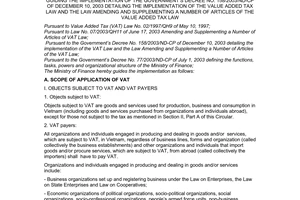

Nội dung toàn văn Official Dispatch No. 3547TCT/PCCS, on currencies written on vat invoices

|

MINISTRY

OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 3547 TCT/PCCS |

Hanoi, October 28, 2004 |

OFFICIAL LETTER

ON CURRENCIES WRITTEN ON VAT INVOICES

To: The Tax Department of Hanoi city

In reply to Official Letter No. 17842/CT-HTr of July 30, 2004, of Tax Department of Hanoi city, on currencies written on VAT invoices, the General Department of Taxation gives the following opinions:

Point 6, Section III, Part C of the Finance Ministry’s Circular No. 120/2003/TT-BTC of December 12, 2003, states that: “in case business establishments have goods and/or service purchase or sale turnover in a foreign currency, such foreign currency amount must be converted into Vietnam dong at the inter-bank average exchange rates publicized by the Vietnam State Bank at the time the goods and/or service purchase or sale is effected and paid in foreign currency(ies) in order to determine the payable VAT amount.”

Under this guidance, if business establishments sell goods and receive payments in foreign currency(ies), the element VAT (if any) on the invoices must be written with the amount paid in a foreign currency and the converted Vietnam dong amount at the inter-bank average exchange rate publicized by the Vietnam State Bank, serving as a basis for VAT calculation.

The General Department of Taxation hereby notifies the Tax Department of Hanoi city thereof for implementation.

|

|

FOR

THE GENERAL DIRECTOR OF TAXATION |