Nội dung toàn văn Circular 211/2016/TT-BTC processing applications registration copyright related rights fees

|

MINISTRY OF

FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No.: 211/2016/TT-BTC |

Hanoi, November 10, 2016 |

CIRCULAR

PROVIDING FOR THE FEES FOR PROCESSING APPLICATIONS FOR REGISTRATION OF COPYRIGHT AND RELATED RIGHTS, THE COLLECTION, TRANSFER AND MANAGEMENT THEREOF

Pursuant to the Law on fees and charges dated November 25, 2015;

Pursuant to the Law on state budget dated June 25, 2015;

Pursuant to the Government's Decree No. 120/2016/ND-CP dated August 23, 2016 detailing and guiding the implementation of a number of articles of the Law on fees and charges;

Pursuant to the Government's Decree No. 215/2013/ND-CP dated December 23, 2013 defining the functions, tasks, powers and organizational structure of Ministry of Finance;

At the request of the Director of the Tax Policy Department,

Minister of Finance provides for the fees for processing applications for registration of copyright and related rights, the collection, transfer and management thereof.

Article 1. Scope and regulated entities

1. This Circular provides for the fees for processing applications for registration of copyright and related rights, the collection, transfer and management thereof.

2. This Circular applies to applicants for registration of copyright and related rights, state authorities that have the power to issue copyright registration certificates or related rights registration certificates, and other organizations and individuals involved in the collection, transfer, management and use of fees.

Article 2. Payers

Any applicants for registration of copyright/ related rights must pay fees in accordance with regulations herein.

Article 3. Collector

The Copyright Office of Vietnam (directly under the Ministry of Culture, Sports and Tourism) shall be responsible for collecting fees.

Article 4. Fee

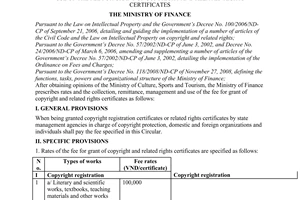

1. Fees are provided for as follows:

|

No. |

Type of copyrighted work |

Fee |

|

I |

Registration of copyright |

|

|

1 |

a) Literary works, scientific works, textbooks, syllabi and other works which are expressed in writing or other characters (referred to as written works); b) Lecture, speech and other talks; c) Journalistic works; d) Musical works; dd) Photographic works. |

100,000 |

|

2 |

a) Architectural works; b) Plans, diagrams, maps, topography-related drawings and scientific works. |

300,000 |

|

3 |

a) Works of plastic arts; b) Works of applied arts. |

400,000 |

|

4 |

a) Cinematographic works; b) Theatrical works recorded on tapes and disks. |

500,000 |

|

5 |

Computer programs, data collection programs or other programs run on computers |

600,000 |

|

II |

Registration of related rights |

|

|

1 |

Performances recorded on: |

|

|

a) Audio recordings; b) Visual recordings; c) Broadcasting programs. |

200,000 300,000 500,000 |

|

|

2 |

Audio recordings |

200,000 |

|

3 |

Visual recordings |

300,000 |

|

4 |

Broadcasting programs |

500,000 |

2. The fees prescribed in Clause 1 of this Article are applicable to the processing of applications for the first registration of copyright/ related rights. With respect to applications for re-issuance, such fees shall be reduced by 50%.

3. The collector must not return the collected fees in cases copyright registration certificates/ related rights certificates are revoked or annulled.

Article 5. Declaration, collection and transfer of fees

1. Not later than the 05th day of every month, the collector must transfer the fees collected in the previous month into the designated state budget account which is opened at the State Treasury.

2. The collector shall make monthly declaration and transfer of collected fees, and annual statement of collected fees in accordance with regulations in Clause 3 Article 19 and Clause 2 Article 26 of the Circular No. 156/2013/TT-BTC dated November 06, 2013 by Minister of Finance providing guidance on a number of articles of the Law on tax management, the Law on amendments to the Law on tax management and the Government's Decree No. 83/2013/ND-CP dated July 22, 2013.

Article 6. Management and use of fees

1. The collector must pay the whole amount of collected fees to state budget. Expenditure on processing of applications and fee collection shall be covered by funding from state budget and specified in the collector's estimates under policies and spending limits regulated by laws.

2. If the collector is provided with a predetermined funding for operation in conformity with regulations of the Government or the Prime Minister on the autonomy in payroll and use of administrative expenditures by state agencies, the collector may retain 70% of the total amount of collected fees in order to cover its expenditures for conducting activities related to the processing of applications and fee collection as regulated in Clause 2 Article 5 of the Government's Decree No. 120/2016/ND-CP dated August 23, 2016 elaborating and guiding the implementation of a number of articles of the Law on fees and charges. In which, other expenditures relating to the fulfillment of tasks, provision of services and fee collection include:

- Expenditure on printing of records of applications for registration of copyright and related rights;

- Expenditure on retention and digitalization of data relating to the registration of copyright and related rights;

- Expenditure on the establishment, management and development of systems of database and information about the copyright and related rights.

The collector shall transfer the remaining amount (30%) to state budget according to corresponding chapter, item and sub-item in the applicable State Budget Index.

Article 7. Implementation

1. This Circular shall come into force as of January 01, 2017 and supersede the Circular No. 29/2009/TT-BTC dated February 10, 2009 by Ministry of Finance providing for the fees for processing applications for copyright certificates and related rights certificates, and the collection, transfer, management and use thereof.

2. Other contents related to the collection, management and transfer of fees, fee receipts, and announcement of fee collection policies, which are not provided for in this Circular, shall be performed in conformity with regulations in the Law on fees and charges; the Government's Decree No. 120/2016/ND-CP dated August 23, 2016 detailing and guiding the implementation of a number of articles of the Law on fees and charges; the Circular No. 156/2013/TT-BTC dated November 06, 2013 by Minister of Finance providing guidance on a number of articles of the Law on tax management; the Law on amendments to the Law on tax management and the Government's Decree No. 83/2013/ND-CP dated July 22, 2013, and the Circular by Minister of Finance providing for the printing, issuance, management and use of receipts of fees and charges as government revenues and other documents on amendments and supplements thereof (if any).

3. Difficulties that arise during the implementation of this Circular should be promptly reported to Ministry of Finance for consideration./.

|

|

PP MINISTER |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed