Nội dung toàn văn Official Dispatch No. 15500/BTC-TCHQ, on guiding some problems related to Custom

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No.: 15500/BTC-TCHQ |

Hanoi, November 03, 2009 |

To: Departments of Customs of provinces, cities.

The Ministry of Finance receives the reflection of the enterprises trading seaports, carriers, logistics companies and some Departments of Customs of provinces, cities on some problems related to customs procedures for transit goods, goods taken out or put into Cat Lai open Port, collection services and share of retail in the CFS and procedures to adjust the cargos manifest, the Ministry of Finance guides the Customs Departments of provinces, cities the unified implementation as follows:

1. Regarding customs supervision for the services performed in the CFS:

1.1. The services performed in the CFS:

a. For exported goods: Packing, repacking, arranging, rearranging goods. To be allowed to take transit goods, transshipment goods into the CFS in the port to split, joint exporting container or to joint with exported goods of Vietnam.

b. For imported goods: It is allowed to split to conduct customs procedures or transfer border gate or joint container with other lot of exported goods for export to third countries.

1.2. Procedures for customs supervision:

Principles and procedures of customs supervision for goods taken out or put into and service performance in the CFS comply with the provisions of Article 13, 14 of Decree No.154/2005/ND-CP Article 16 of Circular No.79/2009/TT-BTC and guidance of the General Department of Customs.

2. Procedures for adjusting goods declaration (manifest):

Procedures for adjusting the declaration of goods specified in Article 87 of Circular No.79/2009/TT-BTC thus the records requesting for correction and adjustment of imported goods declaration (already submitted to the Customs agencies) comprise:

a) Request to correct and adjust the bill of lading of the consignor in foreign countries;

b) Telexed confirmation of ship owner or agent of ship owner from foreign countries (Vietnamese translation, English copy of each type of 01 copy) on the content of adjustment;

c) An application for adjustment of the ship owner or agent of the ship owner;

d) Declaration of adjusted goods;

e) The written authorization of the ship owner or ship owner’s agent to person who is authorized to work with customs authorities to request for adjusting the contents of the declaration of goods;

g) Particularly for the straight bill of lading, if the recipient's name is adjusted, it must have the written rejection of the goods of the consignee on bill of lading.

Now, the Ministry of Finance guides specifically as follows:

2.1. For the adjustment of goods declaration made by the carrier generated by the adjustment of the master bill of lading (master B/L) issued by the carrier shall follow the procedures prescribed in Article 87 of Circular No.79/2009/TT-BTC but the vouchers required to submit are adjusted as follows:

+ For request of repair or adjustment of the bill of lading of the consignor in foreign countries: can accept e-mail of the consignor;

+ Not requiring a Vietnamese translation of telexed confirmation of the carrier or foreign carrier’s agents for the content of adjustment;

+ Not requiring application for adjustment of the ship owner or agent of the ship owner;

+ For the straight bill of lading, it shall not require written rejection of goods of the consignee on the B/L;

+ The adjusted bill of lading and unadjusted bill of lading (copy);

2.2. For the adjustment of the declaration of goods arising from the adjustment of house B/L issued by the logistics company, the dossier of request for correction and adjustment of imported goods declaration includes the following documents:

+ Request for repair or adjustment of the bill of lading of the consignor in foreign countries (can accept e-mail of the consignor) together with copies of the adjusted bills of lading and unadjusted bills of lading.

+ Telexed confirmation of foreign logistics company on the content adjusted.

+ Written authorization of foreign logistics company or agent of a foreign logistics company for the authorized country to work with customs authorities for adjusting the contents of the cargo manifest.

If the logistics companies in Vietnam have signed logistics agent contracts with the foreign logistics company, if contract is presented as requesting for adjustment of the declaration of goods, the application for adjustment of the ship owner or agent of ship owner referred to in point c shall be signed by the logistics company in Vietnam and shall not need a written authorization under point e clause 2 of Article 87 of Circular No.79/2009/TT-BTC

Other procedures are conducted as prescribed in Article 87 of Circular No.79/2009/TT-BTC

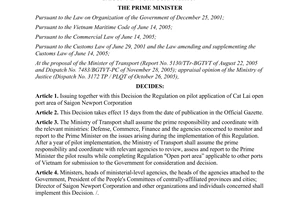

3. Problems on the pilot Regulation of Cat Lai open Port area:

On the amendment of Decision No.37/2006/QD-TTg dated 10/02/2006 of the Prime Minister promulgating the pilot Regulation on Cat Lai open Port area of Saigon Tan Cang Company: Ministry of Finance will discuss with the Ministry of Transport to agree contents of amendments and supplements for submitting to the Prime Minister.

During the implementation, if any problems arise should promptly report to the Ministry of Finance (General Department of Customs) for direction./.

|

|

FOR

MINISTER |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments