Nội dung toàn văn Official Dispatch No. 3592/TCT-DTNN, Transfer of contributed capital of foreign

|

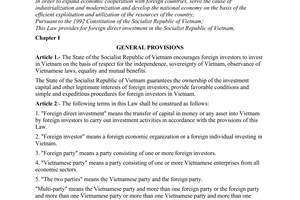

GENERAL

DEPARTMENT OF TAXATION |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No.: 3592/TCT-DTNN |

Hanoi, October 13, 2005 |

To : Department of Taxation of Hai Phong city

In reply of the Official Dispatch No.927/CT-DTNN dated 25/8/2005 of Department of Taxation of Hai Phong city on the transfer of contributed capital of foreign side in the foreign-invested enterprises (FDI), the General Department of Taxation has the following opinions:

- Based on the Law on Foreign Investment in Vietnam;

- Based on Decree No.24/2000/ND-CP dated 31/7/2000 of the Government detailing the implementation of the Law on Foreign Investment in Vietnam and Decree No.27/2003/ND-CP dated 19/3/2003 of the Government amending and supplementing some Articles of Decree No.24/2000/ND-CP;

In order to contribute legal capital, foreign investors must open specialized capital deposit accounts in foreign currency in a bank authorized to trade foreign exchange and make the transactions of transfer of legal capital of investors into Vietnam through this account as stipulated in the Circular No.04/2001/TT-NHNN dated 18/5/2001 of the State Bank of Vietnam guiding the management of foreign exchange for enterprises with foreign owned capital and foreign parties participating in business cooperation contract, there is no regulation that required foreign-invested enterprises to contribute legal capital by funds named the foreign investors themselves stated in the investment license.

General Department Of Taxation replies for the Taxation Department of Hai Phong city to know and implement./.

|

|

FOR

DIRECTOR GENERAL |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft,

for reference only. LawSoft

is protected by copyright under clause 2, article 14 of the Law on Intellectual Property. LawSoft

always welcome your comments