Decision No. 992/2001/QD-NHNN of August 6, 2001, on the level of lending without asset security for joint-stock commercial banks, joint-stock finance companies and joint-venture banks đã được thay thế bởi Decision No. 1380/2002/QD-NHNN of December 16, 2002, on the cancellation of level of lending without asset security of credit institutions. và được áp dụng kể từ ngày 09/11/2002.

Nội dung toàn văn Decision No. 992/2001/QD-NHNN of August 6, 2001, on the level of lending without asset security for joint-stock commercial banks, joint-stock finance companies and joint-venture banks

|

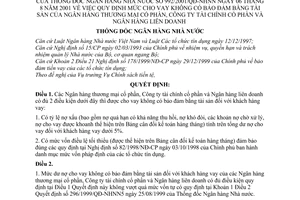

STATE

BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 992/2001/QD-NHNN |

Hanoi, August 6th , 2001 |

DECISION

ON THE LEVEL OF LENDING WITHOUT ASSET SECURITY FOR JOINT-STOCK COMMERCIAL BANKS, JOINT-STOCK FINANCE COMPANIES AND JOINT-VENTURE BANKS

THE GOVERNOR OF THE STATE BANK

Pursuant to the Law on the

State Bank of Vietnam and the Law on Credit Institutions dated 12 December,

1997;

Pursuant to the Decree No. 15/CP dated 2 March, 1993 of the Government on the

assignment, authority and responsibility for State management of the ministries

and ministry-level agencies;

Pursuant to paragraph 2 Article 21 of the Decree No. 178/1999/ND-CP of the

Government dated 29 December, 1999 on the loan security for credit

institutions;

Upon the proposal of the Director of the Monetary Policy Department,

DECIDES

Article 1. Joint-stock commercial banks, joint-stock finance companies and joint-venture banks satisfying two following conditions shall be entitled to lend to borrowing customers without assets security:

1. The bad debts (including overdue debts but potentially recoverable, debts difficult to be recovered, debts pending settlement, frozen debts which appear on the monthly statement of accounts) account for less than 5% of the total outstanding loans to borrowing customers.

2. The minimum charter capital (as reflected in the monthly statement of accounts) is in compliance with respective provisions of the Decree No. 82/1998/ND-CP dated 3 October, 1998 of the Government issuing the list of legal capitals of the credit institutions.

Article 2.

1. The outstanding balance of loans without asset security extended by joint-stock commercial banks, joint-stock finance companies and joint-venture banks that satisfy conditions provided for in paragraph 1 this Article shall not exceed the levels of the own capital which are provided for in paragraph 1, Article 2 of the Decision No. 296/1999/QD-NHNN5 dated 25 August, 1999 of the Governor of the State Bank.

2. The outstanding balance of loans without asset security of joint-stock commercial banks, joint-stock finance companies and joint-venture banks provided for in paragraph 1 of this Article shall not include the outstanding balance of:

a. Loans extended under instruction of the Government;

b. Loans without asset security extended in accordance with the Decision No. 67/1999/QD-TTg dated 30 March, 1999 of the Prime Minister on some banking credit policies for the agricultural and rural development; loans of up to VND 20 millions without asset security extended to farmer's households, owners of farms in the areas of agriculture, forestry, aquatic production of the nature of goods productions in accordance with point 4 Section 1 of the Circular No. 10/2000/TT-NHNN1 dated 31 August, 2000 of the Governor of the State Bank guiding the implementation of measures of security for loan of credit institutions in accordance with Resolution No. 11/2000/NQ-CP dated 31 July, 2000 of the Government on several measures to conduct the plan of socio-economic development in the last 6 months of 2000;

c. Loans of under VND 50 millions extended to organizations, households and individuals of aquatic production without asset security in accordance with point 2 Article 4 of the Decision No. 103/2000/QD-TTg dated 25 August, 2000 of the Government on several measures to encourage aquatic variety development;

d. Loans of small value extended to poor individuals, households with guarantees of socio-political organizations in accordance with Section 3, Chapter IV of the Circular No. 06/2000/TT-NHNN1 dated 4 April, 2000.

dd. Loans extended to State-own enterprises satisfying conditions of lending without asset security in accordance with point 2 Section 1 Chapter IV of the Circular No. 06/2000/TT-NHNN1 dated 4 April, 2000 of the Governor of the State Bank which use borrowed funds for the implementation of investment projects under the key economic program, special economic programs of the State under the decision of the Government, the Prime Minister. Upon the extension of loans to these enterprises, credit institutions shall base on documents: documents of the Government, the Prime Minister on the implementation of key economic programs, special economic programs; economic agreements or documents of competent agencies evidencing the participation of enterprises in the implementation of projects, construction, other works under key economic program, special economic programs; check-up protocol, settlement of the completed work load and other related documents.

e. Loans extended under trust of the Government and organizations, individuals in Vietnam and foreign countries.

3. The outstanding balance of loans without asset security to borrowing customers of joint-stock commercial banks, joint-stock finance companies and joint-venture banks provided for in paragraph 1 of this Article shall only be applicable to credit contracts entered into as from 3 September, 2000.

Article 3. Joint-stock commercial banks, joint-stock finance companies, joint-venture banks lending without asset security to borrowing customers shall comply with provisions of the Decree No. 178/1999/ND-CP dated 29 December, 1999 of the Government on the loan security for credit institutions, and the Circular No. 06/2000/TT-NHNN1 dated 4 April, 2000 of the Governor of the State Bank and related legal documents.

Article 4. Implementing provisions

1. This Decision shall be effective from the date of signing and supercede the Decision No. 266/2000/QD-NHNN1 dated 18 August, 2000 of the Governor of the State Bank.

2. The Chief Inspector of the State Bank shall be responsible for the control, supervision of the implementation of this Decision.

3. The Heads of the State Bank units, General Managers of the State Bank branches in provinces, cities, Chairpersons, General Directors (Directors) of the joint-stock banks, joint-stock finance companies, joint-venture banks shall be responsible for the implementation of this Decision.

4. Any amendment, supplement of this Decision shall be decided upon by the Governor of the State Bank.

|

|

FOR

THE GOVERNOR OF THE STATE BANK |