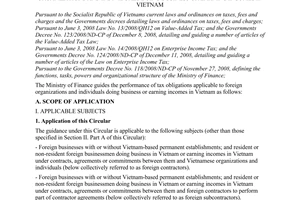

Nội dung toàn văn Official Dispatch No. 2470/TCT-CC Guiding tax policy for foreign contractors

|

THE GENERAL DEPARTMENT OF TAXATION |

SOCIALIST REPUBLIC OF VIETNAM |

|

No. 2470/TCT-CC |

Hanoi, July 12, 2012 |

To: Vietnam Le Long Limited Liability Company

The General Department of Taxation has received the Official Letter No. LLVN20120502, of May 18, 2012 of Vietnam Le Long Limited Liability Company on requesting for guidance of tax policy for foreign contractor doing business in Vietnam under form of on-spot export and import. Regarding this problem, the General Department of Taxation responds as follows:

1. The tax liability of foreign contractor - Thye Ming Industrial Co., Ltd (the foreign contractor):

- Point 1, section I, part A of the Circular No. 134/2008/TT-BTC of December 31, 2008 of the Ministry of Finance providing on applicable subjects of tax liability for foreign contractor as follows: “… This Circular applies to … Foreign businesses with or without Vietnam-based permanent establishments; and resident or non-resident foreign businessmen doing business in Vietnam or earning incomes in Vietnam under contracts, agreements or commitments between them and Vietnamese organizations and individuals (below collectively referred to as foreign contractors)”.

- Point 2, section II, part A of the Circular No. 134/2008/TT-BTC of December 31, 2008 of the Ministry of Finance providing on non-applicable subjects of tax liability for foreign contractor as follows: “Guides in this Circular shall not applicable to: …2. Foreign organizations and individuals supplying goods for Vietnamese organizations and individuals without accompanying services in Vietnam in the following forms:

- Goods delivery at foreign border gates: Sellers are liable for all obligations, expenses and risks related to the export and delivery of goods at foreign border gates; buyers are liable for all obligations, expenses and risks related to the receipt and transportation of goods from foreign border gates to Vietnam.

- Goods delivery at Vietnamese border gates: Sellers are liable for all obligations, expenses and risks related to the transportation of goods to places of delivery at Vietnamese border gates; buyers are liable for all obligations, expenses and risks related to the receipt and transportation of goods from Vietnamese border gates…”

The foreign contractor sells goods for the Vietnam Le Long Co., Ltd under the form of appointing the Vietnam Thye Ming Co., Ltd (unit being outsourced by the foreign contractor for processing) to deliver goods to Vietnam Le Long Company. Because the delivery of goods is not “at foreign border gate” or “at Vietnamese border gate”, the contractor is not non-applicable subject of tax as prescribed in point 2, section II, part A of the mentioned Circular No. 134/2008/TT-BTC of December 31, 2008 of the Ministry of Finance mentioned above.

- Sub-item 2.2, Point 2, section I, part B of the Circular No. 134/2008/TT-BTC of December 31, 2008 of the Ministry of Finance stipulates as follows: “2.2. When goods are supplied under a contract by mode of: goods delivery at a place in the Vietnamese territory (including Vietnams territorial seas, areas beyond and attached to Vietnams territorial seas on which, under the law of Vietnam and in accordance with international laws. Vietnam has sovereignty over the exploration and exploitation of natural resources in the seabed, soil under the seabed and water above); or these goods are supplied together with services provided in Vietnam such as installation, trial operation, warranty, maintenance and replacement and other services accompanying goods supply, even when the provision of those services is included or not included in the value of the goods supply contract. EIT-liable incomes of foreign contractors or subcontractors are the total value of goods and services”.

According to the above-mentioned provision, because the foreign contractor sells goods for the Vietnam Le Long Co., Ltd under the form of appointing the Vietnam Thye Ming Co., Ltd to deliver goods to the Vietnam Le Long Co., Ltd (form of on-spot export and import), the foreign contractor is applicable subject of tax liability for foreign contractor and the EIT-liable income is the total value of goods that the foreign contractor sell for the Vietnam Le Long Co., Ltd (inclusive of value of processing).

2. The tax liability or the Vietnam Le Long Co., Ltd:

At the Point 2, section I, part A of the Circular No.134/2008/TT-BTC of December 31, 2008 of the Ministry of Finance stipulates as follows: “2. The tax payers

The tax payers as guided in this Circular including: …2.2. Organizations established and operating under the law of Vietnam, organizations registering operation under the law of Vietnam, other organizations and businessmen buying services or services accompanying goods, or paying incomes generated in Vietnam under contractor or subcontractor contracts (below collectively referred to as Vietnamese parties)… Before paying foreign contractors, taxpayers specified at Point 2.2, Section I, Part A of this Circular shall withhold value-added tax and enterprise income tax in accordance with Section III, Part B of this Circular”.

According to the above-mentioned provision, the Vietnam Le Long Co., Ltd that has sold goods of foreign contractor shall calculate, withhold and pay the tax amounts into the State budget on behalf of foreign contractor for the total value of goods bought by foreign contract, before paying foreign contractors.

The General Department of Taxation responds to the Vietnam Le Long Co., Ltd for knowledge and implementation.

|

|

THE GENERAL

DIRECTOR OF TAXATION |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments