Nội dung toàn văn Circular No. 05/2016/TT-BTC amending preferential import tax rates environmental goods in APEC 2016

|

MINISTRY OF

FINANCE |

SOCIALIST REPUBLIC OF VIETNAM |

|

No.: 05/2016/TT-BTC |

Ha Noi, January 13, 2016 |

CIRCULAR

AMENDING PREFERENTIAL IMPORT TAX RATES FOR A NUMBER OF ENVIRONMENTAL GOODS IN APEC IN THE COMMODITY HEADINGS 84.19 AND 84.21 IN THE PREFERENTIAL IMPORT TARIFF

Pursuant to the Law on import and export duties No. 45/2005/QH11 dated June 14, 2005;

Pursuant to Resolution No. 295/2007/NQ-UBTVQH12 dated September 28, 2007 of the Standing Committee of the National Assembly promulgating the Export tariff according to the list of taxable commodity headings and the tax bracket on each heading, the preferential import tariff according to the list of taxable commodity headings and preferential tax bracket on each heading;

Pursuant to the Government’s Decree No. 87/2010/ND-CP dated August 13, 2010 providing in detailed for implementing the Law on import and export duties;

Pursuant to the Government’s Decree No.215/2013/ND-CP dated 23 December 2013 defining the functions, tasks, powers and organizational structures of Ministry of Finance;

At the request of the Director General of the Department of tax policy,

The Minister of Finance promulgates a Circular to amend the preferential import tax rates for a number of environmental goods in APEC in the commodity headings 84.19 and 84.21 in the preferential import tariff.

Article 1. Amendments to the preferential import tax rates for a number of commodities in headings 84.19 and 84.21 in the preferential import tariff.

The preferential import tax rates for a number of commodities in headings 84.19 and 84.21 in the preferential import tariff promulgated under the Circular No. 182/2015/TT-BTC dated November 16, 2015 of the Minister of Finance shall be replaced by the new ones in the list of preferential import tax rates enclosed herewith.

Article 2. Effect

This Circular shall take effect from February 27, 2016.

|

|

PP. THE

MINISTER |

LIST

OF PREFERENTIAL IMPORT TAX RATES FOR A NUMBER OF COMMODITIES IN HEADINGS 84.19 AND 84.21

(Promulgated under the Circular No. 05/2016/TT-BTC dated January 13, 2016 of the Minister of Finance)

|

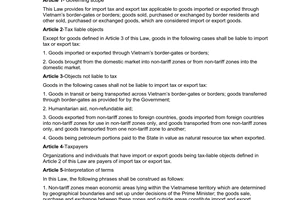

Code |

Description |

Tax rate (%) |

|

8419 |

Machinery, plant or laboratory equipment, whether or not electrically heated (excluding furnaces, ovens and other equipment of heading 85.14), for the treatment of materials by a process involving a change of temperature such as heating, cooking, roasting, distilling, rectifying, sterilising, pasteurising, steaming, drying, evaporating, vaporising, condensing or cooling, other than machinery or plant of a kind used for domestic purposes; instantaneous or storage water heaters, non-electric. |

|

|

|

- Instantaneous or storage water heaters, non-electric: |

|

|

8419.11 |

- - Instantaneous gas water heaters: |

|

|

8419.11.10 |

- - - Household type |

10 |

|

8419.11.90 |

- - - Other |

10 |

|

8419.19 |

- - Other: |

|

|

8419.19.10 |

- - - Household type |

5 |

|

8419.19.90 |

- - - Other |

5 |

|

8419.20.00 |

- Medical, surgical or laboratory sterilisers |

0 |

|

|

- Dryers: |

|

|

8419.31 |

- - For agricultural products: |

|

|

8419.31.10 |

- - - Electrically operated |

0 |

|

8419.31.20 |

- - - Not electrically operated |

0 |

|

8419.32 |

- - For wood, paper pulp, paper or paperboard: |

|

|

8419.32.10 |

- - - Electrically operated |

0 |

|

8419.32.20 |

- - - Not electrically operated |

0 |

|

8419.39 |

- - Other: |

|

|

|

- - - Electrically operated: |

|

|

8419.39.11 |

- - - - Machinery for the treatment of materials by a process involving heating, for the manufacture of printed circuit boards, printed wiring boards or printed circuit assemblies |

0 |

|

8419.39.19 |

- - - - Other |

0 |

|

8419.39.20 |

- - - Not electrically operated |

0 |

|

8419.40 |

- Distilling or rectifying plant: |

|

|

8419.40.10 |

- - Electrically operated |

0 |

|

8419.40.20 |

- - Not electrically operated |

0 |

|

8419.50 |

- Heat exchange units: |

|

|

8419.50.10 |

- - Cooling towers |

3 |

|

8419.50.90 |

- - Other |

3 |

|

8419.60 |

- Machinery for liquefying air or other gases: |

|

|

8419.60.10 |

- - Electrically operated |

0 |

|

8419.60.20 |

- - Not electrically operated |

0 |

|

|

- Other machinery, plant and equipment: |

|

|

8419.81 |

- - For making hot drinks or for cooking or heating food: |

|

|

8419.81.10 |

- - - Electrically operated |

15 |

|

8419.81.20 |

- - - Not electrically operated |

15 |

|

8419.89 |

- - Other: |

|

|

|

- - - Electrically operated: |

|

|

8419.89.13 |

- - - - Machinery for the treatment of materials by a process involving heating, for the manufacture of printed circuit boards, printed wiring boards or printed circuit assemblies |

0 |

|

8419.89.19 |

- - - - Other |

0 |

|

8419.89.20 |

- - - Not electrically operated |

0 |

|

8419.90 |

- Parts: |

|

|

|

- - Of electrically operated articles: |

|

|

8419.90.12 |

- - - Parts of machinery for the treatment of materials by a process involving heating, for the manufacture of printed circuit boards, printed wiring boards or printed circuit assemblies |

0 |

|

8419.90.13 |

- - - Casings for cooling towers |

0 |

|

8419.90.19 |

- - - Other |

0 |

|

|

- - Of not electrically operated articles: |

|

|

8419.90.21 |

- - - Household type |

0 |

|

8419.90.29 |

- - - Other |

0 |

|

|

|

|

|

84.21 |

Centrifuges, including centrifugal dryers; filtering or purifying machinery and apparatus for liquids or gases. |

|

|

|

- Centrifuges, including centrifugal dryers: |

|

|

8421.11.00 |

- - Cream separators |

10 |

|

8421.12.00 |

- - Clothes-dryers |

18 |

|

8421.19 |

- - Other: |

|

|

8421.19.10 |

- - - Of a kind used for sugar manufacture |

5 |

|

8421.19.90 |

- - - Other |

5 |

|

|

- Filtering or purifying machinery and apparatus for liquids: |

|

|

8421.21 |

- - For filtering or purifying water: |

|

|

|

- - - Of a capacity not exceeding 500 l/h: |

|

|

8421.21.11 |

- - - - Filtering machinery and apparatus for domestic use |

5 |

|

8421.21.19 |

- - - - Other |

5 |

|

|

- - - Of a capacity exceeding 500 l/h: |

|

|

8421.21.22 |

- - - - Electrically operated |

5 |

|

8421.21.23 |

- - - - Not electrically operated |

5 |

|

8421.22 |

- - For filtering or purifying beverages other than water: |

|

|

8421.22.30 |

- - - Electrically operated, of a capacity exceeding 500 l/h: |

10 |

|

8421.22.90 |

- - - Other |

10 |

|

8421.23 |

- - Oil or petro-filters for internal combustion engines: |

|

|

|

- - - For machinery of heading 84.29 and 84.30: |

|

|

8421.23.11 |

- - - - Oil filters |

0 |

|

8421.23.19 |

- - - - Other |

0 |

|

|

- - - For motor vehicles of Chapter 87: |

|

|

8421.23.21 |

- - - - Oil filters |

15 |

|

8421.23.29 |

- - - - Other |

15 |

|

|

- - - Other: |

|

|

8421.23.91 |

- - - - Oil filters |

0 |

|

8421.23.99 |

- - - - Other |

0 |

|

8421.29 |

- - Other: |

|

|

8421.29.10 |

- - - Of a kind suitable for medical, surgical or laboratory use |

0 |

|

8421.29.20 |

- - - Of a kind used for sugar manufacturer |

0 |

|

8421.29.30 |

- - - Of a kind used oil drilling operations |

0 |

|

8421.29.40 |

- - - Other, petro-filters |

0 |

|

8421.29.50 |

- - - Other, oil filters |

0 |

|

8421.29.90 |

- - - Other |

0 |

|

|

- Filtering or purifying machinery and apparatus for gases: |

|

|

8421.31 |

- - Intake air filters for internal combustion engines: |

|

|

8421.31.10 |

- - - For machinery of heading 84.29 and 84.30 |

0 |

|

8421.31.20 |

- - - For motor vehicles of Chapter 87 |

10 |

|

8421.31.90 |

- - - Other |

0 |

|

8421.39 |

- - Other: |

|

|

8421.39.20 |

- - - Air purifiers |

0 |

|

8421.39.90 |

- - - Other |

0 |

|

|

- Parts: |

|

|

8421.91 |

- - Of centrifuge, including centrifugal dryers: |

|

|

8421.91.10 |

- - - Of goods of subheading 8421.12.00 |

0 |

|

8421.91.20 |

- - - Of goods of subheading 8421.19.10 |

0 |

|

8421.91.90 |

- - - Of goods of subheading 8421.11.00 or 8421.19.90 |

0 |

|

8421.99 |

- - Other: |

|

|

8421.99.20 |

- - - Filtering cartridges for filters of subheading 8421.23 |

0 |

|

8421.99.30 |

- - - Of goods of subheading 8421.31 |

0 |

|

|

- - - Other: |

|

|

8421.99.91 |

- - - - Of goods of subheading 8421.29.20 |

0 |

|

8421.99.94 |

- - - - Of goods of subheading 8421.21.11 |

0 |

|

8421.99.95 |

- - - - Of goods of subheading 8421.23.11, 8421.23.29, 8421.23.91 or 8421.23.99 |

0 |

|

8421.99.99 |

- - - - Other |

0 |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed