Circular No. 41/2009/TT-BLDTBXH guiding amendment Circular No.03/2007/TT-BLDTBXH đã được thay thế bởi Circular No. 59/2015/TT-BLDTBXH guiding the law on social insurance on compulsory social insurance và được áp dụng kể từ ngày 15/02/2016.

Nội dung toàn văn Circular No. 41/2009/TT-BLDTBXH guiding amendment Circular No.03/2007/TT-BLDTBXH

|

THE MINISTRY

OF LABOR, WAR INVALIDS AND SOCIAL AFFAIRS |

SOCIALIST REPUBLIC OF VIET NAM |

|

No.: 41/2009/TT-BLDTBXH |

Hanoi, December 30, 2009 |

CIRCULAR

GUIDING AMENDMENT, SUPPLEMENTATION TO THE CIRCULAR NO.03/2007/TT-BLDTBXH ON JANUARY 30, 2007 ON GUIDING THE IMPLEMENTATION OF A NUMBER OF ARTICLES OF THE DECREE NO.152/2006/ND-CP DATED DECEMBER 22, 2006 OF THE GOVERNMENT GUIDING A NUMBER OF ARTICLES OF THE LAW ON SOCIAL INSURANCE ON COMPULSORY SOCIAL INSURANCE

Pursuant to the Decree No.152/2006/ND-CP of December 22, 2006 of the Government guiding a number of Articles of the Law on Social Insurance regarding compulsory social insurance (hereinafter referred to as the Decree No.152/2006/ND-CP) and the Decree No.190/2007/ND-CP of December 28, 2007 of the Government guiding a number of Articles of the Law on Social Insurance on voluntary social insurance (hereinafter referred to as the Decree No.190/2007/ND-CP) the Ministry of Labor, War Invalids and Social Affairs guides the amendment and supplementation of a number Clauses of the Circular No.03/2007/TT-BLDTBXH dated January 30, 2007 on guiding the implementation of some Articles of the Decree No.152/2006/ND-CP (hereinafter referred the Circular No.03/2007/TT-BLDTBXH) amended and supplemented in the Circular No.19/2008/TT – BLDTBXH dated September 23, 2008 as follows:

Article 1. To amend and supplement some clauses in the Circular No.03/2007/TT-BLDTBXH

1. To amend and supplement Clause 2, Section II, part B of maternity regime as follows:

"2. Duration for maternity leave entitlement when having baby to be 5 months as prescribed at Point b, Clause 1, Article 15 of the Decree No.152/2006/ND-CP is applied to employees working hard, poisonous and hazardous jobs, including employees working extremely hard, hazardous or dangerous jobs; female employees working full time of 6 months or more in the areas with weighting coefficient of 0.7 or more, during 12 months before giving birth."

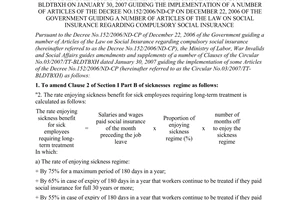

2. To amend Clause 6, Section II, part B of maternity regime as follows:

"6. Duration that employees are entitled the maternity leave from 14 working days or more during the month, both the employee and the employer must not pay social insurance in that month but still be counted as duration of payment for social insurance."

3. To supplement to the end of Clause 4, Section III of regime of occupational accidents, occupational diseases, Part B as follows:

"In case of labor accidents and occupational diseases which cannot be determined later the time of completion of the treatment, leaving the hospital (in the discharge paper, it still has indication of appointment for re-examination; removing the powder; removing the splint; removing the screw), time to enjoy allowance for labor accidents and occupational diseases every month is calculated from the conclusion month of the Council of Medical Examination ".

4. To supplement Clause 12 into Section IV, Part B of pension regime as follows:

"12. Calculation of pension for people participating in compulsory social insurance previously participated in voluntary social insurance.

a) People participating in compulsory social insurance previously participated in voluntary social insurance and reserved time paid voluntary social insurance, the time as a basis for calculation of pension is the total time paid for compulsory social insurance and voluntary social insurance.

Example 1: Mr. A has 10 years of payment for voluntary social insurance and reserved the duration paid for voluntary social insurance, then has 15 years of payment for compulsory social insurance. The time of paying for social insurance as a basis for calculation of pension of Mr. A is 10 years + 15 years = 25 years. "

b) The average of monthly salaries, wages and income paid for social insurance for people participating in compulsory social insurance previously participated in voluntary social insurance and reserved the period of paying voluntary social insurance under the provisions of Clause 2, Article 40 of the Decree No.152/2006/ND-CP is calculated as follows:

|

The average of salaries, wages and monthly income paid for social insurance (Mbqtl,tn) |

= |

Total monthly income paid for voluntary social insurance |

+ |

The average of monthly salaries, wages paid for compulsory social insurance |

x |

Total number of months paid for compulsory social insurance |

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||

|

|

Total number of months paid for voluntary social insurance |

+ |

Total number of months paid for compulsory social insurance |

|

|||||||

In which:

The average of monthly salaries, wages paid for compulsory social insurance is calculated in accordance with provisions of Article 31 of the Decree No.152/2006/ND-CP and the Clauses 4, 5, 6, Section IV of the Circular No.03/2007/TT-BLDTBXH (amended and supplemented in the Circular No.19/2008/TT-BLDTBXH dated September 23, 2008 of the Ministry of Labor, War Invalids and Social Affairs).

b1) When calculating the average of monthly salaries, wages and income paid for social insurance, salaries or wages for the subjects to the implementation of the wage regime determined by the employer and monthly income paid for voluntary social insurance are adjusted on the basis of cost-of-living index defined in Article 32 of the Decree No.152/2006/ND-CP and Article 18 of the Decree No.190/2007/ND-CP

b2) The average of monthly salaries, wages and income paid for social insurance mentioned above is used as a basis for calculating pensions, lump-sum allowance as retirement, allowance for lump-sum social insurance, death grant.

Example 2: Mr. A (in example 1) has 10 years paid for voluntary social insurance with the total monthly incomes paid for voluntary social insurance, after adjusted by the consumption price index is 138 million VND and 15-years paid for compulsory social insurance with the average of monthly salaries, wages and income paid for compulsory social insurance is 2.2 million VND/month. The average of monthly salaries, wages and income paid for social insurance of Mr. A is:

|

Mbqtl,tn |

= |

{138,000,000VND + (2,200,000 VND/month x 15 years x 12 months)} |

|

{(10 years x 12 months) + (15 years x 12 months)} |

= 1,780,000 VND/month.

Example 3: Mr. B is eligible for pension from 01/2013, with the progress of participation in social insurance as follows:

- From 01/1993 to 12/2007 (15 years) participated in compulsory social insurance, then reserved the period of paying for compulsory social insurance;

- From 01/2008 to 12/2008 (1 year) paid for voluntary social insurance with the total monthly incomes paid for the voluntary social insurance, after adjusted by the consumption price index is 8.2 million VND, then reserved the period of paying for voluntary social insurance;

- From 01/2009 to 12/2009 (1 year) participated in compulsory social insurance, and continued to reserve the period of paying for compulsory social insurance;

- From 01/2010 to 12/2011 (2 years) paid for voluntary social insurance with the total monthly incomes paid for the voluntary social insurance, after adjusted by the consumption price index is 25.1 million VND, then continued to reserve the period of paying for voluntary social insurance;

- From 01/2012 to 12/2012 (1 year) participated in compulsory social insurance.

As such, Mr. B has 17 years paid for compulsory social insurance, the average of monthly salaries, wages paid for compulsory social insurance is 3,000,000 VND/month.

Period paid for voluntary social insurance is 3 years, the total monthly incomes paid for voluntary social insurance after adjusted by consumption price index is:

8.2 million VND + 25.1 million VND = 33.3 million VND.

The average of monthly salaries, wages and income paid for social insurance of Mr. B is calculated as follows:

|

Mbqtl,tn |

= |

{33,300,000VND + (3,000,000 VND/month x 17 years x 12 months)} |

|

{(1 year + 2 year) x 12 months + (15 years + 1 year + 1 year) x 12 months)} |

= 2,688,750 VND/month.

c) The monthly pension is calculated equal to the product of the rate of monthly pension with the average of monthly salaries, wages and income paid for social insurance specified at Point b of this Clause.

d) People with total duration paid for compulsory social insurance for full 20 years or more, if the monthly pension after calculating as prescribed at Point c of this Clause is lower than the common minimum wage, it shall be adjusted so as equal to the common minimum wage.

đ) The lump-sum allowance rate as retirement is calculated in accordance with provisions of Clause 4 of Article 28 of the Decree No.152/2006/ND-CP each year of paying social insurance is calculated equal to 0.5 month of the average of monthly salaries, wages and income paid for social insurance specified at Point b of this Clause.

e) People participating in compulsory social insurance previously participated in voluntary social insurance and reserved the period paid voluntary social insurance, conditions to get lump-sum social insurance shall comply with the provisions in Clause 1, Article 30 of the Decree No.152/2006/ND-CP The duration of paying social insurance for calculation for getting lump-sum social insurance is total time paid for compulsory social insurance and voluntary social insurance. Rate of lump-sum social insurance entitlement is calculated equal to 1.5 months of the average of monthly salaries, wages and income paid for social insurance specified at Point b of this Clause, for each year of paying social insurance. In case of paying social insurance for full 3 months to full 6 months, rate is equal to 0.75 month of the average of monthly salaries, wages and income paid for social insurance; paying for social insurance for more than 6 months to full one year, rate is equal to 1.5 months of the average of monthly salaries, wages and income paid for social insurance."

5. To amend Clause 4 Section V, Part B of death regime as follows:

"4. Relatives of the subjects specified in Clause 1, Article 36, if they are reduced working capacity, assessment of decrease level of working capacity for reviewing monthly death grant shall comply with Clause 2, Article 36 of the Decree No.152/2006/ND-CP introduced by the social insurance organization. Time limit for introduction of assessment of working capacity decrease is within 4 months after the employee died.

In case when the employees die that are in the age of entitling monthly allowance, the time limit for introduction of assessment of working capacity decrease is within 4 months before and 4 months after the time of stop of allowance as prescribed. Upon having conclusion of their working capacity decrease of 81% or more, they shall be entitled to receive benefit since the month to be stopped the allowance."

6. To supplement Clause 6 in Section V Part B of death regime as follows:

"6. Death grant for people participating in compulsory social insurance previously participated in voluntary social insurance.

a) People participating in compulsory social insurance previously participated in voluntary social insurance and reserved time paid voluntary social insurance, the time as a basis for calculation of death grant is the total time paid for compulsory social insurance and voluntary social insurance.

b) People who have had a duration to pay compulsory social insurance for full 15 years or more when they die, their relatives shall be paid monthly death grant as provided for in Clause 2 of Article 36 and Article 37 of the Decree No.152/2006/ND-CP.

c) People who have had a duration to pay compulsory social insurance for under 15 years or those who have had a duration to pay compulsory social insurance for full 15 years or more but when they die without relatives eligible for monthly death grant, their relatives shall be entitled to get lump-sum death grant, lump-sum death grant rate is calculated as follows:

Lump-sum death grant rate = N x 1.5 x Mbqtl,tn

In which:

- N: the number of years of paying social insurance (including voluntary social insurance and compulsory social insurance).

- Mbqtl,tn: the average of monthly salaries, wages and income paid for social insurance in accordance with provisions of Clause 6a, Section IV, Part B of this Circular.

Lowest lump-sum death grant rate is equal to three months of the average of monthly salaries, wages and income paid for social insurance.

d) Those who are being entitled to pensions that have less than 15 years of paying compulsory social insurance or have from 15 years of paying compulsory social insurance or more, but do not have relatives eligible for monthly death grant, their relatives are entitled to receive lump-sum death grant, method of calculation is the same as specified in Clause 2, Section V, Part B of the Circular No.03/2007/TT-BLDTBXH; Lowest lump-sum death grant rate is equal to three months of pension being received before their death."

7. To add to the end of Point b, Clause 5 of Part D as follows:

"The time for pension entitlement of these subjects is calculated from the month next to the month that is calculated enough time for paying social insurance and submit complete dossier.

Example 4: Mr. C is old enough to enjoy pension in April/2009, up to April/2009, he has 19 years and 7 months of paying social insurance. If Mr. C is continued to pay for 5 missing months, May/2009 Mr C paid once for 5 missing months and submitted a complete dossier to the social insurance agency. So the time of enjoying pension of Mr. C is calculated from September/2009.

Example 5: If Mr. C (example 4), until 11/2009 Mr. C has just paid enough money for 5 missing months and submitted a complete dossier to the social insurance agency. So the time of enjoying pension of Mr.C is calculated from 12/2009."

8. To add to the end of Point c, Clause 5 of Part D as follows:

" The time for monthly death grant entitlement of these subjects is calculated from the month next to the month the employee died."

9. To supplement the Clauses 13, 14, 15, 16, 17, 18, 19 and Clause 20 in Part D as follows:

"13. Those who are being entitled benefits for labor accidents and occupational diseases monthly before 01/01/2007, the equipment of means supporting to living, orthopedic devices shall comply with the guidance in the documents issued before 01/01/2007.

14. Those who are being entitled benefits for sick soldiers, then have time to participate in work and payment for social insurance, in addition to the sick soldiers regime they are entitled to social insurance regime. Time calculated for social insurance entitlement is the time paid social insurance, working time calculated for sick soldiers regime entitlement shall not be counted for enjoying social insurance.

15. Copies of documents residing abroad for employees entitled lump-sum social insurance regime in the case of going overseas to settle as prescribed in Clause 4 of Article 120 of the Law on Social Insurance is the visa of entry for long-time permanent residence or permanent residence card or long-term residence certificate issued by the competent authorities of the home countries; these documents must be translated and notarized.

16. Paper of discharge or hospital consultation slip for sick workers on the list of diseases requiring long-term treatment, as prescribed for in Clause 2, Article 112 of the Social Insurance Law, which clearly indicates the names of diseases that employees are required treatment. The payment for the sickness regime is carried out according to the profile of each batch that workers leave their jobs for treatment (inpatient or outpatient).

17. Time to be communal officials calculated for social insurance entitlement of workers is considered as the time of paying for social insurance under the salary regime set by the State as the basis for calculating the average of monthly salaries and wages of paying for social insurance.

18. The calculation for working time before January 01, 1995 to enjoy social insurance shall comply with the guidance in the previously prescribed documents on calculation of the working time before January 01, 1995 for enjoying social insurance of officials, public servants, public employees, workers, soldiers and police officers.

19. Workers both having period paid for voluntary social insurance, having period paid for compulsory social insurance, the duration paid for voluntary social insurance are not calculated for enjoying regime of sickness, maternity, labor accidents and occupational diseases.

20. Those who are entitled to pension or monthly social insurance allowance temporarily suspended due to missing, then the court declared dead, then duration calculated from the suspension until the court declared dead is not calculated for enjoying pension, monthly social insurance allowance."

Article 2. Implementation provisions

1. This Circular takes effect 45 days after its signing date.

2. The provisions of clauses 1, 2, 4, 6, 7, 8 and the points 13, 14, 15, 17, 18, 19 and 20 of Clause 9, Article 1 of this Circular are applied from January 01, 2007.

The provisions of clause 3, Article 1 of this Circular are applied from January 01, 2008.

3. In the implementation process, any problem arises, the concerned units should report to the Ministry of Labor, War Invalids and Social Affairs for study and settlement./.

|

|

FOR MINISTER |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments