Circular No. 45/2012/TT-BTC promulgating vietnam’s special preferential import đã được thay thế bởi Circular No. 169/2014/TT-BTC promulgating Vietnam’s special preferential import và được áp dụng kể từ ngày 01/01/2015.

Nội dung toàn văn Circular No. 45/2012/TT-BTC promulgating vietnam’s special preferential import

|

THE MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 45/2012/TT-BTC |

Hanoi, March 16, 2012 |

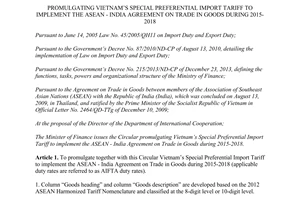

CIRCULAR

PROMULGATING VIETNAM’S SPECIAL PREFERENTIAL IMPORT TARIFF FOR IMPLEMENTATION OF THE ASEAN-INDIA COMMODITY TRADE AGREEMENT IN THE 2012-2014 PERIOD

Pursuant to the Law No. 45/2005/QH11 on Import and Export Duties of June 14, 2005;

Pursuant to the Government's Decree No. 87/2010/ND-CP of August 13, 2010 detailing the implementation of Law on Import and Export Duties No. 45/2005/QH11 of June 14, 2005;

Pursuant to the Government’s Decree No. 118/2008/ND-CP of November 27, 2008, defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

In furtherance of the the Association of Southeast Asian nations (ASEAN)- India commodity trade Agreement signed on August 13, 2009 and October 24, 2009, in Thailand and approved by the Prime Minister of the Government of the Socialist Republic of Vietnam in official dispatch No. 2464/TTg-QHQT of December 10, 2009;

The Ministry of Finance promulgates Circular on Vietnam’s special preferential import tariff for implementation of The Asean-India Commodity Trade Agreement as follows:

Article 1. To promulgate together with this Circular the Vietnam’s special preferential import tariff for implementation of the ASEAN-India Commodity Trade Agreement in the 2012-2014 period (applicable duty rates are abbreviated as AIFTA duty rates).

+ Column “Goods code” and column “Goods description” are formulated on the basis of the 2012 AHTN and classified at the 8-digit level;

+ Column “AIFTA duty rates (%)”, The duty rates will be applicable for each year, from January 01 to December 31 of year. Particularly in 2012, be applicable from the effective day of this Circular to December 31, 2012.

Article 2: To be eligible for AIFTA duty rates, imported goods must meet all the following conditions:

1) Being included in the special preferential import tariff promulgated together with this Circular.

2) Being imported into Vietnam from nations being members of the ASEAN-India Commodity Trade Agreement, including:

- Brunei Darussalam;

- Kingdom of Cambodia;

- Indonesia;

- Lao People's Democratic Republic;

- Malaysia;

- Myanmar;

- Philippines;

- Singapore;

- Kingdom of Thailand;

- Republic of India;

- The Socialist Republic of Vietnam (Commodities from non-tariff zones imported into domestic market).

3) Being transported directly from exporting countries, specified in clause 2 this Article to Vietnam, according to regulations of the Ministry of Industry and Trade;

d) Satisfying regulations on origin of goods in of the ASEAN-India Commodity Trade Agreement and having a certificate of origin of ASEAN-India (C/O form AI) according to regulations of the Ministry of Industry and Trade.

Article 3. This Circular takes effect after 45 days from the day of signing and replaces the Circular No. 58/2010/TT-BTC of April 16, 2010 of the Minister of Finance on promulgating Vietnam’s special preferential import tariff for implementation of the ASEAN-India Commodity Trade Agreement in the 2010-2012 period.

|

|

FOR THE

MINISTER OF FINANCE |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments