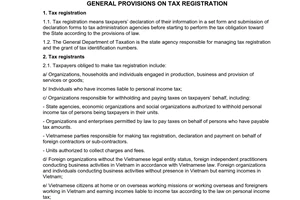

Nội dung toàn văn Official Dispatch No. 3081/TCT-HT on Sale of invoices to foreign contractors

|

MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 3081/TCT-HT |

Hanoi, August 18, 2008 |

|

To: |

Plan ADD Company Ltd. |

The General Department of Taxation has received Plan ADD Company’s Official Letter No. 2008-003/CV of June 11, 2008, on tax policies for foreign contractors. Regarding this issue, the General Department of Taxation expresses the following opinions:

Point 1, Sections I and II, Part C of the Finance Ministry's Circular No. 05/2005/TT-BTC of January 11, 2005, guiding the tax regime applicable to foreign organizations without Vietnamese legal person status and foreign individuals doing business or earning incomes in Vietnam, prescribes tax registration as follows:

* For a foreign contractor or subcontractor applying the Vietnamese accounting system: A foreign contractor or subcontractor shall make its tax registration to obtain a tax identification number at the tax administration agency of the locality where its office is based within 15 working days from the conclusion of a foreign contractor or subcontractor agreement or from the date of obtaining its business permit or professional practice permit (in case a business permit or professional practice permit is required).

* For a foreign contractor or subcontractor not applying the Vietnamese accounting system: The Vietnamese party shall make tax registration and declaration for a foreign contractor or subcontractor at the tax administration agency of the locality where the Vietnamese party’s office is based within 15 working days from its conclusion of a contractor agreement.

Point 4, Section I, Part II of Circular No. 85/TT-BTC of July 18, 2007, guiding the implementation of the Tax Administration Law regarding tax registration, stipulates: “Production, trading and service enterprises, units and organizations shall submit tax registration dossiers to Tax Offices of Provinces and Centrally-runned Cities(below referred to as Provincial Tax Offices) where the enterprises, units and organizations are headquartered…

- An organization or individual who is responsible for withholding and paying tax on behalf of another party shall make tax registration at the tax administration agency of the locality where that organization or individual is headquarted….”

Therefore, a foreign contractor shall, based on the accounting system applied in its contractual activities, make tax registration at a Provincial Tax Office under the above guidance and purchase invoices at that Provincial Tax Office.

The General Department of Taxation informs the Company thereof and advises the Company to contact the Hanoi Tax Office for specific guidance.

|

|

FOR THE GENERAL DIRECTOR OF

TAXATION |