Nội dung toàn văn Decision No. 88/2009/QD-TTg of June 18, 2009 promulgating the Regulation on foreign investors’ contribution of capital to, and purchase of shares from, Vietnamese enterprises.

|

THE

PRIME MINISTER |

SOCIALIST

REPUBLIC OF VIETNAM Independence

- Freedom – Happiness |

|

No. 88/2009/QD-TTg |

Ha Noi, June 18, 2009 |

DECISION

PROMULGATING THE REGULATION ON FOREIGN INVESTORS’ CONTRIBUTION OF CAPITAL TO, AND PURCHASE OF SHARES FROM, VIETNAMESE ENTERPRISES

THE PRIME MINISTER

Pursuant to the December 25,

2001 Law on Organization of the Government;

Pursuant to the November 29, 2005 Investment Law;

Pursuant to the November 29, 2005 Enterprise Law;

Pursuant to the June 29, 2006 Securities Law;

Pursuant to the Government’s 22, 2009, detailing and guiding a number of

articles of the Investment Law;

Pursuant to the Government’s Decree No. 139/2009/ND-CP dated September 5,

2007, detailing a number of articles of the Enterprise Law;

Pursuant to the Government’s Decree No. 160/2006/ND-CP dated December of the

Ordinance on Foreign Exchange;

At the proposal of the Minister of Finance,

DECIDES:

Article 1.

To promulgate together with this Decision the Regulation on foreign investors’ contribution of capital to, and purchase of shares from, Vietnamese enterprises.

Article 2.

The Minister of Finance, the Minister of Planning and Investment, the Governor of the State Bank of Vietnam and concerned ministries and branches shall guide the implementation of this Decision.

Article 3.

This Decision takes effect on August 15, 2009, and replaces the Prime Minister’s Decision No. 36/2003/QD-TTg dated March 11, 2003, promulgating the Regulation on foreign investors' contribution of capital to, and purchase of shares from, Vietnamese enterprises.

Ministers, heads of ministerial-level agencies and government-attached agencies, presidents of provincial-level People's Committees, boards of directors of state business groups and corporations, and concerned organizations and individuals shall implement this Decision.

|

|

PRIME

MINISTER |

REGULATION

ON FOREIGN INVESTORS' CONTRIBUTION OF CAPITAL TO, AND

PURCHASE OF EQUITIES FROM, VIETNAMESE ENTERPRISES

(Promulgated together with the Prime Minister’s Decision No. 88/2009/QD-TTg

dated June 18, 2009)

Chapter I

GENERAL PROVISIONS

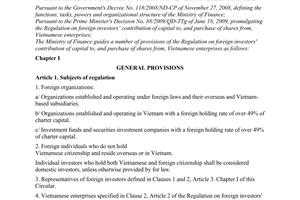

Article 1.Scope of regulation

1. This Regulation provides for foreign investors' contribution of capital to, and purchase of shares from, Vietnamese enterprises.

2. Foreign investors' activities of contributing capital to, or purchasing shares from, Vietnamese enterprises doing business in certain domains subject to specialized laws or commitments in treaties to which Vietnam is a contracting party which are different from provisions of this Regulation must comply with such specialized laws or treaties.

3. The participation of foreign parties in the Vietnamese securities market is subject to a separate regulation issued by the Prime Minister.

4. This Regulation does not govern investing activities of foreign investors specified in Clauses 1, 2, 3, 6 and 7, Article 21 of the Investment Law, including:

a/ Establishing economic organizations with 100% foreign capital;

b/ Pooling capital with domestic investors to establish economic organizations under the Enterprise Law;

c/ Investing under BCC, BOT, BTO or BT contracts;

d/ Investing in merger or acquisition of enterprises;

e/ Making other direct investments.

Article 2. Subjects of regulation

1. Foreign investors defined in this Regulation include foreign organizations and individuals, specifically:

a/ Organizations established and operating under foreign laws and their overseas and Vietnam-based subsidiaries;

b/ Organizations established and operating in Vietnam with a foreign holding rate of over 49%;

c/ Investment funds and securities companies with a foreign holding rate of over 49%;

d/ Foreign individuals who do not hold Vietnamese citizenship, reside overseas or in Vietnam.

2. Vietnamese enterprises defined in this Regulation are economic organizations doing business in sectors, domains or trades in which investment is not banned by law, including:

a/ Enterprises with 100% state capital which undergo equitization or are otherwise transformed in their ownership;

b/ Joint-stock companies, limited liability companies, partnerships and private enterprises established and operating under the Enterprise Law.

Article 3. Level of capital contribution or share purchase

1. Foreign investors may purchase shares of public companies under the cap set by the securities law and relevant guiding documents.

2. Foreign investors may contribute capital to, or purchase shares from, Vietnamese enterprises operating in sectors, domains or trades governed by specialized laws under caps set by these laws.

3. The level of capital contributed or shares purchased by foreign investors to/from Vietnamese traders or service providers must comply with treaties to which Vietnam is a contracting party.

4. Foreign investors may contribute capital to or purchase shares from Vietnamese enterprises which operate in different sectors, domains or trades, including those with different prescribed foreign holding rates, at a level not exceeding the lowest foreign holding rate prescribed for any of these sectors, domains or trades.

5. Foreign investors may contribute capital to or purchase shares from enterprises with 100% of State capital which undergo ownership transformation at levels prescribed in plans approved by competent authorities but not exceeding the prescribed level if transformed enterprises operate in sectors specified in Clauses 2, 3 and 4 of this Article.

6. Apart from the above cases, foreign investors may contribute capital to purchase shares from Vietnamese enterprises unlimitedly.

Article 4. Forms of capital contribution or share purchase

1. Capital contribution:

a/ A foreign investor may acquire capital portions of members of a limited liability company or contribute capital to a limited liability company to become a new member of a limited liability company with two or more members, or acquire the whole charter capital of the owner of a one-member limited liability company to become the new owner of this company;

b/ A foreign investor may acquire capital portions of capital contributors in a partnership or contribute capital to a partnership to become a new capital contributor.

Foreign individual investors may acquire capital portions of partners of a partnership or contribute capital to a partnership to become new partners after getting approval of other partners.

c/ A foreign investor may acquire capital portion of the owner of a private enterprise or pool capital with the latter to transform the private enterprise in to a limited liability company with two or more members and become a member of such company.

2. Share purchase:

a/ Foreign investors may purchase shares in the initial public offering (IPO) of a joint-stock company under the Enterprise Law;

b/ Foreign investors may purchase shares in the IPO of an enterprise with 100% foreign capital undergoing equitization;

c/ Foreign investors may acquire shares that are allowed to be offered or additionally issued by a joint-stock company;

d/ Foreign investors may acquire shares from existing shareholders of joint-stock companies, including also public companies listed or unlisted on the Stock Exchange.

Article 5. Modes of capital contribution or payment for share purchase

1. Foreign investors may contribute capital or purchase shares in Vietnam dong or a freely convertible foreign currency and other lawful assets under Clause 1, Article 2 of Decree No. 108/2006/ND-CP:

a/ For capital contributed or shares purchased in a foreign currency, this foreign currency shall be converted into Vietnam dong at the buying rate applied by commercial banks licensed to conduct foreign exchange operations at the time of capital contribution or share purchase immediately after competent representatives of enterprises give their approval and under current law on foreign exchange management;

b/ For capital contributed or shares purchased in other lawful assets (other than Vietnam dong or a freely convertible foreign currency), these assets must be valuated by either of the following methods:

- Valuation is made by an independent valuation organization and jointly approved by members and founding shareholders of enterprises to which capital is contributed and capital contributors;

- Enterprises set up valuation councils to negotiate with capital contributors on values of contributed assets.

2. Foreign investors that contribute machinery, equipment, raw materials and materials, goods, transferred technologies or other assets as capital to Vietnamese enterprises shall comply with the Vietnamese law on technology, culture, environment, intellectual property, import and export.

3. The trading in securities in the Stock Exchange shall be conducted in Vietnam dong under the securities law.

Article 6. Conditions for foreign investors to contribute capital or purchase shares

1. For foreign institutional investors:

a/ Having investment capital accounts opened at commercial banks in Vietnam. All activities of purchasing and selling shares, transferring contributed capital portions, collecting and using dividends and divided profits, remitting money abroad and other activities related to investment in Vietnamese enterprises shall be carried out via these accounts;

b/ Having copies of their business registration certificates or other equivalent papers evidencing their legal status, certified by a competent authority of the country where they have made registration;

Foreign investors shall take responsibility for the validity of supplied documents.

c/ Other conditions specified in the charters of enterprises to from which foreign investors contribute capital or purchase shares and not contrary to law.

2. For foreign individual investors:

a/ Having private accounts opened at commercial banks in Vietnam. All activities of purchasing and selling shares, transferring contributed capital portions, collecting and using dividends and divided profits, remitting money abroad and other activities related to investment in Vietnamese enterprises shall be carried out via these accounts;

b/ Having copies of their valid passports;

c/ Other conditions specified in the charters of enterprises to/from which foreign investors contribute capital or purchase shares and not contrary to law.

3. Foreign organizations and individuals investing in the securities market shall comply with the securities law.

Chapter II

SPECIFIC PROVISIONS

Article 7. Contribution of capital to limited liability companies or partnerships

1. Foreign investors may contribute capital to limited liability companies or partnerships under the Investment Law, the Enterprise Law and the charters of these companies.

2. For limited liability companies with two or more members and partnerships: The chairman of the Members' Council or the director general (director) of the company (according to the company charter) shall elaborate a capital-raising plan, covering portions of capital to be contributed by foreign investors, and submit it to the members' Council, which shall later decide on the raising of capital and capital and capital portions to be contributed by foreign investors.

Members of limited liability companies with two or more members or partnerships may transfer their contributed capital portions to foreign investors under law and their companies' charters.

3. One-member limited liability companies that transfer part of their charter capital or raise more capital from other entities, including foreign investors, shall comply with Article 19 of the Government's Decree No. 139/2007/ND-CP dated September 5, 2007, detailing a number of articles of the Enterprise Law.

A state-owned one-member limited liability company shall elaborate a plan on transformation of the company into the one with two or more members, then submit it to a competent state authority for approval.

4. In case many investors register to contribute capital to an enterprise with a total value exceeding that of the contributed capital amount under the approved capital-raising plan, the enterprise may reach agreement with these investors or organize an auction for selecting an investor.

For state-owned one-member limited liability companies, the transfer of their contributed capital portions to foreign investors must comply with law and financial management regulations applicable to state companies and state capital portions invested in other enterprises.

Article 8. Acquisition of part of capital or pooling of capital with owners of private enterprise.

1. Owners of private enterprises may decide to resell part of their enterprises' capital or raise capital foreign investors for transforming their enterprises into limited liability companies with two more members.

2. The transformation of private enterprises into limited liability companies with two or more members must comply with Article 24 of the Government’s Decree No. 139/2007/ND-CP dated September 5, 2007, detailing a number of articles of the Enterprise Law.

Article 9. Purchase of IPO shares of equitized enterprises with 100% state capital

Foreign investors may purchase IPO shares of equitized enterprises with 100% state capital under current guiding documents on transformation of enterprises with 100% state capital into joint-stock companies.

Article 10. Purchase of shares of operating joint-stock companies

1. Foreign investors may purchase or sell shares of public joint-stock companies under the Investment Law, the securities Law and these companies' charters.

2. For joint-stock companies that have operated for less than three years from the date of issuance of their business registration certificates, foreign investors may purchase common shares of founding shareholders after obtaining consent of the Shareholders' General Meeting in order to become founding shareholders of these companies.

Foreign investors may purchase shares with preferred dividends, refundable preferred shares and other preferred shares of joint-stock companies when the purchase is permitted under these companies' charters or decided by the Shareholders' General Meeting.

3. The board of directors or director general (director) of a Joint-stock company shall elaborate a plan on capital raising or stock issuance, covering the sale of shares to foreign investors, and submit it to the Shareholders' General Meeting or the Board of Directors (according to the organization and operation charter of the company).

d. The Shareholders' General Meeting or the Board of directors shall decide on sale of shares and proportion of shares to be sold to foreign investors.

4. Foreign investors shall purchase shares of companies listed on the securities market or unlisted public companies in accordance with the securities law.

Chapter III

RIGHTS AND OBLIGATIONS OF FOREIGN INVESTORS

Article 11. Rights of foreign investors

1. To put their stocks in pledge in credit relations and as security for performance of civil obligations under the Vietnamese law.

2. To transfer the ownership of stocks or participate in trading in the securities market when joint-stock companies are listed under the Enterprise Law and the securities law.

3. To transfer their capital holdings or adjust their investment capital amounts in the course of business operation under the Vietnamese law and charters of enterprises.

4. To convert into foreign currencies Vietnam-dong amounts of recovered investment capital and profits earned from investment in Vietnam for remittance abroad, after fulfilling their financial obligations toward the Vietnamese State and related parties. The purchase of foreign-currency amounts for remittance abroad complies with the regulation on foreign exchange management and the Vietnamese law.

5. To take part in corporate administration under the Enterprise Law and the charters of enterprises to/from which they contribute capital or purchase shares (unless they are capital-contributing partners of partnerships).

6. To enjoy benefits like domestic investors when investing in joint-stock companies, limited liability companies or partnerships.

7. To have other rights provided for by the Vietnamese law.

Article 12. Obligations of foreign investors

1. To strictly observe the conditions and commitment for purchase or capital contribution.

2. To fully comply with the provisions of this Regulation and the organization and operation charters of enterprises to/from which they or contribute capital or purchase shares.

3. In case of transfer of their share ownership or profit-earning capital holdings, to pay income tax and other taxes under law.

4. To perform other obligations under the Vietnamese law.

Chapter IV

ORGANIZATION OF IMPLEMENTATION

Article 13. Responsibilities of state management agencies

1. Ministers and heads of ministerial-level agencies and government-attached agencies shall guide and inspect state enterprises which are equitized under their decisions in selling shares to foreign investors.

2. Presidents of provincial-level People’s Committees shall guide and inspect state enterprises which are equitized under their decisions and enterprises operating under the Enterprise Law in their localities in selling shares to or receiving contributed capital from foreign investors.

3. The Ministry of Finance, the Ministry of Planning and Investment, the Sate Bank of Vietnam, and concerned ministries and branches shall guide the implementation of this Regulation.