Decision No.92/2007/QD-BTC of November 01, 2007 amending specific import tax rates for used cars đã được thay thế bởi Decision No. 14/2008/QD-BTC of March 11, 2008, promulgating specific import tax rates for used cars. và được áp dụng kể từ ngày 02/04/2008.

Nội dung toàn văn Decision No.92/2007/QD-BTC of November 01, 2007 amending specific import tax rates for used cars

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 92/2007/QD-BTC |

Hanoi, November 01, 2007 |

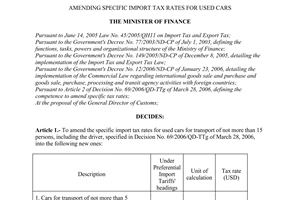

DECISION

AMENDING SPECIFIC IMPORT TAX RATES FOR USED CARS

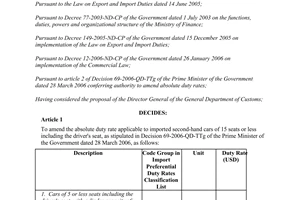

THE MINISTER OF FINANCE

Pursuant to June 14, 2005 Law

No. 45/2005/QH11 on Import Tax and Export Tax;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, tasks, powers and organizational structure of the Ministry of

Finance;

Pursuant to the Government’s Decree No. 149/2005/ND-CP of December 8, 2005,

detailing the implementation of the Import Tax and Export Tax Law;

Pursuant to the Government’s Decree No. 12/2006/ND-CP of January 23, 2006,

detailing the implementation of the Commercial Law regarding international

goods sale and purchase and goods sale, purchase, processing and transit agency

activities with foreign countries;

Pursuant to Article 2 of the Prime Minister’s Decision No. 69/2006/QD-TTg of

March 28, 2006, defining the competence to amend specific tax rates;

At the proposal of the General Director of Customs,

DECIDES:

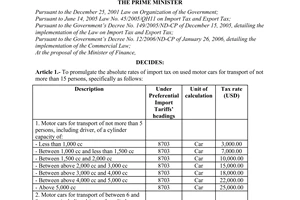

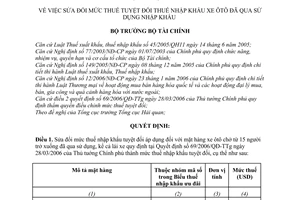

Article 1.- To amend specific tax rates for used cars for transport of not more than 15 persons, including the driver, specified in the Prime Minister’s Decision No. 69/2006/QD-TTg of March 28, 2006, into the following new ones:

|

Description |

Under Preferential Import Tariffs’ headings |

Unit of calculation |

Tax rate (USD) |

|

(1) |

(2) |

(3) |

(4) |

|

1. Cars for transport of not more than 5 persons, including the driver, of a cylinder capacity of: |

|||

|

- Under 1,000 cc |

8703 |

Car |

2,700.00 |

|

- Between 1,000 cc and under 1,500 cc |

8703 |

Car |

6,300.00 |

|

- Between 1,500 cc and 2,000 cc |

8703 |

Car |

8,000.00 |

|

- Between above 2,000 cc and under 2,500 cc |

8703 |

Car |

12,000.00 |

|

- Between 2,500 cc and 3,000 cc |

8703 |

Car |

13,500.00 |

|

- Between above 3,000 cc and 4,000 cc |

8703 |

Car |

16,200.00 |

|

- Between above 4,000 cc and 5,000 cc |

8703 |

Car |

26,400.00 |

|

- Above 5000 cc |

8703 |

Car |

30,000.00 |

|

2. Cars for transport of between 6 and 9 persons, including the driver, of a cylinder capacity of: |

|||

|

- 2,000 cc or less |

8703 |

Car |

7,200.00 |

|

- Between above 2,000 cc and 3,000 cc |

8703 |

Car |

11,200.00 |

|

- Between above 3,000 cc and 4,000 cc |

8703 |

Car |

14,400.00 |

|

- Above 4,000 cc |

8703 |

Car |

24,000.00 |

|

3. Cars for transport of between 10 and 15 persons, including the driver, of a cylinder capacity of: |

|||

|

- 2,000 cc or less |

8702 |

Car |

6,400.00 |

|

- Between above 2,000 cc and 3,000 cc |

8702 |

Car |

9,600.00 |

|

- Above 3,000 cc |

8702 |

Car |

13,500.00 |

Article 2.- This Decision replaces the Finance Minister’s Decision No. 05/2007/QD-BTC of January 15, 2007, and Decision No. 72/2007/QD-BTC of August 7, 2007, takes effect and applies to all declarations of imported goods registered with customs offices 15 days after its publication in “CONG BAO.”

|

|

FOR THE MINISTER OF FINANCE |