Nội dung toàn văn Circular 23/2021/TT-BTC management and use of e stamps for alcohol and tobacco products

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 23/2021/TT-BTC |

Hanoi, March 30, 2021 |

CIRCULAR

GUIDING PRINTING, ISSUANCE, MANAGEMENT AND USE OF E-STAMPS FOR ALCOHOL AND TOBACCO PRODUCTS

Pursuant to Law on Tax Administration No. 38/2019/QH14 dated June 13, 2019;

Pursuant to the Law on E-Transactions No. 51/2005/QH11 dated November 29, 2005;

Pursuant to Law on Information Technology No. 67/2006/QH11 dated June 29, 2006;

Pursuant to Decree No.67/2013/ND-CP dated June 27, 2013 of the Government on elaborating to Law on Tobacco Harm Prevention regarding tobacco sale; Decree No. 106/2017/ND-CP dated September 14, 2017 of the Government on amendment to Decree No. 67/2013/ND-CP dated June 27, 2013 of the Government;

Pursuant to Decree105/2017/ND-CP dated September 14, 2017 of the Government on alcohol product business;

Pursuant to Decree No. 17/2020/ND-CP dated February 5, 2020 of the Government on amendment to a number of Decrees relating the business investment conditions under state management of the Ministry of Industry and Trade;

Pursuant to Decree No. 119/2018/ND-CP dated September 12, 2018 of the Government on e-invoice in commodity sale and service provision;

Pursuant to Decree No. 123/2020/ND-CP dated October 19, 2020 of the Government on invoice and instrument;

Pursuant to Decree No. 87/2017/ND-CP dated July 26, 2017 of the Government on functions, tasks, powers, and organizational structure of the Ministry of Finance;

At request of General Director of General Department of Taxation and General Director of General Department of Customs,

Minister of Finance promulgates Circular guiding printing, issuance, management and use of e-stamps for alcohol and tobacco products:

Chapter I

GENERAL PROVISIONS

Article 1. Scope

This Circular prescribes printing, issuance, management and use of e-stamps for alcohol and tobacco products.

Article 2. Regulated entities

1. Organizations, enterprises and individuals manufacturing and importing products subject to excise tax (alcohol and tobacco products) and utilizing stamps as per the law.

2. Tax authorities, customs authorities.

Chapter II

SPECIFIC PROVISIONS

Article 3. Form and regulation on application of e-stamps.

1. E-stamps are visible stamps containing electronic information and data looked up on website of General Department of Customs, General Department of Taxation to serve management affairs of enterprises, consumers and regulatory agencies.

2. Principles of applying e-stamps

a) Imported tobacco products and manufactured tobacco products for domestic consumption must be applied with e-stamps according to Decree No. 67/2013/ND-CP dated June 27, 2013 of the Government and amendments thereto (if any).

Tobacco products must be packed into either packs or containers (hereinafter collectively referred to as “packs of cigarette”). Each pack of cigarette is applied with 1 e-stamp. In case packs of cigarette are wrapped by a layer of transparent film, the e-stamps must be applied to the packs prior to wrapping the packs with the transparent film. E-stamps must be applied in a position where the stamps will be torn when the packs are opened.

b) Imported alcohol products and manufactured alcohol products for domestic consumption must be applied with e-stamps according to Decree No. 105/2017/ND-CP dated September 14, 2017 of the Government and amendments thereto (if any).

Alcohol products manufactured for domestic consumption and imported alcohol products must be contained in bottles, containers, cans, packs, bags (hereinafter referred to as “bottles of alcohol”). Each bottle of alcohol shall be applied with 1 e-stamp. In case bottles of alcohol are wrapped by a layer of transparent film, the e-stamps must be applied to the bottles prior to wrapping the bottles with the transparent film. E-stamps for alcohol products are applied in a position where the stamps will be torn when the bottles are opened.

3. Form and description of e-stamps

a) Form of e-stamps for tobacco products manufactured for domestic consumption is presented under Annex 1 attached hereto.

b) Form of e-stamps for alcohol products manufactured for domestic consumption is presented under Annex 2 attached hereto.

c) Description of e-stamps for imported alcohol products is presented under Annex 4 attached hereto.

d) Description and application location of e-stamps for imported tobacco products is presented under Annex 5 attached hereto.

4. Entities applying e-stamps

a) For imported tobacco products: Enterprises and organizations importing tobacco products shall guarantee application of e-stamps onto tobacco products as per the law in overseas manufacturing facilities prior to importing in Vietnamese market for consumption.

b) For bottled alcohol products and alcohol products in containers imported and transferred to bottles: Enterprises and organizations shall apply e-stamps and be responsible for applying imported alcohol e-stamps onto imported alcohol products prior to market circulation.

In case enterprises and organizations importing bottled alcohol products wish to apply e-stamps in overseas manufacturing facilities, application of imported alcohol e-stamps onto imported alcohol products must comply with regulations and law prior to import to Vietnamese market for consumption.

c) For tobacco products manufactured for domestic consumption: enterprises possessing license for manufacturing tobacco products must apply e-stamps as per the law for tobacco products at manufacturing facilities after tobacco products are packed into packs of cigarette and before tobacco products are circulated domestically.

d) For alcohol products manufactured for domestic consumption: organizations and individuals having license for manufacturing alcohol products (including license for producing alcohol products manually for sale, license for producing alcohol products industrially) for domestic consumption (hereinafter referred to as “domestic alcohol manufacturing organizations, individuals”) must apply e-stamps as per the law for alcohol products in manufacturing facilities after alcohol products are bottled and before bottles of alcohol are circulated domestically.

Article 4. Principles of managing and using e-stamps

1. Management principles

a) General Department of Customs shall print and issue e-stamps for imported tobacco products, imported alcohol products and sell e-stamps for imported tobacco products, imported alcohol products to enterprises and organizations permitted to import tobacco products and alcohol products or permitted to purchase confiscated products, bidding products of competent agencies as per the law.

b) General Department of Taxation shall print and issue e-stamps for tobacco products manufactured for domestic consumption, alcohol products manufactured for domestic consumption and sell e-stamps for tobacco products manufactured for domestic consumption, alcohol products manufactured for domestic consumption to organizations and individuals possessing license for manufacture as per the law.

c) Organizations and individuals manufacturing or importing alcohol products, tobacco products must be totally responsible for managing, using and transmitting e-stamp data to supervisory agencies as per the law.

2. E-stamp use principles of organizations and individuals

a) Use e-stamps for the right purposes, for the right subjects according to this Circular.

b) Do not exchange, sell, purchase, loan, or borrow e-stamps without permission.

c) Do not intentionally lose or damage sold e-stamps.

Article 5. Management and sale of e-stamps for imported tobacco products, imported alcohol products

1. Planning

a) Enterprise and organizations importing alcohol products, tobacco products are responsible for preparing and registering plans for using e-stamps on customs electronic data processing system before April 30 of the year preceding planning year depending on e-stamp use demands of enterprises and organizations.

E-stamp use plans must include: Name of registering enterprises, organizations; TIN; address; phone number; name of e-stamps; model/symbol of stamps; amount of stamps estimated for use in each Customs Department, Customs Sub-department (if any) using Form No. 08/TEM, Annex 6 attached hereto.

b) In case e-stamp use demands of the year change compared to registered plans, enterprise and organizations importing alcohol products, tobacco products are responsible for preparing and registering revisions to plans for using e-stamps on customs electronic data processing system before August 31 of implementing year.

Revised e-stamp use plans must include: Name of e-stamps; model/symbol of stamps; amount of e-stamps produced, amount of e-stamps used, amount of e-stamps registered for revision in each Customs Department, Customs Sub-department (if any) using Form No. 08/TEM under Annex 6 attached hereto.

c) Customs authorities are responsible for considering and declaring results on customs electronic data processing system within 30 days from the date on which registration of enterprises and organizations importing alcohol products, tobacco products is received.

2. Printing and issuing e-stamps

a) General Department of Customs is responsible for printing and issuing e-stamps for Customs Departments of provinces and cities.

b) Customs Departments of provinces and cities shall issue e-stamps to relevant affiliated Customs Sub-departments.

c) Customs Sub-departments shall sell e-stamps to enterprises and organizations registering to purchase e-stamps.

d) All e-stamps must be declared for issuance by General Department of Customs on their website prior to being used (address: https://customs.gov.vn). Declaration for issuance consists of: Name of e-stamps; model/symbol of e-stamps; quantity of e-stamps; serial number of e-stamps; time of use; sale price.

3. Purchasing and selling e-stamps for tobacco products, e-stamps for alcohol products

a) Responsibilities of customs authorities

General Department of Customs shall notify and update any changes to e-stamp price on their website (address: https://customs.gov.vn).

Customs Sub-departments shall sell e-stamps to enterprises and organizations at request of enterprises and organizations on the basis of adequate application for purchasing e-stamps as per the law and accrued quantity of sold e-stamps (of the whole sector) not exceeding amount of e-stamps approved by customs authorities.

b) Responsibilities of enterprises and organizations when purchasing e-stamps for alcohol products, e-stamps for tobacco products

- Submitting 1 application for purchasing e-stamps for alcohol products/e-stamps for imported tobacco products using Form No. 09/TEM under Annex 6 attached hereto;

- Submitting 1 notice of collection or deposit order to budget (verified by State Treasury) for all e-stamps applied for purchase;

- Present customs declaration or decisions on selling confiscated products, bidding products of competent agencies and records of quality assessment of confiscated illegally imported alcohol products (in case alcohol products are confiscated) when purchasing e-stamps for imported alcohol products; or sale and purchase contracts, product processing contracts, written commitment regarding depreciated quality during manufacturing process when purchasing e-stamps for imported tobacco products, e-stamps for imported alcohol products (for bottled alcohol products applied with e-stamps in overseas manufacturing facilities);

- Submit 1 certified true copy or copy and master registers for comparison of valid permit for distribution of tobacco products (in case of purchasing e-stamps for tobacco products) or valid permit for distribution of alcohol products (in case of purchasing e-stamps for alcohol products) issued by competent agencies (only submit when purchasing e-stamps from Customs Sub-departments that manage enterprises and organizations importing tobacco products, alcohol products);

In case of changes to details in valid permit for distribution of tobacco products or valid permit for distribution of alcohol products issued by competent agencies, enterprises and organizations must provide verified true copies or copies and master registers for comparison of permit containing the changes to customs authorities that receive application;

- Submit 1 power of attorney (in case buyers of e-stamps are authorized by legal representatives of enterprises and organizations);

- Present valid ID Cards or Citizen Identity Cards or passports of legal representatives or authorized individuals of enterprises and organizations.

4. Submitting reports on e-stamp usage

Customs declarants shall declare and send e-stamp data: Total number of stamps used, number of stamps successfully applied, number of stamps damaged, name of stamps, model of stamps, symbols of stamps, TIN, name of manufacturing entities, date of manufacture, name of importing entities, date of import and type of products to customs electronic data processing system using Form No. 12/TEM under Annex 6 attached hereto.

Deadline for sending e-stamp information:

Within 5 days from the date on which e-stamps are applied to product shipments and before products are circulated for imported alcohol products; after receiving customs clearance and before introducing products to market for circulation for imported tobacco products and imported bottled alcohol products applied with e-stamps in oversea manufacturing facilities

In case consolidated data schedules on e-stamps sent to customs authority requires revision, as soon as revision is required (within 5 days from the date on which consolidated data schedules on e-stamps are completed), customs declarants shall send consolidated data schedules on e-stamps replacing the consolidated data schedules on e-stamps that require revision using Form No. 12/TEM under Annex 6 attached hereto.

For damaged e-stamps among e-stamps declared by enterprises and organizations, system of General Department of Customs shall verify the damaged e-stamps to be no longer usable.

5. Looking up e-stamp information

When users of tobacco products, alcohol products or relevant agencies wishing to look up information of e-stamps of tobacco products and e-stamps of alcohol products on imported tobacco products, alcohol products such as: Name of stamps; model/symbols of stamps; serial number; TIN; manufacturing entities; importing entities; import date; type of products, look up on website of General Department of Customs (address: https://customs.gov.vn).

6. Dealing with cases where e-stamps are lost, burned, damaged or disposed

a) Responsibilities of customs authorities:

a1. Participating in Council for disposing e-stamps of enterprises and organizations;

a2. Receiving and updating notice on disposing e-stamps of enterprises and organizations as follows: Custom system shall automatically receive Notice on disposing e-stamps of enterprises, organizations and update serial number of e-stamps no longer usable.

b) Responsibilities of enterprises and organizations:

b1. In case e-stamps are lost or burned: Enterprises and organizations that detect e-stamps that are lost or burned shall use accounts provided by customs authority to notify missing or burned e-stamps on customs electronic data processing system within 30 days from the date on which missing or burned e-stamps are detected as follows: Name of stamps; model/symbols of stamps; serial number; quantity; reason for missing, burned e-stamps using Form No. 11/TEM under Annex 6 attached hereto. In case missing e-stamps are found, enterprises and organizations must dispose the e-stamps within 30 days from the date on which missing e-stamps are found. E-stamp disposal shall conform to Point b3 of this Clause.

b2. In case e-stamps are damaged: Enterprises and organizations that detect e-stamps that are damaged shall use accounts provided by customs authority to notify damaged e-stamps on customs electronic data processing system within 30 days from the date on which damaged e-stamps are detected as follows: Name of stamps; model/symbols of stamps; serial number; quantity; reason for damaged e-stamps using Form No. 11/TEM under Annex 6 attached hereto and dispose the damaged e-stamps. Disposal of damaged e-stamp shall conform to Point b3 of this Clause.

b3. Enterprises and organizations importing tobacco products, alcohol products shall dispose e-stamps for imported tobacco products, e-stamps for imported alcohol products as follows:

- Produce Manifest of e-stamps for tobacco products or e-stamps for alcohol products to be disposed which must specify: Name of entities issuing stamps; name, address, TN of entities issued with stamps; amount of stamps issued (from No. ……… to No. ........, total: .......); characteristics of stamps and list of declaration number or number, date of decisions on selling confiscated products, bidding products of competent agencies;

- Produce Council for disposing e-stamps for imported tobacco products and imported alcohol products consisting of: Representatives of supervisory Customs Sub-departments, representatives of heads of enterprises or organizations, representatives of accounting department, manufacturing department or business department of enterprises, organizations;

- Produce records of disposing e-stamps for imported tobacco products or imported alcohol products which must specify: reason for termination, amount of e-stamps terminated (from No. …….. to No. ………, total: ......), method of disposal;

- After disposing e-stamps (disposed e-stamps cannot be recycled), members of Council for disposing e-stamps of imported tobacco products or imported alcohol products must sign records and be legally responsible for any error.

Documents on disposal of e-stamps for imported tobacco products or imported alcohol products are stored in enterprises, organizations that utilize e-stamps for imported tobacco products or imported alcohol products.

- Declare e-stamp disposal results including photocopy of manifest; records of disposing e-stamps for imported tobacco products or imported alcohol products and update information on e-stamp disposal: Name of entities selling stamps; name, address, TIN of entities purchasing stamps; time of purchase; amount of stamps (from No. ……… to No. ………, total: …); characteristics of stamp model and list of declaration or number, date of decisions on selling confiscated products, bidding products of competent agencies, serial number of disposed stamps via customs electronic data processing system within 15 working days from the date on which records of disposing e-stamps are completed using Form No. 10/TEM using Annex 6 attached hereto.

Article 6. Management of e-stamps for tobacco products and e-stamps for alcohol products manufactured for domestic consumption

1. Responsibilities of tax authorities of all levels in managing declaration for issuance, sale of e-stamps for tobacco products and e-stamps for alcohol products manufactured in domestic consumption

a) Responsibilities of General Department of Taxation

a1. Declaring issuance of e-stamps for tobacco products and e-stamps for alcohol products on website of General Department of Taxation before selling e-stamps using Form No. 01/TB/TEM under Annex 3 attached hereto.

General Department of Taxation shall print e-stamps on the basis of consolidated plans of Departments of Taxation of provinces and central-affiliated cities (according to registration of organizations and individuals manufacturing tobacco products, alcohol products) and spare up to 20% of printing plans as back up.

a2. Issuing e-stamps for tobacco products and e-stamps for alcohol products to Departments of Taxation of provinces and central-affiliated cities registering for e-stamps.

a3. Receiving and looking up e-stamps for tobacco products and e-stamps for alcohol products on website of General Department of Taxation.

a4. Declaring e-stamps for tobacco products and e-stamps for alcohol products no longer usable due to changes to policies on management of e-stamps or missing, burned or damaged e-stamps.

b) Responsibilities of tax authorities of provinces and central-affiliated cities

b1. Departments of Taxation of provinces and cities shall receive e-stamps for tobacco products and e-stamps for alcohol products from General Department of Taxation and sell to organizations and individuals possessing valid license for manufacturing tobacco products and license for manufacturing alcohol products (including issuing stamps for affiliated Tax Sub-departments for sale as per the law).

b2. Tax authorities of all levels shall monitor amount of e-stamps remaining in opening stock, amount of e-stamps received, amount of e-stamps sold to manufacturing organizations and individuals for domestic consumption, amount of stamps lost, burned, damaged, disposed in the period, amount of stamps remaining in ending stock and produce quarterly, annual reports on settlement of e-stamp sale to superior tax authorities.

b3. Regarding receipt of application for registering, using e-stamps of organizations and individuals

- Within 1 working day from the date on which website of General Department of Taxation successfully receives application for registering and using e-stamps of organizations and individuals according to Point 2 Article 6 hereof, tax authorities shall send notice on accepting/rejecting application for registering, using e-stamps using Form No. 02/TB/TEM under Annex 3 attached hereto to organizations and individuals via website of General Department of Taxation.

- In case of rejecting, tax authorities shall inform reason for rejection and provide guidelines to enable organizations and individuals to revise application as per the law.

b4. Regarding sale of e-stamps and disposal of remaining e-stamps for organizations and individuals dividing, separating, merging or transferring to other supervisory tax authorities while still using e-stamps

- Tax authorities are responsible for selling e-stamps as soon as organizations and individuals fully complete procedures for purchasing e-stamps according to this Circular.

- For organizations and individuals dividing, separating, merging or transferring to other supervisory tax authorities while still using remaining e-stamps: In case of accepting Form No. 06/TEM under Annex 3 attached hereto submitted by organizations and individuals, tax authorities shall transfer remaining e-stamps in organizations and individuals dividing, separating, merging to name, TIN of organizations and individuals that are formed after division, separation, merge or transfer remaining stamps to tax authorities that organizations and individuals transfer to.

- Update information of e-stamps sold or transferred to by tax authorities as a result of organizations and individuals divide, separate, merge or transfer to other supervisory tax authorities while still use e-stamps: Name, TIN of organizations and individuals manufacturing tobacco products, alcohol products for domestic consumption; Name of tax authorities selling e-stamps, type of e-stamps, symbol of stamps, from No. ……… to No. ………; date of stamp sale or date of transfer to supervisory tax authorities, quantity, sale price.

b5. Cases where tax authorities inform e-stamps for tobacco products, e-stamps for alcohol products are no longer usable

- E-stamps for tobacco products and e-stamps for alcohol products are no longer usable as declared by organizations and individuals to tax authorities according to Point e Clause 2 of this Article (including cases where e-stamps are unusable as a result of e-stamps being missing, burned or damaged according to declaration of tax authorities);

- E-stamps for tobacco products and e-stamps for alcohol products belonging to organizations and individuals whose TIN is invalidated;

- E-stamps for tobacco products and e-stamps for alcohol products belonging to organizations and individuals which do not operate in registered address as verified and declared by tax authorities;

- Organizations and individuals using e-stamps for tobacco products and e-stamps for alcohol products in the period declared to competent regulatory agencies suspend business operation;

- Authorities detect and inform tax authorities about cases where e-stamps are applied to illegally imported products, prohibited products, counterfeits, products infringing intellectual property rights;

- Business registration bodies and/or competent authorities request organizations, individuals or enterprises to cease operation of conditional business lines upon detecting ineligibility for conducting business operations of the organizations, individuals or enterprises as per the law;

- E-stamps for tobacco products and e-stamps for alcohol products belonging to organizations and individuals that gift and/or sell e-stamps;

- E-stamps for tobacco products and e-stamps alcohol products of organizations and individuals are declared by regulatory agencies to be used incorrectly as per the law.

2. Responsibilities of organizations and individuals in managing and using e-stamps for tobacco products and e-stamps for alcohol products manufactured for domestic consumption

a) Applying for use of e-stamps for tobacco products and e-stamps for alcohol products

a1. Enterprises possessing valid license of manufacturing tobacco products or organizations, individuals possessing valid license for manufacturing alcohol products for domestic consumption issued by competent agencies shall rely on production quota and deadline, use valid electronic trading accounts issued by tax authorities and access website of General Department of Taxation to apply for use of e-stamps using Form No. 01/TEM under Annex 3 attached hereto.

a2. Organizations and individuals shall receive notice on acceptance or rejection of application for use of e-stamps for tobacco products and e-stamps for alcohol products provided by tax authorities electronically using Form No. 02/TB/TEM under Annex 3 attached hereto.

- In case of acceptance, organizations and individuals shall use valid electronic trading accounts provided by tax authorities, access website of General Department of Taxation to apply for use of e-stamps according to section 2 – Application for use of e-stamps of organizations and individuals under Annex 3 attached hereto.

- In case of rejection, organizations and individuals shall revise application according to notice of tax authorities prior to resubmitting application for use of e-stamps electronically.

- Organizations and individuals manufacturing alcohol products for domestic consumption must cease the use of e-stamps issued, purchased from tax authorities according to previous regulations and dispose all remaining and unused e-stamps issued, purchased from tax authorities (if any) from the date on which tax authorities accept application for use of e-stamps according to this Circular.

b) Producing plans for purchase of e-stamps for tobacco products, e-stamps for alcohol products

b1. Based on annual plans for manufacturing tobacco products, alcohol products for domestic consumption, enterprises manufacturing tobacco products or organizations, individuals manufacturing alcohol products for domestic consumption shall use valid electronic trading accounts issued by tax authorities and access website of General Department of Taxation to register plans for purchasing e-stamps using Form No. 02/TEM under Annex 3 attached hereto consisting of: Type of stamps, symbol of stamp model, amount of stamps to be purchased while guaranteeing that amount of stamps applied for purchase does not exceed maximum quota of tobacco products, alcohol products permitted for manufacturing according to valid license for manufacturing issued by competent agencies (cases where excess is permitted must be accompanied by reasons) before May 15 of the year preceding the plan year.

Enterprises manufacturing tobacco products or organizations, individuals manufacturing alcohol products for domestic consumption without registering plans for using e-stamps for tobacco products or e-stamps for alcohol products are considered to have no need for purchasing e-stamps.

In case enterprises owning tobacco and/or alcohol brand hire other entities to manufacture tobacco products and/or alcohol products, e-stamps of enterprises owning the brand shall be used.

b2. In case organizations, individuals have the need to purchase more e-stamps or organizations, individuals possess license of manufacturing tobacco products, alcohol products for domestic consumption before May 15: At least 30 working days from the date on which application for e-stamp purchase is submitted, organizations and individuals shall use valid electronic trading accounts issued by tax authorities, access website of General Department of Taxation to register revision to amount e-stamps for purchase or for additional purchase of the year using Form No. 02/TEM under Annex 3 attached hereto while guaranteeing that amount of stamps applied for purchase must not exceed maximum quota of tobacco products, alcohol products permitted for manufacturing according to valid license of manufacturing (cases where excess is permitted must be accompanied by reasons).

b3. Organizations and individuals shall receive notice on acceptance or rejection of application for plans for purchase, additional purchase of e-stamps for tobacco products and e-stamps for alcohol products provided by tax authorities electronically using Form No. 02/TB/TEM under Annex 3 attached hereto.

- In case of acceptance, organizations and individuals shall adopt procedures for purchasing and receiving e-stamps according to Point c Clause 2 of this Article.

- In case of rejection, organizations and individuals shall revise application according to notice of tax authorities before resubmitting plans for purchase of e-stamps as per the law.

c) Purchasing e-stamps for tobacco products and e-stamps for alcohol products

c1. Based on plans for purchase and additional purchase of e-stamps of plan year registered with supervisory tax authorities, organizations and individuals shall use valid electronic trading issued by tax authorities and access website of General Department of Taxation to apply for purchase of e-stamps using Form No. 03/TEM under Annex 3 attached hereto.

c2. Organizations and individuals shall receive notice on acceptance or rejection of application for purchase of e-stamps for tobacco products and e-stamps for alcohol products provided by tax authorities electronically using Form No. 02/TB/TEM under Annex 3 attached hereto within 1 working day.

- In case of acceptance: Upon arriving at tax authorities to purchase or receive e-stamps for tobacco products and e-stamps for alcohol products, organizations and individuals shall:

+ provide certified true copies or copies and master registers for comparison of valid license for manufacturing tobacco products or valid license for manufacturing alcohol products issued by competent agencies as per the law (when receiving stamps for the first time). In case of changes to valid license for manufacturing tobacco products or valid license for manufacturing alcohol products issued by competent agencies, organizations and individuals must provide certified true copies or copies and master registers for comparison of the license to supervisory tax authorities when purchasing, receiving e-stamps for tobacco products and e-stamps for alcohol products;

+ present valid ID Cards/Citizen Identity Card/passports of individuals purchasing stamps as per the law;

+ pay fees for stamp purchase, receipt, management and use according to this Circular;

- In case of rejection, organizations and individuals shall revise application according to notice of tax authorities prior to adopting procedures for purchasing, receiving stamps as per the law.

c3. In case organizations and individuals fail to use all purchased e-stamps for tobacco products and e-stamps for alcohol products at the end of plan year, the remaining e-stamps shall be saved for next year's use.

d) Transmitting information on e-stamps for tobacco products and e-stamps for alcohol products applied on tobacco products and alcohol products for domestic consumption to tax authorities.

d1. Before the 20th of the following month, organizations and individuals shall use valid electronic trading accounts issued by tax authorities and access website of General Department of Taxation to transmit information of applied e-stamps using Form No. 07/TEM under Annex 3 attached hereto to website of General Department of Taxation, consisting of following information: Name of stamps, model of stamps, symbols of stamps; Total amount of stamps used; Total amount of stamps damaged. In case the last day is not a working day as per the law, the last day shall be the next working day. In case e-stamp data transmitted to tax authorities requires revision, organizations and individuals shall resubmit correct e-stamp data to replace the e-stamp data that requires revision.

d2. Organizations and individuals shall receive notice on acceptance or rejection of e-stamp data manifest provided by tax authorities electronically using Form No. 02/TB/TEM under Annex 3 attached hereto.

In case of rejection, organizations and individuals shall revise application according to notice of tax authorities before resubmitting e-stamp data as per the law.

dd) Disposing e-stamps for tobacco products or e-stamps for alcohol products belonging to organizations, individuals manufacturing tobacco products or alcohol products that cease production, dissolve, go bankrupt, divide, separate, merge or transfer to other supervisory tax authorities.

dd1) Enterprises manufacturing tobacco products or organizations, individuals manufacturing alcohol products upon ceasing production, dissolving, going bankrupt, dividing, separating, merging or transfer to other supervisory tax authorities shall use valid electronic trading accounts issued by tax authorities and access website of General Department of Taxation to perform settlement and dispose the remaining e-stamps that are no longer used within 5 days from the date on which the organizations and individuals issue notice on ceasing production or from the date on which Decisions on dissolution, bankruptcy, division, separation, merge or from the date on which the organizations and individuals transfer to other supervisory tax authorities with following information: methods of disposal, reasons for disposal, models of stamps, symbols of stamps, amount of stamps using Form No. 04/TEM under Annex 3 attached hereto.

dd2. Organizations and individuals dividing, separating, merging or transferring to other supervisory authorities and wishing to use their remaining e-stamps shall use valid electronic trading accounts issued by tax authorities to access website of General Department of Taxation to register transfer of remaining amount of e-stamps in organizations and individuals that divide, separate, merge to name, TIN of organizations and individuals formed as a result of division, separation, merge using Form No. 06/TEM under Annex 3 attached hereto with following information: Models of stamps, symbols of stamps, from No. ………, to No. ………, total amount: ………

dd3. Organizations and individuals shall receive notice on acceptance or rejection of application for use of remaining e-stamps of organizations and individuals provided by tax authorities electronically using Form No. 02/TB/TEM under Annex 3 attached hereto.

In case of rejection, organizations and individuals shall revise application under instruction of tax authorities and resubmit Form No. 06/TEM under Annex 3 attached hereto electronically.

e) Disposing e-stamps for tobacco products and e-stamps for alcohol products that are missing, burned, damaged or disposal

e1. In case e-stamps for tobacco products or e-stamps for alcohol products are missing or burnt: Organizations and individuals detecting missing or burnt stamps shall use valid electronic trading accounts issued by tax authorities and access website of General Department of Taxation to produce reports on missing, burnt stamps within 5 working days from the date on which they detect missing, burnt stamps using Form No. 05/TEM under Annex 3 attached hereto with following information: Models of stamps, symbols of stamps, quantity, reasons for missing or burnt stamps. In case missing stamps are found, organizations and individuals must dispose stamps within 5 days from the date on which missing stamps are found.

e2. In case e-stamps for tobacco products or e-stamps for alcohol products manufactured for domestic consumption are damaged: Enterprises manufacturing tobacco products or organizations, individuals manufacturing alcohol products for domestic consumption must dispose e-stamps for tobacco products or e-stamps for alcohol products that are damaged and no longer usable. Organizations and individuals shall use valid electronic trading accounts issued by tax authorities and access website of General Department of Taxation to produce notice on disposal results of e-stamps for tobacco products or e-stamps for alcohol products within 5 working days from the date on which damaged stamps are disposed using Form No. 04/TEM under Annex 3 attached hereto.

e3. Organizations and individuals shall receive notice on acceptance or rejection of notice on disposal results of e-stamps, reports on missing e-stamps provided by tax authorities electronically using Form No. 02/TB/TEM under Annex 3 attached hereto.

In case of rejection, organizations and individuals shall revise application under instruction of tax authorities and resubmit Form No. 04/TEM and Form No. 05/TEM under Annex 3 attached hereto electronically.

e4. Documents on e-stamp disposal in enterprises manufacturing tobacco products or organizations, individuals manufacturing alcohol products consist of:

- Manifest of e-stamps for tobacco products or e-stamps for alcohol products to be disposed;

- Decisions on establishment of council for disposal of e-stamps for tobacco products or e-stamps for alcohol products. Council for e-stamp disposal: Representatives of heads, representatives of accounting department of enterprises and representatives of production department. Individuals manufacturing alcohol products are not required to establish councils for disposal of e-stamps for alcohol products;

- Records of disposal of e-stamps for tobacco products or e-stamps for alcohol products which specify reasons for disposal. Members of councils for disposal of e-stamps for tobacco products or e-stamps for alcohol products must sign records of disposal and be legally responsible for any error.

Documents on disposal of e-stamps for tobacco products or e-stamps for alcohol products are stored in organizations and individuals using e-stamps for tobacco products or e-stamps for alcohol products.

3. Research and verification of information regarding e-stamps for tobacco products or e-stamps for alcohol products applied on packs of cigarette or bottles of alcohol manufactured for domestic consumption.

When users of tobacco products, alcohol products or relevant agencies wish to look up and/or verify information of e-stamps for tobacco products and e-stamps for alcohol products using QRcode applied on tobacco products, alcohol products such as: Name of stamps, models of stamps, symbols of stamps; Name, TIN of manufacturers of tobacco products, alcohol products; Name of tax authorities selling e-stamps, date of selling e-stamps, research shall be conducted on website of General Department of Taxation.

Chapter III

IMPLEMENTATION

Article 7. Expenditure on printing stamps

Customs authorities shall sell e-stamps for imported tobacco products, alcohol products to enterprises importing tobacco products, alcohol products. Tax authorities shall sell tobacco products, alcohol products for domestic consumption to organizations and individuals possessing license for manufacturing tobacco products, alcohol products (including license of manufacturing alcohol products manually for business purposes, license for manufacturing alcohol products industrially).

Stamp sale price is determined to compensate for all costs including stamp printing costs, stamp distribution costs, stamp management costs and tax submission as per the law; excluding investment for application of information technology in receiving, researching data, managing e-stamps which are guaranteed by state budget to serve state management affairs.

General Director of General Department of Customs, General Director of General Department of Taxation shall decide e-stamp sale price conforming to the aforementioned principles and depending on implementation facts from time to time, in each printing period to satisfy use plans and demands of organizations and individuals permitted to use stamps as per the law.

General Department of Taxation and General Department of Customs shall be provided with funding for printing stamps by state budget; revenue generated by stamp sale (minus tax submission as per the law) shall be submitted to state budget entirely.

Article 8. Imposing penalties

Enterprises importing alcohol products, organizations, individuals manufacturing alcohol products domestically, enterprises manufacturing tobacco products and organizations manufacturing tobacco products domestically that cause e-stamps to be missing, burnt or damaged without complying with regulations on submitting reports, disposing stamps and making statements regarding stamps with tax authorities or customs authorities shall be met with penalties according to Decree No. 109/2013/ND-CP dated September 24, 2013 of the Government on imposing penalties for administrative violations in price, fee, charge and invoice management (and amendments thereto under Decree No. 49/2016/ND-CP dated May 27, 2016 of the Government), Decree No. 125/2020/ND-CP dated October 19, 2020 of the Government and amending documents (if any).

Article 9. Entry into force

1. This Circular comes into force from May 15, 2021.

2. Following documents of Ministry of Finance remain effective until June 30, 2022:

a) Circular No. 15/2020/TT-BTC dated March 23, 2020 of Ministry of Finance providing guidelines on printing, issuing, managing and using stamps for alcohol products manufactured for domestic consumption and imported alcohol products;

b) Circular No. 124/2007/TT-BTC dated October 26, 2007 of Ministry of Finance providing guidelines on printing, issuing, managing, using stamps for imported cigarettes and stamps for imported cigars;

c) Decision No. 2979/QD-BTC of Ministry of Finance on amendments to Decision No. 211/QD-BTC dated January 27, 2010 of Ministry of Finance on issuance of models of stamps and regulations on printing, issuing, managing and using stamps for domestically manufactured tobacco products printed in multi-dimensional barcodes;

d) Decision No. 211/QD-BTC dated January 27, 2010 of Ministry of Finance on issuance of models of stamps and regulations on printing, issuing, managing and using stamps for domestically manufactured tobacco products printed in multi-dimensional barcodes;

e) Decision No. 2000/QD-BTC dated August 19, 2009 of Ministry of Finance on transfer of tasks for printing and issuing certain tax prints to General Department of Customs;

g) Decision No. 2807/QD-BTC dated November 11, 2009 of Ministry of Finance on printing, issuing, managing and using tax collection instrument and other collection instrument relating to import, export activities;

h) Decision No. 918/QD-BTC dated April 22, 2011 of Ministry of Finance on changing models of stamps for imported cigarettes;

i) Decision No. 1010/QD-BTC dated May 15, 2014 of Ministry of Finance changing models of stamps for cigars and relevant legislative documents.

3. Amount of stamps for tobacco products and alcohol products issued, provided and sold as per the law under legislative documents and guiding documents of Minister of Finance under Clause 2 of this Article and remaining in tax authorities, customs authorities and enterprises, organizations, individuals that manufacture, import tobacco products and alcohol products must be completely disposed before August 1, 2022 according to Circular No. 15/2020/TT-BTC dated March 23, 2020 of Ministry of Finance; Circular No. 124/2007/TT-BTC dated October 26, 2007 of Ministry of Finance; Decision No. 211/QD-BTC dated January 27, 2010 of Ministry of Finance; Decision No. 2979/QD-BTC of Ministry of Finance on amendment to Decision No. 211/QD-BTC dated January 27, 2010 of Ministry of Finance and relevant documents.

4. From July 1, 2022, application of e-stamps shall conform to this Circular.

5. From July 1, 2022, Circulars and Decisions of Ministry of Finance specified under Clause 2 of this Article shall expire.

6. Difficulties that arise during implementation of this Circular should be reported to Ministry of Finance./.

|

|

PP.

MINISTER |

ANNEX 1

E-STAMP MODEL FOR TOBACCO PRODUCTS MANUFACTURED FOR DOMESTIC

CONSUMPTION

(Attached to Circular No. 23/2021/TT-BTC dated March 30, 2021 of Minister of

Finance)

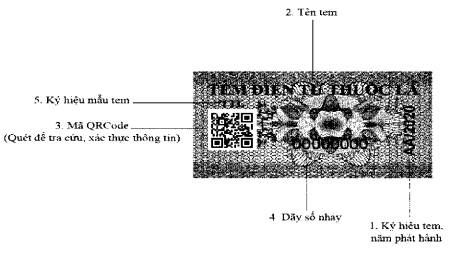

Description of e-stamps for tobacco products:

1. Models of e-stamps for tobacco products are described below.

2. E-stamps for tobacco products shall have dimensions of 2.2 cm x 4.5 cm, contents printed on 65 g/m2 paper with faint pattern. E-stamps for tobacco products must be distinguishable for the naked eyes and contain electronic information, data which can be searched and verified on website of General Department of Taxation serving management affairs of enterprises, consumers and regulatory agencies.

3. E-stamps shall contain “TEM DIỆN TỬ THUỐC LÁ” (E-STAMP FOR TOBACCO PRODUCTS), with model symbol of TTL and QRcode. E-stamps for tobacco products shall contain letters and continuous number from 00.000.001 to 40.000.000. Letters to distinguish e-stamps for tobacco products are 2 letters among 20 capital letters of the Vietnamese alphabet: A, B, C, D, E, G, H, K, L, M, N, P, Q, R, S, T, U, V, X, Y and printing year of the stamps.

ANNEX 2

E-STAMP MODEL FOR ALCOHOL PRODUCTS MANUFACTURED FOR DOMESTIC

CONSUMPTION

(Attached to Circular No. 23/2021/TT-BTC dated March 30, 2021 of Minister of

Finance)

Description of e-stamps for alcohol products:

1. E-stamps are visible stamps containing electronic information and data looked up on website of General Department of Customs, General Department of Customs to serve management affairs of enterprises, consumers and regulatory agencies.

2. e-stamps for alcohol products have 2 types as follows:

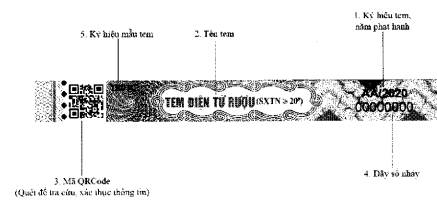

2.1. E-stamps for alcohol products containing at least 20o alcohol (stamps for manual or machine application).

- Stamp dimensions: 11 cm x 1.3 cm.

- Stamps are printed on paper stickers coated in ethanol in case of stamps applied manually or by machine.

- Stamps are printed on flexible paper coated in cold ethanol in case of stamps applied manually or by machine.

- Stamps contain “TEM DIỆN TỬ RƯỢU (SXTN≥20°)” (E-STAMP FOR ALCOHOL PRODUCTS (≥20° ALCOHOL))

- On the left side of e-stamps for alcohol products:

+ Print stamps model of TR01C for ≥20° alcohol products manufactured for domestic consumption for stamps applied by machine; TR01R for ≥20° alcohol products manufactured for domestic consumption for stamps applied by machine (separate stamps) or TR01T for ≥20° alcohol products manufactured for domestic consumption applied manually.

+ Print QRcode.

- On the right side of e-stamps for alcohol products:

+ Print letters to distinguish e-stamps for alcohol products are 2 letters among 20 capital letters of the Vietnamese alphabet: A, B, C, D, E, G, H, K, L, M, N, P, Q, R, S, T, U, V, X, Y and printing year of the stamps.

+ Print order number from 00.000.001 to 20.000.000 in black ink.

|

|

|

|

|

|

|

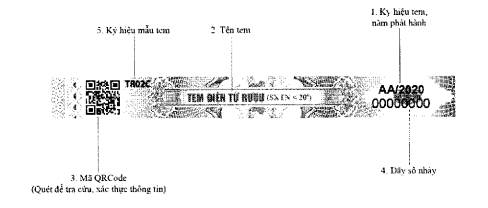

2.2. E-stamps for alcohol products containing less than 20o alcohol (stamps for manual or machine application).

- Stamp dimensions: 11 cm x 1.3 cm.

- Stamps are printed on paper stickers coated in ethanol in case of stamps applied manually or by machine.

- Stamps are printed on flexible paper coated in cold ethanol in case of stamps applied manually or by machine.

- Stamps contain “TEM DIỆN TỬ RƯỢU (SXTN<20°)” (E-STAMP FOR ALCOHOL PRODUCTS (<20° ALCOHOL)).

- On the left side of e-stamps for alcohol products:

+ Print stamps model of TR02C for <20° alcohol products manufactured for domestic consumption for stamps applied by machine or TR02T for <20° alcohol products manufactured for domestic consumption applied manually.

+ Print QRcode.

- On the right side of e-stamps for alcohol products:

+ Print letters to distinguish e-stamps for alcohol products are 2 letters among 20 capital letters of the Vietnamese alphabet: A, B, C, D, E, G, H, K, L, M, N, P, Q, R, S, T, U, V, X, Y and printing year of the stamps.

+ Print order number from 00.000.001 to 20.000.000 in black ink.

|

|

|