Circular No. 89/2013/TT-BTC amending the Circular No. 228/2009/TT-BTC đã được thay thế bởi Circular 48/2019/TT-BTC making settlement of provisions for devaluation of inventory at enterprises và được áp dụng kể từ ngày 10/10/2019.

Nội dung toàn văn Circular No. 89/2013/TT-BTC amending the Circular No. 228/2009/TT-BTC

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 89/2013/TT-BTC |

Hanoi, June 28, 2013 |

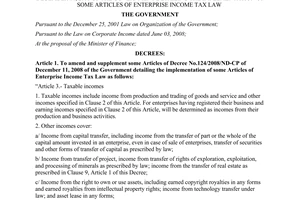

CIRCULAR

AMENDING AND SUPPLEMENTING THE CIRCULAR NO. 228/2009/TT-BTC DATED 7/12/2009 OF THE MINISTRY OF FINANCE GUIDING THE APPROPRIATION AND USE OF PROVISIONS FOR DEVALUATION OF INVENTORIES, LOSSES OF FINANCIAL INVESTMENTS, BAD RECEIVABLE DEBTS AND WARRANTY FOR PRODUCTS, GOODS AND CONSTRUCTION AND INSTALLMENT WORKS AT ENTERPRISES

Pursuant to the Law on Securities;

Pursuant to the Government's Decree No. 124/2008/ND-CP dated 11/12/2008 detailing and guding implementation of a number of articles of the Law on Enterprise income tax;

Pursuant to the Government's Decree No. 122/2011/ND-CP dated 27/12/2011 amending and supplementing a number of articles of the Government’s Decree No. 124/2008/ND-CP dated 11/12/2008 detailing and guiding implementation of a number of articles of Law on Enterprise income tax;

Pursuant to the Government's Decree No. 118/2008/ND-CP dated 27/11/2008 defining the functions, tasks, powers and organizational structure of the Ministry of Finance;

At the proposal of Director of Corporate Finance Department;

The Minister of Finance promulgates the Circular amending and supplementing the Circular No. 228/2009/TT-BTC dated 7/12/2009 of the Ministry of Finance guiding the appropriation and use of provisions for devaluation of inventories, losses of financial investments, bad receivable debts and warranty for products, goods and construction and installment works at enterprises (hereinafter abbreviated to the Circular No. 228/2009/TT-BTC) as follows:

Article 1. To amend and supplement clause 2 Article 5 of the Circular No. 228/2009/TT-BTC as follows:

a) Objects: Capital portions currently invested by an enterprise in other economic organizations set up under law (including: Limited liability companies, joint-stock companies not eligible to make appropriation of provision as prescribed in clause 1 Article 5 of the Circular No. 228/2009/TT-BTC dated 7/12/2009 of the Ministry of Finance, joint venture companies, partnership companies) and other long-term investments for which provisions must be appropriated in case the economic organizations invested by enterprises get loss (except cases of loss anticipated in the business plans compiled before making investment).

The appropriation of provision for long-term investment is performed for investments presented under method of original price, not applied to investments presented under method of equity capital in accordance with law.

b) Conditions: An enterprise performs appropriation of provision only when total actual invested capital of owner is more than total actual value of equity capital of the invested economic organization.

c) Method of appropriating the provision:

The level of the provision for each financial investment to be appropriated is equal to the invested capital amount and calculated according to the following formula:

|

Level of the provision for each financial investment |

= |

Parties' actual investment capital at economic organization |

- |

Actual equity capital of economic organization |

x |

investment capital of each party |

|

Parties' actual investment capital at economic organization |

In which:

- Parties' actual investment capital at the economic organization is determined in the annual accounting balance sheet of the economic organization receiving the contributed capital at the time of appropriating the provision (codes 411 and 412 of the accounting balance sheet, promulgated together with the Finance Minister's Decision No. 15/2006/QD-BTC of March 20, 2006).

- The actual equity capital of economic organization is determined in the economic organization's annual accounting balance sheet at the time of appropriating the provision (code 410 of the accounting balance sheet, promulgated together with the Finance Minister's Decision No. 15/2006/QD-BTC of March 20, 2006).

Example: An A company is a joint-stock company operating in construction with charter capital of VND 50 billion, and structure of 3 shareholders contributed capital, including: B company holds 50% of charter capital, proportion to VND 25 billion; C company holds 30% of charter capital, proportion to VND 15 billion, and D company holds 20% of charter capital, proportion to VND 10 billion. All companies have invested full capital at the rates of charter capital they are holding, so that total investment capital of 3 companies B, C and D at the A company is VND 50 billion.

In 2012, due to deterioration of economy, the production and business result of the A company was lost VND 6 billion, leading to remaining of equity capital (code 410 of the Balance sheet) of the A company of VND 44 billion.

So that, in 2012, when the B company, C company and D company implement appropriation of provision for the financial investment at the A company, they must base on the 2012 financial statements of the A company, the level of appropriation of provision for loss of financial investment at the A joint-stock company of these companies shall be as follows:

Level of appropriation of provision for financial investment of B company:

(VND 50 billion - VND 44 billion) x

![]() = VND

3 billion.

= VND

3 billion.

Level of appropriation of provision for financial investment of C company:

(VND 50 billion – VND 44 billion) x ![]() = VND 1.8 billion

= VND 1.8 billion

Level of appropriation of provision for financial investment of D company:

(VND 50 billion – VND 44 billion) x ![]() = VND 1.2 billion

= VND 1.2 billion

d. Handling of the provision:

At the time of appropriating provisions, if the capital amounts invested in economic organizations are lost due to loss-making operations of these economic organizations, a provision for loss of financial investments must be appropriated according to Item c of this Article;

If the amount of the provision for loss of financial investments to be appropriated is equal to the balance of the existing provision, the enterprise is not required to appropriate the provision;

If the amount of the provision to be appropriated is higher than the balance of the existing provision, the enterprise shall add the difference to its financial expenditures.

If the amount of the provision to be appropriated is lower than the balance of the existing provision, the enterprise shall refund the difference and record it as a decrease in its financial expenditures.

Article 2. Organization of implementation

1. This Circular takes effect on July 26, 2013.

2. For enterprises have implemented appropriation of provision for financial investments on the basis of financial statements in the same year of year when the economic organizations received the contribution capital , if agencies competent to inspection and examination have excluded the deductable expenses from the accounts upon determining taxable incomes, the payable EIT will be increased additionally respectively which enterprises have remitted in the State budget will be reduced for the payable amounts of next year (if enterprises have not yet remitted, enterprises will be not required for remittance and adjustment of accounting books is not required).

Enterprises that have implemented appropriation of provision for financial investments on the basis of the previous annual financial statement of economic organization receiving capital (Example: Mother company make appropriation of provisions of long-term financial investment in 2011 based on the 2010 financial statement of economic organizations receiving its contributed capital), if enterprise has declared tax as prescribed by law, it is not required to adjust appropriation of provision for financial investment as prescribed in this Circular.

In the course of implementation, any arising problems should be reported timely to the Ministry of Finance for timely settlement.

|

|

FOR THE FINANCE MINISTER |