Decision No. 482/2001/QD-NHNN of April 24, 2001, on the amendment, supplement of some accounts in the system of accounts of credit institutions đã được thay thế bởi Decision No.479/2004/QD-NHNN promulgating the system of book-keeping accounts và được áp dụng kể từ ngày 01/10/2004.

Nội dung toàn văn Decision No. 482/2001/QD-NHNN of April 24, 2001, on the amendment, supplement of some accounts in the system of accounts of credit institutions

|

STATE

BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 482/2001/QD-NHNN |

Hanoi, April 24th , 2001 |

DECISION

ON THE AMENDMENT, SUPPLEMENT OF SOME ACCOUNTS IN THE SYSTEM OF ACCOUNTS OF CREDIT INSTITUTIONS

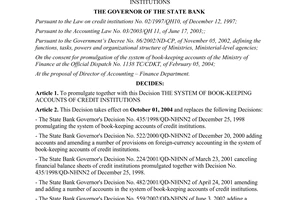

THE GOVERNOR OF THE STATE BANK

Pursuant to the Law on the

Credit Institutions No. 02/1997/QH10 dated 12 December, 1997;

Pursuant to the Decree No. 15 CP dated 02 March, 1993 of the Government on the

assignment, authority and responsibility for the State management of the

ministries and ministry-level agencies;

Upon the proposal of the Director of the Accounting and Finance Department

of the State Bank,

DECIDES

Article 1.

To amend, supplement of some accounts in the System of accounts of credit institutions issued in conjunction with the Decision No. 435/1998/QD-NHNN2 dated 25 December, 1998 of the Governor of the State Bank as follows:

1. To amend the name of the following accounts:

a. to amend account 214 "Short-term lending in foreign currency" to " Short-term lending in foreign currency and Gold"

b. to amend account 215 "Medium-term lending in foreign currency" to " Medium-term lending in foreign currency and Gold"

c. to amend account 216 "Long-term lending in foreign currency" to " Long-term lending in foreign currency and Gold"

d. to amend account 434 "Savings deposits in foreign currency" to " Savings deposits in foreign currency and Gold"

2. To supplement the following accounts to the System of accounts of credit institutions:

a. to supplement to account 207 "Accrued interests expected to collect" the following account of Level III:

2074 - Accrued interest from lending funds under trust

This account is used to account for accrued interests expected to collect on lending funds under trust transferred to credit institutions receiving funds under trust that credit institutions shall be received at maturity.

Accounting contents to the account 2074 shall be in compliance with the provisions for the accounting to the account 207.

b. to supplement to account 214 "Short-term lending in foreign currency and Gold" the following accounts of Level III:

2144 - Current debts and debts rescheduled in Gold

2145 - Recoverable debts overdue up to 180 days in Gold

2146 - Recoverable debts overdue from 181 days to 360 days in Gold

2149 - Debts difficult to recover in Gold

These accounts are used to reflect the Gold value of short-term loans credit institutions have provided to domestic economic organizations, individuals.

c. to supplement to account 215 "Medium-term lending in foreign currency and Gold" the following accounts of Level III:

2154 - Current debts and debts rescheduled in Gold

2155 - Recoverable debts overdue up to 180 days in Gold

2156 - Recoverable debts overdue from 181 days to 360 days in Gold

2159 - Debts difficult to recover in Gold

These accounts are used to reflect the Gold value of medium loans credit institutions have provided to domestic economic organizations, individuals.

d. to supplement to account 216 "Long-term lending in foreign currency and Gold" the following accounts of Level III:

2164 - Current debts and debts rescheduled in Gold

2165 - Recoverable debts overdue up to 180 days in Gold

2166 - Recoverable debts overdue from 181 days to 360 days in Gold

2169 - Debts difficult to recover in Gold

These accounts are used to reflect the Gold value of long-term loans credit institutions have provided to domestic economic organizations, individuals.

dd. to supplement to account 217 "Accrued interests expected to collect" the following accounts of Level III :

2175 - From short-term lending in Gold

2176 From medium-term and long-term in Gold

These accounts are used to account the accrued interests expected to collect from the lending in Gold that credit institutions shall receive at maturity.

Accounting contents to the accounts 2175, 2176 shall be in compliance with the provisions for accounting to the account 217.

e. to supplement to account 27 account 247 of Level II "Lending without security", which contains following accounts of Level III:

2741 - Current debts and debts rescheduled

2742 - Recoverable debts overdue up to 180 days

2743 - Recoverable debts overdue from 181 days to 360 days

2748 - Debts difficult to recover

These accounts are used to account the amount of money that credit institutions shall lend without security to domestic economic organizations, individuals (beyond the 4 measures of secured lending).

Accounting contents to account 274 shall be in compliance with the provision for accounting to the account 211.

g. To supplement to account 277 "Accrued interests expected to collect" following account of level III:

2774 - Lending without security

The account is used to account the accrued interests expected to collect from lending amount without security that credit institutions shall receive at maturity.

Accounting contents to account 2774 shall be in compliance with provisions for accounting to the account 277.

h. to supplement in account 379 "Other receivables" following account of Level III:

3799 - Other receivables

This account is used to reflect other receivables of credit institutions, which are arising in the process of their operation in addition to those that have been accounted to suitable accounts.

i. to supplement in account 434 "Savings deposits in foreign currency and Gold" following accounts of Level III:

4344 - Time savings deposits in Gold with term under 12 months

4345 - Time savings deposits in Gold with term from 12 months onwards

These accounts are used to reflect the Gold value which customers deposit at Banks in form of a term savings deposit.

k. to supplement in account 437 "Accrued interests expected to collect" following account of Level III:

4375 - Savings deposits in Gold

The account is used to account the accrued interests expected to pay on savings deposit in Gold that credit institutions will pay at maturity.

Accounting content to account 4375 shall be in compliance with provisions for accounting to the account 437.

l. to supplement to account 441 "Issue of short-term valuable paper" the following account of Level III:

4413 - Certificates of Gold mobilization

The account is used to reflect funds collected by credit institutions from the issuance of certificates of Gold mobilization with the term under 1 year.

m. to supplement to account 442 "Issue of long-term valuable paper" the following account of Level III"

4423 - Certificates of Gold mobilization

The account is used to reflect funds collected by credit institutions from the issuance of certificates of Gold mobilization with the term of 1 year and more.

3. Amending the accounting contents of some accounts:

a. Account 221 "Discount of commercial paper and short-term valuable paper"

The account is used to reflect the amounts (in VND and foreign currency) credit institutions discount commercial paper and other short-term valuable paper of domestic economic organizations, individuals.

b. Account 222 "Mortgage of commercial paper and other short-term valuable paper"

This account is used to reflect the amounts (in VND and foreign currency) which credit institution lends to domestic economic organizations, individuals in form of mortgage of commercial paper and other short-term valuable paper.

Article 2.

This Decision shall be effective after 15 days from the date of signing.

Article 3.

The Director of the Administrative Department, the Director of the Accounting and Finance Department of the State Bank, General Manager of State Bank branches in provinces, cities, General Directors (Directors) of credit institutions shall be responsible for the implementation of this Decision.

|

|

FOR

THE GOVERNOR OF THE STATE BANK |