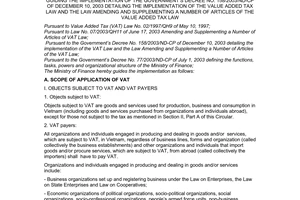

Nội dung toàn văn Official Dispatch No. 12/TCT-PCCS on value added tax for industrial food rations

|

GENERAL DEPARTMENT OF TAXATION |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 12/TCT-PCCS |

Hanoi, January 02, 2007 |

OFFICIAL LETTER

ON VALUE ADDED TAX FOR INDUSTRIAL FOOD RATIONS PROVIDED FOR EXPORT-PROCESSING ENTERPRISES

To: Asian Development Support Ltd. Co.

In response to Official Letter No. 0111/2006/CV of November 20, 2006, of Asia Development Support Ltd. Co., on value-added tax (VAT) policies for industrial food rations provided for export-processing enterprises, the General Department of Taxation gives the following opinion:

According to Point 1, Section II, Part B of the Finance Ministry’s Circular No. 120/2003/TT-BTC of December 12, 2003, and Point 3 of Circular No. 84/2004/TT-BTC of August 18, 2004, guiding value-added tax, export services and services provided to export-processing enterprises for their production and trading activities, except for services provided for personal consumption purposes, are subject to VAT at the rate of 0%. Export services are those provided directly to overseas organizations and individuals, consumed outside Vietnamese territory and fully satisfying the following conditions: the service provider signs a contract with overseas buyers in accordance with the Commercial Law; overseas buyers pay service charges to the service provider based in Vietnam.

Expenses for enterprises’ industrial food rations constitute in essence part of salaries payable by enterprises to laborers under labor contracts; otherwise enterprises would pay income to laborers and laborers pay for the food by themselves.

Therefore, pursuant to the above provisions, when domestic enterprises provide industrial food rations for laborers of export-processing enterprises, those food rations are not subject to VAT at the rate of 0%, but at the rate of 10%.

The General Department of Taxation notifies its opinion to Asia Development Support Ltd. Co. for compliance.

|

|

FOR

THE GENERAL DIRECTOR OF TAXATION |