Nội dung toàn văn Circular No. 53/2016/TT-BTC amending 200/2014/TT-BTC corporate accounting system

|

MINISTRY OF

FINANCE |

SOCIALIST REPUBLIC

OF VIETNAM |

|

No.: 53/2016/TT-BTC |

Hanoi, 31/3/2016 |

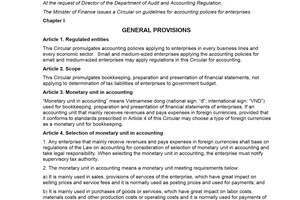

CIRCULAR

AMENDING AND ADDING SOME ARTICLES OF CIRCULAR NO. 200/2014/TT-BTC DATED 22/12/2014 OF THE MINISTRY OF FINANCE GUIDING THE CORPORATE ACCOUNTING SYSTEM

Pursuant to the Accounting Law dated 17/06/2003;

Pursuant to Decree No. 129/2004/ND-CP dated 31/5/2004 of the Government detailing and guiding the implementation of some articles of the Accounting Law in business activities;

Pursuant to Decree No. 215/2013/ND-CP dated 13/2/2013 of the Government defining the functions, power and organizational structure of the Ministry of Finance;

At the request of Director of Department of Accounting and Auditing System

The Minister of Finance issues the Circular amending and adding some articles of Circular No. 200/2014/TT-BTC dated 22/12/2014 guiding the corporate accounting system.

Article 1. Amending and adding some articles of Circular No. 200/2014/TT-BTC as follows:

1. Point g, Clause 1, Article 15 of Circular No. 200/2014/TT-BTC is amended and added as follows:

“g). Upon disposal or sale of trading securities (taking into account each class of securities), the prime cost of trading securities is determined by one of the methods of first in first out or weighted average.

The enterprises must apply the consistent method to choose and calculate the prime cost of trading securities in financial year. In case of change of method for calculation of prime cost of trading securities, the enterprises must make presentation and explaination in accordance with the accounting standards”.

2. Change the phrase “weighted average prime cost” and “book value of stocks exchanged by method of weighted average” by the phrase “prime cost specified under Point d and e, Clause 3, Article 15 of Circular No. 200/2014/TT-BTC.

3. The Clause 1.3, Article 69 of Circular No. 200/2014/TT-BTC is amended and added as follows:

“1.3. Principles to determine the exchange rate:

a) Actual exchange rate for foreign currency transactions arising in the period:

- The actual exchange rate upon sale of foreign currency (spot foreign currency sale contract, forward contract, futures contract, options contract and swap contract) is the exchange rate signed in the foreign currency sale contract between enterprises and commercial banks;

- Where the contract does not specify the payment rate:

+ The enterprise makes entries in the accounting books according to the actual exchange rate: when recording the contributed capital or receipt of contributed capital as the foreign currency sale rate of the bank where the enterprise opens its account to receive capital from the investors on the day of capital contribution; when recording the debts receivable as the buying rate of the commercial bank where the enterprise requires its customer to make payment at the time of transaction; when recording the debts payable as the selling rate of the commercial bank where the enterprise is expected to enter into a transaction at the time of transaction; when recording the asset procurement transactions or costs which are paid immediately in foreign currency (not through the accounts payable) which is the buying rate of commercial bank where the enterprise makes payment.

+ In addition to the above actual exchange rate, the enterprise can choose the actual exchange rate as the one which approximates the average transfer, selling and buying rate of the commercial bank where the enterprise has regular transactions. The approximate exchange rate must ensure its difference does not exceed +/-1% compared with the average transfer and sale rate. The average transfer and sale rate is determined daily, weekly or monthly on the basis of arithmetic average between the daily buying rate and selling rate or transfer rate of commercial bank.

The use of approximate exchange rate must ensure no major effect on the financial situation and result of business and production of accounting period.

b) The actual exchange rate upon re-evaluation of currency items with foreign currency origin by the time of preparation for financial statement:

- The actual exchange rate upon re-evaluation of currency items with foreign currency origin classified as assets: is the foreign currency buying exchange rate of the commercial bank where the enterprise has regular transactions by the time of preparation for financial statement. For foreign currencies deposited at the bank, the actual exchange rate upon re-evaluation is the buying exchange rate of the bank where the enterprise opens its foreign currency account.

- The actual exchange rate upon re-evaluation of currency items with foreign currency origin classified as debts payable: is the foreign currency selling price of the commercial bank where the enterprise has regular transactions by the time of preparation for financial statement.

- The units in the group may apply one exchange rate stipulated by their parent company (must ensure the closeness to the actual exchange rate) to re-evaluate the currency items with foreign currency origin generated from internal transactions.

- Where the enterprise uses the approximate exchange rate specified under Point a of this Clause to record the accounting of transactions in foreign currency generated in the period. At the end of accounting period, the enterprise shall use the transfer exchange rate of the commercial bank where the enterprise has regular transactions to re-evaluate the currency items with foreign currency origin. This transfer exchange rate may be the buying or selling exchange rate or the average transfer, selling and buying rate of the commercial bank.”

4. Replacing the phrases “mobile weighted average exchange rate”, “recorded exchange rate of weighted average” with the phrase “mobile weighted average exchange rate or actual exchange rate” specified under Point e, Clause 1, Article 12, Point dd, Clause 1 of Article 13, Point e, Clause 1 of Article 18, Point c, Clause 1 of Article 51, Clause 1.4 and Point b and c, Clause 1.5 of Article 69 of Circular No. 200/2014/TT-BTC.

5. Clause 4.1, Article 69 of Circular No. 200/2014/TT-BTC is amended and added as follows:

“4.1. Accounting difference of exchange rate incurred in the period (including the exchange rate difference in the previous period of operation of the enterprises whose 100% charter capital is not held by the State):

a) When buying the materials, goods, immovable property and services paid in foreign currency, record:

Debit of accounts 151, 152, 153, 156, 157, 211, 213, 217, 241, 623, 627, 641, 642

Debit of accounts 151, 152, 153, 156, 157, 211, 213, 217, 241, 623, 627, 641 and 642 (actual exchange rate on the transaction date)

Debit of account 635 – Financial activity expenses (exchange rate loss).

Credit of accounts 111 (1112), 112 (1122) (exchange rate recorded in accounting book)

Credit of account 515 - Revenue from financial activities (exchange rate interest)

b) When buying materials, goods, immovable property or services from the provider but not yet paid, when getting a loan or receiving debt internally….in foreign currency, based on the actual exchange rate on the transaction date, record:

Debit of accounts 111, 112, 152, 153, 156, 211, 627, 641, 642...

Credit of accounts 331, 341, 336...

c) When advancing the seller money in foreign currency to purchase materials, goods, immovable property or services:

- The accountant records the amount advanced to the seller in accordance with the actual exchange rate at the time of the advance, record:

Debit of account 331 – Payable to seller (the actual exchange rate on the advance date)

Debit of account 635 - Financial activity expenses (exchange rate loss).

Credit of accounts 111 (1112), 112 (1122) (based on the exchange rate recorded in accounting book))

Credit of account 515 - Revenue from financial activities (exchange rate interest)

- When receiving the materials, goods, immovable property or services from the seller, the accountant shall record it on the principle:

+ For the value of materials, goods, immovable property or services corresponding to the amount in foreign currency advanced to the seller, the accountant shall record it according to the actual exchange rate at the time of advance, record:

Debit of accounts TK 151, 152,153, 156, 157, 211, 213, 217, 241, 623, 627, 641, 642

Credit of TK 331 - Payable to seller (actual exchange rate of advance date)

+ For the value of materials, goods, immovable property or services not yet paid, the accountant shall record it according to the actual exchange rate at the time of generation (transaction date), record:

Debit of accounts 151, 152, 153, 156, 157, 211, 213, 217, 241, 623, 627, 641, 642 (actual exchange rate on the transaction date)

Credit of account 331 - Payable to seller (actual exchange rate on the transaction date)

d) When making debt repayment in foreign currency (debts payable to the seller, loan, financial leasing debt, internal debt…):

Debit of accounts 331, 336, 341,... (exchange rate recorded in accounting book)

Debit of account 635 - Financial activity expenses (exchange rate loss).

Credit of accounts 111 (1112), 112 (1122) (exchange rate recorded in accounting book)

Credit of account 515 - Revenue from financial activities (exchange rate interest)

e) When there is generation of other revenues or incomes in foreign currency, based on the actual exchange rate at the time of generation, record:

Debit of accounts 111(1112), 112(1122), 131... (actual exchange rate on the transaction date)

Credits of accounts 511, 711 (actual exchange rate on the transaction date)

g) When receiving the advance from the buyer in foreign currency to provide the materials, goods, immovable property or services:

- The accountant shall record the advance form the buyer according to the actual exchange rate at the time of receipt of advance, record:

Debit of accounts 111 (1112), 112 (1122)

Credit of account 131 - Receivables from customers

- When delivering the materials, goods, immovable property or services to the buyer, the accountant shall record it on the principle:

+ For the revenues and incomes corresponding to the amount in foreign currency received in advance from the buyer, the accountant shall record it according to the actual exchange rate at the time of receipt of advance, record:

Debit of account 131 – Receivables from customers (actual exchange rate at the time of receiving the buyer’s cash in advance).

Credit of accounts 511, 711.

+ For the revenues and incomes whose money has not yet been collected, the accountant shall record according to the actual exchange rate at the time of generation, record:

Debit of account 131 – Receivables from customers

Credits of accounts 511, 711.

h) When having collected the debts receivable in foreign currency (debts receivable from customers, internal receivable, other receivables…):

Debit of accounts 111 (1112), 112 (1122) (actual exchange rate on the transaction date).

Debit of account 635 - Financial activity expenses (exchange rate loss).

Credit of accounts TK 131, 136, 138 (exchange rate recorded in accounting book)

Credit of account 515 - Revenue from financial activities (exchange rate interest)

i) When making loan or investment in foreign currency

Debit of accounts 121, 128, 221, 222, 228 (actual exchange rate on the transaction date).

Debit of account 635 - Financial activity expenses (exchange rate loss).

Credit of accounts 111 (1112), 112 (1122) (exchange rate recorded in accounting book)

Credit of account 515 - Revenue from financial activities (exchange rate interest)

k) Mortgages or deposits in foreign currency

- Upon mortgage or deposit in foreign currency, record:

Debit of account 244 - Pledge, mortgage, collateral or deposit (actual exchange rate at the time of generation).

Debit of account 635 – Financial activity expenses (exchange rate loss).

Credit of accounts 111 (1112), 112 (1122) (exchange rate recorded in accounting book).

Credit of account 515 - Revenue from financial activities (exchange rate interest)

- When getting back the collateral or deposit :

Debit of accounts 111 (1112), 112 (1122) (actual exchange rate when getting back the collateral or deposit)

Debit of account 635 - Financial expenses (foreign exchange loss)

Credit of account 244 - Pledge, mortgage, collateral or deposit

Credit of account 515 - Revenue from financial activities (exchange rate interest)

l) Where the enterprise uses the actual exchange rate to record the capital accounts in cash and debts receivable on the credit side and the accounts payable in foreign currency on the debit side, the record of exchange rate difference generated in the period is done at the time of generation of transaction or on a periodical basis depending on the characteristics of business activities and the management requirements of the enterprise. Simultaneously at the end of the accounting period:

- The currency items with foreign currency have no original currency balance, the enterprise shall forward all exchange rate differences generated in the period into the financial revenues or financial expenses of reporting period:

+ Forwarding the interest of exchange rate difference, record:

Debit of accounts 1112, 1122, 128, 228, 131, 136, 138, 331, 341,..

Credit of account 515 - Revenue from financial activities

+ Forwarding the loss of exchange rate difference, record:

Debit of account 635 - Financial expenses

Credit of accounts 1112, 1122, 128, 228, 131, 136, 138, 331, 341,...

- The currency items with foreign currency have the original currency balance, the enterprise must re-evaluate the currency items with foreign currency at the end of period and the recording of exchange rate difference due to re-evaluation of currency items with foreign currency at the end of period shall comply with the provisions in Clause 4.2, Article 69 of Circular No. 200/2014/TT-BTC”.

m) The enterprise should give clear explanation about the choice and application of exchange rate on the notes to the financial statement and this choice and application of exchange rate must ensure the consistence principles in accordance with the accounting standards”.

6. Article 120 of Circular No. 200/2014/TT-BTC is amended and added as follows:

“Article 120. Translating the accounting documents into Vietnamese language

1. The accounting documents written in foreign language, when being used to record in accounting books in Vietnam, must be translated into Vietnamese language. The documents which are seldom generated or generated many times but different content must be translated all contents of accounting documents. For the documents which are generated many times with the same content, the first copy must be translated all, from the second copy onwards, only essential contents are translated such as name of document, name of making unit and person, name of receiving unit and person, economic content of document, title of document signer….The translator must sign, specify full name and take responsibility for the contents translated into Vietnamese. The copy of translated document must be attached to the original copy in foreign language.

2. The documents with attached documents such as contract, dossier with attached payment documents, dossier of investment project, finalization report and other relevant documents shall not have to be translated into Vietnamese language unless required by the competent state authority.”

Article 2. Effect and implementation

1. This Circular takes effect from its signing date for circulation and application for the financial year starting on or after 1/1/2016. The enterprises may choose to apply the exchange rate specified in Article 1 of this Circular for their financial statements of 2015.

2. Other provisions on exchange rate specified in the Circular 200/2014/TT-BTC shall comply with the principles specified in this Circular.

3. Any problem arising during the implementation should be reported to the Ministry of Finance for study and settlement./.

|

|

FOR THE

MINISTER |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed