper of the locality where the equitized enterprises are headquartered about information relating to the share auction at least twenty (20) days before the auction is held (Appendix 9).

(d) To provide information relating to the enterprise and the auction to investors and investment promotion organizations together with an application [form] to register for auction participation.

(dd) To receive applications to register for auction participation (Appendices 10a and 10b), to examine the auction participation conditions and issue auction participation cards to eligible investors.

At least three working days before the date on which the auction is held, the body conducting the auction must complete the issuance of auction participation cards to investors.

Where any investor is ineligible for auction participation, the body conducting the auction must provide notification and reimburse the deposit to the investor (where the investor has paid a deposit).

(e) To conduct the auction, to prepare minutes (Appendix 11) and notify the steering committee for equitization of the results.

(g) The body conducting the auction must maintain confidentiality in respect of bid prices of investors up until the time of announcement of the official result.

2.3. An investor participating in the auction shall perform the following tasks:

(a) To submit to the body conducting the auction an application to register [for auction participation] and documents evidencing that he or she has full capacity for civil acts (in the case of individuals) or it has legal entity status (in the cases of organizations). In the case of foreign investors, article 4.2 of Decree 187-2004-ND-CP shall apply.

(b) To make fully a deposit equal to 10% of the value of the shares which they register to buy, calculated according to the reserve price.

(c) The deadline for submission of the application and payment of a deposit shall be no later five days before the date on which the auction is to be held.

(d) To carry out the auction in accordance with the regulations. Its right to participate in the auction shall be deprived and its deposit shall not be reimbursed if [the investor] commits a breach.

(dd) To make fully and on time the payment for shares if the investor is entitled to buy.

3. Conducting auction:

3.1. An auction shall be conducted if it is participated in by at least two eligible investors. Where this condition is not satisfied, the auction shall not be conducted and shall be deemed to have failed.

3.2 An auction shall be conducted as follows:

(a) In the form of secret bid casting in the case of an auction directly at the enterprise or at an intermediary financial organization or at a Securities Trading Centre. Investors shall record their buying prices (bid) of the already registered quantities of shares in the auction participation cards and send them to the body conducting the auction within the time-limit stipulated in the regulations on auctions.

In the case of an auction at a Securities Trading Centre, the investor may select to cast directly at the Securities Trading Centre or send its bid via a securities company being a member participating in the auction at the Securities Trading Centre.

(b) In the case of an auction at a Securities Trading Centre, bids may be offered via a network in accordance with the regulations of the Ministry of Finance.

3.3. Determination of the auction results

(a) The auction results shall be determined on the basis of the highest bids. Investors shall be allowed to purchase shares at the price they have offered.

(b) The investor who offers the highest price shall have the right to buy all the registered quantity of shares at the offered price. The remaining quantity of shares shall be sold to the investors of the immediate lower prices until the quantity of shares offered for sale are sold out.

Where the investors offer equal prices but the quantity of shares offered for sale is smaller than the aggregate quantity of shares they have registered to buy, the quantity of shares which each investor is entitled to purchase shall be determined as follows:

|

Quantity of shares which each investor is entitled to purchase |

= |

Remaining Quantity of shares offered for sale |

x |

Quantity of shares which each investor has registered to buy at the same price |

|

Aggregate quantity of shares which investors have registered to buy at the same price |

(c) In all cases of offering prices lower than the reserve price, the investors shall not be entitled to get back their deposit.

(d) The auction results shall be recorded in the minutes signed by the representatives of the body conducting the auction, of the steering committee for equitization and of the enterprise (in Appendix 11 to this Circular) and forwarded to the body making the decision on valuation of the enterprise, the Ministry of Finance, the steering committee for equitization and the enterprise and kept at the body conducting the auction.

(e) The body conducting the auction shall have to publicly announce the auction results to investors at the end of the auction.

(Specific steps of an auction shall be as specified in Appendix 12)

4. The steering committee for equitization shall direct the enterprise to sell shares to employees and strategic investors in accordance with the approved equitization plan.

5. Payment for purchased shares.

5.1. Within fifteen (15) working days from the date of announcement of the auction results, the body conducting the auction and the investors (including employees and strategic investors) shall be responsible for completing the share purchase and sale and the transfer of the sums for purchase of shares into the bank account of the enterprise undergoing equitization.

5.2. The share purchase and sale shall be effected in Vietnam dong. Where shares are purchased in foreign currencies, such foreign currencies must be converted into Vietnam dong at the average transaction exchange rate on the inter-bank foreign currency market, published by the State Bank of Vietnam at the date of auction. Payment can be made in cash or via bank transfer.

5.3. Where investors (including employees and strategic investors) fail to pay or make an insufficient payment compared to the sums payable for purchase of shares, the unpaid quantities of shares shall be considered as the share quantities they refuse to buy and shall be dealt with in accordance with Part B.6 of Section V of this Circular.

6. Dealing with the remaining quantity of shares.

6.1. Where the investors (including employees and strategic investors) do not buy all the quantities of shares, the remaining quantity of shares shall be sold to investors participating in the auction in accordance with Part B.3.3 of Section V of this Circular.

6.2. Where the investors participating in the auction do not buy all the quantities of shares for sale, the scale of the charter capital and portion of State owned capital in the enterprise shall be adjusted accordingly (except for issuance-underwriting).

6.3. Where the investors participating in the auction do not buy all the quantities of shares they are entitled to buy according to the announced auction results, they shall not be entitled to get back the deposited amounts corresponding to the share quantities they refuse to buy.

7. Deposit management

7.1. For the investors participating properly in the auction that are not entitled to buy shares, within 5 days (after the close of the auction) the body conducting the auction shall have to reimburse fully their deposits.

7.2. For the investors entitled to buy shares according to the auction results, their deposits shall be deducted from the total payable sums corresponding to the portion of shares actually purchased through auction.

7.3. For the deposits which shall not have to be reimbursed to investors, the body conducting the auction shall transfer them to the enterprise to deal with them in accordance with the regulations on management and utilization of proceeds from equitization.

8. Expenses for the share sale auction shall be decided by the steering committee for equitization but shall not exceed ten (10) per cent of the total equitization expenses. In the case of an auction at a Securities Trading Centre, expenses shall be allocated between the Centre and the intermediary financial organization as agreed by the parties.

VI. MANAGEMENT AND UTILIZATION OF PROCEEDS FROM EQUITIZATION

1. Proceeds from equitization, after deducting equitization expenses (in accordance with Section VI.2 of this Circular), shall be managed and utilized as follows:

1.1. To assist the enterprise to implement the policies applicable to people who were employees at the time of the decision on equitization.

(a) To assist [the enterprise] to pay allowances to employees named on the list of the regular employees of the enterprise at the date of the decision on equitization who voluntarily cease work and employees who have been recruited after 21 April 1998 and lose their jobs or have their labour contract terminated, including:

- The level of allowances payable to each employee shall be determined in accordance with articles 17 and 42 of the Labour Code.

- The enterprise shall be responsible for utilizing its reserves for retrenchment allowances (which have been established fully in accordance with State regulations) to pay allowances to employees. If such reserves are insufficient, the proceeds from equitization shall be used.

- The director of the enterprise shall be responsible for:

+ Preparing a plan for allowances payable to employees who lose or cease work and including it in the equitization plan for submission to the authority for approval.

+ Organizing the payment of stipulated allowances to employees and preparing a finalization report and submitting it to the body making the decision on valuation of the enterprise for examination and approval in accordance with the applicable laws.

(b) To assist [the enterprise] to re-train employees so as to assign them to new work in the shareholding company:

- The period of re-training shall not exceed six months; the maximum allowance shall be 350,000 dong per employee per month.

-The director of the enterprise shall be responsible for:

+ Preparing a plan for re-training allowances (number of employees, trades, duration etc.) and including it in the equitization plan.

+ Signing contracts with training establishments after the equitization plan is approved, but not later than thirty (30) days from the date of official conversion of the enterprise into a shareholding company.

+ Liquidating contracts, paying training fees to the training establishments and preparing a report on finalization of training costs and submitting it to the body making the decision on valuation of the enterprise for approval in accordance with the applicable laws within a period of eight months from the date of official conversion of the enterprise into a shareholding company.

1.2. Where the proceeds from equitization are insufficient for assisting the enterprise to implement the policies applicable to employees as stipulated in Section VI.1.1, the deficit shall be funded by:

(a) The corporation in the case of equitization of a member enterprise.

(b) The independent State owned company or member company in the case of equitization of a section of such company.

(c) The Assistance Fund for Restructure of Enterprises at the Ministry of Finance in the case of equitization of independent State owned companies and corporations (in the case of equitization of the whole of a corporation).

1.3 The enterprise shall pay the remaining proceeds from equitization as follows:

(a) To the company in the case of equitization of a section of the company.

(b) To the corporation in the case of equitization of a member company.

(c) To the Assistance Fund for Restructure of Enterprises at the Ministry of Finance in the case of equitization of an independent State owned company or corporation.

The sum payable shall be determined as follows:

|

Sum payable |

= |

Value of State owned capital at the time of valuation of the enterprise |

+ |

Differences resulting from share sale auction |

- |

Value of State shareholding |

- |

Equitization expenses |

- |

Retrenchment allowances |

- |

Training costs |

In which:

- Re-training costs for employees shall be temporarily determined on the basis of the signed contracts with training establishments. Upon liquidation of the contracts, any excess amount shall be paid in accordance with this clause.

- Differences resulting from the share sale auction from which reductions of prices of incentive shares sold to employees and strategic investors have already been set off, shall be calculated according to the following formula:

|

Differences resulting from the share sale auction |

= |

Quantity of |

x [ |

Actual selling price of each type of share |

- |

10,000 dong ] |

In which:

+ Quantity of sold share of each type shall include the quantities of shares actually sold to each investor participating in the auction; and quantities of shares actually sold to employees and strategic investors.

+ Actual selling price of each type of share means the successful auction bid of each such investor participating in the auction; the selling price of incentive shares sold to employees which has been reduced by forty (40) per cent compared to the average auction price6; or the selling price of incentive shares sold to strategic investors which has been reduced by twenty (20) per cent compared to the average auction price7.

1.4. Proceeds from equitization shall be managed and utilized as follows:

(a) The independent company or member company of a corporation shall use them to add to business capital and to assist equitized sections to continue to resolve the issue of employees in accordance with article 36.8 of Decree 187- 2004-ND-CP.

(b) The corporation shall use them to add to business capital and assist equitized companies to pay allowances to retrenched employees in accordance with article 36.8 of Decree 187-2004-ND-CP.

(c) The Assistance Fund for Restructure of Enterprises at the Ministry of Finance shall use [proceeds] to invest additional capital in enterprises in which it is necessary for the State to invest capital in accordance with the applicable regulations; and to assist shareholding companies and equitized corporations to continue to resolve the issue of retrenched employees in accordance with article 36.8 of Decree 187-2004-ND-CP.

2. Equitization expenses means expenses relating to equitization of an enterprise from the date of the decision on equitization to the date of hand-over between the enterprise and the shareholding company.

2.1. Equitization expenses shall include:

(a) Direct costs at an enterprise:

- Costs of conducting professional training on equitization of the enterprise;

- Costs of inventory and calculation of value of assets;

- Costs of preparation of the equitization plan, and preparation of the charter on organization and operation of the shareholding company;

- Costs of a general meeting of all staff of the enterprise for implementation of equitization;

- Costs of advertising and disseminating information on equitization of the enterprise;

- Costs of organizing sale of shares;

- Costs of first general meeting of shareholders;

- Other expenses relating to equitization of the enterprise.

(b) Costs of hiring auditors or consultants to value the enterprise and sell shares.

(c) Expenses for the steering committee for equitization.

2.2. The maximum levels of expenses which is calculated on the basis of the book value of an enterprise shall be specified as follows:

+ Not in excess of two hundred (200) million Vietnamese dong for any enterprise with a value of below thirty (30) billion Vietnamese dong.

+ Not in excess of three hundred (300) million Vietnamese dong for any enterprise with a value of thirty (30) to fifty (50) billion Vietnamese dong.

+ Not in excess of four hundred (400) million Vietnamese dong for any enterprise with a value of over fifty (50) billion Vietnamese dong.

+ Where equitization is of the whole of a State owned corporation, estimated equitization expenses shall be fixed in the plan of equitization of the corporation.

The general director or director of the enterprise shall decide items and necessary levels of expenses within the maximum limit in order to implement the equitization process and shall be responsible for the lawfulness and validity of such expenses.

In cases of equitization of enterprises with a large scale which are complex and require necessary expenses more than the maximum limits; the body making the decision on valuation of the enterprise shall consider and decide on its own initiative on the matter and report [its decision] to the Ministry of Finance.

Upon completion of the equitization process, an enterprise shall implement accounting finalization of equitization expenses and report it to the body making the decision on valuation of the enterprise for approval.

VII. POLICIES APPLICABLE TO ENTERPRISES AND TO EMPLOYEES AFTER EQUITIZATION

1. With respect to enterprises

1.1. Equitized enterprises shall be entitled to the incentives as stipulated in article 36 of Decree 187-2004-ND-CP and the applicable State regulations on enterprises.

With respect to investment incentives, equitized enterprises shall determine on their own initiative levels of incentives in accordance with the applicable laws and register them with the tax authority (accompanied by a copy of the decision approving the equitization plan and of the business registration certificate of the shareholding company) for resolution.

1.2. Shareholding companies which are established from equitization of member companies of a corporation and in which the State owned capital accounts for over fifty (50) per cent of the charter capital shall still be members of the corporation but shall not be required to pay administration expenses to the corporation.

1.3. The State shall provide enterprises with funds from proceeds from equitization and the Assistance Fund for Retrenched Employees due to Restructure of State Owned Enterprises in order to implement policies applicable to employees in accordance with the applicable laws.

2. With respect to employees of enterprises

2.1. Incentives applicable to employees shall be implemented in accordance with articles 36 and 37 of Decree 187-2004-ND-CP, including that employees purchasing incentive shares shall be allowed to freely transfer their shares and shall not be subject to any limit on the period for holding [shares] except for founding shareholders who are subject to the charter of the company.