Nội dung toàn văn Official Dispatch No. 2478 TCT-DTNN on value added tax (VAT) rates applicable

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 2478 TCT/DTNN |

Hanoi, August 09, 2004 |

OFFICIAL LETTER

ON VALUE ADDED TAX (VAT) RATES APPLICABLE TO PRODUCTS OF PLANTED FOREST TIMBER

|

To: |

Cat Phu Joint-Venture Limited

Liability Company |

In reply to Official Letter No. 124/VT-2004 of July 16, 2004, of Cat Phu Joint-Venture Limited Liability Company on VAT rates applicable to products of planted forest timber, the General Department of Taxation hereby gives the following opinion:

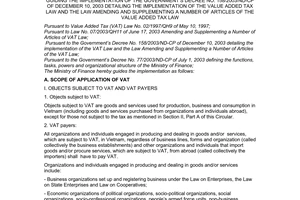

Pursuant to the provisions of the Finance Ministry’s Circular No. 120/2003/TT-BTC of December 12, 2003, guiding the implementation of the Government’s Decree No. 158/2003/ND-CP of December 10, 2003, detailing the implementation of the VAT Law and the Law Amending and Supplementing a Number of Articles of the VAT Law:

- Cultivation products (including products of planted forest timber) unprocessed or preliminarily processed at the commercial business stage are subject to the VAT rate of 5%.

- If the company purchases planted forest timber, then processes such timber into chips, pulp, sawn timber or other products for sale on the market, the VAT rate of 10% shall apply.

The General Department of Taxation hereby notifies the company thereof for knowledge and implementation.

|

|

FOR

THE GENERAL DIRECTOR OF TAXATION |