Decision No.56/2000/QD-BTC of April 19, 2000 promulgating the regulation on financial management of the social funds and charity funds đã được thay thế bởi Decision No. 10/2008/QD-BTC of February 12, 2008, promulgating the regulation on financial management of social funds and charity funds. và được áp dụng kể từ ngày 09/03/2008.

Nội dung toàn văn Decision No.56/2000/QD-BTC of April 19, 2000 promulgating the regulation on financial management of the social funds and charity funds

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 56/2000/QD-BTC |

Hanoi, April 19, 2000 |

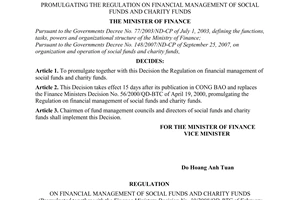

DECISION

PROMULGATING THE REGULATION ON FINANCIAL MANAGEMENT OF THE SOCIAL FUNDS AND CHARITY FUNDS

THE MINISTER OF FINANCE

Pursuant to the Government’s Decree No.15/CP of

March 2, 1993 defining the tasks, powers and State management responsibility of

the ministries and ministerial-level agencies;

Pursuant to the Government’s

Decree No.178/CP of October 28, 1994 defining the tasks, powers and

organizational structure of the Finance Ministry;

Pursuant to the Government’s

Decree No.177/1999/ND-CP of December 22, 1999 promulgating the Regulation on

Organization and Operation of the Social Funds and Charity Funds;

In order to enhance the financial management work and encourage the voluntary

contribution by organizations and individuals to the social funds and charity

funds;

At the proposals of the head of the Department for Financial Policies and the

director of the Finance Ministry’s Office,

DECIDES:

Article 1.- To promulgate together with this Decision the Regulation on financial management of the social funds and charity funds.

Article 2.- This Decision takes effect 15 days after its signing.

Article 3.- The chairmen of the management councils and directors of the social funds and charity funds shall have to implement this Decision.

|

|

FOR THE FINANCE MINISTER |

REGULATION

ON FINANCIAL MANAGEMENT OF THE SOCIAL FUNDS AND CHARITY FUNDS

(Promulgated together with Decision No.56/2000/QD-BTC of April 19, 2000)

Chapter I

GENERAL PROVISIONS

Article 1.- Scope of application

This Regulation shall apply to the social funds and charity funds (hereinafter referred to as the funds for short) which are set up and operate under the Government’s Decree No.177/1999/ND-CP of December 22, 1999 promulgating the Regulation on Organization and Operation of the Social Funds and Charity Funds.

Article 2.- Operation principles

The funds operate for non-profit purposes according to the principles of self-financing on the basis of mobilizing financial support and voluntary contribution from domestic and foreign organizations and individuals, with a view to supporting humanitarian and charity activities and encouraging the cultural, sport, scientific and social development.

The funds shall cover their own expenses for social and charity activities and take self-responsibility with their own properties, without the State budget capital sources.

The funds have the legal person status, are allowed to open accounts at banks or State treasuries and take responsibility before law for their activities.

The funds shall have to make public the situation of capital mobilization, management and use as prescribed by the Prime Minister’s Decision No.225/1998/QD-TTg of November 20, 1998 promulgating the Regulation on financial publicity applicable to the State budget of all levels, budget-drafting units, State enterprises and funds with revenues from people’s contributions, as well as by the Finance Ministry’s Circular No.29/1999/TT-BTC of March 19, 1999 guiding the financial publicity for funds with revenues from people’s contributions.

Chapter II

REVENUES, USE AND MANAGEMENT OF THE FUNDS

Article 3.- The funds shall have the following revenue sources:

- Money and properties voluntarily contributed and donated by domestic and foreign organizations and individuals to the funds in accordance with the provisions of law.

- Money and properties entrusted by domestic and foreign organizations and individuals to the funds to provide purposeful financial supports with concrete addresses according to the funds’ guiding principles and purposes.

- The deposit interests and other lawful revenues (if any).

Article 4.- Use of funds

The funds shall be used for the following purposes:

a/ To provide direct and non-refundable financial support for activities in conformity with the funds’ charters. More concretely:

- To provide financial support for programs and projects for humanitarian or charity purposes, promoting the cultural, sport, scientific and social development;

- To provide financial support for organizations and individuals’ activities which conform to the funds’ purposes and guiding principles;

- To provide financial support under authorization of organizations and individuals and implement the financial-support projects with addresses. The funds shall have to strictly comply with the authorization of donating organizations and individuals as well as the provisions of law.

b/ To spend on the fund management activities, which must not exceed 5% of the total funds’ revenues.

The use of funds shall be decided by their directors on the basis of operation orientations and tasks already approved by the funds’ management councils. The funds must not be used for other activities contrary to their guiding principles and purposes.

Article 5.- Contents of expenditure on the fund management activities include:

- The expense for wages (allowances and subsidies, if any) for the fund management apparatus.

- The expense for renting working offices.

- The expense for the procurement and repair of fixed assets in service of the funds� activities.

- The expense for office supplies.

- The expense for the payment of public service charges (electricity, water, fuel, sanitation and environment charges).

- The other expenses related to the funds’ activities.

The fund management councils shall have to issue concrete regulations on the fund management and use and elaborate norms of expenses for the funds’ activities. The total expenditure on the fund management activities must not exceed 5% of the total revenues of a fund in a year. Where a fund’s revenue in a year falls too short, the fund management council shall decide the minimum expense level for the fund management activities but must ensure that the total expenses therefor in three consecutive years do not exceed 5% of the total fund’s revenues.

Article 6.- Responsibilities of the funds in accounting and financial management work:

- The funds shall have to organize the accounting and statistical work in strict compliance with the provisions of the Ordinance on Accounting and Statistics; and abide by the regimes and regulations on accounting vouchers and invoices.

- To open books to monitor and record the full lists of contributing and donating organizations and individuals as well as the donees, fully reflecting the arising transactions.

- To elaborate and send fully and on time the annual financial statements and final account settlement reports to the finance agencies of the level competent to permit the establishment of the funds.

- To submit to the examination and inspection of the funds’ revenues, management and use by the fund-managing finance agencies. To supply necessary information for the State’s functional management agencies when so requested under the provisions of law.

- The fund control boards shall have to inspect and supervise the funds’ activities and report on the funds’ financial situation to the fund management councils.

- The fund management councils shall have to manage the funds’ activities, approve the financial plans and examine the funds’ final account settlement reports.

- The standing bodies of the fund management councils and the fund directors shall have to make public the following contents:

+ The lists and levels of contributions and donations by organizations and individuals to the funds.

+ The funds’ quarterly financial statements and annual final account settlement reports made according to each revenue-expenditure content.

Article 7.- Chief accountants of the funds

The person assigned to take charge of a fund’s accounting work shall have to assist the fund director to organize and direct the carrying out of all the fund’s accounting and statistical work.

It is absolutely prohibited to appoint persons with previous conviction or sanctions, persons who were disciplined for corruption or embezzlement of the socialist properties and violated economic and financial management policies and regimes to take charge of the funds’ accounting work.

The persons assigned tasks of chief accountants of the funds shall have to fully satisfy the following criteria:

+ Having good moral qualities, being incorruptible and honest.

+ For a fund set up by decision of the president of the People’s Committee of the province or centrally-run city, the chief accountant must have the university degree on economics or finance, have accounting expertise knowledge and have been working as accountant for at least 2 years.

+ For a fund set up by decision of the president of the People’s Committee of the district, provincial capital or town, the chief accountant must have been trained in economics or finance and working as accountant for at least 1 year.

The appointment, dismissal and transfer of persons assigned the task of taking charge the funds’ accountancy shall be decided by the fund management councils at the proposal of the fund directors. In case of the funds’ merger, consolidation, division, splitting or dissolution or his/her transfer to other job, the fund’s chief accountant must complete the final account settlement before taking up the new job and still have to be answerable for accounting data and reports in the period of his/her charge till the complete hand-over of the work to another person.

Chapter III

HANDLING OF PROPERTIES OF FUNDS BEING SUSPENDED FROM OPERATION, MERGED, CONSOLIDATED, DIVIDED, SPLIT UP OR DISSOLVED

Article 8.- Where a fund is merged, consolidated, divided or split up under the permission of the competent State agency, all its money and properties must be inventoried accurately and promptly before the merger, consolidation, division or splitting. It is strictly prohibited to distribute the fund’s properties.

The money and properties of a newly-merged or -consolidated fund must be equal to the total sum of money and properties of all the funds before the merger or consolidation.

The total sum of money and properties of the newly -divided or -split funds must be equal to the total sum of money and properties of the fund before the merger or splitting.

Article 9.- In case of a fund’s dissolution, it is strictly prohibited to distribute its properties. All the fund’s money and properties must be, first of all, used for the payment of the State-owed debts (if any). After the payment of debts and dissolution expenses, the remaining money amount shall be remitted to the State budget of the level that has permitted the establishment of the fund.

Article 10.- In case of suspension of operations of a fund, the fund’s properties shall be dealt with as in case of the fund dissolution stipulated in Article 9 of this Regulation.