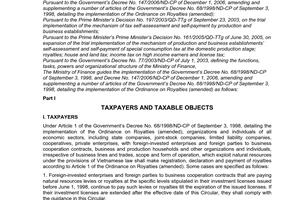

Nội dung toàn văn Decision No. 16/2008/QD-BTC of April 14, 2008 adjusting tax rates in the royalties tariff attached to The Government’s Decree No. 68/1998/ND-CP of September 3, 1998, detailing the implementation of the ordinance on royalties (amended), and Decree No. 147/2006/ND-cp of December 1, 2006, amending and supplementing a number of articles of Decree No. 68/1998/ND-CP

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 16/2008/QD-BTC |

Hanoi, April 14, 2008 |

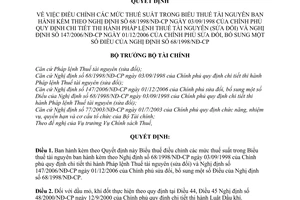

DECISION

ADJUSTING TAX RATES IN THE ROYALTIES TARIFF ATTACHED TO THE GOVERNMENT’S DECREE No. 68/1998/ND-CP OF SEPTEMBER 3, 1998, DETAILING THE IMPLEMENTATION OF THE ORDINANCE ON ROYALTIES (AMENDED), AND DECREE No. 147/2006/ND-CP OF DECEMBER 1, 2006, AMENDING AND SUPPLEMENTING A NUMBER OF ARTICLES OF DECREE No. 68/1998/ND-CP

THE MINISTER OF FINANCE

Pursuant to the Ordinance on Royalties (amended);

Pursuant to the Government’s Decree No. 68/1998/ND-CP of September 3, 1998,

detailing the implementation of the Ordinance on Royalties (amended);

Pursuant to the Government’s Decree No. 147/2006/ND-CP of December 1, 2006,

amending and supplementing a number of articles of Decree No. 68/1998/ND-CP of

September 3, 1998, detailing the implementation of the Ordinance on Royalties

(amended);

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, tasks, powers and organizational structure of the Ministry of

Finance;

At the proposal of the director of the Tax Policy Department,

DECIDES:

Article 1.- To promulgate together with this Decision the Tariff adjusting tax rates in the Royalties Tariff attached to the Government’s Decree No. 68/1998/ND-CP of September 3, 1998, detailing the implementation of the Ordinance on Royalties (amended), and Decree No. 147/2006/ND-CP of December 1, 2006, amending and supplementing a number of articles of Decree No. 68/1998/ND-CP.

Article 2.- For petroleum oil and gas, the provisions of Articles 44 and 45 of the Government’s Decree No. 48/2000/ND-CP of September 12, 2000, detailing the implementation of the Petroleum Law, apply.

Article 3.- This Decision takes effect 15 days after its publication in “CONG BAO”[1] and replaces the Royalties Tariff (Appendix 2) attached to the Finance Ministry’s Circular No. 42/2007/TT-BTC of April 27, 2007, guiding the implementation of the Government’s Decree No. 68/1998/ND-CP of September 3, 1998, detailing the implementation of the Ordinance on Royalties (amended), and Decree No. 147/2006/ND-CP of December 1, 2006, amending and supplementing a number of articles of Decree No. 68/1998/ND-CP.

Article 4.- Royalties payers, tax offices and concerned agencies shall implement this Decision.

|

|

FOR THE MINISTER OF FINANCE |

ROYALTIES TARIFF

(Attached to the Finance Minister’s Decision No. 16/2008/QD-BTC of April 14, 2008

|

No. |

Groups and types of natural resources |

Royalties rate (%) |

|

I |

Metallic minerals |

|

|

1 |

Minerals of ferrous metals (iron, manganese, titanium, etc.) |

5 |

|

2 |

Minerals of non-ferrous metals: |

|

|

|

- Mineral sand gold - Gold nuggets - Rare earths - Platinum, tin, tungsten, silver, antimony - Lead, zinc, aluminum, bauxite, copper, nickel, cobalt, molybdenum, mercury, magnesium, vanadium, platinum - Minerals of other non-ferrous metals |

6 6 8 5 5 |

|

II |

Non-metallic minerals (except for thermal mineral water and natural mineral water specified in Section VII below) |

|

|

1 |

Non-metallic minerals used as common construction materials: |

|

|

|

- Earth exploited for ground-leveling or fill-up or building of works - Non-metallic minerals used as other common construction materials (stone, sand, gravel, earth for brick-making, etc.) |

1 4 |

|

2 |

Non-metallic minerals used as high-grade construction materials (granite, dolomite, fire clay, quartzite, etc.) |

5 |

|

3 |

Non-metallic minerals used in industrial production (pyrite, phosphorite, kaolin, mica, technical quartz, stone for lime and cement manufacture, sand for glass manufacture, etc.) - Particularly: apatite, serpentine |

5 2 |

|

4 |

Coal: - Pit anthracite coal - Open-cast anthracite coal - Lignite, fat coal - Other coals |

2 3 3 2 |

|

5 |

Gems: a/ Diamond, ruby, sapphire, emerald, alexandrite, precious black opal b/ Adrite, rhodonite, pyrope, beryl, spinel, topaz, crystalline quartz (purple blue, greenish yellow, orange), chrysolite, precious opal (white or scarlet), feldspar, birusa, nephrite c/ Other gems |

8 5 3 |

|

6 |

Other non-metallic minerals |

2 |

|

III |

Petroleum (1) |

|

|

IV |

Gas (2) |

|

|

V |

Natural forest products |

|

|

1 |

Log timber of various kinds: - Group I - Group II - Groups III and IV - Groups V, VI, VII and VIII |

40 35 25 15 |

|

2 |

Pit props |

15 |

|

3 |

Timber used as raw materials for paper production (storax, pines, etc.) |

20 |

|

4 |

Timber used as masts or poles in river net fishing |

20 |

|

5 |

Impregnated timber, mangrove timber, cajuput timber |

15 |

|

6 |

Tree branches and tops, firewood |

5 |

|

7 |

Bamboo of all kinds |

10 |

|

8 |

Pharmaceutical materials: - Sandal-wood, codonopsis and aloe - Anise, cinnamon, aquilegia, cardamom - Pharmaceutical materials of other types |

25 10 5 |

|

9 |

Other natural forest products: - Wild birds and animals (allowed to be hunted) - Other natural forest products |

20 5 |

|

VI |

Natural aquatic resources - Pearl, abalone, holothurian - Shrimp, fish, cuttlefish and other aquatic resources |

10 2 |

|

VII |

Mineral water, natural water |

|

|

1 |

Natural mineral water, purified natural water, bottled or canned |

8 |

|

2 |

Natural water used for hydroelectricity generation |

2 |

|

3 |

Natural water exploited for production sectors (other than those specified at Points 1 and 2): |

|

|

|

a) Used as main or auxiliary raw materials which constitute material elements of products b) Used for general production purposes (industrial hygiene, cooling, steam-making, etc.) - In case ground water is used c) Natural water used for production of clean water, for agriculture, forestry, fishery or salt making, and natural water exploited from dug or drilled wells to meet daily-life needs - In case ground water is used |

3 1 2 0 0.5 |

|

4 |

Natural water exploited for purposes other than those specified at Points 1, 2 and 3 |

0 |

|

|

a/ For services: - Use of surface water - Use of ground water |

3 5 |

|

|

b/ For industrial production and construction: - Use of surface water - Use of ground water |

3 4 |

|

|

c/ For other purposes: - Use of surface water - Use of ground water |

0 0.5 |

|

VIII |

Other natural resources |

|

|

|

- Salangane's nests - Other natural resources |

20 10 |

(1) (2): Tax rates for petroleum oil and gas are specified in Articles 44 and 45 of the Government’s Decree No. 48/2000/ND-CP of September 12, 2000, detailing the implementation of the Petroleum Law.