Nội dung toàn văn Decision 635/QD-TCT 2020 adopting regulations on components containing electronic invoice data

|

MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF

VIETNAM |

|

No. 635/QD-TCT |

Hanoi, May 11, 2020 |

DECISION

ADOPTING REGULATIONS ON COMPONENTS CONTAINING ELECTRONIC INVOICE DATA AND APPROACHES TO DATA TRANSMISSION AND RECEPTION BY TAX AUTHORITIES

GENERAL DIRECTOR

Pursuant to the Law on Tax Administration dated November 29, 2006 and the Law on Amendments and Supplements to certain Articles of the Law on Tax Administration;

Pursuant to the Law on Value-added Tax dated June 3, 2008 and the Law on Amendments and Supplements to certain Articles of the Law on Value-added Tax;

Pursuant to the Law on Information Technology dated June 29, 2006;

Pursuant to the Law on Electronic Transactions dated November 29, 2005;

Pursuant to the Government’s Decree No. 119/2018/ND-CP dated September 12, 2018, regulating electronic invoices for sale of goods and provision of services;

Pursuant to the Government's Decree No. 130/2018/ND-CP dated September 27, 2018, elaborating on the implementation of several Articles regarding digital signature and digital signature authentication service;

Pursuant to the Government’s Decree No. 165/2018/ND-CP dated December 24, 2018 on electronic financial transactions;

Pursuant to the Prime Minister's Decision No. 41/2018/QD-TTg dated September 25, 2018, defining the functions, tasks, powers and organizational structure of the General Department of Taxation subsidiary to the Ministry of Finance;

Pursuant to the Circular No. 39/2017/TT-BTTTT dated December 15, 2017 of the Ministry of Information and Communications, issuing the list of technical standards on application of information technology to activities of state regulatory authorities;

Pursuant to the Circular No. 68/2019/TT-BTC dated September 30, 2019 of the Ministry of Finance, providing guidance on several articles of the Government’s Decree No. 119/2018/ND-CP dated September 12, 2018, regulating electronic invoices for sale of goods and provision of services;

Upon the request of the Director of the Information Technology Department.

HEREBY DECIDES

Article 1. Regulations on components containing electronic invoice data and approaches to data transmission and reception by tax authorities shall be annexed hereto.

Article 2. This Decision shall enter into force from the signature date and shall be applied to enterprises, organizations, business households and individuals registering, using and providing e-invoicing solutions in accordance with regulations laid down in the Decree No. 119/2018/ND-CP and the Circular No. 68/2019/TT-BTC.

Article 3. Heads of Departments, affiliates or subsidiaries of the General Department of Taxation, Directors of Tax Departments of provinces and centrally-affiliated cities, relevant entities and persons shall be responsible for implementing this Decision./.

Article 4. If documents used as references herein are revised, amended or replaced, new versions thereof shall be applied.

In the course of implementation hereof, if there is any difficulty or query that arises, relevant units may send feedbacks to the General Department of Taxation (via the Information Technology Department) to seek its decision on any proper amendment or supplementation./.

|

|

GENERAL DIRECTOR |

REGULATIONS

ON

COMPONENTS CONTAINING ELECTRONIC INVOICE DATA AND APPROACHES TO DATA

TRANSMISSION AND RECEPTION BY TAX AUTHORITIES

(Annexed

to the Decision No. 635/QD-TCT dated May 11, 2020

of the General Director of the General Department of Vietnam Customs)

Part I

GENERAL PROVISIONS

I. Scope and subjects of application

1. Scope: Requirements on technical specifications, structured format, data components and methods of e-invoice exchange between enterprises, organizations, business households, individuals or e-invoice service providers and tax authorities.

2. Subjects of application: This Circular shall apply to those covered by Article 2 in the Circular No. 68/2019/TT-BTC dated dated September 30, 2019 of the Ministry of Finance, providing guidance on several articles of the Government’s Decree No. 119/2018/ND-CP dated September 12, 2018, regulating electronic invoices for sale of goods and provision of services.

II. Legal references and citations

1. National Standard TCVN 7322: 2009 Information technology - Automatic identification and data capture techniques - Technical requirements for QR Codes 2005;

2. EMV Book 4: EMV Integrated Circuit Card Specifications for Payment Systems - Book 4 Cardholder, Attendant, and Acquirer Interface Requirements;

3. Decision No. 1928/QD-NHNN dated August 5, 2018 of the Governor of the State bank of Vietnam regarding announcement of basic standards.

III. Abbreviations

|

No. |

Abbreviations |

Description |

|

1 |

CQT |

Tax authority or agency |

|

2 |

CMND |

9-digit or 12-digit (old or new) ID card |

|

3 |

GTGT |

Value added tax |

|

4 |

Hóa đơn có mã |

e-invoices with tax authorities' identification code numbers |

|

5 |

Hóa đơn không mã |

e-invoices without tax authorities' identification code numbers |

|

6 |

NHNN |

State Bank of Vietnam |

|

7 |

MST |

Tax identification number |

|

8 |

NNT |

Taxpayer |

|

9 |

QR Code |

Quick Response Code |

|

10 |

T-VAN |

Intermediary service provider of e-invoice solution |

|

11 |

TCKNGTT |

Organization or enterprise selling goods or providing services having connection to transmit data to them in the direct form (not via T-VAN) |

|

12 |

STT |

Ordinal number |

|

13 |

XML |

eXtensible Markup Language |

IV. General provisions e-invoice data components and exchanged messages

1. XML tabs and data representation

a) XML tabs

The tab’s tag is written without space and may be abbreviated according to the following principles:

- Take the capitalized first letter of each word. In particular, the last word with the capitalized first letter is written in full. Example: The tab indicating the quantity data field is abbreviated into SLuong; the tab indicating the invoice data field is abbreviated into DLHDon;

- In case of identical abbreviated tags, some characters must be added to distinguish them. Example: The Tổng tiền (Sum/total) field is abbreviated into TgTien; the Thành tiền (Sum/total) is abbreviated into ThTien.

- Common phrases can be abbreviated under the regulations of Section III of Part I.

Notes: Regulations in this section shall not apply to digital signature tabs.

b) Regulations on data representation

- Character set representation standard (Encoding): UTF-8.

- Vietnamese-language character set and encoding standard: TCVN 6909:2001.

2. Data format

a) Numeric format: Data type in the numeric format contains the maximum of 19 numeric characters, including the maximum of 4 numeric characters in the fractional part. The decimal point (.) is used for separating the integral part from the fractional part (if any), including:

- Decimal data type is described to have the maximum length as x and y (where: x denotes total numeric characters at maximum (including both the whole part and the decimal places, excluding the decimal point (.) or separator); y denotes the maximum number of numeric characters in the fractional part).

Example: The Exchange rate data type is described to have the maximum length as 7 and 2 (where: 7 is total numeric characters at maximum (including both the whole part and the decimal places); 2 is the maximum number of numeric characters in the fractional part).

- Integer data type is described to have the maximum length as x which denotes the the maximum number of numeric characters.

Example: Invoice number data type is described to have the maximum length as 8 which is the the maximum number of numeric characters.

b) Date format: In this data type, data are represented in the YYYY-MM-DD format, where: YYYY refers to 4 digits indicating the calendar year; MM refers to 2 digits indicating the calendar month; DD refers to 2 digits indicating the calendar day. This data type is adjusted to the GMT+7 (+07:00) timezone.

Example: 2020-04-24 is the 24th of April of 2020.

c) DateTime format: In this data type, data are represented in the YYYY-MM-DDThh:mm:ss format, where: YYYY means 4 digits indicating the calendar year; MM means 2 digits indicating the calendar month; T means the symbol used for separating date from hour; hh means 2 digits indicating hour (from hour 00 to hour 23; AM/PM hour format is not allowed); mm means 2 digits indicating minute; ss means 2 digits indicating second. This data type is adjusted to the GMT+7 (+07:00) timezone.

Example: 2020-04-24T18:39:30 indicates 18 hour 39 minute 30 second of the 24th of April of 2020.

Notes: Numeric, date and time format is only used for XML data. Data are represented under the provisions of the Circular No. 68/2019/TT-BTC.

d) Regulations on currency units: Regulations laid down in point c of clause 2 of Article 3 in the Circular No. 68/2019/TT-BTC shall be observed.

3. Tax authority's identification/verification code inscribed on electronic invoices

Tax authority’s identification/verification code inscribed on an e-invoice is a set or sequence of characters, including 12 numeric characters, which the tax authority’s system creates and affixes onto e-invoices with tax authority’s identification/verification codes.

Tax authority’s code exists in the N1N2N3N4N5N6N7N8N9N10N11N12 format (N1 through N12 is the numeric characters ranging from 0 to 9).

4. Digital signature

- Digital signature must comply with the provisions of the Law on Electronic Transactions No. 51/2005/QH11 dated November 29, 2005 and other instructional documents thereof. Digital signature specifications shall conform to XML-Signature Syntax and Processing standard prescribed in the Circular No. 39/2017/TT-BTTTT dated December 15, 2017 of the Ministry of Information and Communications, issuing the list of technical standards on application of information technology to activities of state regulatory authorities.

- Digital signature data field provides information about the signing time (the SigningTime tab put inside the following tabs: Signature\Object\SignatureProperties\SignatureProperty). The SigningTime tab contains date and time data in accordance with regulations laid down in clause 2 of Section IV in Part I.

- URI property of Reference tabs of the XML Signature Syntax and Processing standard is used for determining data fields where each datum and message needs to be digitally signed, and even the signing time is required.

5. Messages exchanged between T-VAN or TCKNGTT and tax authority

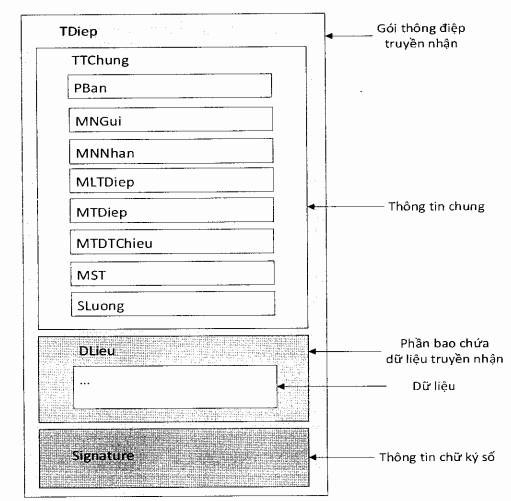

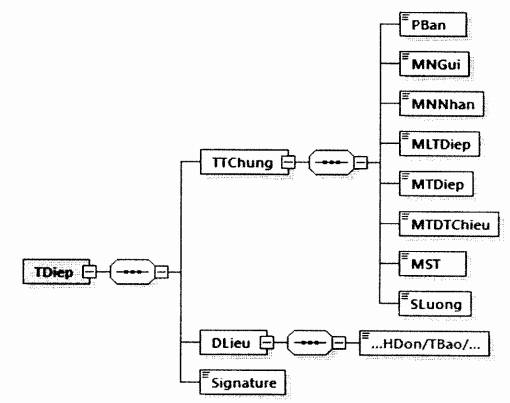

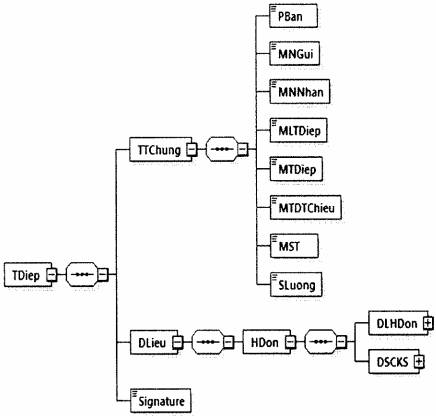

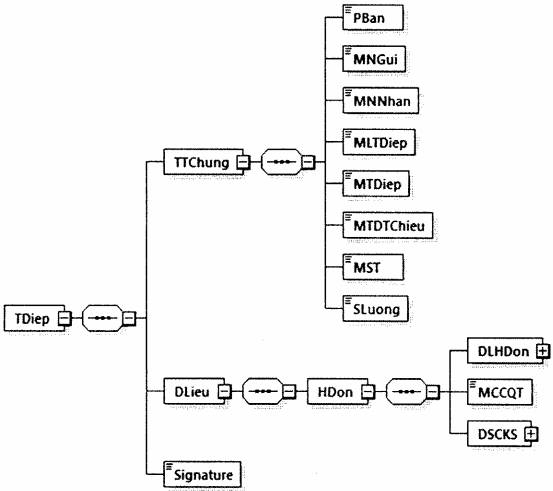

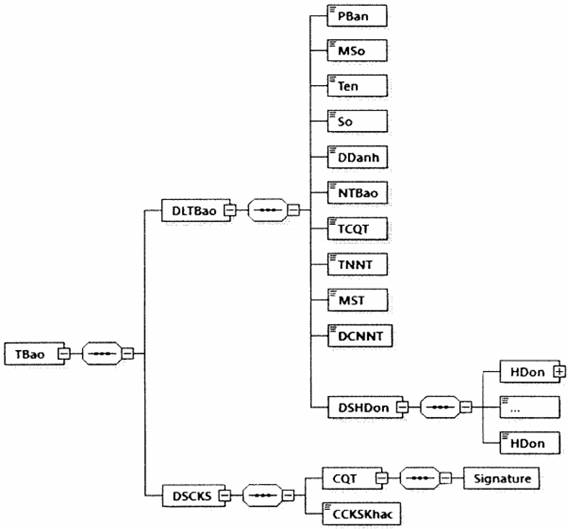

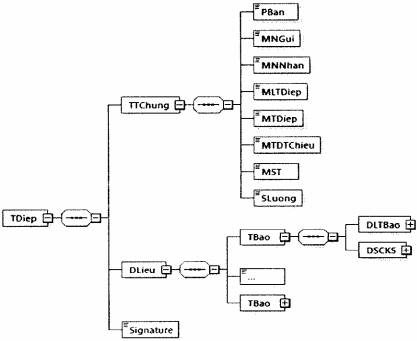

A message is formatted into 3 parts: General information (TTChung), data (DLieu) and digital signature (Signature) are described as follows:

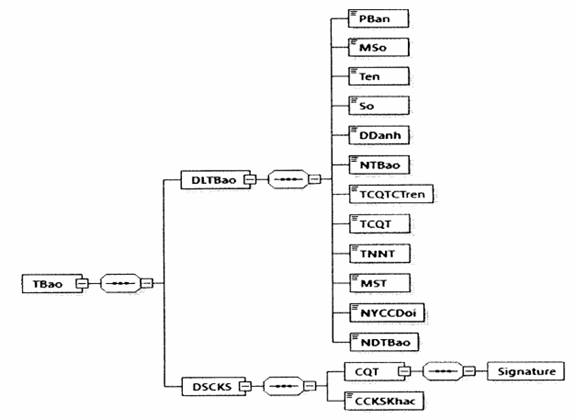

Image 1: Format of a message explained in the block chart

Image 2: Format of a message explained in the tree diagram

Where:

- General information (TTChung) part: Containing information about application version, sender’s code, recipient’s code, code of message type, message code, reference message code, TIN, quantity.

- Data (DLieu) part: Containing information about invoice, cancellation notice, request, chart of e-invoice data sent to tax authority, etc., which are defined in Section II herein.

- Digital signature (Signature) part: Containing information about the sender’s digital signature.

Detailed format of a message is described by the following table:

|

Data functions |

Tabs |

Maximum length |

Data type |

Required/optional |

|

TDiep tab contains exchanged information, including general information, specific information and digital signature information |

||||

|

TDiep\TTChung tab contains general information conveyed by a message |

||||

|

Message version (In these Regulations, the 1.0.0 version is used) |

PBan |

6 |

String |

Required |

|

Sender’s code |

MNGui |

13 |

String |

Required |

|

Recipient’s code |

MNNhan |

13 |

String |

Required |

|

Message classification code |

MLTDiep |

3 |

Numeric |

Required |

|

Message code |

MTDiep |

25 |

String |

Required |

|

Reference message code |

MTDTChieu |

25 |

String |

Optional |

|

Tax Identification Number (Taxpayer’s TIN) |

MST |

14 |

String |

Required |

|

Quantity |

SLuong |

7 |

Numeric |

Required |

|

TDiep\DLieu tab contains the data part of a message |

||||

|

TDiep tab contains digital signature information (digitally signing on the entire message) |

||||

|

Digital signature |

Signature |

|

|

Required |

Detailed description:

- General information (TTChung) part:

+ Sender’s code (MNGui), recipient’s code (MNNhan) is TCT with respect to a tax authority; is the taxpayer’s MST (TIN) code without the mark "-" with respect to T-VAN or TCKNGTT.

Example: Company A's MST (TIN) is 0107001729-001.

If company A sends data to a tax authority, MNGui and MNNhan will be 0107001729001 and TCT, respectively.

If the tax authority sends data to company A, MNGui and MNNhan will be TCT and 0107001729001., respectively.

+ Message classification code is the code describing the type of the sent/received message. More details shall be given in the Appendix I hereto.

+ Message code is created by the sender’s system, ensuring uniqueness across the entire system, and is formatted like: MNGui + Y1Y2 + N1N2N3N4N5N6N7N8N9N10N11N12, where: Y1, Y2 denotes 2 ending digits indicating the sending year; N1 through N10 denotes digits ranging from 0 to 9.

Example: Company A's MST (TIN) is 0107001729-001.

If company A sends data to a tax authority in 2021, the message code created will be 0107001729001210000000001.

If a tax authority sends data to company A in 2021, the message code created will beTCT210000000001.

+ Reference message code is created with respect to response messages and valued as an arriving message code.

Example: T-VAN A’s MST is 0107001729.

If T-VAN A sends company B’s e-invoice data to the tax authority issuing the identification/verification code in 2021, a message code will be created as 0107001729210000000001.

If a tax authority responds with an issued code, then the message code and the reference message code will be TCT210000000001 and 0107001729210000000001, respectively.

+ Tax identification number (MST) is the tax identification number of the taxpayer whose data are sent in a message.

+ Quantity (SLuong) is total number of data (total number of invoices without identification/verification codes, total number of charts of data on invoices without identification/verification codes, etc.) inside the Dlieu tab of the message.

Example: If T-VAN A concurrently sends a tax authority all of 4 e-invoices without identification/verification codes of company B in 2021, the value of the Quantity (SLuong) function in a sent message will be 4.

- Data (DLieu) part: Each message contains a particular data type of a taxpayer. Data types may be data on e-invoices with identification/verification codes, e-invoices without identification/verification codes and other data. With respect to data on invoices without identification/verification codes, each message only contains e-invoice data.

- Digital signature (Signature) part: This part contains information about the sender’s digital signature (e.g. T-VAN, TCKNGTT or tax authority) and digital signature shall be affixed onto all data of a message.

- The maximum storage capacity of a message is 2 MB.

6. QR Codes on e-invoices

a) Data represented in a QR Code

Value of a data object in a QR Code presented on the merchant side is formatted as follows:

|

No. |

Name of data type |

Definition |

|

1 |

Sequence of numeric characters |

Is a format of numeric characters, including 10 characters ranging from “0” to “9” |

|

2 |

Sequence of special numeral characters |

Is a format of special numeral characters regulated by EMV Book 4, including 96 characters composed of alphabetical, numeric characters and the mark (.) |

|

3 |

String |

Is precomposed character sets stipulated under the Unicode character standard |

Details about the representation of QR code data shall be subject to point d of clause 6 of this section.

b) Formating of QR code data objects in e-invoices

QR code data are formed as follows: Each data object is made up of three individual fields, including: (1) reference data object identification (ID) field; (2) length field that explicitly indicates the number of characters included in the value field; (3) value field. Fields are coded as follows:

- ID field is coded as a two-digit numeric value, with a value ranging from “00” to “99”;

- Length field is coded as a two-digit numeric value, with a value ranging from “01” to “99”;

- Value field has a minimum length of one character and a maximum length of 99 characters.

If the value field is blank (length is zero), ID field, length field and value field shall not be entered into QR code data.

c) Detailed description of components of QR code data

Formats, lengths, representation forms and definitions of data objects are specified in the following chart. Characters are stored in data fields in the Unicode UTF-8 format.

|

Field description |

ID |

Data types |

Length |

Required/optional |

Remarks |

|

QR Code Specification version |

"00" |

Sequence of numeric characters |

2 |

Required |

In this Regulation, the value of “01” |

|

Information fields for invoice payments (if any) |

|||||

|

Generation method |

"01" |

Sequence of numeric characters |

2 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Information about a merchant’s number |

"02"-"03" |

Sequence of special numeric characters |

Max. 99 |

Required (at least a data object identifying a merchant) |

Details provided at Point d of Clause 6 in this Section |

|

"04"-"05" |

|||||

|

"06"-"08" |

|||||

|

"09"-"10" |

|||||

|

"11"-"12" |

|||||

|

“13"-"14" |

|||||

|

"15"-"16" |

|||||

|

"17"-"25" |

|||||

|

"26"-"51" |

|||||

|

Globally Unique Identifier - GUID |

“26-00” |

Sequence of special numeric characters |

Max. 32 |

Required |

Details provided at Point d of Clause 6 in this Section |

|

Merchant ID |

“26-01” |

String |

Max. 14 |

Required |

Details provided at Point d of Clause 6 in this Section |

|

Merchant category code |

“52” |

Sequence of numeric characters |

4 |

Required |

Details provided at Point d of Clause 6 in this Section |

|

Currency code |

"53" |

Sequence of numeric characters |

3 |

Required |

This field’s value conforming to ISO 4217 standard, and converted from the Invoice Currency Unit function (DVTTe tab). Example: Vietnam Dong is represented by the value of “704”. |

|

Transaction value |

"54" |

Sequence of special numeric characters |

Max. 13 |

Required |

Details provided at Point d of Clause 6 in this Section |

|

Country code |

"58” |

Sequence of special numeric characters |

2 |

Required |

Details provided at Point d of Clause 6 in this Section |

|

Merchant’s name |

"59" |

Sequence of special numeric characters |

Max. 25 |

Required |

Details provided at Point d of Clause 6 in this Section |

|

City |

"60" |

Sequence of special numeric characters |

Max. 15 |

Required |

Details provided at Point d of Clause 6 in this Section |

|

Postal code |

"61" |

Sequence of special numeric characters |

Max. 10 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Additional information |

"62" |

String |

Max. 99 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Invoice/receipt number |

“62-01” |

Sequence of special numeric characters |

Max. 25 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Store code |

“62-03” |

Sequence of special numeric characters |

Max. 25 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Code of a merchant’s point of sale/terminal device |

“62-07” |

Sequence of special numeric characters |

Max. 25 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Transaction purpose |

“62-08” |

Sequence of special numeric characters |

Max. 25 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Request for customer’s additional data |

“62-09” |

Sequence of special numeric characters |

Max. 3 |

Optional |

Details provided at Point d of Clause 6 in this Section |

|

Information fields for invoice search (if any) |

|||||

|

Invoice information |

“99” |

String |

Max. 99 |

Optional |

|

|

Globally Unique Identifier - GUID |

“99-00” |

Sequence of special numeric characters |

Max. 13 |

Optional |

This field accepts the value of the seller’s Tax Identification Number function on the invoice (MST tab inside NBan tab). In case of TIN of a branch, the mark "-" must be omitted. Example: If the seller’s MST tab has the value of “0107001729-001”, this field’s value will be “0107001729001”. |

|

Invoice form symbol |

“99-01” |

String |

1 |

Optional |

This field’s value is the invoice form symbol function (KHMSHDon tab). Example: 1. |

|

Invoice symbol |

“99-02” |

String |

6 |

Optional |

This field’s value is the invoice symbol function (KHHDon tab). Example: C21TYY. |

|

Invoice number |

“99-03” |

String |

Max. 8 |

Optional |

This field’s value is the invoice number function (SHDon tab). Example: 68. |

|

Invoice date |

“99-04” |

String |

8 |

Optional |

This field’s value is the invoicing date function (TDLap tab), using the format YYYYMMDD. Example: 20211121. |

|

Total payment written in numbers |

“99-05” |

Sequence of special numeric characters |

Max. 20 |

Optional |

This field’s value is the function of total payment in numbers (TgTTTBSo tab). |

|

Information fields for for checking and verification |

|||||

|

Cyclic Redundancy Check CRC (Checksum) code |

"63" |

Sequence of special numeric characters |

4 |

Required |

Details provided at Point d of Clause 6 in this Section |

The chart above providing a minimum of QR code data fields is used for invoice search and payment (where needed). Merchants may add other information in accordance with SBV’s regulations.

See examples of e-invoice QR Code in the Appendix XII hereto.

d) Details about QR Code format used in the payment sector in Vietnam

![]() Detailed

information about QR code format used in the payment sector in Vietnam is

regulated under the Decision No. 1928/QĐ-NHNN (Technical specification of QR Code

presented on the merchant side in Vietnam).

Detailed

information about QR code format used in the payment sector in Vietnam is

regulated under the Decision No. 1928/QĐ-NHNN (Technical specification of QR Code

presented on the merchant side in Vietnam).

Part II

FORMATS OF COMPONENTS CONTAINING ELECTRONIC INVOICE DATA

I. Data components used for e-invoicing registration/change of e-invoice access information, and the on-demand request for issuance of e-invoices with tax authority's identification/verification codes

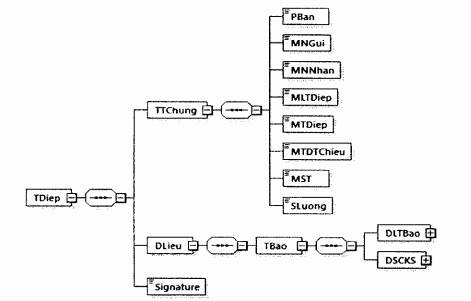

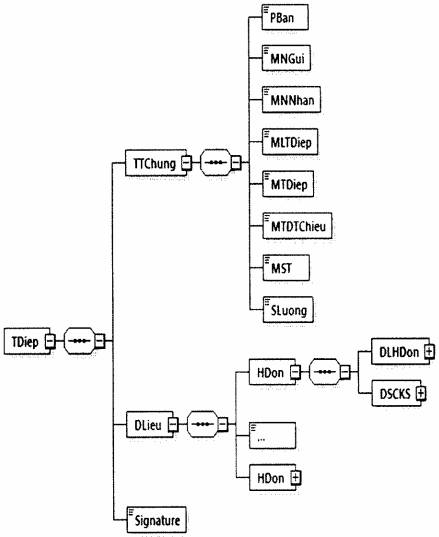

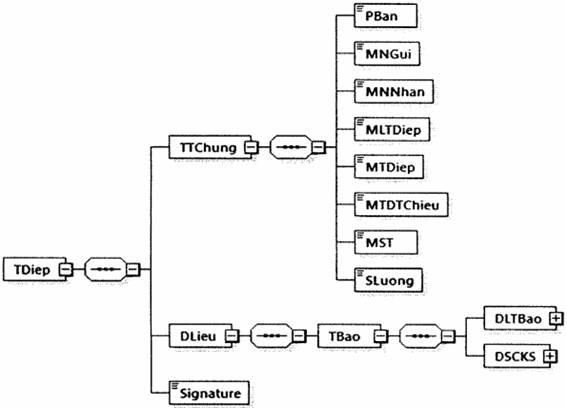

1. Format of data in the form of e-invoicing registration/the request form for change in e-invoice access information

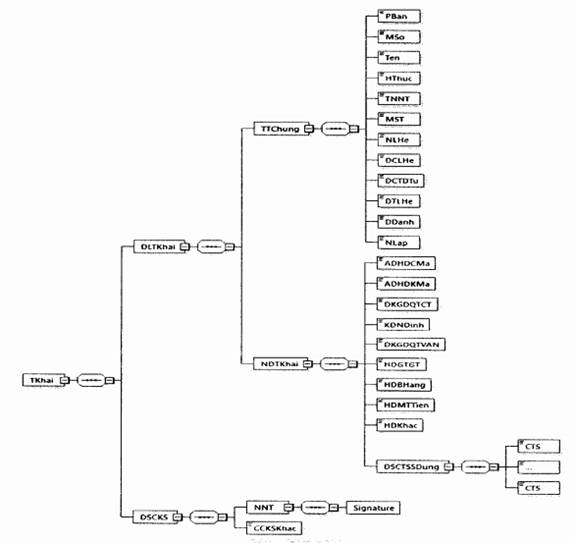

a) The form shall be formatted as follows:

Image 3: Format of the form of e-invoicing registration/the request form for change in e-invoice access information

b) Detailed format of the form is described in the following table:

|

Data functions |

Tab name |

Maximum length |

Data types |

Required/optional |

|

TKhai tab contains form data and taxpayer’s digital signature |

||||

|

TKhai\DLTKhai tab contains form data, including: General information and detailed information included in the form |

||||

|

TKhai\DLTKhai\TTChung tab contains general information of the form |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Form number (number of the form) |

MSo |

1 |

Numeric (Details proviced in Appendix III hereto). |

Required |

|

Name (Name of the form) |

Ten |

100 |

String |

Required |

|

Form of e-invoicing registration/change in e-invoice access information |

HThuc |

1 |

Numeric (1: Registration; 2: Change) |

Required |

|

Taxpayer’s name |

TNNT |

400 |

String |

Required |

|

Tax identification number |

MST |

14 |

String |

Required |

|

Contact person |

NLHe |

50 |

String |

Required |

|

Contact address |

DCLHe |

400 |

String |

Required |

|

Email address |

DCTDTu |

50 |

String |

Required |

|

Contact phone |

DTLHe |

20 |

String |

Required |

|

Place name |

DDanh |

50 |

String |

Required |

|

Date of issue |

NLap |

|

Date |

Required |

|

TKhai\DLTKhai\NDTKhai tab contains detailed information included in the form |

||||

|

Is this applicable to invoices with identification/verification codes? |

ADHDCMa |

1 |

Boolean (0: False; 1: True) |

Required |

|

Is this applicable to invoices without identification/verification codes? |

ADHDKMa |

1 |

Boolean (0: False; 1: True |

Required |

|

Is registration for transaction 1 made through General Department of Taxation (Is registration for transaction made through the website of the General Department of Taxation?) |

DKGDQTCT |

1 |

Boolean (0: False; 1: True |

Required |

|

Clause, Article, Decree (According to Clause, Article of Decree) |

KDNDinh |

100 |

String |

Required in case of registration for transaction made through General Department of Taxation’s website |

|

Is registration of transaction made via T-VAN? |

DKGDQTVAN |

1 |

Boolean (0: False; 1: True |

Required |

|

VAT invoice (Is VAT invoice used?) |

HDGTGT |

1 |

Boolean (0: False; 1: True |

Required |

|

Sale invoice (Is sale invoice used?) |

HDBHang |

1 |

Boolean (0: False; 1: True |

Required |

|

Cash register invoice (Is an invoice generated by a cash register is used?) |

HDMTTien |

1 |

Boolean (0: False; 1: True |

Required |

|

Other invoice (Is other invoice used?) |

HDKhac |

1 |

Boolean (0: False; 1: True |

Required |

|

TKhai\DLTKhai\NDTKhai\DSCTSSDung tab contains listed digital certificates in use |

||||

|

TKhai\DLTKhai\NDTKhai\DSCTSSDung\CTS tab contains details of the digital certificate in use |

||||

|

Ordinal number |

STT |

3 |

Numeric |

Optional |

|

Institution’s name (Name of the authority or entity authenticating/issuing/endorsing digital signatures or electronic signatures) |

TTChuc |

400 |

String |

Required |

|

Serial numbers of digital certificate |

Seri |

40 |

String |

Required |

|

From date (Digital certificate is valid from (date)…) |

TNgay |

|

Date and time |

Required |

|

To (date)… (Digital certificate expires on (date)) |

DNgay |

|

Date and time |

Required |

|

Form (Form of registration) |

HThuc |

1 |

Numeric (1: Add; 2: Extend; 3: Stop using) |

Required |

|

TKhai\DSCKS tab contains details of digital signature, including taxpayer’s digital signature and other (if any). |

||||

|

TKhai\DSCKS\NNT tab contain details of digital signature of the taxpayer or legal representative (affixed onto TKhai\DLTKhai tab) |

||||

|

Digital signature |

Signature |

|

|

Required |

|

TKhai\DSCKS\CCKSKhac tab contains other digital signature (if any). |

||||

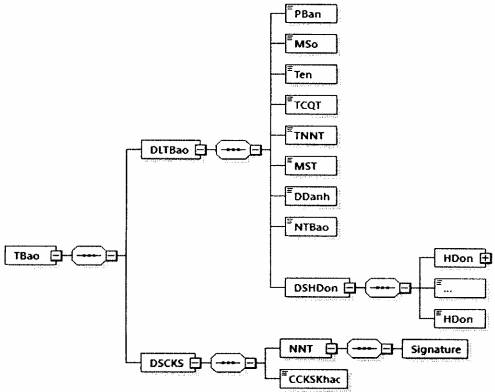

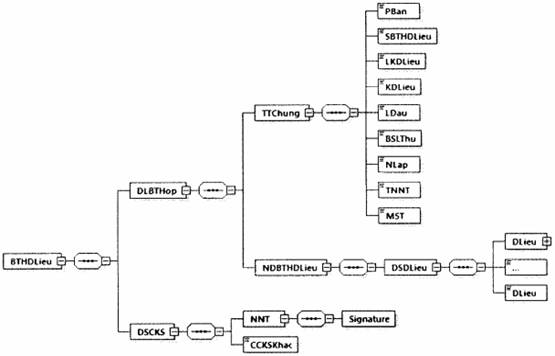

2. Format of data included in a notice of acceptance/rejection for use of e-invoices

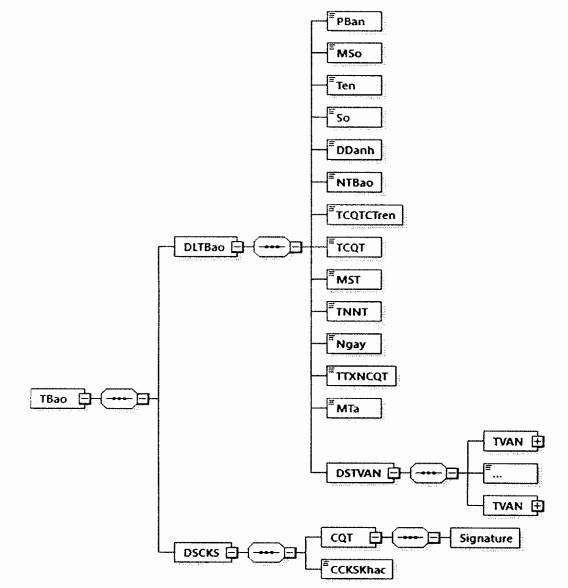

a) A notice shall be formatted as follows:

Image 4: Format of data included in a notice of acceptance/rejection for e-invoicing registration/change of e-invoice access information

b) Detailed format of the form is described in the following table:

|

Data functions |

Tab name |

Maximum length |

Data types |

Required/optional |

|

TBao tab contains data included in a notice and digital signature of the tax authority |

||||

|

TBao\DLTBao tab contains data included in a notice |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Form number (Notice form number) |

MSo |

1 |

Numeric (Details proviced in Appendix III hereto). |

Required |

|

Name (Notice’s name) |

Ten |

255 |

String |

Required |

|

Number (Notice number) |

So |

30 |

String |

Required |

|

Place name |

DDanh |

50 |

String |

Required |

|

Notification date |

NTBao |

|

Date |

Required |

|

Supervisory tax authority’s name |

TCQTCTren |

100 |

String |

Required |

|

Tax authority’s name (Name of the issuing tax authority) |

TCQT |

100 |

String |

Required |

|

Tax identification number |

MST |

14 |

String |

Required |

|

Taxpayer’s name |

TNNT |

400 |

String |

Required |

|

Date (Date of registration/change) |

Ngay |

|

Date |

Required |

|

Status of tax authority’s confirmation |

TTXNCQT |

1 |

Numeric (Details provided in Appendix XI hereto). |

Required |

|

Remarks |

MTa |

400 |

String |

Required |

|

TBao\DLTBao\DSTVAN tab contains listed intermediary service providers of e-invoice solution trusted by tax authorities (if any). |

||||

|

TBao\DLTBao\DSTVAN\TVAN tab contains the name and registered address. This tab is repeated multiple times, depending on the number of T-VAN organizations trusted by tax authorities |

||||

|

Name (Name of the intermediary service provider of e-invoice solution trusted by the tax authority) |

Ten |

400 |

String |

Required |

|

Registered address (Registered address of the intermediary service provider of e-invoice solution trusted by the tax authority) |

DCDKy |

400 |

String |

Required |

|

TBao\DSCKS tab contains details of digital signature, including tax authority’s digital signature and other digital signature (if any) |

||||

|

TBao\DSCKS\CQT tab contains information of tax authority’s digital signature (affixed onto TBao\DLTBao tab) |

||||

|

Digital signature |

Signature |

|

|

Required |

|

TBao\DSCKS\CCKSKhac tab contains other digital signature (if any). |

||||

3. Format of data included in a notice of expiration of an e-invoice with identification/verification code issued through the website of the General Department of Taxation/under authorization given an intermediary service provider of e-invoice solution; of ineligibility for use of e-invoices without identification/verification codes.

a) A notice shall be formatted as follows:

Image 5: Format of data included in a notice of expiration of an e-invoice with identification/verification code issued through the website of the General Department of Taxation/under authorization given an intermediary service provider of e-invoice solution. This format is not used for e-invoices without identification/verification codes.

b) Detailed format of a notice is described in the following table:

|

Function |

Tab name |

Maximum length |

Data type |

Required/optional |

|

TBao tab contains data included in a notice of expiration of e-invoice with identification/verification code and digital signature of decision-making officer or authority |

||||

|

TBao\DLTBao tab contains data included in a notice |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Form number (Notice form number) |

MSo |

1 |

Numeric (Details proviced in Appendix III hereto). |

Required |

|

Name (Notice’s name) |

Ten |

255 |

String |

Required |

|

Number (Notice number) |

So |

30 |

String |

Required |

|

Place name |

DDanh |

50 |

String |

Required |

|

Notification date |

NTBao |

|

Day and month |

Required |

|

Supervisory tax authority’s name |

TCQTCTren |

100 |

String |

Required |

|

Tax authority’s name (Name of the issuing tax authority) |

TCQT |

100 |

String |

Required |

|

Taxpayer’s name |

TNNT |

400 |

String |

Required |

|

Tax identification number |

MST |

14 |

String |

Required |

|

Transformation request date |

NYCCDoi |

|

Day and month |

Required |

|

Notice contents |

NDTBao |

400 |

String |

Required |

|

TBao\DSCKS tab contains details of digital signature, including tax authority’s digital signature and other digital signature (if any). |

||||

|

TBao\DSCKS\CQT tab contains information of tax authority’s digital signature (affixed onto TBao\DLTBao tab) |

||||

|

Digital signature |

Signature |

|

|

Required |

|

TBao\DSCKS\CCKSKhac tab contains other digital signatures (if any). |

||||

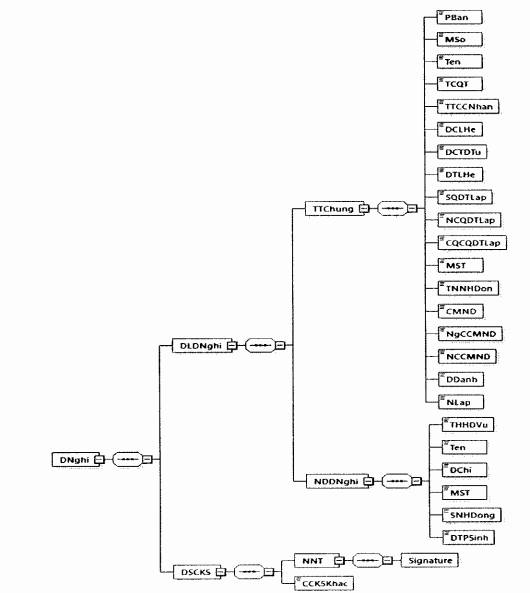

4. Format of data of an on-demand request for issuance of e-invoice with identification/verification code

a) The request shall be formatted as follows:

Image 6: Format of data of an on-demand request for issuance of e-invoice with identification/verification code

b) Detailed format of the request is described in the following table:

|

Function |

Tab name |

Maximum length |

Data type |

Required/optional |

|

DNghi tab contains data of the on-demand request for issuance of e-invoice with identification/verification code and taxpayer’s digital signature |

||||

|

DNghi\DLDNghi tab contains data of the on-demand request for issuance of e-invoice with identification/verification code, and details of the request |

||||

|

DNghi\DLDNghi\TTChung tab contains general information |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Form number (number of the request form) |

MSo |

1 |

Numeric (Details provided in Appendix III hereto). |

Required |

|

Title (Request title) |

Ten |

100 |

String |

Required |

|

Tax authority’s name (Name of the issuing tax authority) |

TCQT |

100 |

String |

Required |

|

Name of the requesting organization or individual |

TTCCNhan |

400 |

String |

Required |

|

Contact address |

DCLHe |

400 |

String |

Required |

|

Email address |

DCTDTu |

50 |

String |

Required |

|

Contact phone |

DTLHe |

20 |

String |

Required |

|

Number of establishment decision (Number of the decision on establishment of the requesting organization) |

SQDTLap |

50 |

String |

Optional |

|

Date of establishment decision (Date of issuance of decision on establishment of the requesting organization) |

NCQDTLap |

|

Date |

Optional |

|

Authority granting establishment decision |

CQCQDTLap |

200 |

String |

Optional |

|

Tax identification number |

MST |

14 |

String |

Optional |

|

Invoice recipient’s name |

TNNHDon |

50 |

String |

Required |

|

ID card (Number of invoice recipient’s ID card) |

CMND |

12 |

String |

Required |

|

Date of issuance of ID card (Date of issuance of invoice recipient’s ID card) |

NgCCMND |

|

Date |

Required |

|

Place of issuance of ID card (Place of issuance of invoice recipient’s ID card) |

NCCMND |

100 |

String |

Required |

|

Place name |

DDanh |

50 |

String |

Required |

|

Request date |

NLap |

|

Date |

|

|

DNghi\DLDNghi\NDDNghi tab contains contents of the request |

||||

|

Description of invoiced goods and services |

THHDVu |

500 |

String |

Required |

|

Name (Name of commodity or service buyer) |

Ten |

400 |

String |

Required |

|

Address (Address of commodity or service buyer) |

DChi |

400 |

String |

Required |

|

Tax identification number (Tax identification number of commodity or service buyer) |

MST |

14 |

String |

Optional |

|

Number and date of contract (Number and date of commodity and service sale and purchase contract) |

SNHDong |

150 |

String |

Optional |

|

Revenue earned |

DTPSinh |

19,4 |

Numeric |

Required |

|

DNghi\DSCKS tab contains details of digital signature, including taxpayer’s digital signature and other digital signature (if any). |

||||

|

DNghi\DSCKS\NNT tab contains information about taxpayer’s digital signature (affixed onto DLDNghi tab) |

||||

|

Taxpayer’s digital signature |

Signature |

|

|

Required |

|

DNghi\DSCKS\CCKSKhac tab contains other digital signature (if any). |

||||

5. Notification message of expiration of an e-invoice with identification/verification code issued through the website of the General Department of Taxation/under authorization given an intermediary service provider of e-invoice solution; of ineligibility for use of e-invoices without identification/verification codes.

a) The message shall be formatted as follows:

Image 7: Format of a notification message of expiration of an e-invoice with identification/verification code issued through the website of the General Department of Taxation/under authorization given an intermediary service provider of e-invoice solution; of ineligibility for use of e-invoices without identification/verification codes.

- Notification message of expiration of an e-invoice with identification/verification code issued through the website of the General Department of Taxation/under authorization given an intermediary service provider of e-invoice solution; of ineligibility for use of e-invoices without identification/verification codes.

- General format of the message is described in clause 5 of section IV in Part I.

b) Detailed format of a notification message of expiration of an e-invoice with identification/verification code issued through the website of the General Department of Taxation/under authorization given an intermediary service provider of e-invoice solution is described in clause 3 of section I in Part II.

II. Data components applicable to the process for issuing and sending e-invoices to tax authorities

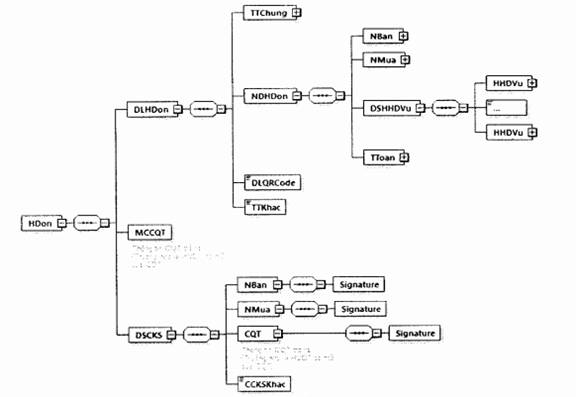

1. General e-invoice format

An e-invoice shall be formatted as follows:

Image 8: E-invoice format

Each e-invoice is composed of the following data components:

- <HDon> tab contains all data included in an e-invoice.

- <HDon> tab is structured into the following sections:

+ <DLHDon/> tab contains data of the e-invoice issued by the seller:

<TTChung> tab contains general information of the invoice (e.g. invoice title, invoice form symbol, invoice symbol and number, invoice date, ...)

<NDHDon> tab contains information about contents of the invoice (e.g. seller, buyer, goods or services, payment,…)

DLQRCode tab contains QR Code data serving the purposes of searching and paying e-invoices (if any). Details about the format of this tab is provided in clause 6 of section IV in Part I.

■ <TTKhac> tab contains taxpayer’s additional information (if any). The tab has the maximum storage capacity of 500 characters. <TTKhac> tab can be put in multiple positions inside <DLHDon> tab. The format of <TTKhac> tab shall be as follows:

<TTKhac>

<TTin>

<TTruong>Mã hàng hóa (commodity code)</TTruong>

<KDLieu>string</KDLieu>

<DLieu>MHH01</DLieu>

</TTin>

……

</TTKhac>

Where:

<TTruong> tab contains the name of the data field that need to be presented on the e-invoice.

<KDLieu> tab contains types of data on information that needs to be displayed (e.g. string/numeric,…)

<DLieu> tab contains data to be presented.

Detailed format of other part of information is described in the following table:

|

Function description |

Tab name |

Data type |

Required/optional |

|

Field title |

TTruong |

String |

Required |

|

Data type |

KDLieu |

String (Details provided in Appendix III hereto). |

Required |

|

Data |

DLieu |

String |

Required |

+ <MCCQT> tab contains data of tax authority’s code, is created by the tax authority and applied to e-invoices with identification/verification codes (This tab does not appear in invoices that taxpayers send to tax authorities to apply for their identification/verification codes). Details about this tab are regulated in clause 3 of section IV in Part I.

+ <DSCKS> tab contains data of the digital signature of the seller, buyer and tax authority (with respect to e-invoices with identification/verification codes) and other digital signature (if any). Where:

■ <NBan> tab contains the seller/vendor’s digital signature affixed onto all data inside <DLHDon> tab.

■ <NMua> tab contains data of the buyer/purchaser’s digital signature put inside the information part of digital signature <DSCKS>. The buyer’s digital signature is not required.

■ Other digital signature (if any) may be defined and managed by taxpayers, and put inside CCKSKhac tab.

Detailed information put inside <DLHDon/>, <MCCQT/> and <DSCKS/> tabs are defined in detail under clause 2 of section II in Part II.

2. Electronic data formatting

a) Value added tax invoice

|

Function description |

Tab name |

Maximum length |

Data type |

Required/optional |

|

Hdon tab contains e-invoice data and digital signature information |

||||

|

HDon\DLHDon tab contains general information, detailed information about invoice, QR Code data and other information defined by sellers on their own |

||||

|

HDon\DLHDon\TTChung tab contains general information about an invoice |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Invoice title |

THDon |

50 |

String |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice form symbol |

KHMSHDon |

1 |

Numeric (Details provided in Appendix II hereto). |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice symbol |

KHHDon |

6 |

String |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice number |

SHDon |

8 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice date |

TDLap |

|

Date |

Required |

|

Currency unit |

DVTTe |

3 |

String (details provided in clause 2 of section IV in Part I) |

Required |

|

Forex rate |

TGia |

7,2 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\TTChung\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon tab contains invoice contents, including: Information about seller, buyer, indexed commodities and services, and payment details on an invoice |

||||

|

HDon\DLHDon\NDHDon\Nban tab contains name, address and TIN of the seller |

||||

|

Name |

Ten |

400 |

String |

Required |

|

Tax identification number |

MST |

14 |

String |

Required |

|

Address |

DChi |

400 |

String |

Required |

|

HDơn\DLHDon\NDHDon\NBan\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\NMua tab contains name, address and TIN of the buyer |

||||

|

Name |

Ten |

400 |

String |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Tax identification number |

MST |

14 |

String |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Address |

DChi |

400 |

String |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\NDHDon\NMua\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\DSHHDVu tab contains indexed commodities or services |

||||

|

HDon\DLHDon\NDHDon\DSHHDVu\HHDVu tab contains details of 01 line of commodity or service |

||||

|

Attributes/characteristics |

TChat |

1 |

Numeric (Details provided in Appendix IV hereto) |

Optional |

|

Ordinal number |

STT |

4 |

Numeric |

Optional |

|

Name |

Ten |

500 |

String |

Required |

|

Unit |

DVTinh |

50 |

String |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Quantity |

SLuong |

19,4 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Unit price |

DGia |

19,4 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Discount rate (used in case of presenting discount information in columns corresponding to specific commodities or services) |

TLCKhau |

6,4 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Discount amount (used in case of presenting commission information in columns corresponding to specific commodities or services) |

STCKhau |

19,4 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Total (Amount before VAT) |

ThTien |

19,4 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Tax rate (VAT tax rate) |

TSuat |

5 |

String (Details provided in Appendix V hereto). |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\NDHDon\DSHHDVu\HHDVu\TTkhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\TToan tab contains invoice payment information |

||||

|

HDon\DLHDon\NDHDon\TToan\THTTLTSuat tab contains information of all e-invoices specific to tax rates |

||||

|

HDon\DLHDon\NDHDon\TToan\THTTLTSuat\LTSuat tab contains detailed information of all e-invoices specific to tax rates |

||||

|

Tax rate (VAT tax rate) |

TSuat |

5 |

String (Details provided in Appendix V hereto). |

Required |

|

Total (Amount before VAT) |

ThTien |

19,4 |

Numeric |

Required |

|

Tax amount (VAT amount) |

TThue |

19,4 |

Numeric |

Required |

|

HDon\DLHDon\NDHDon\TToan tab contains information about invoiced payment amount and tax amount |

||||

|

Total before tax (Total amount before VAT) |

TgTCThue |

19,4 |

Numeric |

Required |

|

Total tax (Total VAT amount) |

TgTThue |

19,4 |

Numeric |

Required |

|

HDon\DLHDon\NDHDon\TToan\DSLPhi tab contains listed fees and charges (if any) |

||||

|

HDon\DLHDon\NDHDon\TToan\DSLPhi\Lphi tab contains details of specific fees and charges. This tab may be repeated multiple times, depending on the number of fees and charges. |

||||

|

Description |

TLPhi |

100 |

String |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Amount |

TPhi |

19,4 |

Numeric |

Required (except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

The following functions are put inside HDon\DLHDon\NDHDon\TToan tab |

||||

|

Total discount |

TTCKTMai |

19,4 |

Numeric |

Optional |

|

Total written in numbers |

TgTTTBSo |

19,4 |

Numeric |

Required |

|

Total written in words |

TgTTTBChu |

255 |

String |

Required |

|

HDon\DLHDon\VDHDon\TToan\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

The following functions are put inside HDon\DLHDon tab and placed behind NDHDon tab |

||||

|

QR Code data (details provided in clause 6 of section IV in Part I) |

DLQRCode |

512 |

String |

Optional |

|

HDon\DLHDon\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

If any e-invoice with identification/verification code conforms to requirements for grant of identification/verification codes, the tax authority’s system shall return to the function of tax authority’s Code on e-invoice (MCCQT tab put inside Hdon tab) |

||||

|

Tax authority’s identification/verification code (Tax authority’s identification/verification code presented on e-invoice) |

MCCQT |

12 |

String |

Required |

|

HDon\DSCKS tab contains details of digital signature, including digital signature of the seller, the buyer, the tax authority and other digital signature (if any). |

||||

|

HDon\DSCKS\NBan tab contains information about the seller’s digital signature |

||||

|

Seller’s digital signature (subject to regulations laid down in point dd of clause 1 of Article 3 in the Circular No. 68/2019/TT-BTC) |

Signature |

|

|

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DSCKS\NMua tab contains information about the buyer’s digital signature (if any) |

||||

|

Buyer’s digital signature (subject to regulations laid down in point dd of clause 1 of Article 3 in the Circular No. 68/2019/TT-BTC) |

Signature |

|

|

Optional |

|

If any e-invoice conforms to requirements for grant of identification/verification codes, the tax authority’s system shall return to the e-invoice function and add CQT tab (put inside HDon\DSCKS tab) containing information about the digital signature of the tax authority (affixed onto HDon\MCCQT tab and HDon\DLHDon tab) |

||||

|

Tax authority’s digital signature |

Signature |

|

|

Required |

|

HDon\DSCKS\CCKSKhac tab contains other digital signature (if any). |

||||

- In order to replace any faulty e-invoice, the substitute e-invoice must add the following information to the <TTChung/> tab and after the <TDLap/> tab:

|

Function description |

Tab name |

Maximum length |

Data type |

Required/optional |

|

Replaced invoice type |

HTHDBTThe |

1 |

Numeric (Details provided in Appendix VI hereto) |

Optional |

|

Replaced invoice date |

TDLHDBTThe |

|

Date |

Required |

|

Replaced invoice form symbol |

KHMSHDBTThe |

11 |

String (Details provided in Appendix II hereto). |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Replaced invoice symbol |

KHHDBTThe |

8 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Replaced invoice number |

SHDBTThe |

8 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

b) E-invoices for sale of goods

|

Function description |

Tab name |

Maximum length |

Data type |

Required/optional |

|

HDon tab contains information about e-invoice data and digital signature |

||||

|

HDon\DLHDon tab contains general information, detailed contents of an e-invoice, QR Code data and other information defined by the seller on their own |

||||

|

HDon\DLHDon\TTChung tab contains general information about an invoice |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Invoice title |

THDon |

50 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice form symbol |

KHMSHDon |

1 |

Number (Details provided in Appendix II hereto). |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice symbol |

KHHDon |

6 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice number |

SHDon |

8 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice date |

TDLap |

|

Date |

Required |

|

Currency unit |

DVTTe |

3 |

String (Details provided in clause 2 of section IV in Part I) |

Required |

|

Forex rate |

TGia |

7,2 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\TTChung\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon tab contains invoice contents, including: Information about seller, buyer, indexed commodities and services, and payment details of the e-invoice |

||||

|

HDon\DLHDon\NDHDon\Nban tab contains name, address and TIN of the seller |

||||

|

Name |

Ten |

400 |

String |

Required |

|

Tax identification number |

MST |

14 |

String |

Required |

|

Address |

DChi |

400 |

String |

Required |

|

HDon\DLHDon\NDHDon\NBan\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\NMua tab contains name, address and TIN of the buyer |

||||

|

Name |

Ten |

400 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Tax identification number |

MST |

14 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Address |

DChi |

400 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\NDHDon\NMua\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\DSHHDVu tab contains indexed commodities or services |

||||

|

HDon\DLHDon\NDHDon\DSHHDVu\HHDVu tab contains details of 01 line of commodity or service |

||||

|

Attributes/characteristics |

TChat |

1 |

Numeric (Details provided in Appendix IV hereto) |

Optional |

|

Ordinal number |

STT |

4 |

Numeric |

Optional |

|

Name |

Ten |

500 |

String |

Required |

|

Unit |

DVTinh |

50 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Quantity |

SLuong |

19,4 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Unit price |

DGia |

19,4 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Discount rate (used in case of presenting discount information in columns corresponding to specific commodities or services) |

TLCKhau |

6,4 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Discount amount (used in case of presenting commission information in columns corresponding to specific commodities or services) |

STCKhau |

19,4 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Total amount |

ThTien |

19,4 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\NDHDon\DSHHDVu\HHDVu\TTkhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\TToan tab contains information about invoiced payment amount |

||||

|

Total sum of invoiced goods or services |

TgTHHDVu |

19,4 |

Numeric |

Required |

|

HDon\DLHDon\NDHDon\TToan\DSLPhi tab contains listed fees and charges (if any) |

||||

|

HDon\DLHDon\NDHDon\TToan\DSLPhi\Lphi tab contains details of specific fees and charges. This tab may be repeated multiple times, depending on the number of fees and charges. |

||||

|

Description |

TLPhi |

100 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Amount |

TPhi |

19,4 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

The following functions are put inside HDon\DLHDon\NDHDon\TToan tab |

||||

|

Total discount |

TTCKTMai |

19,4 |

Numeric |

Optional |

|

Total written in numbers |

TgTTTBSo |

19,4 |

Numeric |

Required |

|

Total written in words |

TgTTTBChu |

255 |

String |

Required |

|

HDon\DLHDon\NDHDon\TToan\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

The following functions are put inside HDon\DLHDon tab and placed behind NDHDon tab |

||||

|

QR Code data (details provided in clause 6 of section IV in Part I) |

DLQRCode |

512 |

String |

Optional |

|

HDon\DLHDon\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

If any e-invoice with identification/verification code conforms to requirements for grant of identification/verification codes, the tax authority’s system shall return to the function of tax authority’s Code on e-invoice (MCCQT tab put inside HDon tab) |

||||

|

Tax authority’s identification/verification code (Tax authority’s identification/verification code presented on e-invoice) |

MCCQT |

12 |

String |

Required |

|

HDon\DSCKS tab contains details of digital signature, including digital signature of the seller, the buyer, the tax authority and other digital signature (if any). |

||||

|

HDon\DSCKS\NBan tab contains information about the seller’s digital signature |

||||

|

Seller’s digital signature (subject to regulations laid down in point dd of clause 1 of Article 3 in the Circular No. 68/2019/TT-BTC) |

Signature |

|

|

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DSCKS\NMua tab contains information about the buyer’s digital signature (if any) |

||||

|

Buyer’s digital signature (subject to regulations laid down in point dd of clause 1 of Article 3 in the Circular No. 68/2019/TT-BTC) |

Signature |

|

|

Optional |

|

If any e-invoice conforms to requirements for grant of identification/verification codes, the tax authority’s system shall return to the e-invoice function and add CQT tab (put inside HDon\DSCKS tab) containing information about the digital signature of the tax authority (affixed onto HDon\MCCQT tab and HDon\DLHDon tab) |

||||

|

Tax authority’s digital signature |

Signature |

|

|

Required |

|

HDon\DSCKS\CCKSKhac tab contains other digital signature (if any). |

||||

- In order to replace any faulty e-invoice, the substitute e-invoice must add the following information to the <TTChung/> tab and after the <TDLap/> tab:

|

Function description |

Tab name |

Maximum length |

Data type |

Required/optional |

|

Replaced invoice types |

HTHDBTThe |

1 |

Numeric (Details provided in Appendix VI hereto) |

Optional |

|

Replaced invoice date |

TDLHDBTThe |

|

Date |

Required |

|

Replaced invoice form symbol |

KHMSHDBTThe |

11 |

String (Details provided in Appendix II hereto). |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Replaced invoice symbol |

KHHDBTThe |

8 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Replaced invoice number |

SHDBTThe |

8 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

c) Electronic dispatch and delivery/transfer/consignment notes (hereinafter referred to as electronic dispatch notes)

|

Function description |

Tab name |

Maximum length |

Data type |

Required/optional |

|

HDon tab contains information presented on an electronic dispatch note, including information about the dispatch note and digital signature |

||||

|

HDon\DLHDon tab contains general information about a dispatch note, detailed contents of an dispatch note and other information defined by the seller on their own |

||||

|

HDon\DLHDon\TTChung tab contains general information about a dispatch note, including: |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Invoice title |

THDon |

50 |

String |

Required |

|

Invoice form symbol |

KHMSHDon |

1 |

Numeric (Details provided in Appendix II hereto). |

Required |

|

Invoice symbol |

KHHDon |

6 |

String |

Required |

|

Invoice number |

SHDon |

8 |

Numeric |

Required |

|

Invoice date |

TDLap |

|

Date |

Required |

|

Currency unit |

DVTTe |

3 |

String (details provided in clause 2 of section IV in Part I) |

Required |

|

Forex rate |

TGia |

7,2 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\TTChung\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon tab contains invoice data, including information about the seller, buyer, indexed commodities and services, and payment details of the e-invoice |

||||

|

HDon\DLHDon\NDHDon\NBan tab contains name, address and TIN of the consignor |

||||

|

Name (Consignor’s name) |

Ten |

400 |

String |

Required |

|

Tax identification number (consignor’s TIN) |

MST |

14 |

String |

Required |

|

Internal dispatch instruction |

LDDNBo |

255 |

String |

Required |

|

Address (Departure warehouse) |

DChi |

400 |

String |

Required |

|

Carrier’s name |

TNVChuyen |

400 |

String |

Required |

|

Means of transport |

PTVChuyen |

50 |

String |

Required |

|

HDon\DLHDon\NDHDon\NBan\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\NMua tab contains the consignee’s information |

||||

|

Name (Consignee’s name) |

Ten |

400 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Tax identification number (consignee’s TIN) |

MST |

14 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Address (Arrival warehouse) |

DChi |

400 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\NDHDon\NMua\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\DSHHDVu tab contains indexed commodities or services |

||||

|

HDon\DLHDon\NDHDon\DSHHDVu\HHDVu tab contains details of 01 line of commodity or service |

||||

|

Attributes/characteristics |

TChat |

1 |

Numeric (Details provided in Appendix IV hereto) |

Optional |

|

Ordinal number |

STT |

4 |

Numeric |

Optional |

|

Name |

Ten |

500 |

String |

Required |

|

Unit |

DVTinh |

50 |

String |

Required |

|

Quantity |

SLuong |

19,4 |

Numeric |

Required |

|

Unit price |

DGia |

19,4 |

Numeric |

Required |

|

Total amount |

ThTien |

19,4 |

Numeric |

Required |

|

HDon\DLHDon\NDHDon\DSHHDVu\HHDVu\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

The following functions are put inside HDon\DLHDon tab and placed behind NDHDon tab |

||||

|

QR Code data (details provided in clause 6 of section IV in Part I) |

DLQRCode |

512 |

String |

Optional |

|

If any e-invoice with identification/verification code conforms to requirements for grant of identification/verification codes, the tax authority’s system shall return to the function of tax authority’s Code on e-invoice (MCCQT tab put inside HDon tab) |

||||

|

Tax authority’s identification/verification code (Tax authority’s identification/verification code presented on e-invoice) |

MCCQT |

12 |

String |

Required |

|

HDon\DSCKS tab contains details of digital signature, including consignor’s digital signature and other digital signature (if any). |

||||

|

HDon\DSCKS\NBan tab contains information about the consignor’s digital signature (affixed onto DLHDon tab) |

||||

|

Consignor’s digital signature (subject to regulations laid down in point dd of clause 1 of Article 3 in the Circular No. 68/2019/TT-BTC) |

Signature |

|

|

Required |

|

HDon\DSCKS\NMua tab contains information about the consignee’s digital signature (if any) |

||||

|

Consignee’s digital signature (subject to regulations laid down in point dd of clause 1 of Article 3 in the Circular No. 68/2019/TT-BTC) |

Signature |

|

|

Optional |

|

If any e-invoice conforms to requirements for grant of identification/verification codes, the tax authority’s system shall return to the e-invoice function and add CQT tab (put inside HDon\DSCKS tab) containing information about the digital signature of the tax authority (affixed onto HDon\MCCQT tab and HDon\DLHDon tab) |

||||

|

Tax authority’s digital signature |

Signature |

|

|

Required |

|

HDon\DSCKS\CCKSKhac tab contains other digital signature (if any). |

||||

- In order to replace any faulty electronic dispatch note, the substitute note must add the following information to the <TTChung/> tab and after the <TDLap/> tab:

|

Function description |

Tab name |

Maximum length |

Data type |

Required/optional |

|

Replaced invoice form (Form of replaced dispatch note) |

HTHDBTThe |

1 |

Numeric (Details provided in Appendix VI hereto) |

Optional |

|

Replaced invoice date |

TDLHDBTThe |

|

Date |

Required |

|

Replaced invoice form symbol |

KHMSHDBTThe |

11 |

String (Details provided in Appendix II hereto). |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Replaced invoice symbol |

KHHDBTThe |

8 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Replaced invoice number |

SHDBTThe |

8 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

d) Bill-cum-VAT declaration forms

|

Function description |

Tab name |

Maximum length |

Data type |

Required/optional |

|

HDon parent tab contains information about e-invoice data and digital signature |

||||

|

HDon\DLHDon tab contains general information, detailed contents of an e-invoice, QR Code data and other other information defined by the seller on their own |

||||

|

HDon\DLHDon\TTChung tab contains general information about an e-invoice, including: |

||||

|

XML version (In this Regulation, the value of this function is 1.0.0) |

PBan |

6 |

String |

Optional |

|

Invoice title |

THDon |

50 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice form symbol |

KHMSHDon |

1 |

Numeric (Details provided in Appendix II hereto). |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice symbol |

KHHDon |

6 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice number |

SHDon |

8 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Invoice date |

TDLap |

|

Date |

Required |

|

Currency unit |

DVTTe |

3 |

String (Details provided in clause 2 of section IV in Part I) |

Required |

|

Forex rate |

TGia |

7,2 |

Numeric |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

HDon\DLHDon\TTChung\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon tab contains invoice contents, including: Information about seller, buyer, indexed commodities and services, and payment details on the e-invoice |

||||

|

HDon\DLHDon\NDHDon\NBan tab contains name, TIN and address of the seller/vendor (enterprise) |

||||

|

Name (selling entity’s name) |

Ten |

400 |

String |

Required |

|

Tax identification number |

MST |

14 |

String |

Required |

|

Address |

DChi |

400 |

String |

Required |

|

HDon\DLHDon\NDHDon\NBan\TTKhac tab contains other information (Details shall be provided in clause 1 of section II in Part II) |

||||

|

HDon\DLHDon\NDHDon\NMua tab contains the customer’s information |

||||

|

Name (Full name) |

Ten |

100 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Passport (Passport/other entry-exit document) number |

SHChieu |

20 |

String |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|

Passport (Passport/other entry-exit document) issuance date |

NCHChieu |

|

Date |

Required (Except those cases specified in Article 3 in the Circular No. 68/2019/TT-BTC) |

|