Nội dung toàn văn Decision No. 15/2005/QD-BTC, adjusting the preferential import tax rates of a number of electronic accessories and spare parts, promulgated by the Ministry of Finance.

|

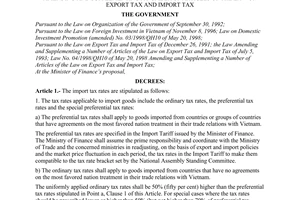

THE

MINISTER OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 15/2005/QD-BTC |

Hanoi, March 17, 2005 |

DECISION

ADJUSTING THE PREFERENTIAL IMPORT TAX RATES OF A NUMBER OF ELECTRONIC ACCESSORIES AND SPARE PARTS

THE MINISTER OF FINANCE

Pursuant to the Government’s

Decree No. 86/2002/ND-CP of November 5, 2002 defining the functions, tasks,

powers and organizational structures of the ministries and ministerial-level agencies;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003 defining

the functions, tasks, powers and organizational structure of the Ministry of

Finance;

Pursuant to the Tariff according the list of import tax-liable commodity

groups, issued together with Resolution No. 63/NQ-UBTVQH10 of October 10, 1998

of the Xth National Assembly Standing Committee, which was amended

and supplemented under Resolution No. 399/2003/NQ-UBTVQH11 of June 19, 2003 of

the XIth National Assembly Standing Committee, amending and

supplementing the Tariff according to the list of import tax-liable commodity

groups;

Pursuant to Article 1 of the Government’s Decree No. 94/1998/ND-CP of November

17, 1998 detailing the implementation of Law No. 04/1998/QH10 of May 20, 1998

Amending and Supplementing a Number of Articles of the Law on Import Tax and

Export Tax;

At the proposal of the Director of the Tax Policy Department,

DECIDES:

Article 1.- To amend the preferential import tax rates of a number of electronic accessories and spare parts under Headings No. 8504, 8522, 8529, 8532, 8534, 8540 and 8541 defined in the Finance Minister’s Decision No. 110/2003/QD-BTC of July 25, 2003 into new preferential import tax rates defined in the list enclosed herewith.

Article 2.- This Decision takes effect 15 days after its publication in the Official Gazette.

|

|

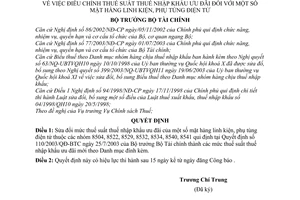

FOR

THE MINISTER OF FINANCE |

LIST

OF

AMENDED IMPORT TAX RATES OF A NUMBER OF ELECTRONIC ACCESSORIES AND SPARE PARTS

DEFINED IN THE PREFERENTIAL IMPORT TARIFF

(Issued together with the Finance Minister’s Decision No. 15/2005/QD-BTC of

March 17, 2005)

|

Code |

Description |

Tax rate (%) |

||

|

8504 |

|

|

Electrical transformers, static converters (for example, rectifiers) and inductors |

|

|

8504 |

10 |

00 |

- Ballasts for discharge lamps or tubes |

15 |

|

|

|

|

‑ Liquid dielectric transformers: |

|

|

8504 |

21 |

|

- - Having a power handling capacity not exceeding 650 kVA: |

|

|

8504 |

21 |

10 |

- - - Step-voltage regulators; instrument transformers with handling capacity not exceeding 5 kVA |

30 |

|

|

|

|

- - - Other: |

|

|

8504 |

21 |

91 |

- - - - Having a power handling capacity exceeding 10 kVA |

30 |

|

8504 |

21 |

99 |

- - - - Other |

30 |

|

8504 |

22 |

|

- - Having a power handling capacity exceeding 650 kVA but not exceeding 10,000 kVA: |

|

|

|

|

|

- - - Step-voltage regulators: |

|

|

8504 |

22 |

11 |

- - - - Of a high side voltage of 66,000 volts or more |

30 |

|

8504 |

22 |

19 |

- - - - Other |

30 |

|

8504 |

22 |

90 |

- - - Other |

30 |

|

8504 |

23 |

|

- - Having a power handling capacity exceeding 10,000 kVA: |

|

|

8504 |

23 |

10 |

- - - Having a power handling capacity not exceeding 15,000 kVA |

5 |

|

8504 |

23 |

20 |

- - - Having a power handling capacity exceeding 15,000 kVA |

5 |

|

|

|

|

‑ Other transformers: |

|

|

8504 |

31 |

|

- - Having a power handling capacity not exceeding 1 kVA: |

|

|

8504 |

31 |

10 |

- - - Instrument potential transformers |

30 |

|

8504 |

31 |

20 |

- - - Instrument current transformers |

30 |

|

8504 |

31 |

30 |

- - - Flyback transformers |

5 |

|

8504 |

31 |

40 |

- - - Intermediate frequency transformers |

30 |

|

8504 |

31 |

50 |

- - - Step up/down transformers, slide regulators, stabilizers |

30 |

|

8504 |

31 |

90 |

- - - Other |

30* |

|

8504 |

32 |

|

- - Having a power handling capacity exceeding 1 kVA but not exceeding 16 kVA: |

|

|

8504 |

32 |

10 |

- - - Instrument transformers, (potential and current) of a power handling capacity not exceeding 5 kVA |

30* |

|

8504 |

32 |

20 |

- - - Used with toys, scale models or similar recreational models |

30 |

|

8504 |

32 |

30 |

- - - Other, high frequency |

0 |

|

|

|

|

- - - Other: |

|

|

8504 |

32 |

91 |

- - - - Of a power handling capacity not exceeding 10 kVA |

30* |

|

8504 |

32 |

99 |

- - - - Of a power handling capacity exceeding 10 kVA |

30* |

|

8504 |

33 |

|

- Having a power handling capacity exceeding 16 kVA but not exceeding 500 kVA: |

|

|

8504 |

33 |

10 |

- - - Of high side voltage of 66,000 volts or more |

30* |

|

8504 |

33 |

90 |

- - - Other |

30* |

|

8504 |

34 |

|

- - Having a power handling capacity exceeding 500 kVA: |

|

|

|

|

|

- - - Having a power handling capacity not exceeding 15,000 kVA: |

|

|

8504 |

34 |

11 |

- - - - Having a power handling capacity exceeding 10,000 kVA |

|

|

|

|

|

or of high side voltage of 66,000 volts or more |

30 |

|

8504 |

34 |

19 |

- - - - Other |

30 |

|

8504 |

34 |

20 |

- - - Having a power handling capacity exceeding 15,000 kVA |

30 |

|

8504 |

40 |

|

- Static converters: |

|

|

|

|

|

- - Static converters for automatic data processing machines and units thereof, and telecommunications apparatus: [ITA1/A-024] |

|

|

8504 |

40 |

11 |

- - - UPS |

5 |

|

8504 |

40 |

19 |

- - - Other |

0 |

|

8504 |

40 |

20 |

- - Battery chargers having a rating exceeding 100 kVA |

0 |

|

8504 |

40 |

30 |

- - Other rectifiers |

0 |

|

8504 |

40 |

40 |

- - Other inverters |

0 |

|

8504 |

40 |

90 |

- - Other |

0 |

|

8504 |

50 |

|

- Other inductors: |

|

|

|

|

|

- - Having a power handling capacity exceeding of 2,500 kVA but not exceeding 10,000 kVA: |

|

|

8504 |

50 |

11 |

- - - Inductors for power supplies for automatic data processing machines and units thereof, and telecommunication apparatus [ITA1/A-025] |

0 |

|

8504 |

50 |

12 |

- - - Other chip type fixed inductors [ITA/2] |

0 |

|

8504 |

50 |

19 |

- - - Other |

0 |

|

|

|

|

- - Having a power handling capacity exceeding 10,000 kVA: |

|

|

8504 |

50 |

21 |

- - - Inductors for power supplies for automatic data processing machines and units thereof, and telecommunication apparatus |

0 |

|

8504 |

50 |

22 |

- - - Other chip type fixed inductors |

0 |

|

8504 |

50 |

29 |

- - - Other |

0 |

|

|

|

|

- - Other: |

|

|

8504 |

50 |

91 |

- - - Chip type fixed inductors [ITA/2] |

0 |

|

8504 |

50 |

99 |

- - - Other |

0 |

|

8504 |

90 |

|

- Parts: |

|

|

8504 |

90 |

10 |

- - Of goods of subheading of 8504.10.00 |

5 |

|

8504 |

90 |

20 |

- - Printed circuit assemblies for the goods of subheading 8504.40.11, 8504.40.19 or 8504.50.11 [ITA1/B-199] |

0 |

|

8504 |

90 |

30 |

- - For electrical transformers of capacity not exceeding 10,000 kVA |

5 |

|

8504 |

90 |

40 |

- - For electrical transformers of capacity exceeding 10,000 kVA |

0 |

|

8504 |

90 |

50 |

- - Other, for inductors of capacity not exceeding 2,500 kVA |

0 |

|

8504 |

90 |

60 |

- - Other, for inductors of capacity exceeding 2,500 kVA |

0 |

|

8504 |

90 |

90 |

- - Other |

0 |

|

8522 |

|

|

Parts and accessories suitable for use solely or principally with the apparatus of headings 85.19 to 85.21 |

|

|

8522 |

10 |

|

- Pick‑up cartridges: |

|

|

8522 |

10 |

10 |

- - For special use in cinematographic, television, broadcasting |

0 |

|

8522 |

10 |

90 |

- - Other |

0 |

|

8522 |

90 |

|

- Other: |

|

|

8522 |

90 |

10 |

- - Printed circuit boards assemblies for television, broadcasting, cinematographic sound recorders and reproducers |

5 |

|

8522 |

90 |

20 |

- - Printed circuit boards assemblies for telephone answering machines (ITA1/B-199] |

10 |

|

8522 |

90 |

30 |

- - Other printed circuit boards assemblies |

5 |

|

8522 |

90 |

40 |

- - Audio or video tapedecks and compact disc mechanisms |

0 |

|

8522 |

90 |

50 |

- - Audio or visual reproduction heads, magnetic type; magnetic erasing heads and rods |

0 |

|

|

|

|

- - Other: |

|

|

8522 |

90 |

91 |

- - - Other parts and accessories of television, broadcasting, cinematographic sound recorders and reproducers |

5 |

|

8522 |

90 |

92 |

- - - Other parts of telephone answering machines |

10 |

|

8522 |

90 |

93 |

- - - Other parts and accessories for goods of subheadings 8519.92, 8519.93, 8519.99 and headings 85.20 (other than for telephone answering machines) or 85.21 |

5 |

|

8522 |

90 |

99 |

- - - Other |

5 |

|

8529 |

|

|

Parts suitable for use solely or principally with the apparatus of headings 85.25 to 85.28 |

|

|

8529 |

10 |

|

- Aerials and aerial reflectors of all kinds; parts suitable for use therewith: |

|

|

8529 |

10 |

10 |

- - Aerials or antennae of a kind used with apparatus for radio- telephony and radio-telegraphy [ITA1/A-052]; parts of paging alert devices [ITA1/B-197] |

10 |

|

8529 |

10 |

20 |

- - Parabolic aerial reflector dishes for direct broadcast multi-media systems and parts thereof |

10 |

|

8529 |

10 |

30 |

- - Telescopic, rabbit and dipole antennae for television or radio receivers |

20 |

|

8529 |

10 |

40 |

- - Aerial filters and separators [ITA/2] |

10 |

|

|

|

|

- - Parts mounted on PCB and / or cabinet / cabinet parts: |

|

|

8529 |

10 |

51 |

- - - For use with transmission apparatus or reception apparatus for radio-telegraphy, radio-telephony, radio-broadcasting or television |

10 |

|

8529 |

10 |

59 |

- - - Other |

10 |

|

8529 |

10 |

60 |

- - Wave guide (feed horn) |

10 |

|

|

|

|

- - Other: |

|

|

8529 |

10 |

91 |

- - - For radio-telephony or radio-telegraphy |

10 |

|

8529 |

10 |

92 |

- - - For transmission apparatus for radio-broadcasting or television |

10 |

|

8529 |

10 |

99 |

- - - Other |

10 |

|

8529 |

90 |

|

- Other: |

|

|

|

|

|

- - Parts including printed circuit assemblies of the following: transmission apparatus other than radio-broadcasting or television transmission; digital still image video cameras; portable receivers for calling, alerting or paging [ITA1/A-053] and paging alert devices, including pagers [ITA1/B-197]: |

|

|

8529 |

90 |

11 |

- - - For cellular phones |

5 |

|

8529 |

90 |

12 |

- - - Other |

0 |

|

8529 |

90 |

20 |

- - For decoders, other than those of 8529.90.11 and 8529.90.12 |

0 |

|

|

|

|

- - Printed circuit boards, assembled, other than those of 8529.90.11 and 8529.90.12: |

|

|

8529 |

90 |

31 |

- - - For goods of subheading 8527.13, 8527.19, 8527.21, 8527.29, 8527.31, 8527.39 or 8527.90 (for radio-telephony or radio- telegraphy only) |

10 |

|

8529 |

90 |

32 |

- - - For the goods of 8525.10 or 8525.20 (not for radio-telephony or radio-telegraphy) |

0 |

|

8529 |

90 |

33 |

- - - For the goods of 8527.13, 8527.19, 8527.21, 8527.29, 8527.31, |

|

|

|

|

|

8527.39 or 8527.90 (not for radio-telephony or radio-telegraphy) |

5 |

|

8529 |

90 |

34 |

- - - For goods of subheading 85.26 |

0 |

|

8529 |

90 |

35 |

- - - For goods of subheading 85.28 |

5 |

|

8529 |

90 |

36 |

- - - For goods of subheading 8525.30 |

0 |

|

8529 |

90 |

37 |

- - - For goods of subheading 8527.12 or 8527.32 |

5 |

|

8529 |

90 |

39 |

- - - Other |

5 |

|

|

|

|

- - Other: |

|

|

8529 |

90 |

91 |

- - - For television |

5 |

|

8529 |

90 |

92 |

- - - For radio-telephony or radio-telegraphy only |

10 |

|

8529 |

90 |

93 |

- - - Other, of goods of heading 85.28 |

5 |

|

8529 |

90 |

99 |

- - - Other |

5 |

|

8532 |

|

|

Electrical capacitors, fixed, variable or adjustable (pre‑set) |

|

|

8532 |

10 |

00 |

- Fixed capacitors designed for use in 50/60 Hz circuits and having a reactive power handling capacity of not less than 0.5 kvar (power capacitors) |

5 |

|

|

|

|

‑ Other fixed capacitors [ITA1/A-056]: |

|

|

8532 |

21 |

00 |

- - Tantalum [ITA1/A-057] |

10 |

|

8532 |

22 |

00 |

- - Aluminum electrolytic [ITA/A-058] |

10 |

|

8532 |

23 |

00 |

- - Ceramic dielectric, single layer [ITA1/A-059] |

0 |

|

8532 |

24 |

00 |

- - Ceramic dielectric, multilayer [ITA1/A-060] |

0 |

|

8532 |

25 |

00 |

- - Dielectric of paper or plastics [ITA1/A-061] |

5 |

|

8532 |

29 |

00 |

- - Other [ITA1/A-062] |

5 |

|

8532 |

30 |

00 |

- Variable or adjustable (pre‑set) capacitors [ITA1/A-063] |

5 |

|

8532 |

90 |

|

- Parts: [ITA1/A-064] |

|

|

8532 |

90 |

10 |

- - Used with capacity of 500 kVA or more |

5 |

|

8532 |

90 |

90 |

- - Other |

5 |

|

8534 |

|

|

Printed circuits [ITA1/A-072] |

|

|

8534 |

00 |

10 |

- Single-sided |

0 |

|

8534 |

00 |

20 |

- Double-sided |

0 |

|

8534 |

00 |

30 |

- Multi-layer |

0 |

|

8534 |

00 |

90 |

- Other |

0 |

|

8540 |

|

|

Thermionic, cold cathode or photo‑cathode valves and tubes (for example, vacuum or vapor or gas filled valves and tubes, mercury arc rectifying valves and tubes, cathode‑ray tubes, television camera tubes) |

|

|

|

|

|

‑ Cathode‑ray television picture tubes, including video monitor cathode‑ray tubes: |

|

|

8540 |

11 |

|

- - Color: |

|

|

8540 |

11 |

10 |

- - - Flat monitor |

15 |

|

8540 |

11 |

90 |

- - - Other |

20 |

|

8540 |

12 |

00 |

- - Black and white or other monochrome |

|

|

8540 |

20 |

|

- Television camera tubes; image converters and intensifiers; other photo-cathode tubes: |

|

|

8540 |

20 |

10 |

- - For use with articles of heading 85.25 |

10 |

|

8540 |

20 |

90 |

- - Other |

10 |

|

8540 |

40 |

|

- Data/graphic display tubes, color, with a phosphor dot screen pitch smaller than 0.4 mm: [ITA1/B-195] |

|

|

8540 |

40 |

10 |

- - For use with articles of heading 85.25 |

0 |

|

8540 |

40 |

90 |

- - Other |

0 |

|

8540 |

50 |

|

- Data/graphic display tubes, black and white or other monochrome: |

|

|

8540 |

50 |

10 |

- - For use with articles of heading 85.25 |

0 |

|

8540 |

50 |

90 |

- - Other |

0 |

|

8540 |

60 |

00 |

- Other cathode-ray tubes |

0 |

|

|

|

|

‑ Microwave tubes (for example, magnetrons, klystrons, traveling wave tubes, carcinotrons), excluding grid‑controlled tubes |

|

|

8540 |

71 |

|

- - Magnetrons: |

|

|

8540 |

71 |

10 |

- - - For use with articles of heading 85.25 |

0 |

|

8540 |

71 |

90 |

- - - Other |

0 |

|

8540 |

72 |

|

- - Klystrons: |

|

|

8540 |

72 |

10 |

- - - For use with articles of heading 85.25 |

0 |

|

8540 |

72 |

90 |

- - - Other |

0 |

|

8540 |

79 |

|

- - Other: |

|

|

8540 |

79 |

10 |

- - - For use with articles of heading 85.25 |

0 |

|

8540 |

79 |

90 |

- - - Other |

0 |

|

|

|

|

‑ Other valves and tubes: |

|

|

8540 |

81 |

|

- - Receivers or amplifier valves and tubes: |

|

|

8540 |

81 |

10 |

- - - For use with articles of heading 85.25 |

0 |

|

8540 |

81 |

90 |

- - - Other |

0 |

|

|

|

|

- - Other |

|

|

8540 |

89 |

10 |

- - - For use with articles of heading 85.25 |

0 |

|

8540 |

89 |

90 |

- - - Other |

0 |

|

|

|

|

‑ Parts: |

|

|

8540 |

91 |

|

- - Of cathode‑ray tubes: |

|

|

8540 |

91 |

10 |

- - - For use with articles of heading 85.25 |

0 |

|

8540 |

91 |

20 |

- - - Beam directing coils and voltage transforming coils |

15* |

|

8540 |

91 |

90 |

- - - Other |

0 |

|

8540 |

99 |

|

- - Other: |

|

|

8540 |

99 |

10 |

- - - Of microwave tubes |

0 |

|

8540 |

99 |

20 |

- - - For use with articles of heading 85.25 |

0 |

|

8540 |

99 |

90 |

- - - Other |

0 |

|

8541 |

|

|

Diodes, transistors and similar semi‑conductor devices; photosensitive semi‑conductor devices, including photovoltaic cells whether or not assembled in modules or made up into panels; light emitting diodes; mounted piezo‑electric crystals |

|

|

8541 |

10 |

00 |

- Diodes, other than photosensitive or light emitting diodes [ITA1/A-078] |

0 |

|

|

|

|

‑ Transistors, other than photosensitive transistors: |

|

|

8541 |

21 |

00 |

- - With a dissipation rate of less than 1 W [ITA1/A-079] |

0 |

|

8541 |

29 |

00 |

- - Other [ITA1/A-080] |

0 |

|

8541 |

30 |

00 |

- Thyristors, diacs and triacs, other than photosensitive devices [ITA1/A-081] |

0 |

|

8541 |

40 |

|

- Photosensitive semiconductor devices, including photovoltaic cells whether or not assembled in modules or made up into panels; light emitting diodes: [ITA1/A-082] |

|

|

8541 |

40 |

10 |

- - Light emitting diodes |

0 |

|

8541 |

40 |

20 |

- - Photocells, including photodiodes and phototransistors |

0 |

|

|

|

|

- - Other: |

|

|

8541 |

40 |

91 |

- - - For use with articles of heading 85.25 |

0 |

|

8541 |

40 |

99 |

- - - Other |

0 |

|

8541 |

50 |

00 |

- Other semiconductor devices [ITA1/A-083] |

0 |

|

8541 |

60 |

00 |

- Mounted piezo‑electric crystals [ITA1/A-084] |

0 |

|

8541 |

90 |

00 |

- Parts [ITA1/A-085] |

0 |

Notes: In the tax rate column of the above-said list, a number of commodity items are marked with (*) next to their preferential import tax rates. The mark (*) denotes that a commodity item of this code enjoys the preferential import tax rate defined in Table II issued together with the Finance Minister’s Decision No. 110/2003/QD-BTC of July 25, 2003. -