Nội dung toàn văn Official Dispatch No. 11971/BTC-TCT, on personal income tax payable by owners

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 11971/BTC-TCT |

Hanoi, August 26, 2009 |

To: Provincial – level Tax Departments

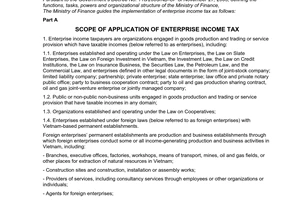

The Ministry of Finance has recently received some requests of provincial-level Tax Departments for specific guidance on whether owners of private enterprises are obliged to pay income amounts remaining after their enterprises have paid business income tax. Regarding this matter, the Ministry of Finance provides the following guidance:

According to Article 141 of November 29, 2005 Law No. 60/2005/QH11 on Enterprises, a private enterprise means an enterprise owned by an individual who take responsibility for all operations of this enterprise with all of his/her assets.

According to Point 1.1, Part A, and Item d, Point 2.5, Section IV, Part C of Circular No. 130/2008/TT-BTC of December 26, 2008, guiding a number of articles of Law No. 14/2008/QH12 on Business Income Tax, and guiding the Government’s Decree No. 124/2008/ND-CP of December 11, 2008, detailing the implementation of the Law on Business Income Tax, private enterprises are obliged to pay business income tax.

Based on the above provisions, owners of private enterprises are not obliged to pay personal income tax for income amounts remaining after their enterprises have paid business income tax.

Owners of private enterprises are obliged to pay personal income tax for other incomes not related to their enterprises’ operations, such as won prizes, inheritances, gifts, etc.

The Ministry of Finance notifies the above guidance to provincial-level Tax Departments for information and implementation guidance.-

|

|

UNDER THE MINISTER OF FINANCE’S

AUTHORIZATION |