Nội dung toàn văn Decision No. 1380/QD-BCT 2011 list of goods discouraged for import

|

MINISTRY OF INDUSTRY AND TRADE |

SOCIALIST REPUBLIC OF VIETNAM |

|

No: 1380/QD-BCT |

Ha Noi, Date 25 month 03 year 2011 |

DECISION

PROMULGATING LIST OF GOODS DISCOURAGED FOR IMPORT

MINISTRY OF INDUSTRY AND TRADE

Pursuant to Decree No. 189/2007/ND-CP dated December 27, 2007 of the Government defining the functions, tasks, powers and organizational structure of the Ministry of Industry and Trade;

Pursuant to Resolution No.11NQ-CP dated 24 February 2011 of the Government on the concentrated solution to control inflation, stabilize the macroeconomy and ensure social security; At the request of the Leader of Import and Export Department;

DECISION

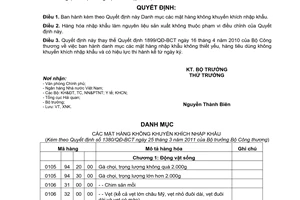

Article 1. Issue together with this Decision the list of good items discouraged for import.

Article 2. Goods imported used as raw materials for production outside the scope of this decision.

Article 3. Decision replaces Decision 1899/QD-BCT dated April 16, 2010 of the Ministry of Industry and Trade on revising the list of the non-essential imports , consumption goods discouraged for import and takes effect from the signing date.

|

Recipients: |

FOR MINISTER |

LIST

OF

GOODS ITEMS OF WHICH THE IMPORT IS NOT ENCOURAGED

(Promulgated together with Decision No. 1380/QD-BCT dated March 25, 2011 of the Minister of Industry and Trade)

|

Code |

Description |

Remarks |

|||

|

|

|

|

|

Chapter 1: Live anim als |

|

|

0105 |

94 |

20 |

00 |

Fighting cocks, weighing not more than 2,000 g |

|

|

0105 |

94 |

30 |

00 |

Fighting cocks, weighing of more than 2,000 g |

|

|

0106 |

31 |

00 |

00 |

- - Birds of prey |

|

|

0106 |

32 |

00 |

00 |

- - Psittaciformes (including parrots, parakeets, macaws and cockatoos) |

|

|

0106 |

39 |

00 |

00 |

- - Other |

|

|

0106 |

90 |

00 |

00 |

- Other |

|

|

|

|

|

|

Chapter 2: Meat and edible meat offal |

|

|

0201 |

|

|

|

Meat of bovine animals, fresh or chilled |

|

|

0202 |

|

|

|

Meat of bovine animals, frozen |

|

|

0203 |

|

|

|

Meat of swine, fresh, chilled or frozen |

|

|

0204 |

|

|

|

Meat of sheep or goats, fresh, chilled or frozen. |

|

|

0205 |

00 |

00 |

00 |

Meat of horses, asses, mules or hinnies, fresh, chilled or frozen. |

|

|

0206 |

|

|

|

Edible offal of bovine animals, swine, sheep, goats, horses, asses, mules or hinnies, fresh, chilled or frozen |

|

|

0207 |

|

|

|

Meat and edible offal, of the poultry of heading 01.05, fresh, chilled or frozen |

|

|

0208 |

|

|

|

Other meat and edible meat offal of other animal, fresh, chilled or frozen |

|

|

0209 |

00 |

00 |

00 |

Pig fat, free of lean meat, and poultry fat, not rendered or otherwise extracted, fresh, chilled, frozen, salted, in brine, dried or smoked |

|

|

0210 |

|

|

|

Meat and edible meat offal, salted, in brine, dried or smoked; edible flours and meals of meat or meat offal |

|

|

|

|

|

|

Chapter 3: Fish and crustaceans, molluscs and other aquatic invertebrates |

|

|

0301 |

|

|

|

Live fish (excluding that for breeding) |

|

|

0302 |

|

|

|

Fish, fresh or chilled, excluding fish fillets and other fish meat of heading 03.04 |

|

|

0303 |

|

|

|

Fish, frozen, excluding fish fillets and other fish meat of heading 03.04 |

|

|

0304 |

|

|

|

Fish fillets and other fish meat (whether or not minced), fresh, chilled or frozen |

|

|

0305 |

|

|

|

Fish, dried, salted or in brine; smoked fish, whether or not cooked before or during the smoking process; flours, meals and pellets of fish, fit for human consumption |

|

|

0306 |

|

|

|

Crustaceans, whether in shell or not, live, fresh, chilled, frozen, dried, salted or in brine; crustaceans, in shell, cooked by steaming or by boiling in water, whether or not chilled, frozen, dried, salted or in brine; flours, meals and pellets of crustaceans, fit for human consumption (excluding that for breeding) |

|

|

0307 |

|

|

|

Molluscs, whether in shell or not, live, fresh, chilled, frozen, dried, salted or in brine; aquatic invertebrates other than crustaceans and molluscs, live, fresh, chilled, frozen, dried, salted or in brine; flours, meals and pellets of aquatic invertebrates other than crustaceans, fit for human consumption |

|

|

|

|

|

|

Chapter 4: Milk and dairy products; birds’ eggs; natural honey; edible products of animal origin, not elsewhere specified or included |

|

|

0401 |

|

|

|

Milk and cream, not concentrated nor containing added sugar or other sweetening matter |

|

|

0402 |

|

|

|

Milk and cream, concentrated or containing added sugar or other sweetening matter (excluding HS codes 0402 10 30 10, 0402 21 90 00) |

|

|

0403 |

|

|

|

Buttermilk, curdled milk and cream, yogurt, kephir and other fermented or acidified milk and cream, whether or not concentrated or containing added sugar or other sweetening matter or flavoured or containing added fruit, nuts or cocoa |

|

|

0404 |

|

|

|

Whey, whether or not concentrated or containing added sugar or other sweetening matter; products consisting of natural milk constituents, whether or not containing added sugar or other sweetening matter, not elsewhere specified or included |

|

|

0405 |

|

|

|

Butter and other fats and oils derived from milk; dairy spreads |

|

|

0406 |

|

|

|

Cheese and curd |

|

|

0407 |

|

|

|

Birds' eggs and poultry’s eggs, in shell, fresh, preserved or cooked |

|

|

0408 |

|

|

|

Birds' eggs and poultry’s eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise preserved, whether or not containing added sugar or other sweetening matter |

|

|

0409 |

00 |

00 |

00 |

Natural honey |

|

|

0410 |

|

|

|

Edible products of animal origin, not elsewhere specified or included |

|

|

|

|

|

|

Chapter 6: Live trees and other plants; bulbs, roots and the like; cut flowers and ornamental foliage |

|

|

0603 |

|

|

|

Cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes, fresh, dried, dyed, bleached, impregnated or otherwise prepared |

|

|

0604 |

|

|

|

Foliage, branches and other parts of plants, without flowers or flower buds, and grasses, mosses and lichens, being goods of a kind suitable for bouquets or ornamental purposes, fresh, dried, dyed, bleached, impregnated or otherwise prepared |

|

|

|

|

|

|

Chapter 7: Edible vegetables and certain roots and tubers |

|

|

0701 |

90 |

00 |

00 |

- Other |

|

|

0702 |

00 |

00 |

00 |

Tomatoes, fresh or chilled |

|

|

0703 |

|

|

|

Onions, shallots, garlic, leeks and other alliaceous vegetables, fresh or chilled (excluding that for sowing) |

|

|

0704 |

|

|

|

Cabbages, cauliflowers, kohlrabi, kale and similar edible brassicas, fresh or chilled |

|

|

0705 |

|

|

|

Lettuce (Lactuca sativa) and chicory (Cichorium spp.), fresh or chilled |

|

|

0706 |

|

|

|

Carrots, turnips, salad beetroot, salsify, celeriac, radishes and similar edible roots, fresh or chilled |

|

|

0707 |

00 |

00 |

00 |

Cucumbers and gherkins, fresh or chilled |

|

|

0708 |

|

|

|

Leguminous vegetables, shelled or unshelled, fresh or chilled |

|

|

0709 |

|

|

|

Other vegetables, fresh or chilled |

|

|

0710 |

|

|

|

Vegetables (uncooked or cooked by steaming or boiling in water), frozen |

|

|

0711 |

|

|

|

Vegetables provisionally preserved (for example, by sulphur dioxide gas, in brine, in sulphur water or in other preservative solutions), but unsuitable in that state for immediate consumption |

|

|

0712 |

|

|

|

Dried vegetables, whole, cut, sliced, broken or in powder, but not further prepared |

|

|

0713 |

|

|

|

Dried leguminous vegetables, shelled, whether or not skinned or split (excluding that for sowing and that fit for animal feeding) |

|

|

0714 |

|

|

|

Manioc, arrowroot, salep, Jerusalem artichokes, sweet potatoes and similar roots and tubers with high starch or inulin content, fresh, chilled, frozen or dried, whether or not sliced or in the form of pellets; sago pith |

|

|

|

|

|

|

Chapter 8: Edible fruit and nuts; peel of citrus fruit or melons |

|

|

0801 |

|

|

|

Coconuts, Brazil nuts and cashew nuts, fresh or dried, whether or not shelled or peeled (excluding HS code 0801.31.00.00) |

|

|

0802 |

|

|

|

Other nuts, fresh or dried, whether or not shelled or peeled |

|

|

0803 |

|

|

|

Bananas, including plantains, fresh or dried |

|

|

0804 |

|

|

|

Dates, figs, pineapples, avocados, guavas, mangoes and mangosteens, fresh or dried |

|

|

0805 |

|

|

|

Citrus fruit, fresh or dried |

|

|

0806 |

|

|

|

Grapes, fresh or dried |

|

|

0807 |

|

|

|

Melons (including watermelons) and papaws (papayas), fresh |

|

|

0808 |

|

|

|

Apples, pears and quinces, fresh |

|

|

0809 |

|

|

|

Apricots, cherries, peaches (including nectarines), plums and sloes, fresh |

|

|

0810 |

|

|

|

Other fruit, fresh |

|

|

0811 |

|

|

|

Fruit and nuts, uncooked or cooked by steaming or boiling in water, frozen, whether or not containing added sugar or other sweetening matter |

|

|

0813 |

|

|

|

Fruit, dried, other than that of headings 08.01 to 08.06; mixtures of nuts or dried fruits of this Chapter |

|

|

0814 |

00 |

00 |

00 |

Peel of citrus fruit or melons (including watermelons), fresh, frozen, dried, or provisionally preserved in brine, in sulphur water or in other preservative solutions |

|

|

|

|

|

|

Chapter 9: Coffee, tea, m até and spices |

|

|

0901 |

21 |

|

|

- - Not decaffeinated: |

|

|

0901 |

22 |

|

|

- - Decaffeinated: |

|

|

0901 |

90 |

20 |

00 |

- - Coffee substitutes containing coffee |

|

|

0902 |

|

|

|

Tea, whether or not flavoured |

|

|

0903 |

00 |

00 |

00 |

Maté |

|

|

0904 |

|

|

|

Pepper of the genus Piper; dried or crushed or ground fruits of the genus Capsicum or of the genus Pimenta |

|

|

0910 |

|

|

|

Ginger, saffron, turmeric (curcuma), thyme, bay leaves, curry and other spices |

|

|

|

|

|

|

Chapter 10: Cereals |

|

|

1005 |

90 |

10 |

00 |

- - Popcorn |

|

|

1006 |

20 |

|

|

- Husked (brown) rice |

|

|

1006 |

30 |

|

|

- Semi milled or wholly milled rice, whether or not polished or glazed |

|

|

1006 |

40 |

00 |

00 |

- - Broken rice |

|

|

|

|

|

|

Chapter 12: Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruit; industrial or medicinal plants; straw and fodder |

|

|

1206 |

00 |

00 |

00 |

Sunflower seeds, whether or not broken |

|

|

|

|

|

|

Chapter 15: Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes |

|

|

1501 |

00 |

00 |

00 |

Pig fat (including lard) and poultry fat, other than that of heading 02.09 or 15.03 |

|

|

1502 |

|

|

|

Fats of bovine animals, sheep or goats, other than those of heading15.03 |

|

|

1507 |

90 |

20 |

00 |

- - Refined oil |

|

|

1508 |

90 |

21 |

00 |

- - - Solid fractions, not chemically modified |

|

|

1508 |

90 |

29 |

00 |

- - - Other |

|

|

1509 |

90 |

21 |

00 |

- - - In packing of net weight not exceeding 30 kg |

|

|

1509 |

90 |

29 |

00 |

- - - Other |

|

|

1510 |

00 |

92 |

00 |

- - Refined oil |

|

|

1511 |

90 |

90 |

00 |

- - Other |

Excluding palm oil not packed and in bulk |

|

1512 |

19 |

20 |

00 |

- - - Refined oil |

|

|

1512 |

29 |

20 |

00 |

- - - Refined oil |

|

|

1513 |

19 |

20 |

00 |

- - - Refined oil |

|

|

1513 |

29 |

29 |

00 |

- - - - Other |

|

|

1514 |

19 |

20 |

00 |

- - - Refined oil |

|

|

1514 |

99 |

20 |

00 |

- - - Refined oil |

|

|

1515 |

29 |

91 |

00 |

- - - - Solid fractions, not chemically modified |

|

|

1515 |

29 |

99 |

00 |

- - - - Other |

|

|

1515 |

50 |

90 |

00 |

- - Other |

|

|

1515 |

90 |

19 |

00 |

- - - Other |

|

|

1515 |

90 |

99 |

|

- - - Other |

|

|

|

|

|

|

Chapter 16: Preparations of meat, of fish or of crustaceans, molluscs or other aquatic invertebrates |

|

|

|

|

|

|

The whole chapter |

|

|

|

|

|

|

Chapter 17: Sugar and sugar confectionery |

|

|

1701 |

91 |

00 |

00 |

- - Containing added flavouring or colouring matter |

|

|

1701 |

99 |

|

|

- - Other |

|

|

1704 |

|

|

|

Sugar confectionery (including white chocolate), not containing cocoa |

|

|

|

|

|

|

Chapter 18: Cocoa and cocoa preparations |

|

|

1806 |

|

|

|

Chocolate and other food preparations containing cocoa |

|

|

|

|

|

|

Chapter 19: Preparations of cereals, flour, starch or milk; pastrycooks' products |

|

|

1901 |

10 |

|

|

- Preparations for infant use, put up for retail sale (excluding HS code 1901.10.20.10 and HS code 1901.10.90.10) |

|

|

1901 |

90 |

31 |

00 |

- - - Containing milk |

|

|

1901 |

90 |

39 |

90 |

- - - - Other |

|

|

1901 |

90 |

41 |

00 |

- - - In powder form |

|

|

1901 |

90 |

49 |

00 |

- - - In other forms |

|

|

1901 |

90 |

90 |

90 |

- - - Other |

|

|

1902 |

|

|

|

Pasta, whether or not cooked or stuffed (with meat or other substances) or otherwise prepared, such as Spaghetti, macaroni, noodles, lasagne, gnocchi, ravioli, cannelloni; couscous, whether or not prepared |

|

|

1903 |

00 |

00 |

00 |

Tapioca and substitutes therefor prepared from starch, in the form of flakes, grains, pearls, siftings or in similar forms |

|

|

1904 |

|

|

|

Prepared food obtained by the swelling or roasting of cereals or cereal products (for example, corn flakes); cereals (other than maize (corn)), in grain form or in the form of flakes or other worked grains (except flour, groats and meal), pre cooked or other prepared, and not elsewhere specified or included |

|

|

1905 |

|

|

|

Bread, pastry, cakes, biscuits and other bakers' wares, whether or not containing cocoa; communion wafers, empty cachets of a kind suitable for pharmaceutical use, sealing wafers, rice paper and similar products (excluding HS code 1905 90 60 00) |

|

|

|

|

|

|

Chapter 20: Preparations of vegetables, fruit, nuts or other parts of plants |

|

|

|

|

|

|

The whole chapter |

|

|

|

|

|

|

Chapter 21: Miscellaneous edible preparations |

|

|

2101 |

|

|

|

Extracts, essences and concentrates, of coffee, tea or maté and preparations with a basis of these products or with a basis of coffee, tea or maté; roasted chicory and other roasted coffee substitutes, and extracts, essences and concentrates thereof |

|

|

2103 |

|

|

|

Sauces and preparations therefor; mixed condiments and mixed seasonings; mustard flour and meal and prepared mustard |

|

|

2104 |

|

|

|

Soups and broths and preparations therefor; homogenised composite food preparations |

|

|

2105 |

00 |

00 |

00 |

Ice-cream and other edible ice, whether or not containing cocoa |

|

|

2106 |

90 |

10 |

00 |

- - Dried bean curd and bean curd sticks |

|

|

2106 |

90 |

20 |

00 |

- - Flavoured or coloured syrups |

|

|

2106 |

90 |

30 |

00 |

- - Nondairy creamer |

|

|

2106 |

90 |

70 |

00 |

- - Additional food preparations |

|

|

2106 |

90 |

91 |

00 |

- - - Fortificant premixes |

|

|

2106 |

90 |

92 |

00 |

- - - Ginseng based preparations |

|

|

2106 |

90 |

93 |

00 |

- - - Food preparations for lactase deficient infants |

|

|

2106 |

90 |

94 |

00 |

- - - Other infant food preparations |

|

|

2106 |

90 |

95 |

00 |

- - - Seri kaya |

|

|

2106 |

90 |

99 |

10 |

- - - - Sweetening preparations including artificial sweetening matter and food matter |

|

|

2106 |

90 |

99 |

20 |

- - - - Flavoured preparations |

|

|

2106 |

90 |

99 |

90 |

- - - - Other |

|

|

|

|

|

|

Chapter 22: Beverage, spirits and vinegar |

|

|

2201 |

|

|

|

Waters, including natural or artificial mineral waters and aerated waters, not containing added sugar or other sweetening matter nor flavoured; ice and snow |

|

|

2202 |

|

|

|

Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured, and other non alcoholic beverages, not including fruit or vegetable juices of heading 20.09 |

|

|

2203 |

|

|

|

Beer made from malt |

|

|

2204 |

|

|

|

Wine of fresh grapes, including fortified wines; grape must other than that of heading 20.09 |

|

|

2205 |

|

|

|

Vermouth and other wines of fresh grapes flavoured with plants or aromatic substances |

|

|

2206 |

|

|

|

Other fermented beverages (for example, cider, perry, mead); mixtures of fermented beverages and mixtures of fermented beverages and non alcoholic beverages, not elsewhere specified or included |

|

|

2207 |

|

|

|

Undenatured ethyl alcohol of an alcoholic strength by volume of 80% vol or higher; ethyl alcohol and other spirits, denatured, of any strength |

|

|

2208 |

|

|

|

Undenatured ethyl alcohol of an alcoholic strength by volume of less than 80% vol; spirits, liqueurs and other spirituous beverages. |

|

|

2209 |

00 |

00 |

00 |

Vinegar and substitutes for vinegar obtained from acetic acid |

|

|

|

|

|

|

Chapter 23: Residues and waste from the food industries; prepared animal fodder |

|

|

2309 |

10 |

|

|

- Dog or cat food, put up for retail sale |

|

|

|

|

|

|

Chapter 24: Tobacco and m anufactured tobacco substitutes |

|

|

2402 |

|

|

|

Cigars, cheroots, cigarillos and cigarettes, of tobacco or tobacco substitute |

|

|

2403 |

10 |

11 |

00 |

- - - Blended tobacco |

|

|

2403 |

10 |

19 |

00 |

- - - Other |

|

|

2403 |

91 |

00 |

00 |

- - "Homogenised" or "reconstituted" tobacco |

|

|

2403 |

99 |

|

|

- - Other (excluding HS codes 2403 99 10 00 and 2403 99 30 00) |

|

|

|

|

|

|

Chapter 25: Salt; sulphur; earths and stone; plastering materials, lim e and cem ent |

|

|

2501 |

00 |

10 |

00 |

- Table salt |

|

|

|

|

|

|

Chapter 33: Essential oils and resinoids; perfumery, cosmetic or toilet preparations |

|

|

3303 |

00 |

00 |

00 |

Perfumes and toilet waters |

|

|

3304 |

|

|

|

Beauty or make up preparations and preparations for the care of the skin (other than medicaments), including sunscreen or sun tan preparations; manicure or pedicure preparations |

|

|

3305 |

|

|

|

Preparations for use on the hair |

|

|

3306 |

|

|

|

Preparations for oral or dental hygiene, including denture fixative pastes and powders; yarn used to clean between the teeth (dental floss), in individual retail packages |

|

|

3307 |

|

|

|

Pre-shave, shaving or after-shave preparations, personal deodorants, bath preparations, depilatories and other perfumery, cosmetic or toilet preparations, not elsewhere specified or included; prepared room deodorisers, whether or not perfumed or having disinfectant properties |

|

|

|

|

|

|

Chapter 34: Soap, organic surface-active agents, washing preparations, lubricating preparations, artificial waxes, prepared waxes, polishing or scouring preparations, candles and similar articles, modelling pastes, “ dental waxes” and dental preparations with a basis of plaster |

|

|

3401 |

|

|

|

Soap; organic surface active products and preparations for use as soap, in the form of bars, cakes, moulded pieces or shapes, whether or not containing soap; organic surface; active products and preparations for washing the skin, in the form of liquid or cream and put up for retail sale, whether or not containing soap, paper, wadding, felt, nonwovens, impregnated, coated or covered with soap or detergent (excluding soap in other forms, heading 3401 20) |

|

|

3402 |

20 |

|

|

- Preparations put up for retail sale: |

|

|

3405 |

|

|

|

Polishes and creams, for footwear, furniture, floors, coachwork, glass or metal, scouring pastes and powders and similar preparations (whether or not in the form of paper, wadding, nonwovens, cellular plastics or cellular rubber, impregnated, coated or covered with the above-mentioned preparations) other than waxes of heading 34.04 |

|

|

3406 |

00 |

00 |

00 |

Candles, tapers, and the like |

|

|

|

|

|

|

Chapter 36: Explosives; pyrotechnic products; matches; pyrophoric alloys; certain combustible preparations |

|

|

3604 |

90 |

20 |

00 |

- - Miniature pyrotechnic munitions and percussion caps for toys |

|

|

3605 |

00 |

00 |

00 |

Matches, other than pyrotechnic articles of heading 36.04 |

|

|

|

|

|

|

Chapter 38: Miscellaneous chemical products |

|

|

3808 |

50 |

12 |

00 |

- - - In the form of mosquito coils or mosquito coil powder |

|

|

3808 |

50 |

19 |

10 |

- - - - Mosquito coverings and nets impregnated with mosquito killer |

|

|

3808 |

91 |

20 |

00 |

- - - In the form of mosquito coils or mosquito coil powder |

|

|

3808 |

91 |

90 |

10 |

- - - - Mosquito coverings and nets impregnated with mosquito killer |

|

|

|

|

|

|

Chapter 39: Plastics and articles thereof |

|

|

3918 |

|

|

|

Floor coverings of plastics, whether or not self adhesive, in rolls or in the form of tiles; wall or ceiling coverings of plastics, as defined in Note 9 to this Chapter |

|

|

3922 |

|

|

|

Baths, shower baths, sinks, wash basins, bidets, lavatory pans, seats and covers, flushing cisterns and similar sanitary ware, of plastics |

|

|

3924 |

|

|

|

Tableware, kitchenware, other household articles and toilet articles, of plastics |

|

|

3926 |

20 |

90 |

00 |

- - Other |

|

|

3926 |

90 |

80 |

90 |

- - - Other |

|

|

3926 |

90 |

90 |

20 |

- - - Racket strings of a length not exceeding 15 m put up for retail sale |

|

|

3926 |

90 |

90 |

90 |

- - - Other |

|

|

|

|

|

|

Chapter 42: Articles of leather; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silk-worm gut) |

|

|

4201 |

00 |

00 |

00 |

Saddlery and harness for any animal (including traces, leads, knee pads, muzzles, saddle cloths, saddle bags, dog coats and the like), of any material |

|

|

4202 |

|

|

|

Trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels, spectacle cases, binocular cases, camera cases, musical instrument cases, gun cases, holsters and similar containers; travelling-bags, insulated food or beverages bags, toilet bags, rucksacks, handbags, shopping bags, wallets, purses, map- cases, cigarette-cases, tobacco-pouches, tool bags, sports bags, bottle-cases, jewellery boxes, powder-boxes, cutlery cases and similar containers, of leather or of composition leather, of sheeting of plastics, of textile materials, of vulcanised fibre or of paperboard, or wholly or mainly covered with such materials or with paper |

|

|

4203 |

|

|

|

Articles of apparel and clothing accessories, of leather or of composition leather (excluding HS codes 4203 21 00 00, 4203 29 10 00, 4203 40 00 00) |

|

|

|

|

|

|

Chapter 43: Furskins and artificial fur; manufactures thereof |

|

|

4303 |

|

|

|

Articles of apparel, clothing accessories and other articles of furskin (excluding 4303 90 20 00) |

|

|

|

|

|

|

Chapter 44: Wood and articles of wood; wood charcoal |

|

|

4414 |

00 |

00 |

00 |

Wooden frames for paintings, photographs, mirrors or similar objects |

|

|

4419 |

00 |

00 |

00 |

Tableware and kitchenware, of wood |

|

|

4420 |

|

|

|

Wood marquetry and inlaid wood; caskets and cases for jewellery or cutlery, and similar articles, of wood; statuettes and other ornaments of wood; wooden articles of furniture not falling in Chapter 94 |

|

|

4421 |

10 |

00 |

00 |

- Clothes hangers |

|

|

4421 |

90 |

80 |

00 |

- - Toothpicks |

|

|

4421 |

90 |

92 |

00 |

- - - Prayer beads |

|

|

4421 |

90 |

99 |

00 |

- - - Other |

|

|

|

|

|

|

Chapter 46: Manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork |

|

|

4601 |

21 |

00 |

00 |

- - Of bamboo |

|

|

4601 |

22 |

00 |

00 |

- - Of rattan |

|

|

4601 |

29 |

00 |

00 |

- - Other |

|

|

4601 |

99 |

10 |

00 |

- - - Mats and matings |

|

|

4602 |

|

|

|

Basketwork, wickerwork and other articles, made directly to shape from plaiting materials or made up from goods of heading 46.01; articles of loofah |

|

|

|

|

|

|

Chaper 48: Paper and paperboard; articles of paper pulp, of paper or of paperboard |

|

|

4811 |

10 |

10 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

10 |

90 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

51 |

20 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

51 |

90 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

59 |

30 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

59 |

90 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

60 |

10 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

60 |

90 |

10 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

90 |

30 |

20 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4811 |

90 |

90 |

30 |

- - - Floor coverings having a basis of paper or paperboard, whether or not cut to size |

|

|

4814 |

|

|

|

Wallpaper and similar wall coverings; window transparencies of paper |

|

|

4817 |

|

|

|

Envelopes, letter cards, plain postcards and correspondence cards, of paper or paperboard; boxes, pouches, wallets and writing compendiums, of paper or paperboard, containing an assortment of paper stationery |

|

|

4818 |

|

|

|

Toilet paper and similar paper, cellulose wadding or webs of cellulose fibres, of a kind used for household or sanitary purposes, in rolls of a width not exceeding 36 cm, or cut to size or shape; handkerchiefs, cleansing tissues, towels, tablecloths, serviettes, napkins for babies, tampons, bed sheets and similar household, sanitary or hospital articles, articles of apparel and clothing accessories, of paper pulp, paper, cellulose wadding or webs of cellulose fibres (excluding 4818 50 00 00) |

|

|

4819 |

|

|

|

Cartons, boxes, cases, bags and other packing containers, of paper, paperboard, cellulose wadding or webs of cellulose fibres; box files, letter trays, and similar articles, of paper or paperboard of a kind used in offices, shops or the like |

|

|

4820 |

|

|

|

Registers, account books, note books, order books, receipt books, letter pads, memorandum pads, diaries and similar articles, exercise books, blotting-pads, binders (loose-leaf or other), folders, file covers, manifold business forms, interleaved carbon sets and other articles of stationery, of paper or paperboard; albums for samples or for collections and book covers, of paper or paperboard |

|

|

4823 |

61 |

00 |

00 |

- - Of bamboo |

|

|

4823 |

69 |

00 |

00 |

- - Other |

|

|

4823 |

90 |

60 |

00 |

- - Punched jacquard cards |

|

|

4823 |

90 |

70 |

00 |

- - Fans and handscreens |

|

|

4823 |

90 |

90 |

10 |

- - - Joss paper |

|

|

|

|

|

|

Chapter 49: Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans |

|

|

4909 |

00 |

00 |

00 |

Printed or illustrated postcards; printed cards bearing personal greetings, messages or announcements, whether or not illustrated, with or without envelopes or trimmings |

|

|

4910 |

00 |

00 |

00 |

Calendars of any kind, printed, including calendar blocks |

|

|

|

|

|

|

Chapter 57: Carpets and other textile floor coverings |

|

|

|

|

|

|

The whole chapter |

|

|

|

|

|

|

Chapter 61: Articles of apparel and clothing accessories, knitted or crocheted |

|

|

|

|

|

|

The whole chapter (excluding headings 6113 and 6114 30 00 10) |

|

|

|

|

|

|

Chapter 62: Articles of apparel and clothing accessories, not knitted or crocheted |

|

|

|

|

|

|

The whole chapter (excluding 6210, 6211 33 00 10, 6211 39 00 10, 6211 43 10 00, 6216 00 10 00, 6217) |

|

|

|

|

|

|

Chapter 63: Other made up textile articles; sets; worn clothing and worn textile articles; rags |

|

|

6301 |

|

|

|

Blankets and traveling rugs |

|

|

6302 |

|

|

|

Bed linen, table linen, toilet linen and kitchen linen |

|

|

6303 |

|

|

|

Curtains (including drapes) and interior blinds; curtain or bed valances |

|

|

6304 |

|

|

|

Other furnishing articles excluding those of heading 94.04 |

|

|

6307 |

10 |

|

|

- Floor-cloths, dish-cloths, dusters and similar cleaning cloths: |

|

|

6308 |

00 |

00 |

00 |

Sets consisting of woven fabric and yarn, whether or not with accessories, for making up into rugs, tapestries, embroidered table cloths or serviettes, or similar textile articles, put up in packings for retail sale |

|

|

6309 |

00 |

00 |

00 |

Worn clothing and other worn articles |

|

|

|

|

|

|

Chapter 64: Footwear, gaiters and the like; parts of such articles |

|

|

|

|

|

|

The whole chapter excluding HS codes 6406 10 10 00 and 6406 99 21 00 |

|

|

|

|

|

|

Chapter 65: Headgear and parts thereof |

|

|

6504 |

00 |

00 |

00 |

Hats and other headgear, plaited or made by assembling strips of any material, whether or not lined or trimmed |

|

|

6505 |

|

|

|

Hats and other headgear, knitted or crocheted, or made up from lace, felt or other textile fabric, in the piece (but not in strips), whether or not lined or trimmed; hair-nets of any material, whether or not lined or trimmed |

|

|

6506 |

10 |

10 |

00 |

- - Helmets for motorcyclists |

|

|

6506 |

91 |

00 |

00 |

- - Of rubber or of plastics |

|

|

6506 |

99 |

|

|

- - Of other materials |

|

|

|

|

|

|

Chapter 66: Umbrellas, sun umbrellas, walking-sticks, seat- sticks, whips, riding-crops, and parts thereof |

|

|

6601 |

|

|

|

Umbrellas and sun umbrellas (including walking-stick umbrellas, garden umbrellas and similar umbrellas) |

|

|

6602 |

00 |

00 |

00 |

Walking-sticks, seat-sticks, whips, riding-crops and the like |

|

|

|

|

|

|

Chapter 67: Prepared feathers and down and articles made of feathers or of down; artificial flowers; articles of human hair |

|

|

6702 |

|

|

|

Artificial flowers, foliage and fruit and parts thereof; articles made of artificial flowers, foliage or fruit |

|

|

6703 |

00 |

00 |

00 |

Human hair, dressed, thinned, bleached or otherwise worked; wool or other animal hair or other textile materials, prepared for use in making wigs or the like |

|

|

6704 |

|

|

|

Wigs, false beards, eyebrows and eyelashes, switches and the like, of human or animal hair or of textile materials; articles of human hair not elsewhere specified or included |

|

|

|

|

|

|

Chapter 69: Ceramic products |

|

|

6910 |

|

|

|

Ceramic sinks, wash basins, wash basin pedestals, baths, bidets, water closet pans, flushing cisterns, urinals and similar sanitary fixtures |

|

|

6911 |

|

|

|

Tableware, kitchenware, other household articles and toilet articles, of porcelain |

|

|

6912 |

00 |

00 |

00 |

Ceramic tableware, kitchenware, other household articles and toilet articles, other than of porcelain |

|

|

6913 |

|

|

|

Statuettes and other ornamental ceramic articles |

|

|

6914 |

|

|

|

Other ceramic articles |

|

|

|

|

|

|

Chapter 70: Glass and glassware |

|

|

7013 |

|

|

|

Glassware of a kind used for table, kitchen, toilet, office, indoor decoration or similar purposes (other than that of heading 70.10 or 70.18) |

|

|

7018 |

10 |

00 |

00 |

- Glass beads, imitation pearls, imitation precious or semi-precious stones and similar glass smallwares |

|

|

7018 |

90 |

00 |

90 |

- - Other |

|

|

|

|

|

|

Chapter 71: Natural or cultured pearls, precious or semi- precious stones, precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin |

|

|

7113 |

|

|

|

Articles of jewellery and parts thereof, of precious metal or of metal clad with precious metal |

|

|

7114 |

|

|

|

Articles of goldsmiths’ or silversmiths’ wares and parts thereof, of precious metal or of metal clad with precious metal |

|

|

7115 |

|

|

|

Other articles of precious metal or of metal clad with precious metal |

|

|

7116 |

|

|

|

Articles of natural or cultured pearls, precious or semi-precious stones (natural, synthetic or reconstructed) |

|

|

7117 |

|

|

|

Imitation jewellery |

|

|

|

|

|

|

Chapter 73: Articles of iron or steel |

|

|

7321 |

|

|

|

Stoves, ranges, grates, cookers (including those with subsidiary boilers for central heating), barbecues, braziers, gas-rings, plate warmers and similar non-electric domestic appliances, and parts thereof, of iron or steel (excluding heading 7321.90) |

|

|

7323 |

|

|

|

Table, kitchen or other household articles and parts thereof, of iron or steel; iron or steel wool; pot scourers and scouring or polishing pads, gloves and the like, of iron or steel |

|

|

7324 |

|

|

|

Sanitary ware and parts thereof, of iron or steel |

|

|

|

|

|

|

Chapter 74: Copper and articles thereof |

|

|

7418 |

|

|

|

Table, kitchen or other household articles and parts thereof, of copper; pot scourers and scouring or polishing pads, gloves and the like, of copper; sanitary ware and parts thereof, of copper |

|

|

|

|

|

|

Chapter 76 : Aluminum and aluminum products |

|

|

7615 |

|

|

|

Table, kitchen or other household articles and parts thereof, of aluminum; pot scourers and scouring or polishing pads, gloves and the like, of aluminum; sanitary ware and parts thereof, of aluminum |

|

|

|

|

|

|

Chapter 82: Tools, implem ents, cutlery, spoons and forks, of base metal; parts thereof of base metal |

|

|

8210 |

00 |

00 |

00 |

Hand operated mechanical appliances, weighing 10 kg or less, used in the preparation, conditioning or serving of food or drink |

|

|

8211 |

91 |

00 |

00 |

- - Table knives with fixed blades |

|

|

8211 |

92 |

90 |

00 |

- - - Other |

|

|

8212 |

10 |

00 |

00 |

- Razors |

|

|

8212 |

20 |

10 |

00 |

- - Double-edged razor blades |

|

|

8212 |

20 |

90 |

00 |

- - Other |

|

|

8213 |

00 |

00 |

00 |

Scissors, tailors’ shears and similar shears, and blades thereof |

|

|

8214 |

20 |

00 |

00 |

- Manicure or pedicure sets and instruments (including nail files) |

|

|

8215 |

|

|

|

Spoons, forks, ladles, skimmers, cake-servers, fish-knives, butter- knives, sugar tongs and similar kitchen or tableware |

|

|

|

|

|

|

Chapter 83: Miscellaneous articles of base metal |

|

|

8301 |

30 |

00 |

00 |

- Locks of a kind used for furniture |

|

|

8301 |

70 |

00 |

00 |

- Keys presented separately |

|

|

8302 |

42 |

|

|

- - Other, suitable for furniture: |

|

|

8302 |

50 |

00 |

00 |

- Hat-racks, hat-pegs, brackets and similar fixtures |

|

|

8306 |

|

|

|

Bells, gongs and the like, non-electric, of base metal; statuettes and other ornaments, of base metal; photograph, picture or similar frames, of base metal; mirrors of base metal |

|

|

|

|

|

|

Chapter 84: Nuclear reactors, steam boilers, engines and mechanic equipm ent and parts thereof |

|

|

8414 |

51 |

|

|

- - Table, floor, wall, window, ceiling or roof fans, with a self- contained electric motor of an output not exceeding 125 W: |

|

|

8415 |

10 |

00 |

10 |

- - Of an output not exceeding 26.38 kW |

|

|

8415 |

81 |

99 |

10 |

- - - - - Of an output not exceeding 21.10 kW |

|

|

8415 |

81 |

99 |

20 |

- - - - - Of an output over 21.10 kW but not exceeding 26.38 Kw |

|

|

8415 |

82 |

90 |

10 |

- - - - Of an output not exceeding 26.38 kW |

|

|

8415 |

83 |

90 |

10 |

- - - - Of an output not exceeding 26.38 kW |

|

|

8418 |

10 |

10 |

00 |

- - Household type |

|

|

8418 |

21 |

00 |

00 |

- - Compression type |

|

|

8418 |

29 |

00 |

00 |

- - Other |

|

|

8418 |

30 |

00 |

10 |

- - Of a capacity not exceeding 200 liters |

|

|

8418 |

40 |

00 |

10 |

- - Of a capacity not exceeding 200 liters |

|

|

8419 |

11 |

10 |

00 |

- - - Household type |

|

|

8419 |

19 |

10 |

00 |

- - - Household type |

|

|

8419 |

81 |

|

|

- - For making hot drinks or for cooking or heating food: |

|

|

8421 |

12 |

00 |

00 |

- - - Clothes-dryers |

|

|

8421 |

21 |

11 |

00 |

- - - - Filtering machinery and apparatus for domestic use |

|

|

8421 |

21 |

21 |

|

- - - - Filtering machinery and apparatus for domestic use: |

|

|

8421 |

22 |

10 |

00 |

- - - Of a capacity not exceeding 500 l/hr: |

|

|

8421 |

22 |

20 |

|

- - - Of a capacity exceeding 500 l/hr |

|

|

8422 |

11 |

|

|

- - Household type |

|

|

8423 |

10 |

|

|

- Personal weighing machines, including baby scales; household scales: |

|

|

8423 |

81 |

|

|

- - Having a maximum weighing capacity not exceeding 30 kg. |

|

|

8443 |

31 |

|

|

- - Machines which perform two or more of the functions (of printing, copying or facsimile transmission, etc.), capable of connecting to an automatic data processing machine or to a network: |

|

|

8443 |

32 |

|

|

- - Other, capable of connecting to an automatic data processing machine or to a network: (excluding HS code 8443.32.50.00) |

|

|

8443 |

39 |

|

|

- - Other |

|

|

8443 |

99 |

20 |

00 |

- - - Ink-filled printer cartridges |

|

|

8443 |

99 |

30 |

00 |

- - - Paper feeders and sorters |

|

|

8450 |

|

|

|

Household or laundry-type washing machines, including machines which both wash and dry (excluding HS code 8450 20 00 00 and subheading 8450 90) |

|

|

8451 |

21 |

00 |

00 |

- - Each of a dry linen capacity not exceeding 10 kg |

|

|

8451 |

80 |

10 |

00 |

- - Household type |

|

|

8452 |

10 |

00 |

00 |

- Sewing machines of the household type |

|

|

8471 |

30 |

10 |

00 |

- - Handheld computers including palmtops and personal digital assistants (PDAs) |

|

|

8471 |

30 |

20 |

00 |

- - Laptops including notebooks and sub notebooks |

|

|

8471 |

30 |

90 |

90 |

- - - Other |

|

|

8471 |

41 |

10 |

00 |

- - - Personal computers excluding portable computers of subheading 8471.30 |

|

|

8471 |

41 |

90 |

90 |

- - - - Other |

|

|

8471 |

49 |

10 |

00 |

- - - Personal computers excluding pocket-size computers of subheading 8471.30 |

|

|

|

|

|

|

Chapter 85: Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles |

|

|

8508 |

11 |

00 |

00 |

- - Of a power not exceeding 1,500 W and having a dust bag or other receptacle capacity not exceeding 20 l |

|

|

8508 |

19 |

00 |

10 |

- - - With capacity from 1,500W to below 2,500 W |

|

|

8509 |

|

|

|

Electro-mechanical domestic appliances, with self-contained electric motor, other than vacuum cleaners of heading 85.08 (excluding parts of subheadings 8509 90) |

|

|

8510 |

|

|

|

Shavers, hair clippers and hair-removing appliances, with self- contained electric motor (excluding parts of HS code 8510.90.00.00) |

|

|

8516 |

|

|

|

Electric instantaneous or storage water heaters and immersion heaters; electric space heating apparatus and soil heating apparatus; electro-thermic hair-dressing apparatus (for example, hair dryers, hair curlers, curling tong heaters) and hand dryers; electric smoothing irons; other electro-thermic appliances of a kind used for domestic purposes; electric heating resistors, other than those of heading 85.45 (excluding subheadings 8516 80 and 8516 90) |

|

|

8517 |

11 |

00 |

00 |

- - Line telephone sets with cordless handsets |

|

|

8517 |

12 |

00 |

00 |

- - Telephones for cellular networks or for other wireless networks |

|

|

8517 |

18 |

00 |

00 |

- - Other |

|

|

8518 |

21 |

00 |

00 |

- - Single loudspeakers, mounted in their enclosures |

|

|

8518 |

22 |

00 |

00 |

- - Multiple loudspeakers, mounted in the same enclosure |

|

|

8518 |

29 |

10 |

00 |

- - - Box speaker assemblies |

|

|

8518 |

29 |

90 |

00 |

- - - Other |

|

|

8518 |

30 |

10 |

00 |

- - Headphones |

|

|

8518 |

30 |

20 |

00 |

- - Earphones |

|

|

8518 |

30 |

31 |

00 |

- - - Handsets for telephonic apparatus |

|

|

8518 |

30 |

39 |

00 |

- - - Other |

|

|

8518 |

30 |

90 |

00 |

- - Other |

|

|

8519 |

20 |

00 |

00 |

- Apparatus operated by coins, banknotes, bank cards, tokens or by other means of payment |

|

|

8519 |

30 |

00 |

00 |

- Turntables (record-decks) without built in amplifiers and loud- speakers |

|

|

8519 |

50 |

00 |

00 |

- Telephone answering machines |

|

|

8519 |

81 |

10 |

00 |

- - - Pocket-size cassette recorders, the dimensions of which do not exceed 170 mm x 100 mm x 45 mm |

|

|

8519 |

81 |

20 |

00 |

- - - Cassette recorders, with built in amplifiers and one or more built in loudspeakers, operating only with an external source of power |

|

|

8519 |

81 |

30 |

00 |

- - - Compact disc players |

|

|

8519 |

81 |

90 |

90 |

- - - - Other |

|

|

8519 |

89 |

20 |

00 |

- - - Record-players with or without loudspeakers |

|

|

8519 |

89 |

90 |

90 |

- - - - Other |

|

|

8519 |

89 |

20 |

00 |

- - - - Other |

|

|

8521 |

10 |

00 |

90 |

- - Other |

|

|

8521 |

90 |

19 |

00 |

- - - Other |

|

|

8521 |

90 |

99 |

00 |

- - - Other |

|

|

8523 |

29 |

11 |

00 |

- - - - Computer tapes, unrecorded |

|

|

8523 |

29 |

12 |

00 |

- - - - Video tapes, recorded |

|

|

8523 |

29 |

19 |

10 |

- - - - - Unrecorded |

|

|

8523 |

29 |

19 |

90 |

- - - - - Recorded |

|

|

8523 |

29 |

21 |

00 |

- - - - Video tapes, unrecorded |

|

|

8523 |

29 |

22 |

00 |

- - - - Video tapes, recorded |

|

|

8523 |

29 |

29 |

10 |

- - - - Computer tapes, BETACAM, UMATIC and DIGITAL tapes, unrecorded |

|

|

8523 |

29 |

29 |

20 |

- - - - - Computer tapes, recorded |

|

|

8523 |

29 |

29 |

40 |

- - - - - Other types, unrecorded |

|

|

8523 |

29 |

29 |

90 |

- - - - - Other types, recorded |

|

|

8523 |

29 |

31 |

00 |

- - - - Computer tapes, in pancake or in jumbo forms, unrecorded |

|

|

8523 |

29 |

32 |

00 |

- - - - Other computer tapes, unrecorded |

|

|

8523 |

29 |

33 |

00 |

- - - - Other types, in pancake or in jumbo forms, unrecorded |

|

|

8523 |

29 |

39 |

|

- - - - Computer tapes, in pancake or in jumbo forms, unrecorded (excluding HS code 8523 29 39 30) |

|

|

8523 |

40 |

12 |

90 |

- - - - Other |

|

|

8523 |

40 |

13 |

90 |

- - - - Other |

|

|

8523 |

40 |

14 |

|

- - - Of a kind used for reproducing representations of instructions, data, sound and image, recorded in a machine readable binary form, and capable of being manipulated or providing interactivity to a user, by means of an automatic data processing machine; proprietary format storage (recorded) media |

|

|

8523 |

40 |

19 |

20 |

- - - - Other types, unrecorded |

|

|

8523 |

40 |

19 |

90 |

- - - - Other types, recorded |

|

|

8523 |

80 |

40 |

00 |

- - Gramophone records |

|

|

8525 |

80 |

|

|

- Television cameras, digital cameras and video camera recorders: |

|

|

8527 |

12 |

00 |

00 |

- - Pocket-size radio cassette-players |

|

|

8527 |

13 |

|

|

- - Other apparatus combined with sound recording or reproducing apparatus |

|

|

8528 |

71 |

90 |

10 |

- - - - Colors |

|

|

8528 |

71 |

90 |

90 |

- - - - Other |

|

|

8528 |

72 |

|

|

- - Other types, colored; |

|

|

8528 |

73 |

|

|

- - Other types, black and white or monochromatic: |

|

|

|

|

|

|

Chapter 87: Vehicles other than railway or tram way rolling- stock, and parts and accessories thereof |

|

|

8703 |

|

|

|

Motor cars and other motor vehicles principally designed for the transport of persons (other than those of heading 87.02), including station wagons and racing cars |

|

|

8703 |

10 |

10 |

00 |

- - Golf cars, including golf buggies |

|

|

8703 |

10 |

90 |

00 |

- - Other |

|

|

8703 |

21 |

10 |

00 |

- - - Go-karts |

|

|

8703 |

21 |

29 |

00 |

- - - - Other |

|

|

8703 |

21 |

90 |

90 |

- - - Other |

|

|

8703 |

22 |

19 |

00 |

- - - - Other |

|

|

8703 |

22 |

90 |

90 |

- - - Other |

|

|

8703 |

23 |

51 |

00 |

- - - - Of a cylinder capacity not exceeding 1,800 cc |

|

|

8703 |

23 |

52 |

00 |

- - - - Of a cylinder capacity exceeding 1,800 cc but not exceeding 2,000 cc |

|

|

8703 |

23 |

53 |

00 |

- - - - Of a cylinder capacity exceeding 2,000 cc but not exceeding 2,500 cc |

|

|

8703 |

23 |

54 |

00 |

- - - - Of a cylinder capacity exceeding 2,500 cc |

|

|

8703 |

23 |

91 |

00 |

- - - - Of a cylinder capacity not exceeding 1,800 cc |

|

|

8703 |

23 |

92 |

00 |

- - - - Of a cylinder capacity exceeding 1,800 cc but not exceeding 2,000 cc |

|

|

8703 |

23 |

93 |

00 |

- - - - Of a cylinder capacity exceeding 2,000 cc but not exceeding 2,500 cc |

|

|

8703 |

23 |

94 |

00 |

- - - - Of a cylinder capacity exceeding 2,500 cc |

|

|

8703 |

24 |

50 |

|

- - - Motor cars (including station wagons, SUVs and sports cars, but not including vans), other |

|

|

8703 |

24 |

90 |

|

- - - Other |

|

|

8703 |

31 |

20 |

00 |

- - - Motor cars (including station wagons, SUVs and sports cars, but not including vans), other |

|

|

8703 |

31 |

90 |

90 |

- - - Other |

|

|

8703 |

32 |

51 |

00 |

- - - - Of a cylinder capacity not exceeding 2,000 cc |

|

|

8703 |

32 |

59 |

00 |

- - - - Other |

|

|

8703 |

32 |

91 |

00 |

- - - - Of a cylinder capacity not exceeding 2,000 cc |

|

|

8703 |

32 |

99 |

00 |

- - - - Other |

|

|

8703 |

33 |

51 |

00 |

- - - - Of a cylinder capacity exceeding 2,500 cc but not exceeding 3,000 cc |

|

|

8703 |

33 |

52 |

00 |

- - - - Of a cylinder capacity exceeding 3,000 cc |

|

|

8703 |

33 |

90 |

00 |

- - - Other |

|

|

8703 |

90 |

51 |

00 |

- - - Of a cylinder capacity not exceeding 1,800 cc |

|

|

8703 |

90 |

52 |

00 |

- - - Of a cylinder capacity exceeding 1,800 cc but not exceeding 2,000 cc |

|

|

8703 |

90 |

53 |

00 |

- - - Of a cylinder capacity exceeding 2,000 cc but not exceeding 2,500 cc |

|

|

8703 |

90 |

54 |

00 |

- - - - Of a cylinder capacity exceeding 2,500 cc |

|

|

8703 |

90 |

90 |

00 |

- - Other |

|

|

8711 |

10 |

91 |

00 |

- - - Motorcycles, including mopeds and motor scooters |

|

|

8711 |

10 |

99 |

00 |

- - - Other |

|

|

8711 |

20 |

10 |

00 |

- - Motocross motorcycles |

|

|

8711 |

20 |

41 |

00 |

- - - - Of a cylinder capacity not exceeding 125 cc |

|

|

8711 |

20 |

42 |

00 |

- - - - Of a cylinder capacity exceeding 125 cc but not exceeding 150 cc |

|

|

8711 |

20 |

43 |

00 |

- - - - Of a cylinder capacity exceeding 150 cc but not exceeding 200 cc |

|

|

8711 |

20 |

44 |

00 |

- - - - Of a cylinder capacity exceeding 200 cc but not exceeding 250 cc |

|

|

8711 |

20 |

90 |

00 |

- - - Other |

|

|

8711 |

30 |

|

|

- With reciprocating internal combustion piston engine of a cylinder capacity exceeding 250 cc but not exceeding 500 cc, (excluding HS code 8711 30 30 00) |

|

|

8711 |

40 |

|

|

- With reciprocating internal combustion piston engine of a cylinder capacity exceeding 500 cc but not exceeding 800 cc (excluding HS code 8711 40 20 00) |

|

|

8711 |

50 |

|

|

- With reciprocating internal combustion piston engine of a cylinder capacity exceeding 800 cc |

|

|

8711 |

90 |

40 |

00 |

- - Side-cars |

|

|

8711 |

90 |

90 |

00 |

- - Other |

|

|

8712 |

|

|

|

Bicycles and other cycles (including delivery tricycles), not motorized. |

|

|

8715 |

00 |

00 |

00 |

Baby carriages and parts thereof |

|

|

|

|

|

|

Chapter 90: Optical, photographic, cinematographic measuring, checking, precision, m edical or surgical instruments and apparatus; parts and accessories thereof |

|

|

9004 |

10 |

00 |

00 |

- Sunglasses |

|

|

9006 |

51 |

00 |

00 |

- - With a through-the-lens viewfinder (single lens reflex (SLR)), for roll film of a width not exceeding 35 mm |

|

|

9006 |

52 |

00 |

90 |

- - - Other |

|

|

9006 |

53 |

00 |

90 |

- - - Other |

|

|

9006 |

61 |

00 |

00 |

- - Discharge lamp (“electronic”) flashlight apparatus |

|

|

9006 |

69 |

00 |

00 |

- - Other |

|

|

|

|

|

|

Chapter 91: Clocks and watches and parts thereof |

|

|

9101 |

|

|

|

Wrist-watches, pocket-watches and other watches, including stop- watches, with case of precious metal or of metal clad with precious metal |

|

|

9102 |

|

|

|

Wrist-watches, pocket-watches and other watches, including stop- watches, other than those of heading 91.01 |

|

|

9103 |

|

|

|

Clocks with watch movements, excluding clocks of heading 91.04 |

|

|

9105 |

11 |

00 |

00 |

- - Electrically operated |

|

|

9105 |

19 |

00 |

00 |

- - Other |

|

|

9105 |

21 |

00 |

00 |

- - Electrically operated |

|

|

9105 |

29 |

00 |

00 |

- - Other |

|

|

9105 |

91 |

00 |

90 |

- - - Other |

|

|

9105 |

99 |

00 |

90 |

- - - Other |

|

|

|

|

|

|

Chapter 92: Musical instruments; parts and accessories of such articles |

|

|

|

|

|

|

The whole chapter excluding heading 9209 |

|

|

|

|

|

|

Chapter 94: Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; lam ps and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; prefabricated buildings |

|

|

9401 |

30 |

00 |

00 |

- Swivel seats with variable height adjustment |

|

|

9401 |

40 |

00 |

00 |

- Seats other than garden seats or camping equipment, convertible into beds |

|

|

9401 |

51 |

00 |

00 |

- - Of bamboo or of rattan |

|

|

9401 |

59 |

00 |

00 |

- - Other |

|

|

9401 |

61 |

00 |

00 |

- - Upholstered |

|

|

9401 |

69 |

00 |

00 |

- - Other |

|

|

9401 |

71 |

00 |

00 |

- - Upholstered |

|

|

9401 |

79 |

00 |

00 |

- - Other |

|

|

9401 |

80 |

|

|

- Other seats: |

|

|

9403 |

10 |

00 |

00 |

- Metal furniture of a kind used in offices |

|

|

9403 |

20 |

00 |

90 |

- - Other |

|

|

9403 |

30 |

00 |

00 |

- Wooden furniture of a kind used in offices |

|

|

9403 |

40 |

00 |

00 |

- Wooden furniture of a kind used in the kitchen |

|

|

9403 |

50 |

00 |

00 |

- Wooden furniture of a kind used in the bedroom |

|

|

9403 |

60 |

00 |

90 |

- - Other |

|

|

9403 |

70 |

00 |

90 |

- - Other |

|

|

9403 |

81 |

00 |

90 |

- - - Other |

|

|

9403 |

89 |

00 |

90 |

- - - Other |

|

|

9404 |

|

|

|

Mattress supports; articles of bedding and similar furnishing (for example, mattresses, quilts, eider-downs, cushions, pouffes and pillows) fitted with springs or stuffed or internally fitted with any material or of cellular rubber or plastics, whether or not covered |

|

|

9405 |

10 |

90 |

00 |

- - Other |

|

|

9405 |

20 |

90 |

90 |

- - - Other |

|

|

9405 |

30 |

00 |

00 |

- Lighting sets of a kind used for Christmas trees |

|

|

9405 |

40 |

60 |

00 |

- - Other exterior lighting |

|

|

9405 |

40 |

90 |

90 |

- - - Other |

|

|

9405 |

50 |

11 |

00 |

- - - Of brass of a kind used for religious rites |

|

|

9405 |

50 |

19 |

00 |

- - - Other |

|

|

9405 |

50 |

90 |

90 |

- - - Other |

|

|

9405 |

60 |

|

|

- Illuminated signs, illuminated name-plates and the like: |

|

|

9406 |

00 |

10 |

00 |

- Greenhouses fitted with mechanical or thermal equipment |

|

|

|

|

|

|

Chapter 95: Toys, games and sports requisites; parts and accessories thereof |

|

|

9503 |

|

|

|

Tricycles, scooters, pedal cars and similar wheeled toys; dolls' carriages; dolls; other toys; reduced-size ("scale") models and similar recreational models, working or not; puzzles of all kinds (excluding the Codes HS of 9503 00 22 00 and 9503 00 29 00) |

|

|

9504 |

|

|

|

Articles for funfair, table or parlour games, including pintables, billiards, special tables for casino games and automatic bowling alley equipment |

|

|

9505 |

|

|

|

Festive, carnival or other entertainment articles, including conjuring tricks and novelty jokes |

|

|

9506 |

|

|

|

Articles and equipment for general physical exercise, gymnastics, athletics, other sports (including table-tennis) or outdoor games, not specified or included elsewhere in this Chapter; swimming pools and paddling pools |

|

|

|

|

|

|

Chapter 96: Miscellaneous m anufactured articles |

|

|

9601 |

|

|

|

Worked ivory, bone, tortoise-shell, horn, antlers, coral, mother-of- pearl and other animal carving material, and articles of these materials (including articles obtained by moulding) |

|

|

9602 |

00 |

20 |

00 |

- Cigar or cigarette cases, tobacco jars and household ornamental articles |

|

|

9602 |

00 |

90 |

00 |

- Other |

|

|

9603 |

10 |

|

|

- Brooms and brushes, consisting of twigs or other vegetable materials bound together, with or without handles: |

|

|

9603 |

21 |

00 |

00 |

- - Tooth brushes, including dental-plate brushes |

|

|

9603 |

29 |

00 |

00 |

- - Other |

|

|

9603 |

30 |

00 |

00 |

- Artists’ brushes, writing brushes and similar brushes for the application of cosmetics |

|

|

9603 |

40 |

00 |

00 |

- Paint, distemper, varnish or similar brushes (other than brushes of subheading 9603.30); paint pads and rollers |

|

|

9603 |

90 |

20 |

00 |

- - Hand-operated mechanical floor sweepers, not motorised |

|

|

9604 |

|

|

|

Hand sieves and hand riddles |

|

|

9605 |

|

|

|

Travel sets for personal toilet, sewing or shoe or clothes cleaning |

|

|

9608 |

|

|

|

Ball point pens; felt tipped and other porous-tipped pens and markers; fountain pens, stylograph pens and other pens; duplicating stylos; propelling or sliding pencils; pen-holders, pencil- holders and similar holders; parts (including caps and clips) of the foregoing articles, other than those of heading 96.09 (excluding HS Codes 9608 91 and 9608 99) |

|

|

9609 |

|

|

|

Pencils (other than pencils of heading 96.08), crayons, pencil leads, pastels, drawing charcoals, writing or drawing chalks and tailors’ chalks |

|

|

9610 |

00 |

90 |

00 |

- Other |

|

|

9613 |

|

|

|

Cigarette lighters and other lighters, whether or not mechanical or electrical, and parts thereof other than flints and wicks (except for 9613 90) |

|

|

9614 |

|

|

|

Smoking pipes (including pipe bowls) and cigar or cigarette holders, and parts thereof |

|

|

9615 |

|

|

|

Combs, hair-slides and the like; hair pins, curling pins, curling grips, hair-curlers and the like, other than those of heading 85.16, and parts thereof |

|

|

9616 |

|

|

|

Scent sprays and similar toilet sprays, and mounts and heads thereof; powder-puffs and pads for the application of cosmetics or toilet preparations |

|

|

9617 |

|

|

|

Vacuum flasks and other vacuum vessels, complete with cases; parts thereof other than glass inners |

|

|

9618 |

00 |

00 |

00 |

Tailors’ dummies and other lay figures; automata and other animated displays used for shop window dressing |

|

|

|

|

|

|

Chapter 97: Works of art, collectors’ pieces and antiques |

|

|

9701 |

|

|

|

Paintings, drawings and pastels, executed entirely by hand, other than drawings of heading 49.06 and other than hand-painted or hand-decorated manufactured articles; collages and similar decorative plaques. |

|

|

9705 |

00 |

00 |

00 |

Collections and collectors’ pieces of zoological, botanical, mineralogical, anatomical, historical, archaeological, palaeontological, ethnographic or numismatic interest |

|

|

9706 |

00 |

00 |

00 |

Antiques of an age exceeding one hundred years |

|

* Remarks: The detailed list of HS codes is built based on the Preferential Import Tariffs promulgated together with the Ministry of Finance’s Circular No. 184/2010/TT-BTC dated November 15, 2010, which provides the export and import tariff rates pursuant to the list of taxable goods items.