Nội dung toàn văn Decree No. 47/2014/NĐ-CP compensation support and resettlement upon land expropriation by the State

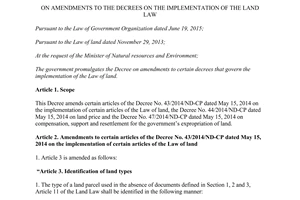

|

THE

GOVERNMENT |

SOCIALIST REPUBLIC OF VIETNAM |

|

No.: 47/2014/NĐ-CP |

Hanoi, May 15, 2014 |

DECREE

REGULATIONS ON COMPENSATION, SUPPORT, AND RESETTLEMENT UPON LAND EXPROPRIATION BY THE STATE

Pursuant to the Law on Government organization dated December 25, 2001;

Pursuant to the Law on Land dated November 29, 2013;

At the proposal of the Minister of Natural Resources and Environment,

The Government has promulgated the decree regulating compensation, support, and resettlement upon land expropriation by the State.

Chapter 1.

GENERAL PROVISIONS

Article 1. Governing scope

This Decree details some articles of the Law on Land concerning compensation, support, and resettlement upon land expropriation by the State.

Article 2. Regulated entities

1. Land management agency; organizations in charge of compensation and site clearance.

2. Land users as defined in Article 5 of the Law on Land upon expropriation

3. Other organizations, individuals relating to compensation, support, and resettlement

Chapter 2.

DETAILED REGULATIONS ON COMPENSATION, SUPPORT, AND RESETTLEMENT UPON LAND EXPROPRIATION BY THE STATE

Article 3. Compensation for the remaining land-related investment expense upon expropriation for national defense and security; socio-economic development for the benefits of the public and the country

1. Article 76. Compensation for the remaining land-related investment expense upon expropriation for the purposes of national defense and security; socio-economic development for the benefits of the public and the country

2. The remaining land-related investment expense means expenses invested in land by land users in accordance with land use purpose and such expenses are not yet fully expropriated at the date of expropriation. The remaining land-related investment expense mean all or part of the following costs:

a) Expenses for land grading

b) Expenses for soil nutrient enrichment, removal of salt, corrosion and erosion control of the land used for agricultural production;

c) Expenses for reinforcement load, vibration, and sinking bearing capacity of the land used as business premises;

d) Other expenses invested in accordance with land use purpose.

3. Conditions for determination of the remaining land-related investment expense as follows:

a) Documents or vouchers proving investment has been made. In case there are no documents or vouchers to prove such investment, the People’s Committees of central-affiliated provinces and cities (hereinafter referred to as the province-level People’s committee) shall rely on actual circumstances in the locality to determine the remaining land-related investment expense;

b) The remaining land-related investment expense does not originate from the state budget.

4. The remaining land-related investment expense should be in accordance with market price at the time of expropriation and determined according to the following formula:

![]()

Where:

P: The remaining land-related investment expense;

P1: Expenses for land grading;

P2: Expenses for enrichment of soil nutrients, soil desalination and de-acidification, corrosion and erosion control of the land used for agricultural production;

P3: Expenses for reinforcement load, vibration, and sinking bearing capacity of the land used as business premises;

P4: Other expenses in accordance with land use purpose.

T1: Land use term;

T2: Remaining land use term;

In case the time of investment in land takes places after the time of land allocation by the State, land use term (T1) shall be calculated from the time of investment in land.

Article 4. Compensation, support to households and individuals whose agricultural land is subject to expropriation.

Compensation, support to households and individuals whose agricultural land is expropriated beyond the limit due to receipt of transfer of land use right from others as defined in Point c, Clause 1 of Article 77 of the Law on Land shall be done as follows:

1. Households and individuals who are currently using a piece of agricultural land that is beyond the limit actually allocated by the State coming from inheritance, gifts, or receipt of transfer of land use rights from others under the Law and are eligible for compensation shall be compensated, supported according to actual area to be expropriated.

2. Any household and individual who is currently using a piece of agricultural land as defined in Clause 1 of this Article but has no Certificate of Land Use Right or is ineligible for issuance of Certificates of land use right, certificates of ownership of land-linked houses and properties as stipulated by the Law on Land shall be compensated within the allocated limit. For the excess area of agricultural land, compensation in the form of land shall not be done but pecuniary support shall be considered according to the provisions set out in Article 25 hereof.

3. Land use term serving as the basis for compensation calculation with respect to agricultural land allocated by the State to households and individuals for agricultural production, recognition of land use right, receipt of transfer of land use rights according to the Law on Land shall be applied in the same way as land are allocated by the State for stable and long-term use.

Article 5. Compensation for land and remaining expenses invested in the landcurrently used by residential community and religious establishments upon expropriation by the State

1. Compensation for land and expenses invested in agricultural land currently used by residential community and religious establishments as defined in Clause 3, Article 78 of the Law on Land shall be done as follows:

a) As for agricultural land used before July 01, 2004 (the effective date of the Law on Land in 2003) including the land not originally allocated by the State, the land leased out by the State with annual payment of land rent and included with Certificate of land use right or eligible for issuance of certificates of land use right, ownership of land-linked houses and properties as defined in Article 100 and 102 shall be compensated in the form of land as defined in Clause 2, Article 74 of the Law on Land;

b) As for agricultural land originally allocated by the State without payment of land levies, or leased out by the State with annual payment of land rent shall not be compensated in the form of land but shall be compensated for the remaining land-related investment expense (if any). Determination of the remaining land-related investment expense for compensation shall be done according to the provisions set out in Article 3 hereof.

2. Compensation for land and the remaining expenses invested in the land not owned by residential community, religious establishments as defined in Clause 5, Article 81 of the Law on Land shall be stipulated as follows upon expropriation of non-agricultural land by the State:

a) As for non-agricultural land used before July 01, 2004 including the land not originally allocated by the State, the land leased out by the State with annual payment of land rent and included with Certificate of land use right or eligible for issuance of certificates of land use right, ownership of land-linked houses and properties as defined in Article 100 and 102 of the Law on Land shall receive compensation for land as defined in Clause 2, Article 74 of the Law on Land;

Non-agricultural land that is used by religious establishments from July 01, 2004 to the date of expropriation notification and originates from land transfer or gifts shall not be compensated for land;

b) Agricultural land originally allocated by the State without payment of land levies, or leased out by the State with annual payment of land rent shall not be compensated for land but shall be compensated for the remaining land-related investment expense (if any). Determination of the remaining land-related investment expense for compensation shall be done according to the provisions set out in Article 3 hereof.

In case all or part of the area of land is expropriated and the remaining area is ineligible for use and if residential community or religious establishments need to use the land for their common purposes, they shall receive new land allocated elsewhere. Such allocation must conform to land-use planning approved by competent agencies.

Article 6. Compensation for land upon expropriation of inhabited land by the State

Compensation for land upon expropriation as defined in Article 79 of the Law on Land shall be done as follows:

1. Households and individuals, overseas Vietnamese who are owning inhabited land, land - linked houses in Vietnam, have Certificate of land use right or are eligible for issuance of Certificates of land use right, ownership of land-linked houses and properties according to the Law on Land, the compensation for land shall be done as follows:

a) In case all of inhabited land is expropriated or the remaining area of inhabited land after expropriation is ineligible for residence according to the regulations prescribed by the province-level People’s committee and such owners have no other land or houses elsewhere for residence, the compensation in the form of land or resettlement housing shall be made to them.

b) In case all of inhabited land is expropriated or the remaining area of inhabited land after expropriation is ineligible for residence according to the regulations prescribed by the province-level People’s committee and such owners have no other land or houses elsewhere for residence, the compensation in money shall be made to them. For localities that have land fund, compensation in the form of land shall be considered.

2. In case one household of multiple families residing in the same parcel of land subject to expropriation or multiple households co-owning the same parcel of land subject to expropriation and if such land is eligible for division into separate families according to the provisions of the Law on Residence, the province-level People’s committee shall rely on land fund, resettlement housing and actual circumstances in the locality to decide grant of land, resettlement housing to individual households.

3. Households and individuals, overseas Vietnamese as defined in Clause 1 of this Article who do not require compensation in the form of land or resettlement housing shall be compensated in money by the State.

4. If households and individuals are subject to relocation but ineligible for compensation of land, the State shall offer sale, lease, lease-purchase of houses or allocation of inhabited land with land levies if such households and individuals have no other land or houses elsewhere for residence upon expropriation by the State. Prices of sale, lease, lease-purchase of houses; rate of land levies on land allocated by the State shall be stipulated by the province-level People’s committee.

5. In case portion of the inhabited land subject to expropriation is agricultural land and not yet recognized as inhabited land, conversion of such portion of land into inhabited land shall be accepted by the State upon demand by households and individuals as owners thereof. However, portion of land to be converted into inhabited land must fall within the limit of land allocation by locality and such conversion of use purpose must conform to land-use planning approved by competent agencies. Upon conversion of use purpose, households and individuals must perform their financial obligations as stipulated by the Law on collection of land levies, land rent, water surface rent.

6. In case a parcel of land currently employed by economic organizations, overseas Vietnamese, foreign-invested enterprises (commonly referred to as entities) for a construction project is subject to expropriation by the State, and if conditions for compensation as defined in Article 75 of the Law on Land are met by such entities, compensation shall be accepted and made as follows:

a) In case a portion of the land is expropriated and the remaining portion is still eligible for the implementation of the construction project, compensation for the expropriated portion shall be made in the form of money;

b) In case all or portion of the land is expropriated and the remaining portion is ineligible for the implementation of the construction project, compensation for all or portion of the expropriated land shall be made in the form of land for the implementation of the project or in the form of money;

c) For any project that is already put into practice, compensation shall be made in the form of money upon expropriation.

Article 7. Compensation for land and the remaining land-related investment expense to households and individuals upon expropriation of non-agricultural land by the State

Compensation for land and the remaining land-related investment expense to households and individuals upon expropriation of non-agricultural land (different from inhabited land) as stipulated in Article 80 of the Law on Land is done as follows:

1. Households and individuals currently using non-agricultural upon expropriation shall be compensated as follows if conditions for compensation as defined in Article 75 of the Law on Land are met:

a) Land with limited use duration upon expropriation shall be compensated with the land of the same purpose; compensation shall be based on remaining land use term of the expropriated land. In case land for compensation is not available, the compensation shall be made in the form of money and determined as follows:

Where:

![]()

Tbt: Amount of compensation;

G: Land price at the time of expropriation; if the land is allocated by the State with land levies, G shall be the price for calculation of land levies; if the land is leased out by the State with land rent being paid once for the entire lease, G shall be the price for calculation of land rent;

S: Area of land expropriated;

T1: Land use term;

T2: Remaining land use term;

b) In case households and individuals need to extend remaining land use term of the expropriated land which serves as foundation for compensation, such extension shall be approved by competent agencies but land users must perform their financial obligations with respect to the extended period according to the provisions of law.

2. In case non-agricultural land exempted from land rent is expropriated by the State, households and individuals as users thereof shall be compensated for the remaining land-related investment expense only (if any) according to the provisions set out in Article 3 hereof except otherwise as regulated in Clause 3 of this Article.

3. In case non-agricultural land exempted from land rent thanks to the policy on people dedicated to national revolution is expropriated by the State, households and individuals as users thereof shall be compensated in the form of land. Based on actual circumstances and availability of fund land, the province-level People’s committee shall decide compensation.

4. In case land for long-term commercial, service, non-agricultural purposes is expropriated, households and individuals as users thereof shall be compensated in the form of land according to the price of inhabited land if conditions for compensation are met according to the provisions of law upon expropriation.

5. In case land with houses built thereon before July 01, 2004 and originally related to transgression, invasion is expropriated, households and individuals as users thereof shall be granted new land with land levies imposed or offered sale of resettlement houses. Rate of land levies and purchase price of resettlement housing shall be decided by the province-level People’s committee.

Article 8. Compensation for land and the remaining land-related investment expense to economic organizations and joint-venture enterprises upon expropriation of non-agricultural land by the State

1. Compensation for land currently used as graveyard by economic organizations upon expropriation by the State as defined in Clause 2, Article 81 of the Law on Land shall be done as follows:

a) In case all or part of the land is expropriated and the remaining part is ineligible for the construction of graveyard, users thereof shall be compensated with new land of the same purpose if transfer of infrastructure-linked land use right is done; shall be compensated in the form of money if the construction of infrastructure structure is in progress and transfer of infrastructure-linked land use right is not yet done;

b) In case a portion of the land is expropriated and the remaining portion is eligible for the construction graveyard, users thereof shall be compensated in the form of money for the expropriated part. Tombs and graves shall be moved to the remaining land of the project if they are situated on the expropriated portion; In case the remaining land of the project is completely transferred, users thereof shall be granted new land for the construction of graveyard to serve movement of tombs and graves in the area under expropriation.

Allocation of new land for the construction of graveyard as defined in this Point must be in accordance with land-use planning approved by competent agencies.

2. In case non-agricultural land that is capitalized in the form of transfer of land use right as defined in Article 184 of the Law on Land is expropriated by the State, joint-venture enterprises as users thereof shall be compensated in the form of land as defined in Clause 2, Article 74 of the Law on Land in the following cases:

a) Land contributed by economic organizations in the form of capital as defined in Article 184 of the Law on Land and originally allocated by the State with land levies, leased out with land rent being paid once for the entire lease and such land levies and land rent are not originally related to the state budget;

b) Land allocated to economic organizations by the State without land levies, or with land levies originating from the state budget, leased out with annual land rent but used the same way as allocated by the State to enterprises without debit and land rent according to the provisions of the Law on Land for contribution of capital to foreign organizations and individuals;

c) Land contributed by economic organizations in the form of capital and originally related to transfer of land use right according to the law and money paid for the transfer is not originally related to the state budget;

d) Land allocated to overseas Vietnamese with land levies, leased out to overseas Vietnamese with land rent being paid once for the entire lease; land allocated to a joint-venture to which capital contribution by Vietnamese side is in the form of land use right now converted into foreign-invested enterprises.

Article 9. Compensation for losses caused to land-linked houses, construction works upon expropriation by the State

Compensation for land-linked houses, construction works upon expropriation as defined in Clause 2, Article 89 of the Law on Land shall be done as follows:

1. Compensation for houses and works equals to total existing value of lost houses, works and the amount of money is calculated in percentage of the existing value of such houses, works.

Existing value of lost houses, works is determined by multiplying percentage of remaining quality of such houses, works by the value of complete construction of houses, works according to technical standards promulgated by relevant ministries.

Amount of compensation is calculated in percentage of the existing value of houses, construction works shall be stipulated by the province-level People’s committee but not exceed 100% of value of complete construction of houses, works with technical standards equivalent to lost houses, construction works.

2. Existing value of lost houses, construction works shall be determined as follows:

![]()

Where:

Tgt: Existing value of lost houses, works;

G1: Value of new construction of lost houses, works with technical standards promulgated by relevant ministries;

T: Depreciation period applied to lost houses, works;

T1: Period over which lost houses, works are used;

3. For any house or work part of which is demolished and the remaining part is unusable, compensation shall be made for the entire house or work; houses, works part of which is demolished and the remaining part is usable, compensation shall be made for the demolished part only plus expenses for repair and completion of the remaining part according to technical standards applied to houses, works prior to demolition.

4. For houses, works that do not meet technical standards as stipulated by relevant ministries, the province-level People’s committee shall rely on actual circumstances in the locality to decide specific compensation appropriately.

Article 10. Compensation for losses due to restricted use of land, losses caused to land-linked properties with respect to land in safety corridors upon construction of public works with safety corridors

Compensation for losses due to restricted use of land, losses to land-linked properties with respect to land in safety corridor upon construction of works with safety corridors as defined in Article 94 of the Law on Land is done as follows:

1. In case of change of land use purpose:

a) For changes in land use purpose from inhabited land to non-agricultural land or from inhabited land to agricultural land, compensation for losses shall be determined as follows:

Tbt = (G1 – G2)xS

Where:

Tbt: Amount of compensation;

G1: Average price of inhabited land per square meter;

G2: Average price of non-agricultural land or agricultural land per square meter;

S: Area of land subject to change of land use purpose:

b) For changes in land use purpose from non-agricultural land to agricultural land, compensation for losses shall be determined as follows:

Tbt = (G3 – G4)xS

Where:

Tbt: Amount of compensation;

G2: Average price of non-agricultural land per square meter;

G4: Average price of agricultural land per square meter;

S: Area of land subject to change of land use purpose:

2. In case land use purpose is unchanged but use of land is restricted, compensation for losses shall be decided by the province-level People’s committee based on actual circumstances in the locality.

3. For land-linked houses, works and properties within safety corridors suffering losses caused by site clearance, compensation shall be made according to level of loss determined.

4. When safety corridors occupy more than 70% of the land with houses and works thereon, the remaining area shall be considered for compensation according to the provisions set out in Clauses 1, 2 of this Article.

5. For land situated within a safety corridor and displaced by the construction of public works with safety corridors, households and individuals as users thereof shall be granted resettlement housing, compensation for movement and support for living and production stabilization.

Article 11. Compensation and support for land upon expropriation with respect to land allocated ultra vires before July 01, 2004

For land allocated ultra vires before July 01, 2004 with land levies paid but users thereof are not yet granted the Certificate of land use right, compensation and support in the form of land shall be done as follows:

1. In case the land is used before October 15, 1993, users thereof shall be compensated for land according to area and type of land allocated.

2. In case the land is used from October 15, 1993 to July 01, 2004, users thereof shall be compensated and supported as follows:

a) Receive compensation and support for the area allocated as agricultural land, non-agricultural land and inhabited land within the limit of allocation as defined in Clause 2, Article 83 and Clause 5, Article 84 of the Law on Land in 2003;

b) Receive compensation for the area allocated as inhabited land beyond the limit of allocation as defined in Clause 2, Article 83 and Clause 5, Article 84 of the Law on Land in 2003 but land levies as stipulated by the Government must be deducted from the amount of compensation.

3. Compensation for properties linked to expropriated land is done according to the Law on Land and this Decree.

Article 12. Compensation, support for land when real-life area is different from what is stated in land use right papers upon expropriation

Upon expropriation, real-life area is found different from the area stated in land use right papers as defined in Clauses 1, 2, 3, Article 100 of the Law on Land and Article 18 of the Government’s Decree No. 43/2014/NĐ-CP dated May 15, 2014 detailing the implementation of some articles of the Law on Land (hereinafter referred to as the Decree No. 43/2014/NĐ-CP) compensation shall be made as follows:

1. If real-life area is smaller than the area stated in land use right papers, compensation shall be made according to real-life area.

2. If real-life area is more than the area stated in land use right papers due to previous inaccurate measurement or only part of real-life area was previously declared by land user but the entire land boundary remains unchanged, is not in dispute with neighboring land users, and not related to invasion, transgression, compensation shall be made according to real-life area.

3. If real-life area is more than the area stated in land use right papers, and such outstanding area is confirmed by the People’s Committee of commune, district and town level (hereinafter referred to as the People’s Committee of commune) where the land is situated as resulting from land reclaimation or receipt of transfer of land use right from previous users, and that the land has been stably employed and not in dispute, compensation shall be made according to real-life area.

4. If real-life area is more than the area stated in land use right papers, and the outstanding area is confirmed as resulting from transgression or invasion, no compensation in the form of land shall be made with respect to such outstanding area.

5. Compensation for properties linked to expropriated land as defined in Clauses 2, 3 of this Article shall be done according to the provisions of the Law on Land and this Decree.

Article 13. Compensation for land to users without land use right papers

1. Upon expropriation, land users do not have land use right papers as defined in Clauses 1, 2 and 3, Article 100 of the Law on Land and Article 18 of the Decree No. 43/2014/NĐ-CP but eligible for issuance of Certificate of use land right, ownership of land-linked houses and properties as defined in Articles 101 and 102 of the Law on Land, Articles 20, 22, 23, 25, 27 and 28 of the Decree No. 43/2014/NĐ-CP users thereof shall be compensated for land.

2. In case users thereof are compensated in money, such amount of compensation shall deduct the amount paid to the State as financial obligations of land users according to the law on collection of land levies, land rent and water surface rent.

Article 14. Compensation to users of state-owned houses, works subject to expropriation

1. For state-owned houses (leased or self-managed houses) that are subject to demolition, users thereof shall not be compensated for the area owned by the State and the illegally expanded area but shall be compensated for the expenses for reformation, repair and upgrading and amount of compensation shall be decided by the province-level People’s committee.

2. Users of state-owned houses subject to demolition shall be granted a lease on resettlement houses with a rent being equal to that on state-owned houses; leased resettlement houses shall be sold to lessee according to the Government’s provisions on sale of state-owed houses to lessee; in case resettlement houses are not available, compensation shall be made in money that is equal to 60% of the land and 60% of the leased houses in value.

Article 15. Compensation for land to users as co-owners of land use right

1. Organizations, households and individuals as co-owners of land use right, upon expropriation, shall be compensated according to each portion of land shown in the Certificate of land use right; in case papers to prove each portion of land owned by individual organizations, households and individuals are not available, compensation shall be made commonly to all co-owners of land use right.

2. The province-level People’s committee shall instruct division of amount of compensation for land among users as co-owners of land use right as defined in Clause 1 of this Article.

Article 16. Compensation, support, and resettlement to users of land in the area suffering environmental pollution and likely threat to human life; users of land susceptible to landslide, sinking and other natural catastrophes imposing threat to human life.

1. Compensation, support, and resettlement upon expropriation to users of land in the area suffering environmental pollution and likely threat to life; users of land susceptible to landslide, sinking and other natural catastrophes imposing threat to life as defined in Clause 3, Article 87 of the Law on Land shall be done according to the provisions set out in Clause 1, Article 79 of the Law on Land, Articles 6 and 22 hereof.

2. In case all or part of the land used by households and individuals slides or sinks all of a sudden and the remaining part is no longer usable, users thereof shall be arranged new land in resettlement area as stipulated as follows:

a) Area of land shall be decided by the province-level People’s committee based on specific local conditions but not permitted to exceed the limit of allocation in the locality;

b) Payment of land levies, exemption from land levies and other incentives shall be done according to the provisions of the Decree on collection of land levies.

3. Compensation and support for area of land expropriated shall be done as follows:

a) Paid by the State in case expropriation results from natural catastrophes;

b) Paid by enterprises in case life-threatening pollution to the area where the land is situated caused by such enterprises; or paid by the State in case such enterprises close down or go bankrupt.

Article 17. Compensation, support upon expropriation for the implementation of investment projects advocated and approved by the National Assembly and the Prime Minister respectively

In case expropriation for the implementation of investment projects advocated and approved by the National Assembly and the Prime Minister respectively forces the movement of the entire residential community imposing impacts on life and socio-economic activities as well as cultural traditions of the community and such expropriation is related to multiple provinces and cities affiliated to the Center, the compensation and support shall be done as follows:

1. Ministries and Departments related to the investment projects shall be responsible for presiding over and collaborating with the province-level People’s committee where expropriation takes places on building the policy framework for compensation, support and resettlement (hereinafter referred to as the policy framework) and making submission to the Prime Minister for consideration and ensuring expenditures for compensation, support, and resettlement according to the provisions of law.

The policy framework shall include the following information:

a) Area of each type of land to be expropriated;

b) Number of land users in the area subject to expropriation;

c) Planned compensation, support for each type of land subject to expropriation; planned price of compensation for each type of land and position;

d) Plan of resettlement (planned number of households, location and manner of resettlement);

dd) Planned total amount of compensation, support and resettlement and source of capital for implementation;

e) Plan of movement and transfer of site plan

2. The Ministry of Natural Resources and Environment shall preside over and collaborate with relevant agencies, organizations on appraising the policy framework before making submission to the Prime Minister for decision.

3. Based on the policy framework approved by the Prime Minister, relevant Ministries and Departments shall organize formulation, appraisal and approval of the plan for compensation, support, and resettlement for the entire project.

The province-level People’s committee shall rely on the plan for compensation, support, and resettlement approved by the Ministries and Departments to organize formulation, appraisal and approval of the plan for compensation, support and resettlement with respect to the project implemented locally after a written approval from relevant Ministries and Departments is issued; to organize the implementation and final settlement of expenditures for compensation, support, and resettlement with relevant Ministries and Departments.

Article 18. Compensation for movement of tombs, graves

For movement of tombs and graves other than the cases as defined in Clause 1, Article 8 hereof, persons to which such tombs and graves belong shall be compensated new land, expenses for movement and construction of new tombs and graves and other relevant expenses. The province-level People’s committee shall decide specific compensation according to customs and reality in the locality.

Article 19. Support for living and production stabilization upon expropriation by the State

Providing support for living and production stabilization upon expropriation by the State as defined in Point a, Clause 2, Article 83 of the Law on Land shall be done as follows:

1. Subjects to receive support include:

a) Households and individuals who were allocated agricultural land according to the State under the Government’s Decree No. 64/CP dated September 27, 1993 promulgating a statute on allocation of agricultural land to households and individuals for stable and long-term agricultural production; the Government’s Decree No. 85/1999/NĐ-CP dated August 28, 1999 amending and supplementing some articles of the aforesaid statute on allocation of agricultural land to households and individuals for stable and long-term agricultural production and supplementing allocation of salt production land to households and individuals for stable and long-term use, supplementing allocation of forestland according to the Government’s Decree No. 02/CP dated January 15, 1994 promulgating a statute on allocation of forestland to organizations, households and individuals for stable and long-term forest production; the Government’s Decree No. 163/1999/NĐ-CP dated November 16, 1999 on allocation, lease of forestland to organizations, households and individuals for stable and long-term forest production; the Government’s Decree No. 181/2004/NĐ-CP dated October 29, 2004 on the implementation of the Law on Land;

b) Members of the households as defined in Point a of this Clause but arising after the time of allocation of land to such households.

c) Households and individuals who are eligible for allocation of agricultural land as defined in Point a of this Clause but are not yet granted the allocation of land and are currently using the agricultural land from transfer, inheritance, gifts and reclaimation according to the provisions of law confirmed by the People’s Committee of the commune where expropriation takes place as developing production on such agricultural land;

d) Households and individuals who are currently using land allocated from state-run farms, plantations for agricultural, forestry and aquaculture production (excluding specialized forestland, protective forestland) and are also officials and public servants (still working, retired on a pension, retired due to loss of capacity for work, retired on redundancy payments); households and individuals who are currently developing agricultural production and earning stable income on such land;

dd) Economic organizations, households and individuals doing business, foreign-invested enterprises that are forced into suspension of production and business by the expropriation shall be supported for production stabilization.

2. Conditions for receipt of support for living and production stabilization:

a) Households and individuals, economic organizations, foreign-invested enterprises who currently use the land, being subjects as defined in Clause 1 of this Article, already granted the Certificate of land use right or eligible for issuance of Certificate of land use right, ownership of land-linked houses and properties as defined in Articles 100, 101 and 102 of the Law on Land except otherwise as regulated in Point b of this Clause;

b) Households and individuals who currently use the land allocated from state-run farms, plantations for agricultural, forestry and aquaculture production (excluding specialized forestland, protective forestland) as defined in Point d, Clause 1 of this Article and have a contract of land allocation.

3. Providing support for living stabilization toward those as defined in Points a, b, c and d, Clause 1 of this Article is done as follows:

a) In case from 30% to 70% of agricultural land is expropriated, support shall be provided for a period of six months if residence is not moved and a period of twelve months if residence is moved; in case residence is moved to areas of extreme socio-economic difficulties, support shall be provided for a maximum of 24 months.

In case over 70% of agricultural land is expropriated, support shall be provided for a period of twelve months if residence is not moved and a period of 24 months if residence is moved; in case residence is moved to areas of extreme socio-economic difficulties, support shall be provided for a maximum of 36 months;

b) Area of expropriated land as defined in Point a of this Clause shall be determined according to each expropriation decision made by the People’s Committee of competent authorities;

c) One member of households as defined in Points a and b of this Clause shall receive support in money (equivalent to 30 kilogram of rice per month)

4. Providing support for production stabilization shall be done as follows:

a) Any household or individual who receives compensation in agricultural land shall be supported for production stabilization including: plant varieties, breeds of domestic animals for agricultural production, agricultural and forestry extension services, plant protection services, veterinary medicine, cultivation and cattle-breeding techniques, and professional skills for production and business in industry and trade services;

b) Economic organizations, households and individuals doing in business, foreign-invested enterprises as defined in Point dd, Clause 1 of this Article shall be supported in money for production stabilization (a maximum of 30% of income after tax according to average income of three most recent years).

Income after tax is determined on financial statement audited or approved by tax agency; in case financial statement is not audited or approved by tax agency, income after tax shall be based on income declared on the financial statement and annual production performance report sent to tax agency.

5. Households and individuals who currently use the land allocated from state-run farms, plantations for agricultural, forestry and aquaculture production, being subjects as defined in Point d, Clause 1 of this Article shall be supported in money for living and production stabilization.

6. Employees hired by economic organizations, households and individuals doing business, foreign-invested enterprises as defined in Point dd, Clause 1 of this Article under labor contract shall receive support for six months in the form of severance pay according to the provisions of the law on labor.

7. The province-level People’s committee shall decide level of compensation, duration of payment of compensation in accordance with local specific circumstances.

Article 20. Support in training, occupational change and job seeking to households and individuals directly involved in agricultural production upon expropriation of agricultural land

1. For households and individuals directly involved in agricultural production development as defined in Points a, b, c and d, Clause 1, Article 19 of this Decree (except households and individuals as officials and public servants from state-run farms, plantations who are retired on a pension, retired due to loss of capacity for work and retired on redundancy payments), upon expropriation, compensation shall be made in the form of support in training, occupational change and job seeking in addition to the compensation in money made for the area of agricultural land expropriated.

a) Compensation in money should not exceed five times the price of agricultural land of the same type in the land price list promulgated by local authorities with respect to all agricultural land subject to expropriation; the area for which support shall be provided should not exceed the limit of allocation in the locality;

b) Level of compensation shall be decided by the province-level People’s committee based on actual circumstances in the locality.

2. The Ministry of Labor, Invalids and Social Affairs shall preside over and collaborate with relevant Ministries and Departments on making submission to the Prime Minister for decision about policy on jobs and occupational training to persons whose agricultural land is subject to expropriation.

3. The province-level People’s committee shall rely on the policy on jobs and occupational training decided by the Prime Minister to direct formulation and implementation of the plan for training, occupational change and job seeking to working-age population in the locality. The plan for training, occupational change and job seeking shall be formulated and approved at the same time with the plan for compensation, support, and resettlement. During the formulation of the plan for training, occupational change and job seeking, consultation should be made with persons whose land is subject to expropriation.

Article 21. Support in training, occupation change and job seeking to households and individuals whose inhabited land linked with business and services thereon is subject to expropriation

1. Households and individuals whose inhabited land linked with business and services thereon is subject to expropriation and forced to move residence shall be supported in training, occupational change and job seeking according to the provisions set out in Point b, Clause 2, Article 83 of the Law on Land.

2. The Ministry of Labor, Invalids and Social Affairs shall preside over and collaborate with relevant Ministries and Departments on making submission to the Prime Minister for decision about a policy on jobs and occupational training to existing working-age population of households and individuals whose land is subject to expropriation.

3. The province-level People’s committee shall rely on the policy on jobs and occupational training decided by the Prime Minister and actual circumstances in the locality to decide level of compensation as appropriate for each household and individual whose land is subject to expropriation.

Article 22. Compensation in the form of resettlement to households, individuals, overseas Vietnamese whose land is subject to expropriation and forced to move residence

Providing support in resettlement to households, individuals and overseas Vietnamese whose land is subject to expropriation and forced to move residence as defined in Point a, Clause 2, Article 83 of the Law on Land is done as follows:

1. Upon receipt of inhabited land and resettlement houses as compensation, in case the compensation in the form of land is less than value of an approved minimum resettlement allotment (hereinafter referred to as an allotment) as defined in Article 27 hereof, the difference between the compensation in the form of land and the value of an allotment shall be paid to households, individuals, and overseas Vietnamese as mentioned above.

2. Households and individuals, overseas Vietnamese who manage residence themselves shall receive support in resettlement in addition to the compensation in the form of land. The province-level People’s committee shall rely on the area expropriated, number of population of households and local specific circumstances to decide level of compensation as appropriate;

Article 23. Compensation to lessees on houses not owned by the State

In case houses not owned by the State are subject to expropriation and households and individuals as lessees thereon are forced to move residence, compensation for expenses for movement of belongings shall be made according to the provisions prescribed by the province-level People’s committee.

Article 24. Compensation for public land owned by communes, wards and towns upon expropriation

Compensation shall be made for public land owned by communes, wards and towns upon expropriation and level of compensation shall be decided by the province-level People’s committee; Such compensation shall be paid to the state budget and included in the communes, wards and towns’ annual budget estimates and only used for investment in infrastructural constructions and for communes, wards and towns’ common purposes.

Article 25. Other support to land users upon expropriation

In addition to support as defined in Articles 19, 20, 21, 22, 23 and 24 hereof and based on actual circumstances in the locality, President of the province-level People’s committee shall decide other support measures to ensure residence, living and production stabilization and fairness to those whose land is expropriated; in case an agricultural land on which households and individuals develop agricultural production is subject to expropriation and is found ineligible for compensation as defined in Article 75 of the Law on Land, the province-level People’s committee shall rely on actual circumstances in the locality to consider compensation as appropriate or to make submission to the Prime Minister for decision in case of necessity.

Article 26. Formulation and implementation of resettlement projects

Formulation and implementation of resettlement projects as stipulated in Article 85 of the Law on Land shall be done as follows:

1. Resettlement projects shall be formulated and approved independently of the plan for compensation, support and resettlement but availability of inhabited land, resettlement houses should be ensured before competent authorities decide expropriation.

2. Formulation of resettlement projects and selection of investors shall be done according to the law on development and management of resettlement houses ensure compliance with the provisions set out in Clauses 2, 3, Article 69 of the Law on Land.

3. Resettlement area shall be established for one or more projects; houses, land in the resettlement area shall be arranged in multiple grades of housing and various areas appropriate for level of compensation and creditworthiness of persons subject to resettlement.

4. As for projects of concentrated resettlement area with construction phases according to sub-projects, progress of land expropriation and construction of houses or infrastructure of the resettlement area shall follow progress of each sub-project and connection of infrastructural works of individual sub-projects to common technical infrastructure of the resettlement area must ensure strict compliance with the detailed planning approved by competent authorities.

5. Ensuring expenditures for the implementation of resettlement projects shall be done according to Article 32 hereof.

Article 27. An allotment

1. An allotment as prescribed in Clause 4, Article 86 of the Law on Land shall be defined in the form of inhabited land, houses or money to suit the choice of persons arranged for resettlement.

2. In case an allotment is defined in the form of inhabited land, houses, area of resettlement land should not be less than minimum area approved of partition in the locality and area of resettlement house should not be less than minimum area of an apartment as defined by the Law on houses.

In case an allotment is defined in the form of houses, area of a resettlement house should not be less than minimum area of an apartment according to the provisions of the Law on houses.

In case an allotment is defined in the form of money, a sum of money for an allotment shall be equal to value of an allotment defined in the form of inhabited land, houses in the resettlement area.

3. Based on the provisions set out in Clauses 1, 2 of this Article and actual circumstances in the locality, the province-level People’s committee shall decide an allotment in the form of inhabited land, houses and money.

Article 28. Plan for compensation, support, and resettlement upon expropriation by the State for the implementation of projects other than the case as defined in Article 17 hereof

1. The plan for compensation, support, and resettlement upon expropriation for national defense and security, socio-economic development for the benefits of the public and the country other than the case as defined in Article 17 hereof comprises:

a) Full name and address of person whose land is expropriated;

b) Area, type of land, origin of expropriated land; existing quantity and value of properties linked to land subject to loss;

c) Foundations for calculation of compensation, support such as land price, house price, construction price, number of household members, number of working-age people, number of people entitled to welfare payment;

d) Amount of compensation, support;

dd) Expenses for formulation and implementation of compensation and site clearance;

e) Resettlement arrangement;

g) Movement of construction works owned by the State, organizations, religious establishments and residential community;

h) Movement of tombs, graves

2. Collecting suggestions about the plan for compensation, support, and resettlement as defined in Clause 1 hereof shall be done according to the provisions set out in Clause 2, Article 69 of the Law on Land. All the suggestions contributed by residents in the area when expropriation takes places must be welcomed and sealed for at least 20 days.

Article 29. Division of the content of compensation, support and resettlement into sub-projects and responsibilities for expropriation, compensation, support, and resettlement for investment projects initiated by the ministries, departments

1. Based on scale of expropriation for the implementation of investment projects, competent agencies that approve the investment project shall divide the content of compensation, support, and resettlement into sub-projects and implement them independently.

2. The province-level People’s committee shall be responsible for organizing expropriation, compensation, support, and resettlement for investment projects that are initiated by the ministries, ministerial-level agencies, Governmental agencies, economic groups, corporations, central-affiliated public service providers.

3. Relevant Ministries and Departments shall be responsible for collaborating with the province-level People’s committee and organizations in charge of compensation and site clearance during the implementation, ensuring expenditures for compensation, support and resettlement according to the provisions of law.

Article 30. Payment for compensation, support and resettlement

1. Deduction of an amount as financial obligation to land use unfulfilled by land users from the amount of compensation as defined in Clause 4, Article 93 of the Law on Land shall be done as follows:

a) An amount as financial obligation to land use unfulfilled consists of land levies, land rent that are still unpaid to the State till the date of expropriation;

b) An amount as financial obligation to land use unfulfilled by users as defined in Point a shall be determined according to the provisions of the law on collection of land levies; land rent and water surface rent.

In case such unpaid amount as financial obligation to land use to the date of issuance of expropriation decision is more than the amount of compensation, households and individuals as land users shall be permitted debits for such difference; after resettlement house has been arranged to households and individuals and the difference after subtracting amount of compensation from amount for allocation of inhabited land and houses in the resettlement area is less than the unpaid amount as financial obligation to land use, households and individuals shall be permitted debits for such difference;

c) Amount of compensation subtracted from unpaid amount as financial obligation include amount of compensation for land and the remaining land-related investment expense (if any). Amounts of compensation for movement, losses caused to properties, suspension of business and production and others shall not be subtracted from unpaid amount as financial obligation to land use.

2. In case compensation in the form of allocation of new land, inhabited land or houses in the resettlement area results in any difference in value, such difference shall be paid in money as follows:

a) In case amount of compensation for land is more than value of inhabited land, houses in the resettlement area, persons subject to resettlement shall receive such difference.

b) In case amount of compensation for land is less than value of inhabited land, houses in the resettlement area, persons subject to resettlement shall pay such difference except otherwise as regulated in Clause 1, Article 22 hereof.

3. In case the area subject to expropriation is in dispute over land use right, compensation and support for such area shall be transferred to State Treasuries pending competent authorities’ decision and paid back to its real user after the case is concluded.

4. Advances for compensation, support and resettlement shall be made as follows:

a) Land development fund shall make advances to organizations in charge of compensation and site clearance for the establishment of a clean land fund used for allocation and lease of land according to the model Statute on management and use of land development fund;

b) Any person who is allocated or leased land to with land levies and land rent respectively under the Law on Land volunteers to make advances for compensation, support and resettlement according to the plan approved by competent agencies shall be paid back by subtraction from land levies and land rent. Amount to be subtracted should not exceed land levies, land rents; remaining amount (if any) shall be included in the investment capital of the project.

If any person who is allocated or leased land to with or without land levies or land rent according to the Law on Land and exempted from land levies, land rent volunteers to make advances for compensation, support, and resettlement according to the plan approved by competent agencies, expenditures for compensation, support, and resettlement shall be included in the investment capital of the project.

Article 31. Expenses for the implementation of compensation, support and resettlement

1. Any organization in charge of compensation and site clearance shall be responsible for making cost estimates for the implementation of compensation, support, and resettlement on each project as follows:

a) For any expense that has limit, standard and unit price defined by competent authorities, applicable regulations shall be executed;

b) For any expense that has no limit, standard and unit price, cost estimates shall be made based on characteristics of each project and actual circumstances in the locality;

c) Expenses for printed documents, office supplies, petrol, logistic support and others… serving the management system shall be calculated based on actual demand of each project.

2. Expenditure ensuring the implementation of compensation and site clearance to be deducted shall not exceed 2% of total expenditure for compensation and support for the project. For any project that is implemented on the administrative division facing socio-economic difficulties, linear infrastructure projects or any cases enforced the audit, the organization charged with the implementation of compensation, support and resettlement shall be permitted to make cost estimates for the implementation of compensation, support, and resettlement for the project according to actual work quantities without being restricted to 2% deduction.

Competent agencies who approve the plan for compensation, support, and resettlement shall decide expenditures for the implementation of compensation, support, and resettlement for each project according to the law.

3. In case expropriation is enforced, the organization charged with the implementation of compensation and site clearance shall make cost estimates for the implementation of enforcement and make submission to regulatory agencies for decision. Expenditures for the implementation of land expropriation enforcement shall be arranged as follows:

a) For land that is allocated or leased out without land levies and land rent, this expenditure shall be included in the investment capital of the project;

b) For land that is expropriated to form a clean land fund for allocation or lease of land via auction, this expenditure shall be advanced from the land development fund;

c) In case investors volunteer to make advances for compensation, support, and resettlement (including expenditures for the implementation of expropriation enforcement), this expenditure shall be subtracted from land levies, land rents.

4. The Ministry of Finance shall instruct the formulation of cost estimation, use and final settlement of the expenditures for the implementation of compensation, support, and resettlement.

Article 32. Expenses for the implementation of compensation, support and resettlement

1. Expenditure for compensation, support, and resettlement includes amount of compensation, support and resettlement for the land expropriated for the implementation of the investment project, expenses for the implementation of compensation, support, and resettlement and others.

Determination of amount of compensation, support, and resettlement shall follow the plan for compensation, support, and resettlement approved by competent agencies.

2. Expenditure for compensation, support, and resettlement upon expropriation by the State for the implementation of projects as defined as follows:

a) Expenditure for the implementation of compensation, support and resettlement shall be included in the expenditure for the implementation of investment project;

b) Relevant Ministries and Departments shall be responsible for ensuring expenditures for compensation, support, and resettlement with respect to investment projects advocated and approved by the National Assembly and the Prime Minister respectively and implemented by the Ministries and Departments and other projects invested by the Ministries and Departments;

c) The province-level People’s committee shall be responsible for ensuring expenditures for compensation, support, and resettlement with respect to projects decided by provincial People’s Councils;

d) Any investor who volunteers to make advances for compensation, support, and resettlement shall be responsible for ensuring expenditures for the implementation of projects other than the case as defined in Points b and c of this Clause.

Chapter 3.

IMPLEMENTATION

Article 33. Responsibilities of central-affiliated agencies, organizations and the province-level People’s committee for the implementation of compensation, support, and resettlement

1. Ministries, ministerial-level agencies Governmental agencies, economic groups, corporations, central-affiliated public service providers that initiate investment projects shall be responsible for directing and investigating the implementation of compensation, support, and resettlement; collaborating with the province-level People’s committee and the organization charged with the implementation of compensation and site clearance during the implementation; ensuring expenditures for compensation, support, and resettlement according to the provisions hereof.

2. The province-level People’s committee shall be responsible for directing expropriation, compensation, support, and resettlement according to the provisions hereof and reporting results of the implementation of expropriation, compensation, support, and resettlement to the Ministry of Natural Resources and Environment before December 01 annually.

3. The Ministry of Natural Resources and Environment shall be responsible for directing and investigating the implementation of compensation, support, and resettlement according to the provisions hereof and handling difficulties arising at the request of the province-level People’s committee.

Article 34. Handling of problems arising from the promulgation of the Decree

1. For project land that is subject to expropriation by the State and the investor therein is permitted by the province-level People’s committee to receive transfer of the land within the project scope before July 01, 2014, the amount paid by the investor for the transfer of land use right shall be subtracted from land levies and land rent according to the law before July 01, 2014.

2. For project land before July 01, 2014 that is subject to expropriation due to misled and inefficient land use; land is left unemployed for twelve months straight or progress of land use is 24 months later than the progress stated in the investment project and expropriated by the People’s committee of competent authorities where expropriation takes place, the handling of land levies, land rent and properties invested thereon shall be done according to the provisions of the Law on Land before July 01, 2014; in case expropriation decision is not yet issued, the provisions set out in Point i, Clause 4, Article 64 of the Law on Land shall be applied.

3. In case expropriation decision is issued and the plan for compensation, support, and resettlement is approved according to the provisions of the Law on Land before July 01, 2014, implementation shall be based on the approved plan.

4. In case expropriation decision is issued and the plan for compensation, support, and resettlement is not yet approved before July 01, 2014, the followings shall be done:

a) For project the land for which is subject to expropriation as defined in Articles 61 and 62 of the Law on Land and the investor therein has met the conditions as defined in Clause 3, Article 58 of the Law on Land, the province-level People’s committee shall allow formulation, appraisal and approval of the plan for compensation, support, and resettlement according to the Law on Land in 2013;

b) For project that has not met the conditions as defined in Point a of this Clause, the People’s Committee of competent authorities shall decide to postpone expropriation decision and direct relevant organizations and individuals to stop the implementation of the project;

c) For project the land for which is given green light by competent authorities for expropriation according to progress, the State shall continue expropriation for the remaining area of land and carry out formulation, appraisal and approval of the plan for compensation, support, and resettlement under the Law on Land in 2013.

5. In case land used before July 01, 2014 and originally leased out by the State with land rent paid once for the entire lease is expropriated, the users thereof shall not be compensated for the land but be compensated for the expenses invested on such land according to the provisions set out in the Decree No.197/2004/NĐ-CP dated December 03, 20014 of the Government on compensation, support and resettlement upon land expropriation by the State.

Article 35. Effect

1. This Decree takes effect since July 01, 2014.

2. This Decree shall replace the Decree No. 197/2004/NĐ-CP dated December 03, 2004 of the Government on compensation, support and resettlement upon land expropriation by the State.

Article 36. Responsibilities for implementation

Ministers, Heads of ministerial-level agencies, Heads of Governmental agencies, President of the People’s Committee of all levels, relevant organizations, individuals shall be responsible for executing this Decree.

|

|

PP

THE GOVERNMENT |