Nội dung toàn văn Official Dispatch No. 28/ TCHQ-GSQL Concerning the guidance for settlement

|

MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No: 28/TCHQ-GSQL |

Ha Noi, January 05, 2009 |

To: Customs Departments of cities and provinces

Based on the results of 28th Specialized Group Meeting on Rules of Origin of the member nations of ASEAN and the opinion of the Ministry of Industry and Trade in a number of official dispatches No. 10566/BCT-XNK dated November 4, 2008 and No. 11570/ BCT-XNK dated December 04, 2008 about the difficulties in the process of implementation of Decision No.19/2008/QD-BCT dated July 24, 2008 of the Ministry of Industry and Trade, the General Department of Customs makes guidance for the Customs Departments of cities and provinces to perForm on consensus as follows:

1. Decision No. 19/2008/QD-BCT dated July 24, 2008 of the Ministry of Industry and Trade issuing Regulation on issuance of Certificate of Origin (C/O) Form D with effect from September 02, 2008. However, during the transitional period from August 1 to September 2, the customs authorities still accept both C / O old Form D old and C / O new Form D with both ways of recording new and old origin criteria (For example, CTSH WO ... on C / O of old Form D).

2. Requiring no seal "Issued restroactively" in the case of issuance after C / O but only tick (Ö) with a pen, ball pen or computer in the corresponding box in the box No.13 (for C /O new Form D). If during the checking or verification of C / O, the customs authorities discovers that the enterprise intentionally make supplementation to the box No.13 without approval of the C /O issuing agency, the Customs shall reject C / O and record violations as prescribed.

3. The copy of C/O certifying the original C/O was lost or damaged must bear the issuance date of original C/ O – Form D with the words "certified true copy" affixed on C/O.

For C/O with small errors, the C/O issuer may correct inFormation, then sign and affix its seal on the correction place or issue new C/O. In case of issuance new C/O with new reference number, the reference number of the original C/O shall be recorded on the copy of C/O by the words “Replacing C/O Ref..." (number of the original C/O). The customs authorities shall refuse favor if the copy of C/O does not have the words said above.

4. If a C / O Form D has many products which can not be recorded all on the C / O Form D, these products can be further declared on the similar C / O or recorded on to the appendix attached but these appendices must have adequate information of the products and reference number of the C / O, paraph (or normal signature) issued by the officer and the seal of the issuer affixed on those appendices.

5. At the 28th Specialized Group Meeting on Rules of Origin from October 20-22, 2008, the nations of ASEAN have agreed upon minor differences such as incorrect tick on box No. 13, paper size of C / O Form D not in line with A4 size can be considered and accepted until December 31, 2008.

6. In case of refusal of invalid C / O: The customs authorities shall tick the box No.4 on C / O (the original), stating the reasons therefor and guide the importing enterprise to send back the C/O to the issuer of the exporting country for possible certification and replacement of C/O as prescribed.

7. In case the C / O should be verified when there is doubt about the seal, signature, all units should comply with the instructions in the official dispatch No. 4802/TCHQ-GSQL dated September 24, 2008 of the General Department of Customs.

The General Department of Customs shall guide Department of Customs of provinces and cities for implementation.

|

|

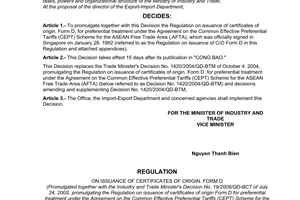

PP. GENERAL DIRECTOR |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments