Nội dung toàn văn Circular No. 40/2011/TT-NHNN regulating on licensing and organizations

|

STATE BANK OF

VIETNAM |

THE SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 40/2011/TT-NHNN |

Hanoi, 15 December 2011 |

CIRCULAR

PROVIDING FOR THE ISSUANCE OF LICENSE AND THE ORGANIZATION, OPERATION OF COMMERCIAL BANKS, FOREIGN BANK'S BRANCHES, REPRESENTATIVE OFFICES OF FOREIGN CREDIT INSTITUTIONS, OTHER FOREIGN ORGANIZATIONS HAVING BANKING ACTIVITIES IN VIETNAM

- Pursuant to the Law on the State Bank of Vietnam No. 46/2010/QH12 dated 16 June 2010;

- Pursuant to the Law on Credit institutions No. 47/2010/QH12 dated 16 June 2010;

- Pursuant to the Law on Enterprises No. 60/2005/QH11 dated 29 November 2005;

- Pursuant to the Law on Investment No. 59/2005/QH11 dated 29 November 2005;

- Pursuant to Decree No. 96/2008/ND-CP dated 26 August 2008 of the Government providing for the functions, duties, authorities and organizational structure of the State Bank of Vietnam;

The State Bank of Vietnam (herein after referred to as the State Bank) hereby provides the issuance of License, the organization and operation of commercial banks, foreign bank's branches, and representative offices of foreign credit institutions, other foreign organizations having banking activities in Vietnam as follows:

Chapter 1

GENERAL PROVISIONS

Article 1. Governing scope and subjects of application

1. Governing scope:

This Circular provides the issuance of the License and several contents about the organization, operation of commercial banks, foreign bank's branches, and representative offices of foreign credit institutions, other foreign organizations having banking activities in Vietnam.

2. Subjects of application:

a) Commercial banks;

b) Foreign bank's branches;

c) Representative offices of foreign credit institutions, other foreign organizations having banking activities in Vietnam (hereinafter shortly referred to as Representative offices);

d) Organizations, individuals which involve in the establishment, organization and operation of commercial banks, foreign bank's branches, and representative offices.

Article 2. Interpretation

In this Circular, following terms shall be construed as follows:

1. License shall include establishment and operation License of a commercial bank, establishment License of a foreign bank's branch, establishment License of a representative office issued by the State Bank. Documents issued by the State Bank on the amendment, supplement of the License is an integral part of the License.

2. Commercial bank shall mean a type of bank which is entitled to perform all banking activities and other business activities as provided for by the Law on Credit institutions for the purpose of profits.

3. Joint stock commercial bank shall mean a commercial bank which is established, organized in the form of a joint-stock company.

4. 100% foreign owned bank shall mean a commercial bank which is established in Vietnam, whose 100% of the charter capital is owned by a foreign credit institution; be a Vietnamese legal entity and whose head office is located in Vietnam. A 100% foreign owned bank shall be established in the form of a one-member limited liability company whose owner is a

foreign bank or a limited liability company with two or more members, in which there must be a foreign bank holding 50% of the charter capital.

5. Joint venture bank shall be a bank which is established in Vietnam by the capital contribution of Vietnamese party (including one or several Vietnamese banks) and foreign party (including one or several foreign banks) on the basis of a joint venture contract; be Vietnamese legal entity and whose head office is located in Vietnam. A joint venture bank shall be established and organized in the form of a limited liability company with two or more members, providing that the members shall not exceed 05, and in which one member and related persons are not allowed to hold more than 50% the charter capital.

6. Foreign bank's branch shall be an underlying unit of a foreign bank, have no legal entity and be guaranteed by the foreign bank to take responsibility for all the obligations and commitments of the foreign bank's branch in Vietnam.

7. Representative office shall be an underlying unit of a foreign credit institution, other foreign organization having banking activities. A representative office shall not be permitted to conduct business activities in Vietnam.

8. Foreign credit institution shall be a credit institution that is established in a foreign country in accordance with provisions of foreign laws.

9. Other foreign organization having banking activities shall be an organization, which is established in a foreign country in accordance with the provision of foreign laws and is permitted to regularly conduct business activities, to supply one or several operations as follows:

a) Deposit taking;

b) Extension of credit;

c) Supply of payment service via the account.

10. Capital contributing shareholder shall mean an organization, individual holding at least one issued share of a joint-stock commercial bank at the time of establishment.

11. Founding shareholder shall mean a shareholder who contributes capital to the establishment, takes part in the setting up, gives approval and signs on the initial charter on the organization and operation of a joint-stock commercial bank.

12. The first General Shareholders’ Meeting shall be a meeting that involves founding shareholders and other capital contributing shareholders after being approved in principle by the State Bank, is responsible for approving the Charter on the organization and operation of a commercial bank, shares, election of members of the Board of Directors, members of the Controllers’ Committee of the first tenure, and making decision on other issues relating to the establishment of the joint-stock commercial bank.

13. Capital contributing member shall be a Vietnamese bank, a foreign bank which contributes capital to a joint-venture bank; be a foreign credit institution which contributes capital to a 100% foreign owned bank.

14. Founding member shall be a capital contributing member who takes part in the preparation, approval and signing on the first charter on the organization and operation of a joint-venture bank, 100% foreign-owned bank.

15. The first meeting of capital contributing members shall be a meeting that involves founding members and other capital contributing members after being approved in principle by the State Bank, is responsible for approving the charter on the organization and operation of the bank, election of members in the Board of Members, members of the Controllers’ Committee of the first tenure, and making decision on other issues relating to the establishment of the joint-venture bank, 100% foreign owned bank that is a limited liability company with two or more members.

16. Owner shall be an entity that has the ownership over the entire capital of a commercial bank that is a one-member limited liability company.

17. Parent bank shall be a foreign bank that proposes for the establishment of a branch or has a bank branch in Vietnam.

18. Preparatory Board is a group of people selected by founding shareholders, capital contributing members, owner, parent bank, who on be half of these people are responsible for developing works relating to the application for issuance of the License. A Preparatory Board shall consist of at least 02 members, of whom 01 member shall be the head of the board.

19. Legal representative of the organization is the Chairman of the board, Chairman of the Board of Members or General Director (Director) provided for in the charter.

20. Native country, for a foreign credit institution, other foreign organization having banking activities, is the country where the foreign credit institution, other foreign organization having banking activities are established with head office in that country.

Chapter 2

PROVISIONS ON THE ISSUANCE OF A LICENSE

SECTION 1. GENERAL PROVISIONS

Article 3. Competence of making decision on the issuance and revocation of a License

1. The Governor of the State Bank shall decide on the issuance of a License in accordance with provisions of the Law on credit institutions, of this Circular and provisions of applicable laws.

2. The Governor of the State Bank shall decide on the revocation of a License that is issued in cases as provided for in Article 28 of the Law on credit institutions. The revocation of a License shall be performed in accordance with regulations of the State Bank.

Article 4. License

1. The State Bank shall provide in details for contents of the banking activities, other business activities of a commercial bank, foreign bank’s branch, operating contents of a representative office in the License issued to a specific commercial bank, foreign bank’s branch, representative office in conformity with the form in Appendix 01 of this Circular.

2. In case where the License is lost, torn, burned, or destroyed under other forms, the commercial bank, foreign bank’s branch, representative office shall prepare a document clearly stating the reasons and submit via post service or directly to the State Bank to apply for the issuance of a copy of the License from the original register in compliance with applicable laws.

Within a period of 02 days since the receipt of the written application, the State Bank shall re-issue a copy from the original register to the commercial bank, foreign bank’s branch, representative office.

3. The commercial bank, foreign bank’s branch, representative office shall use the issued License in accordance with provisions in Article 27 of the Law on credit institutions.

Article 5. Order and procedure for issuance of a License

1. Order and procedure for issuance of an Establishment and operation License of a commercial bank, Establishment license of a foreign bank’s branch shall be as follows:

a) Preparatory Board shall set up an application file for issuance of the License as provided for in Article 13, 14, paragraph 1, 2, 3 Article 15, paragraph 1, 2, 3, 4, 5, 6 Article 16, paragraph 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 Article 17 of this Circular and submit via post service or directly to the State Bank.

Within a period of 60 days since the full receipt of the application file for issuance of the License, the State Bank shall send a letter to the Preparatory Board confirming its full receipt of a valid application file for approving in principles. In case where the application file is not sufficient, the State Bank shall send a written request to the Preparatory Board for supplement.

b) Within a period of 90 working days since the confirmation of the full receipt of the valid application file, the State Bank shall give a written approval in principle to the establishment of a commercial bank, a foreign bank’s branch. In case of disapproval, the State Bank shall give a written answer to the Preparatory Board, which clearly states the reasons for disapproval.

c) Within a period of 60 days since the receipt of the written approval in principle to the establishment of a commercial bank, a foreign bank’s branch, the Preparatory Board shall prepare supplemental documents as provided for in paragraph 4 Article 15, paragraph 7 Article 16, paragraph 13 Article 17 of this Circular and send via post mail or directly submit at the State Bank. If the State Bank does not receive or receives an insufficient application file within the stipulated period of time, the written approval in principle shall be invalid.

Within the a period of 02 working days since the full receipt of the supplemental documents, the State Bank shall give a written confirmation of the full receipt of the supplemental documents. Within 30 days since the full receipt of the supplemental documents, the State Bank shall issue the License in accordance with provisions. In case of refusal to license issuance, the State Bank shall send a written answer to the Preparatory Board, which clearly states the reasons thereof.

2. Order and procedure for issuance of a License on establishment of a representative office shall be as follows:

a) The foreign credit institution, other foreign organization having banking activities shall prepare an application file for issuance of the License as provided for in Article 13, Article 18 of this Circular and send via post service or directly submit to the State Bank

Within a period of 30 working days since the receipt of the application file for issuance of the License, the State Bank shall send a written document to foreign credit institution, foreign organization having banking activities confirming the full receipt of a valid application file.

In the event where the application file is insufficient, invalid, the State Bank shall send a written document to foreign credit institution, other foreign organization having banking activities requesting for supplement.

b) Within a period of 60 working days since the written confirmation of the full receipt of the valid application file, the State Bank shall issue the License in accordance with applicable provisions. In case of refusal to license, the State Bank shall give a written answer to foreign credit institution, other foreign organization having banking activities, with reasons thereof clearly stated.

Article 6. Payment of fee for issuance of License

1. A commercial bank, a foreign bank’s branch, a representative office which is granted with

a License shall be required to pay the fee for the license issuance to the State Bank (Banking Operation Department) within a period of 15 working days from the date where the License is granted.

2. The fee level for issuance of a license shall be in accordance with provisions of the Ministry of Finance on licensing fee.

Article 7. Registration of business and operation

After being granted with a License, a commercial bank, foreign bank’s branch shall be required to register for the business operation; a representative office shall be required to register its operation in accordance with provisions of applicable laws.

Article 8. Opening of operation

1. A commercial bank, foreign bank’s branch, representative office to be licensed shall be subject to the operation since the opening of operation.

2. In order for the opening of operation, a commercial bank, foreign bank’s branch to be granted with a License shall be subject to the full conditions provided for in paragraph 2 Article 26 of the Law on credit institutions.

3. In order for the opening of operation, representative office shall be subject to the information announcement in accordance with Article 25 of the Law on credit institutions.

4. A commercial bank, foreign bank’s branch which are granted with a License shall, via post service or directly, submit the written notice on the conditions for opening of operation to State Bank’s branch in province, city where the head office is located as provided for in paragraph 2 of this Article in at least 15 days prior the expected date of opening the operation.

5. A commercial bank, foreign bank’s branch, representative office shall be required to open its operation within a period of 12 months since the date of being licensed; the License shall be revoked if the commercial bank, foreign bank’s branch, representative office fails to open its operation.

SECTION 2. CONDITIONS FOR THE ISUANCE OF LICENSE

Article 9. Conditions for the issuance of establishment and operation license of a join- stock commercial bank

1. Conditions as provided for in paragraph 1 Article 20 of the Law on credit institutions.

2. Conditions applicable to a founding shareholder:

a) To take full responsibility of the legal contributed capital source;

b) To make commitment in providing financial support to the joint-stock commercial bank to deal with difficulties in case the joint-stock commercial bank faces with problems in capital or liquidity;

c) Not be a founding shareholder, owner, founding member, strategic shareholder of another credit institution;

d) To have at least 02 founding shareholders who are entities;

dd) Within a period of 05 years since the grant of License, founding shareholders shall be required altogether to hold at least 50% of the charter capital upon the establishment of a joint-stock commercial bank, of which the corporate founding shareholders are required altogether to hold at least 50% of the total number of shares of founding shareholders;

e) Besides conditions as provided for in points a, b, c, dd of this paragraph, an individual founding shareholder shall be required to satisfy following conditions:

(i) To have Vietnamese nationality, to have full civil act capacity in accordance with provisions of applicable law;

(ii) Not be a prohibited subject in accordance with provisions of the Law on Enterprises;

(iii) To have financial capacity to contribute capital to the establishment of a joint-stock commercial bank; not be allowed to use trusted capital, capital borrowed from other organizations, individuals for capital contribution;

(iv) To be the manager of an enterprise whose business is profitable in at least 03 consecutive years prior to the year of applying for the License issuance or to have a university qualification or higher in economics or law profession.

g) Besides conditions as provided for in points a, b, c, dd of this paragraph, a corporate founding shareholder shall be required to satisfy following conditions:

(i) To be established in accordance with Vietnamese law;

(ii) To have sufficient financial capacity for capital contribution to the establishment of a joint-stock commercial bank and to commit not to use trusted fund, mobilized capital, capital borrowed from other organizations, individuals to make capital contribution;

(iii) To fully perform the obligations of taxes, social insurance in accordance with regulations as of the time of applying for License issuance;

(iv) The owner capital must be at least VND 500 billion in 05 consecutive years prior to the year of applying for the License;

(v) The business operation is profitable in 05 consecutive years prior to the year of applying for the License.

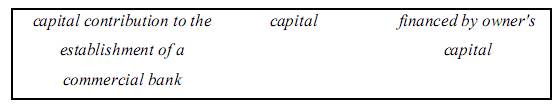

(vi) In case where the enterprise dealing in the business that requires legal capital, there must be a guarantee that the owner capital minus the legal capital equals to committed contributed capital at the minimum basing on the figures in the audited financial report of the year preceding to the year of applying for the License;

(vii) For the case of a state-owned enterprise, it must obtain a written approval to the participation in capital contribution to the establishment of a joint-stock commercial bank as provided for by applicable laws;

(viii) For the case of an organization that is granted with a License for the establishment and operation in banking, securities, insurance field, it is obliged to contribute capital in accordance with provisions of applicable laws;

(ix) For the case of a commercial bank:

- The total assets must be VND 100,000 billion at the minimum, to fully comply with regulations on risk management and making provision in accordance with regulations at the time of applying for the License and as of the issuance of the License;

- Not to break the prudential ratios in banking activities as provided for by the State Bank in 05 consecutive years before to the year of applying for the License and as of the issuance of the License;

- To observe conditions, the limit on purchase, holding of shares of a credit institution as provided for in paragraph 6 Article 103 of the Law on credit institutions;

- To observe the minimum capital adequacy ratio when contributing capital to the establishment of a joint-stock commercial bank.

Article 10. Conditions for the issuance of establishment and operation License to a joint venture bank, 100% foreign owned bank

1. Conditions as provided for in paragraph 2 Article 20 of the Law on credit institutions.

2. Conditions applicable to a founding member, owner as a foreign credit institutions:

a) Not to seriously violate provisions on banking activities and other provisions of applicable laws of its native country within 05 latest consecutive years prior to the year applying for the license till the issuance of the license;

b) To have experience in international operation, is ranked from average and stable upwards by international credit rating organizations, can prove the ability to perform financial commitments and operate normally even when economic situation, condition faces adverse changes;

c) To be profitable in the 05 consecutive years preceding the year of applying for the License and as of the time of obtaining the License;

d) The total assets must be approximately USD 10 billion at the end of the year preceding the year of applying for the license;

dd) To be assessed by a competent agency of the native country in respect of the capital adequacy ratio, other prudential ratios, to fully comply with regulations on risk management and making provision as provide for by the native country in the year before the year of applying for the license till the issuance of license;

e) Not to be the owner, founding member, strategic shareholder of another Vietnamese credit institution.

3. A founding member, which is a Vietnamese commercial bank, of a joint-venture bank shall satisfy conditions as provided for in points a, b, c, g paragraph 2 Article 9 of this Circular.

4. Within a period of 05 years since the issuance of the License, founding members shall be required altogether to hold 100% of the charter capital of a joint-venture bank, 100% foreign owned bank.

Article 11. Conditions for issuance of establishment license to a foreign bank’s branch

1. Conditions provided for in paragraph 3 Article 20 of the Law on Credit institutions.

2. Conditions applicable to a parent bank:

a) To fully satisfy conditions as provided for at points a, b, c, dd paragraph 2 Article 10 of this Circular;

b) Total assets of parent bank as of the year consecutively preceding the year of applying for the license are at least equal to USD 20 billion.

Article 12. Conditions for issuance of establishment license to a representative office

1. Conditions as provided for in paragraph 4 Article 20 of the Law on credit institutions.

2. Chief of the representative office shall have full civil act capacity in accordance with provisions of applicable laws of Vietnam, not be a subject prohibited from business management as provided for in the Law on enterprises, not concurrently assume the position of the General Director (Director) of a foreign bank’s branch in Vietnam.

SECTION 3. APPLICATION FILE FOR A LICENSE

Article 13. Principles of the application file preparation

1. Documents in the application file for a license of establishment and operation of a commercial bank, application file for a license of establishment of a foreign bank’s branch must be signed by the chief of the Preparatory Board, except otherwise as provided for in this Circular. Documents signed by the Head of the Preparatory Board must have the title “Preparatory Board for establishment and the name of commercial bank, foreign bank’s branch”.

An application file for the license of establishment of a representative office must be signed by the legal representative of the foreign credit institution, other organizations having banking activities, except otherwise as provided for in this Circular.

2. An application file for the issuance of the license for establishment and operation of a joint-stock commercial bank shall be made in one original set of documents in Vietnamese.

3. An application file for the issuance of a license for establishment and operation of a joint- venture commercial bank, 100% foreign owned bank, application file for the issuance of a license for the establishment of a foreign bank’s branch, application file for issuance of a license for establishment of a representative are made in 02 original sets of documents including one in Vietnamese and one in English, in which:

a) The set of documents in English must be legalized in accordance with provisions of applicable laws, except for following documents:

(i) Documents of competent agency of the native country shall be directly sent to the State Bank;

(ii) Financial statements shall be prepared in English.

b) Documents translated from English into Vietnamese must be certified with signature of translator in accordance with regulations on certification of Vietnamese applicable laws;

c) Translated version of financial statements must be supported by a confirmation of the organization, individual who are permitted to provide translation services in accordance with provisions of applicable laws;

d) Original Vietnamese documents (or copied from original Vietnamese documents) that are prepared in Vietnam shall not need translating into English.

4. Copies of documents, qualifications shall be certified by competent authorities in accordance with applicable laws.

5. Each set of documents must contain a list of documents.

Article 14. Application file for the establishment and operation license of a commercial bank

1. The Application for the establishment and operation license of a commercial bank shall be signed by founding shareholders, owners, founding members in line with the form in Appendix 02a of this Circular.

2. A draft Charter

3. A Project on the establishment of a commercial bank that includes following contents at the minimum:

a) The necessity for the establishment of a commercial bank;

b) Name of the commercial bank, name of the province/city under the central Government’s management where the head office is expected to locate, duration of operation, charter capital upon establishment, operation contents;

c) Financial capacity of shareholders, members who contribute capital to the establishment;

d) Expected organization structure and operation network of the bank within 03 beginning years;

dd) Expected list of personnel detailing the professional level, working experience in finance, banking and risk management that are qualifiable for each position, each title:

(i) Chairman, member, independent member of the Board of Directors, Board of Members; Head of Committees under the management of the Board of Directors, Board of Members;

(ii) Chief, member, member in charge of the Controllers’ Committee;

(iii) General Director (Director), Deputy General Director (Deputy Director), chief accountant and head of units under the direct management in the organizational structure.

e) Risk management policy: identification, measurement, prevention, management, and supervision of credit risk, operational risk, market risk, liquidity risk and other types of risk arising in the process of operating;

g) Information technology:

(i) The expected financial investment in information technology;

(ii) The information technology system must satisfy the requirements for the management administration, risk management of a commercial bank and regulations of the State Bank;

(iii) The applicability of information technology, which clearly states: time for investment in information technology; form of technology expected to be applied; staff and ability of staff in implementation of information technology; ensuring the information system shall be able to integrate and connect with the management system of the State Bank in order to provide information upon request by the State Bank;

(iv) Profile on the information technology infrastructure to serve the operation of the commercial bank;

(v) Safety and security solutions corresponding to the type of service expected to develop;

(vi) Identification, measurement, and implementation of the risk management plan for the technology expected to be applied in the operation of the commercial bank;

(vii) Expected assignment of reporting responsibility and supervision of operation of the information technology system.

h) The viability and ability to develop of the bank in the market:

(i) An analysis and assessment on the banking market, which clearly states the real situation, challenges, and prospects;

(ii) The ability to participate in and to compete in banking market, which proves the advantage of the bank when joining the market;

(iii) The strategy for development, expansion of the operation network and operation content of the bank, types of customers and the number of customers, among which, to analyze in details the satisfaction of the conditions applicable to conditional operations.

i) The internal control and audit system:

(i) Operation principles of the internal control system;

(ii) A draft of fundamental internal regulations on the organization and operation of the bank, which at least includes internal regulations as provided for in paragraph 2 Article 93 of the Law on credit institutions and following regulations:

- Regulations on the organization and operation of the Board of Directors, Board of

Members, Controllers’ Committee, manager;

- Regulations on the organization and operation of the head office and other units under the direct management.

(iii) Contents and operation procedure of internal audit.

k) The expected business plan for 03 beginning years, which includes at least following contents: Analysis of the market, strategy, target and action plan, annual financial statements (balance sheet, income statement, cash flow statement, capital adequacy ratio, ratios on operation efficiency and explanation of ability to perform the annual financial ratios).

4. Documents evidencing the capability of the expected management, control system:

a) Curriculum of vitae in line with the form as provided for in Appendix 03 of this Circular, criminal record (or similar document) in accordance with applicable laws;

b) Certified copies of the qualifications evidencing the professional level;

c) Other documents evidencing the satisfaction of conditions, standards as provided for in the Law on credit institutions and relevant provisions of applicable laws;

d) For the case where the person expected to be elected as a member of the Board of Directors, Board of Members, Controllers’ Committee, General Director (Director) does not have Vietnamese nationality, in addition to above-stated documents, there must be a document committing to fully satisfy the conditions for residing and working in Vietnam.

5. Meeting minutes of the founding shareholders, founding members or documents of owner on selection of the Preparatory Board, chief of the Preparatory Board, approval to the draft charter, the plan on establishment of a bank and expected list of managers, controllers, executive officers.

Article 15. Application file for the establishment and operation license of a joint-stock commercial bank

1. Components of the application file as provided for in Article 4 of this Circular;

2. List of founding shareholders and the expected list of capital contribution shareholders in accordance with the form provided for in Appendix 04 of this Circular.

3. Profile of shareholders who contribute capital for establishment:

a) For individuals:

(i) An application for purchase of shares applicable to individuals in accordance with the form as provided for in Appendix 05a of this Circular;

(ii) A declaration of related people in accordance with the form as provided for in Appendix 06 of this Circular;

(iii) Besides the above components, founding shareholders are required to submit following documents:

- A Curriculum of vitae in accordance with the form as provided for in Appendix 03 of this

Circular, a criminal record (or similar document) in compliance with provisions of applicable laws;

- Financial statements of 03 consecutive years prior to the year of applying for the license of the enterprise managed by the founding shareholders or the copy of university qualification or higher in economics or law profession;

- A written commitment of each shareholder on providing financial support to the bank to solve difficulty in case where the bank faces difficulties concerning capital or liquidity;

- A list of assets which have the value of 100 million VND or above, debts and related documentations of individuals in accordance with the form as provided for in Appendix 07 of this Circular;

b) For entities:

(i) An application for purchase of shares in accordance with the form as provided for in Appendix 05b of this Circular;

(ii) A declaration of related people in accordance with the form as provided for in Appendix 06 of this Circular;

(iii) Establishment license or business registration certification or similar document;

(iv) A letter of authorization of representative for the capital contributed at the bank in conformity with provisions of applicable laws;

(v) Charter on organization and operation;

(vi) Identity card or passport of the legal representative and the representative for the contributed capital of the entity at the bank;

(vii) A written approval issued by the competent agency to the capital contribution of the entity;

(viii) Financial statements of the year preceding the year of applying for the License and the latest financial statements as from the submission of application for the License, which were independently audited by an audit firm that is a subject in the list of audit firms as announced by the Ministry of Finance to be eligible for auditing enterprises and reports without the exclusive opinion of the audit firm;

(ix) Besides the contents stated above, a founding shareholder shall be required to submit following documents:

- A Curriculum vitae of the representative for the contributed capital in accordance with the form as provided for in Appendix 03 of this Circular, a criminal record in compliance with provisions of applicable laws;

- A written commitment on providing financial support in case where the bank faces with difficulty in capital or liquidity;

- Financial statements of 05 consecutive years prior to the year of applying for the License which were independently audited by an audit firm that is a subject in the list of audit firms as announced by the Ministry of Finance to be eligible for auditing enterprises and these reports have no exclusive opinion of the audit firm;

(x) A table of determination of financial capacity in contribution of capital to the establishment of a joint-stock commercial bank of an entity which is not a credit institution in accordance with the form as provided for in Appendix 08 of this Circular;

(xi) Documents of the tax authority, social insurance agency confirming the full performance of the tax and social insurance obligations by the entity.

4. Upon receipt of the written approval in principles, the Preparatory Board shall supplement following documents:

a) The charter on the organization and operation of the joint-stock commercial bank which has been approved by the General Shareholders’ Meeting;

b) Minutes of the first General Shareholders’ Meeting;

c) Minutes of the Board of Directors’ Meeting on approving the election of the Chairman title; Minutes of meeting of the Controllers’ Committee on the election of the Chief of Controllers’ Committee and members in charge of the Controllers’ Committee;

d) Decision of the Board of Directors on the election of the General Director (Director), chief accountant;

dd) List of shareholders who contribute capital for establishment in accordance with the the form as provided for in Appendix 04 of this Circular;

e) Documents of a commercial bank where the Preparatory Board maintain an account for the purpose of confirming the amount of capital contributed by capital contributing shareholders;

g) Documents proving the ownership or legal right to use the head office of the joint-stock commercial bank;

h) Internal regulations on the organization and operation of a joint-stock commercial bank as provided for in point I paragraph 3 Article 14 of this Circular, which have been approved by the General Shareholders’ Meeting, Board of Directors;

i) Report of founding members who are domestic commercial bank on the satisfaction of the conditions provided for in point g paragraph 2 Article 9 of this Circular since the submission of the application file for a License till the supplement submission of the missing documents.

Article 16. Application file for the establishment and operation license of a joint- venture bank, 100% foreign owned bank

1. Components of the application file as provided for in Article 14 of this Circular;

2. Profile of the owner, founding members who are foreign credit institutions:

a) Audited financial statements of 05 consecutive years prior to the year of applying for the license without exclusive opinions from the audit firm;

b) A copy of the establishment and operation license or similar document;

c) Documents of the competent agency of the native country providing information on the foreign credit institution as follows:

(i) Authorized operation contents within the native country at the time of submitting the application file for a License;

(ii) The compliance with laws on banking activities and other legal regulations within 05 consecutive years preceding the year of applying for the License and up to the time of applying for the license;

(iii) Capital adequacy ratio and other prudential ratios in accordance with provisions of the native country in the year prior to the year of applying for a License up to the time of applying for the license;

(iv) The compliance with regulations on risk management and provision in the year prior to the year applying for the License till the time applying for the license.

d) A document or materials of an international credit rating institution which rates the creditworthiness of the foreign credit institution within 06 months before the submission of the application file;

dd) Charter on the organization and operation of the foreign credit institution;

e) A report on the process of establishment, operation and development orientation of the foreign credit institution up to the time of applying for the license;

g) Decision on the appointment of the representative for the capital contributed at the join venture bank, 100% foreign owned bank of the foreign credit institution in accordance with provisions of applicable laws enclosing with a passport of the representative of contributed capital.

3. Profile of founding members of a joint venture bank which is a Vietnamese commercial bank, including documents, materials as provided for in point b paragraph 3 Article 15 of this Circular, excluding the application for purchase of shares.

4. The joint-venture contract containing major contents in accordance with provisions of applicable laws; contract and agreement of capital contribution between founding members for the case of a 100% foreign owned bank;

5. A written document issued by the competent agency of the native country ensuring the ability to supervise the entire activities of the foreign bank (including activities of the joint venture bank, 100% foreign owned bank in Vietnam) on the basis of consolidation in accordance with international rules.

6. Written commitment of the owner, founding members on:

a) Being ready to give support in finance, technology, management, operation to the joint venture bank, 100% foreign owned bank;

b) Ensuring to maintain the real value of the charter capital of the joint venture bank, 100% foreign owned bank not to be lower than the legal capital and to fully satisfy provisions on prudential operation as required by the State Bank.

7. Upon receipt of the written approval in principles, the Preparatory Board shall supplement following documents:

a) A Charter on the organization and operation of the bank which has been approved by the Board of Members;

b) A document of a commercial bank where the Preparatory Board maintains a capital contribution account to verify the amount of capital contributed by founding members;

c) Documentations for the ownership or legal right to use the head office of the commercial bank;

d) Internal regulations on the organization and operation of joint-venture bank, 100% foreign owned bank as provided for in point i paragraph 3 Article 14 of this Circular, which have been approved by the Board of Members;

dd) A report of founding members who are domestic commercial banks on the satisfaction of conditions as prescribed in paragraph 2 Article 9 of this Circular from the time of submission of application file to the supplement of documents;

e) A document of the competent agency of the native country giving assessment on the owner, founding members who are foreign credit institutions, the satisfaction of conditions as prescribed in point a, point c, point dd paragraph 2 Article 10 of this Circular from the time of submission of application file to the supplement of documents;

g) Besides the components as provided for in points a, b, c, d, dd, e of this paragraph, the Preparatory Board for establishing a 100% foreign owned bank that is limited liability company with one member shall be required to submit following documents:

(i) A decision of the owner on the assignment of Chairman of the Board of Members, members of the Board of Members, members of Controllers’ Committee, General Director (Director), Deputy General Director (Deputy director), chief accountant;

(ii) Meeting minutes of the Controllers’ Committee on the election of the Chief of Controllers’ Committee and members of responsible Controllers’ Committee.

h) A part from the components provided for in point a, b, c, c, dd, e paragraph 7 of this Article, the Preparatory Board for establishing a joint-venture bank, 100% foreign owned bank that is a limited liability company with two or more members, shall be required to supplement following documents:

(i) Minutes of the first meeting of capital contributors;

(ii) Minutes of the Board of Members’ meeting on approval to the election of the Chairman of the Board of Members; meeting minutes of Controllers’ Committee on the election of the Chief of Controllers’ Committee and members in charge of the Controllers’ Committee;

(iii) A Decision of the Board of Members as to the election of the General Director (Director), Deputy General Director (Deputy Director), chief accountant.

Article 17. Application file for an establishment license of a foreign bank’s branch

1. An Application for the establishment license of a foreign bank’s branch signed by the legal representative of foreign bank in accordance with the form as provided for in Appendix 02b of this Circular.

2. A project on the establishment of the foreign bank’s branch, including following basic contents:

a) The necessity for the establishment of a foreign bank’s branch;

b) Name of that foreign bank’s branch, name of province/city under central Government’s management where the branch’s head office is expected to locate, operation contents, duration of operation, appropriated capital upon establishment;

c) Organizational structure, expected list of personnel of the foreign bank’s branch in conformity with provisions in Article 89 of the Law on credit institutions; the expected list of personnel must describe in details the professional level, working experience, risk management capacity qualifiable for each position;

d) Risk management policy: Identify, measure, prevent, manage, and control credit risk, operational risk, market risk, liquidity risk and other types of risk arising in the operation;

dd) Information technology:

(i) Plan for financial investment in information technology;

(ii) The information technology must satisfy the requirements for administration, risk management of foreign bank’s branch and regulations of the State Bank;

(iii) Applicability of information technology, which clearly states: Time for the investment in technology; type of technology to be implemented; plan for the staff and ability of the staff in implementation of information technology; undertaking to ensure that the information technology system can integrate and connect with the management system of the State Bank in order to provide information satisfying the management requirement of the State Bank;

(iv) Profile on the information technology infrastructure to serve the operation of the foreign bank’s branch;

(v) Safety and security solutions corresponding to the type of service expected to develop;

(vi) Identification, measurement, and implementation of the risk management plan for the technology expected to be applied in the operation of the foreign bank’s branch;

(vii) Expected assignment of reporting responsibility and supervision of operation of the information technology system.

e) The viability and ability to develop of the foreign bank’s branch in the market:

(i) An analysis and assessment on the banking market, which clearly states the real situation, challenges, and prospects;

(ii) The ability to participate in and to compete in banking market, which proves the advantage of the foreign bank’s branch when joining the market;

(iii) The strategy for development, expansion of the operation network and operation content of the bank, types of customers and the number of customers, among which, to analyze in details the satisfaction of the conditions applicable to conditional operations.

g) The internal control and audit system:

(i) Operation principles of the internal control system;

(ii) A draft of fundamental internal regulations on the organization and operation of the bank, which at least includes internal regulations as provided for in paragraph 2 Article 93 of the Law on credit institutions and regulations on the organization and operation of a foreign bank’s branch;

(iii) Operation procedure of internal audit.

h) The expected business plan for 03 beginning years, which includes at least following contents: Analysis of the market, strategy, target and action plan, annual financial statements (balance sheet, profit and loss statement, cash flow statement, minimum capital adequacy ratio, ratios on operation efficiency and explanation of ability to implement the annual financial ratios).

3. Charter of the parent bank.

4. Curriculum vitae of the General Director (Director) of the expected foreign bank’s branch in accordance with the form as provided for in Appendix 03 of this Circular with confirmation of the parent bank, a criminal record (or similar document) in compliance with provisions of applicable laws; qualifications, certifications evidencing the ability, professional level and documents evidencing the satisfaction of conditions, standards as provided for in the Law on credit institutions and relevant regulations of applicable laws of the expected General Director (Director).

5. A copy of the establishment and operation license or similar document which were granted to parent bank by a competent agency of the native country.

6. Documents issued by the competent agency of the native country providing information on the parent bank as follows:

a) Authorized operations within the native country at the time of applying for a license;

b) The compliance with laws on banking activities and other provisions of applicable laws within 05 consecutive years preceding the year of applying for a license as of the submission of application file for the License;

c) Capital adequacy ratio and other prudential ratios in accordance with provisions of the native country in the year prior to the year of applying for the License up to the submission of application file for the License;

d) The observance of regulations on risk management and making provisions in the year preceding the year of applying for a License up to the submission of the application file for the License.

7. Documents of the competent agency of the native country ensuring the supervision over the entire activities of the parent bank (including the activities of foreign bank’s branch in Vietnam) on the basis of consolidation in accordance with international practices;

8. Audited financial statements of 05 consecutive years preceding the year of applying for a License;

9. A document or materials of an international credit rating institution which rates the creditworthiness of the parent bank within 06 months before the submission of the application file;

10. A document issued by the parent bank undertaking to take full responsibility of all obligations and commitments of the branch in Vietnam; ensuring to maintain the real value of the charter capital of foreign bank’s branch not to be lower than the legal capital and to fully satisfy requirements on prudential operation in accordance with provisions of the State Bank;

11. A report on the process of establishment, operation and development orientation of the foreign credit institution up to the time of applying for the license;

12. Documents of the parent bank that are signed by the legal representative on the appointment of the Preparatory Board and the authorization to the head of the Preparatory Board.

13. Upon receipt of the written approval in principles, the Preparatory Board shall supplement following documents:

a) A document on the appointment of the General Director (Director) of the foreign bank’s branch, which is signed by the legal representative of the parent bank;

b) Documentations for the legal use right to the office of the foreign bank’s branch;

c) Internal regulations on the organization and operation of foreign bank’s branch as provided for in point g paragraph 2 of this Article, which have been approved by the parent bank;

d) A document of the competent agency of the native country ensuring that parent bank has fully satisfied the conditions as provided for in point a, c, dd paragraph 2 Article 10, point b paragraph 2 Article 11 of this Circular from the time of submission of application file to the supplement of documents.

Article 18. Application file for an establishment License of a representative office

1. An application for an establishment License of a representative office, which is signed by the legal representative of the foreign credit institution, other foreign organization having banking activity in accordance with the form as provided for in Appendix 02c of this Circular.

2. A copy of the operation license or similar document granted by the competent agency of the native country to the foreign credit institution, other foreign organization having banking activities.

3. Written documents of the competent agency of the native country providing information on the compliance with applicable laws by the foreign credit institution, other foreign organization having banking activities.

4. Written documents of the competent agency of the native country allowing the foreign credit institution, other organization having banking activities to establish a representative office in Vietnam; in case where the native country’s laws do not require such permission documents, there must be evidence for this.

5. A report on the process of establishment, operation of the credit institution, other foreign organization having banking activities as of the submission of the application file for a License and the development orientation of the foreign credit institutions, other foreign organization having banking activities in Vietnam.

6. Audited financial statements of the year preceding the year of applying for a License of the foreign credit institution, other organization having banking activities.

7. Curriculum vitae of the expected Chief of the representative office in accordance with the form as prescribed in Appendix 03 of this Circular with confirmation of the foreign credit institution, other foreign organization having banking activities, a criminal record (or similar document) in accordance with provisions of applicable law; qualifications, certificates demonstrating the ability, professional level of the expected Chief of the representative office in Vietnam.

8. Documentations for the legal use right of the representative office.

Chapter 3

PROVISIONS ON THE ORGANIZATION AND OPERATION SECTION 1. GENERAL PROVISIONS

Article 19. Application principles

Commercial banks, foreign bank’s branches, representative offices shall organize and operate in accordance with provisions of the Law on credit institutions, this Circular and relevant provisions of applicable laws.

Article 20. Language of transaction

Official transaction documents of the commercial banks, foreign bank’s branches, representative offices shall use Vietnamese language or use Vietnamese and popular foreign languages simultaneously.

Article 21. Operation contents

1. A commercial bank, foreign bank’s branch shall not be permitted to conduct any business activity other than banking activities, other business activities as stated in the License granted by the State Bank to each commercial bank, foreign bank’s branch.

2. Banking activities, other business activities of a commercial bank, foreign bank’s branch as provided for in the Law on credit institutions, in compliance with the guidelines of the State bank.

3. Operation contents of a 100% foreign owned bank shall be the operations which the owner, the foreign bank that holds 50% of the charter capital of such 100% foreign owned bank is authorized to perform at the country where the head office of the owner, the foreign bank is located.

4. Operation contents of a foreign bank’s branch shall be the operations which parent bank is authorized to perform at the country where the head office of parent bank locates.

5. A representative office shall be authorize to conduct the operations in accordance with provisions in Article 125 of Law on credit institutions. The Chief of a representative office shall not be permitted to sign any business contract, investment contract of the foreign credit institution, other foreign organization having banking activities with Vietnamese individuals, organizations.

Article 22. Period of operation, change of period of operation

1. Operation period of a commercial bank, foreign bank’s branch as prescribed in the License shall be no more than 99 years; operation period of a representative office shall be no more than 5 years.

2. Orders, procedures and application file for the change of operation period shall be in accordance with the guidelines of the State Bank.

SECTION 2. ORGANIZATIONAL AND MANAGEMENT STRUCTURE

Article 23. Name, head office of a commercial bank, foreign bank’s branch, representative office

1. Name of commercial bank, foreign bank’s branch, representative office shall make sure:

a) To comply with provisions of the Law on enterprises and of applicable laws;

b) To be arranged according to following forms:

(i) Joint stock commercial bank and its specific name;

(ii) Joint venture bank and its specific name;

(iii) Limited liability bank with one member and name of the foreign bank and Vietnamese bank;

(iv) Limited liability bank and specific name for a 100% foreign owned bank with two or more members;

(v) Bank and name of the foreign bank – branch in province, city under the central Government's management where the branch is located. In the event where the foreign bank establishes two branches or more in the same province, city, it shall be required to supplement respective names of each branch to differentiate these branches;

(vi) Representative office and name of he foreign credit institution, other foreign organization having banking activities – name of province, city under central Government's management where the head office is located.

2. Head office of a commercial bank shall be required to satisfy the regulations applicable to the head office of an enterprise in accordance with provisions of the Law on enterprises and following conditions:

a) To be the working place of the Board of Directors, Board of Members, Executive Committee, to be stated in the License and Business Registration Certificate in accordance with applicable laws;

b) To be located within the territory of Vietnam, at a specified address with room number (if any), floor number, name of the building (applicable to office buildings for lease), house number, street (alley) name or name of the commune, ward, town, district, city under the provincial management, province, city under central Government's management. In case where the commercial bank registers to locate its head office at more than one house number or buildings with different addresses, such house numbers and buildings must be adjacent to each other;

c) To ensure the asset safety and the conformity with the requirements of banking activities;

d) To have an information management system with online connection among the branches and business units of the bank, satisfying the requirements on management and risk management of a commercial bank and the management requirements of the State Bank.

3. Head office of a foreign bank’s branch must satisfy the provisions on an enterprise’s head office in accordance with provisions of the Law on enterprises and following conditions:

a) To be the working place of the General Director (Director) and Executive Committee, the place where transaction with customers takes place, to be stated in the License and Business Registration Certificate in accordance with applicable laws;

b) To be located within the territory of Vietnam, at a specified address with room number (if any), floor number, name of building (applicable to office buildings for lease), house number, street (alley) name or name of the commune, ward, town, district, city under the provincial management, province, city under central Government's management;

c) To ensure the asset safety and the conformity with the requirements of banking activities;

d) To have an information management system with online connection among the branches and business units of the bank, satisfying the requirements on management and risk management of a commercial bank and the management requirements of the State Bank.

4. Location of a representative office must be within the territory of Vietnam, at a specified address with room number (if any), floor number, name of building (applicable to office buildings for lease), house number, street (alley) name or name of commune, ward, district, town, city under the provincial management, province, city under central management.

Article 24. The organizational and management structure of a commercial bank, foreign bank’s branch

1. The organizational and management structure of a commercial bank:

a) A commercial bank shall be required to have an organizational structure, administration and management system, internal audit, risk management system and an internal control system which is suitable with the type of business in accordance with provisions of the Law on credit institutions and other provisions of applicable laws.

b) The organizational and management structure of a joint-stock commercial bank shall comprise: the General Shareholders' Meeting, Board of Directors, Controllers’ Committee, General Director (Director).

c) The organizational and management structure of a 100% state owned commercial bank, joint venture bank, 100% foreign owned bank shall comprise: the Board of Members, Controllers’ Committee, General Director (Director).

2. The organizational and management structure of a foreign bank’s branch:

The organizational, administrative and executive structure of a foreign bank's branch in Vietnam shall be decided by the parent bank in compliance with applicable laws of the country where its head office is located and provisions of the Law on credit institutions on the organizational, administrative and management structure, internal audit system and be subject to the written approval of the State Bank before implementation.

Article 25. The organizational structure of Risk Management Committee and Personnel Committee

1. The Board of Directors, Board of Members shall be responsible for establishing a Risk Management Committee, a Personnel Committee and provide for the judgement mechanism to the proposals of these two committees.

2. A committee shall have at least three members, including a Head who is a member of the Board of Directors, Board of Members and other members who are decided, appointed and dismissed by the Board of Directors, Board of Members in accordance with the Charter of the commercial bank. A member of the Board of Directors, Board of Members shall only be authorized to undertake the position of the Head of one committee. For a joint stock commercial bank, the Risk Management Committee shall have at least one member who is an independent member of the Board of Directors.

Article 26. Regulation on working of the Risk Management Committee and Personnel Committee

1. Upon establishment of the Committees, the Board of Directors, Board of Members shall be responsible for the promulgation of working regulations as well as the functions, duties of each committee. Immediately after the promulgation, the commercial bank shall send such internal regulations to the State Bank (Banking Inspection and Supervision Department) for report.

2. Working regulations and functions, duties of the committees shall at least contain following contents:

a) Working rules:

(i) Number of members of the Committee and responsibilities of each member;

(ii) Regular meeting sessions of the Committee;

(iii) Irregular meeting sessions of the Committee;

(iv) Decision making of the Committee;

b) Duties, functions of the committees:

(i) Risk Management Committee:

- To give advise to the Board of Directors, Board of Members in the promulgation of the procedures, policies within its competence in regard of risk management in banking activities in accordance with provisions of applicable laws and the Charter of the Bank.

- To analyze, give warnings on prudential level of the bank against the threats, possible risks and preventive measures for such risks in short-term as well as in long-term.

- To consider, assess the conformity and the effect of current procedures, risk management policies of the bank in order to give recommendations, proposals to the Board of Directors, Board of Members on requirements for amendment of the current procedures, policies and operating strategies.

- To give advisory to the Board of Directors, Board of Members in giving approval to the investments, relevant transactions, risk management policy and risk processing options within the functions, obligations assigned by the Board of Directors, Board of Members.

(ii) Personnel Committee:

- To give advise to the Board of Directors, Board of Members on the scale and structure of the Board of Directors, Board of Members, on the manager in correspondence with the operation scale and development strategy of the bank.

- To give advise to the Board of Directors, Board of Members in dealing with personnel issues arising in the process of election, appointment, dismissal, relief of members of the Board of Directors, Board of Members, Controllers’ Committee and Managers of the bank in accordance with provisions of applicable laws and Charter of the bank.

- To research, give advise to the Board of Directors, Board of Members in issuance of internal regulations of the bank within the competence of the Board of Directors, Board of Members as to the regime on wages, remuneration, bonus, regulation on personnel recruitment, training and other treatment policies applicable to managers, staffs of the bank.

Article 27. Registration of the Charter, amendment and supplement of the Charter

1. Charter of a commercial bank shall contain major contents as provided for in paragraph 1 Article 31 of the Law on credit institutions and must not be contrary to the Law on credit institutions, other provisions of applicable laws. The commercial bank shall take full responsibility to the law for the contents of the Charter, for the amendment and supplement of the charter.

2. Charter and any amendment, supplement thereof of a commercial bank shall be effective after having been approved and signed off by the General Shareholders' Meeting, Board of Members.

3. In issuing the License, the State Bank shall confirm the charter registration of the commercial bank. For the case of amendment, supplement of the Charter, the commercial bank shall register such amendment, supplement of the commercial bank's Charter with the State Bank (Banking Inspection and Supervision Department) within a period of 15 days since the date of approval.

4. The commercial bank shall send 01 set of application file, via post service or directly, to the State Bank (Bank Inspection and Supervision Department) requesting for the confirmation of the amendment, supplement of the Charter. The application file shall include:

a) An application of the commercial bank, which clearly states the reasons, the necessity for changes of the Charter's contents (attached with the detailed contents of the current Charter, contents to be amended, supplemented and legal basis for the amendment, supplement).

b) Resolution of the General Shareholders' Meeting, resolution of the Board of Members on approving the amendment, supplement of the Charter, which shall clearly state the amended and supplemented contents.

c) The Charter which has already included the amended, supplemented contents of the Charter of the commercial bank.

d) Other documents as required by the State Bank to clarify the issues to be supplemented (if any).

5. The State Bank (Banking Inspection and Supervision Department) shall be responsible for confirming the amendment and supplement of the Charter of the commercial bank within 07 days since the full receipt of a valid application file.

6. In case where contents of the Charter, the amendment, supplement of the Charter are not conformable to provisions of laws, the State Bank (Banking Inspection and Supervision Department) shall give a written request to the commercial bank to amend and supplement accordingly.

Article 28. Internal regulations

1. A commercial bank shall draw up its internal regulations in line with provisions in Article 93 of the Law on credit institutions. Internal regulations and any amendment, supplement thereof shall be issued by the Board of Directors, Board of Members.

2. A foreign bank’s branch shall draw up its internal regulations as provided for in Article 93 of the Law on credit institutions or use the internal regulations issued by the parent bank in accordance with the guidelines of the State Bank.

3. Immediately after the issuance or after the use of internal regulations issued by the parent bank, the commercial bank, foreign bank’s branch shall send their internal regulations and any amendment, supplement thereof to the State Bank (Banking Inspection and Supervision Department) for the purpose of inspection and supervision.

SECTION 3. CHARTER CAPITAL, APPROPRIATED CAPITAL

Article 29. Charter capital, appropriated capital

1. Charter capital of a commercial bank:

a) Charter capital of a commercial bank shall be the real capital appropriated by the owner or the real capital contributed by shareholders, capital contributors and to be stated in the Bank’s Charter.

b) Charter capital of a bank may be increased from following sources:

(i) Reserved fund for charter capital supplement; Fund of share capital surplus; retained earnings and other funds in accordance with provisions of applicable laws;

(ii) Public offer of stocks, private offer of stocks;

(iii) Conversion of convertible bonds to common stocks;

(iv) Capital additionally appropriated by the owner, capital contributing members;

(v) Other sources in accordance with provisions of applicable laws.

2. Appropriated capital of a foreign bank’s branch:

a) Appropriated capital of a foreign bank’s branch shall be the real capital granted by parent bank to its foreign bank’s branch and to be recorded in the License.

b) Appropriated capital of a foreign bank’s branch may be increased from following sources:

(i) Retained earnings;

(ii) Extra capital appropriated by the parent bank;

(iii) Other sources of capital in accordance with applicable laws.

Article 30. Repurchase of share upon request by shareholders or under the decision of the joint-stock commercial bank

1. Share repurchase by shareholders of a joint-stock commercial bank must be in compliance with provisions of applicable laws.

2. A joint-stock commercial bank shall only be authorized to repurchase shares from its shareholders if after the full payment for the repurchased shares, the prudential ratios are still ensured in banking activities, the real value of the charter capital is not lower than the legal capital; in case where the repurchase of shares results in the decrease of charter capital for the joint stock commercial bank, there must be a written approval from the State Bank.

3. Orders, procedures and application file for repurchase of shares resulting in decrease of charter capital of a joint stock commercial bank shall be implemented in accordance with the guidelines of the State Bank.

Article 31. Transfer of contributed capital, repurchase of contributed capital of a joint venture bank, 100% foreign owned bank

1. The transfer of the contributed capital, repurchase of contributed capital shall be in accordance with provisions of the Law on enterprises.

2. Within a period of 05 years since the issuance of the License, a founding member shall only be authorized to transfer the contributed capital to another founding member. Within a period of 03 years since the capital contribution to the joint venture bank, 100% foreign owned bank, capital contributors shall only be authorized to transfer their contributed capital to other capital contributors.

3. The transfer of contributed capital to an organization which is not a capital contributor to the joint venture bank, 100% foreign owned bank, shall be required to ensure the ratio of capital contribution in accordance with provisions in paragraph 4, paragraph 5 Article 2 of this Circular and following conditions:

a) For a 100% foreign owned bank:

(i) New partners shall be subject to the conditions as provided for in points b, c, d, dd, e paragraph 2 Article 20 of the Law on credit institutions and paragraph 2 Article 10 of this Circular;

(ii) If the assignment results in the fact that another foreign bank holds more than 50% of the charter capital of 100% foreign owned bank, the new foreign bank shall fully satisfy conditions as prescribed in paragraph 3 Article 21 of this Circular.

b) For a joint venture bank:

(i) New partner as a foreign bank shall be subject to conditions as provided for in points b, c,

d, dd, e paragraph 2 Article 20 of the Law on credit institutions and paragraph 2 Article 10 of this Circular;

(ii) New partner as a Vietnamese commercial bank shall be subject to conditions as provided for in points a, b, c, g paragraph 2 Article 9 of this Circular.

4. Conditions for repurchase of the contributed capital:

a) Application for repurchase of the contributed capital, conditions for payment and disposal of the contributed capital shall be implemented in accordance with provisions on repurchase of contributed capital of the Law on enterprises;

b) After making full payment for the repurchased capital, the bank still ensures the full payment of all debts and other asset obligations, satisfaction of the prudential ratios in banking activities, the real value of the charter capital shall not be lower than the legal capital;

c) To fully comply with provisions on risk management and provisions in accordance with provisions at the time of applying for approval of the State Bank to the repurchased capital;

d) Unceasingly profitable business in 05 consecutive years preceding the year of applying for the contributed capital acquisition and having no accumulated loss;

dd) Not to be imposed with any administrative punishment measure by the state bank in the monetary area and banking activity in 05 years preceding the year of applying for repurchase of contributed capital and up to the time of applying for the approval of the State Bank to the acquisition of contributed capital of contributing members.

5. The assignment of contributed capital, repurchase of contributed capital shall be subject to a written approval of the State Bank before performance. The order, procedure and application file for assignment of contributed capital, repurchased of contributed capital shall be performed in accordance with the guidelines of the State Bank.

Chapter 4

RESPONSIBILITIES OF RELATED ORGANIZATIONS, INDIVIDUALS

Article 32. Responsibilities of the Preparatory Board

1. To prepare and send the application file in accordance with provisions of this Circular.

2. Upon receipt of the written approval in principles, the Preparatory Board shall be responsible for:

a) Organizing the first General Shareholders’ Meeting, the first meeting of capital contributors for ratifying contents as stipulated in paragraphs 12, 15 Article 2 of this Circular;

b) Notifying capital contributing shareholders, owners, capital contributed members, the parent bank to transfer money to the account opened by the Preparatory Board at a Vietnamese commercial bank.

3. Instructing the capital contributing shareholders in performing the capital contribution and appraise the application file of capital contributing shareholders.

4. The completion, accuracy of the application file submitted to the State Bank.

5. Notifying the capital contributing shareholders, founding members, the parent bank of the reasons for not being granted with the License where the State Bank refuses to issue.

6. Presenting in front of the Appraisement Board on the full satisfaction of conditions for being granted with a License upon request by the State Bank.

7. Defending contents in the Project on establishment of the commercial bank, foreign bank’s branch in front of the Appraisement Board.

Article 33. Responsibility of the Preparatory Board's Chief

1. To convene the first General shareholders’ meeting, the first meeting for founding members in accordance with provisions of applicable laws.

2. To sign the documents within the competence to apply for the establishment of the bank until the issuance of License by the State Bank.

Article 34. Responsibilities of organizations, individuals relating to the establishment, organization and operation of a commercial bank, foreign bank’s branch and representative office

Organizations, individuals in connection with the establishment, organization and operation of a commercial bank, foreign bank’s branch, and a representative office shall be subject to the full, correct and timely supplying of information required by the State Bank, Preparatory

Board in accordance with provisions of this Circular and take responsibilities in front of the law for the information provided above.

Article 35. Cooperation in issuance of a License

1. The State Bank shall give a written document to get the opinion from:

a) People’s Committee in provinces, cities under central management where the head office of commercial bank is situated, the office of foreign bank’s branch, representative office with regards to the location of the head office of a commercial bank, head office of a foreign bank’s branch, representative office;

b) The Ministry of Public Security (Department of Finance, Monetary, and Investment Security) on the list staff to be elected, assigned as member of the Board of Directors, Board of Members, member of Controllers’ Committee and General Director (Director) of commercial bank, General Director (director) of foreign bank’s branch, head of representative office.

2. Within a period of 15 days since the receipt of the State Bank, the relevant agencies as stated above shall give their written opinions to the State Bank. After the above said period, if the State Bank does not receive the written opinions from relevant agencies, it shall be deemed that such agencies have no reply to the request for issuance of a License of the State Bank.

3. The State Bank shall issue the License basing on the opinions of relevant agencies.

Article 36. Responsibilities of the State Bank

1. The Board for appraisement of application files for establishment and operation License of commercial banks, establishment License of foreign bank’s branches (hereinafter shortly referred to as the Appraisement Board):

a) The Appraisement Board shall be decided by the State Bank, including: the Governor or a deputy Governor (authorized by the Governor) as the Chairman, members who are Heads of units as provided for in paragraphs 2, 3, 4, 5, 6, 7, 8 of this Article;

b) Duties of the Appraisement Board:

(i) To appraise the application files for a License on establishment and operation of a commercial bank, establishment license of a foreign bank’s branch.

In the appraisement, the Appraisement Board shall employ the form of personal interview to verify the professional level, the reasonability and feasibility of the establishment Project in respect of each content of the Project, knowledge about banking area of the people who are expected to be appointed to titles of administrator, manager of the commercial bank, General Director (Director) of the foreign bank’s branch;

(ii) To select the list of eligible application files based on the opinions of the members for submission to the State Bank's Governor for issuance of the License.