Nội dung toàn văn Official Dispatch No. 4683/TCT-TNCN dated 2013 personal income tax policy

|

MINISTRY OF

FINANCE |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No: 4683/TCT-TNCN |

Hanoi, December 31, 2013 |

To: Tuoi Tre Newspaper

There was an article “Personal Income Tax: Circular contradicts Decree” written by Le Thanh on Tuoi Tre Newspaper (November 27, 213) stating that: According to Decree No. 65, incomes generated from multi-level marketing, insurance brokerage, lottery brokerage are classified as incomes from business activities and therefore they are subject to tax under partially progressive tax schedule. Deductions such as personal deduction deductions of insurance premium, charity donations… may be made before calculating tax. However, Circular No. 111 does not regulate that the incomes from commission on insurance brokerage, lottery brokerage and multi-level marketing brokerage are subject to tax. This makes many insurance brokers and multi-level marketing brokers face difficulties with tax agencies. Below are opinions of General Department of Taxation with regard to this issue:

1. Tax withholding:

Decree No. 65/2013 / ND-CP dated June 27, 2013 of the Government detailing some Articles of the Law on Personal Income Tax and the Law on amendments to the Law on Personal Income Tax only specify types of incomes subject to tax withholding, not personal income tax withholding of insurance brokers, lottery brokers, multi-level marketing brokers. The personal income tax of these individuals shall be withheld in accordance with Clause c1, c2, Point 5, Article 7 of Circular No. 111/2013 / TT-BTC dated August 15, 2013 of The Ministry of Finance guiding the implementation of the Law on Personal Income Tax, the Law on amendments to the Law on Personal Income Tax and Decree No 65/2013/ND-CP of the Government detailing some Articles of the Law on Personal Income Tax as follows:

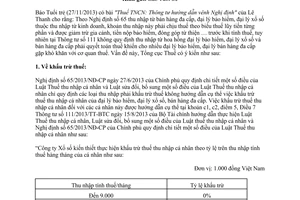

“Lottery companies shall withhold personal income tax on monthly assessable incomes of individuals at the following rates:

Unit: 1,000 VND

|

Assessable income/month |

Tax rate |

|

Up to 9,000 |

0% |

|

Above 9,000 |

5% |

“Insurance, multi-level marketing companies shall withhold personal income tax on monthly assessable incomes of individuals at the following rates:

Unit: 1,000 VND

|

Assessable income/month |

Tax rate |

|

Up to 9,000 |

0% |

|

Above 9,000 up to 20,000 |

5% |

|

Above 20,000 |

10% |

2. Tax declaration:

- Point 5 Article 30 of Circular No.65/2013/ND-CP dated June 27, 2013 of The Government regulates that:

“Tax declaration

Every income payer; resident having incomes from wage, salary, or business activities; resident transferring securities who pays 20% income tax shall file tax declarations annually, except for the following cases:

The tax payable by the individual is smaller than the provisional tax paid quarterly, but the individual does not wish to get a tax refund or offset the difference against tax of the next period;

The individual or business household has only one source of income from business activities and has paid tax as prescribed in Clause 1, Article 10 of this Decree;”

- Clause c, e5, Point 2, Article 26 of Circular No. 111/2013/TT-BTC dated August 15, 2013 of the Ministry of Finance guiding the implementation on the Law on Personal Income Tax and the Law on amendments to some Articles of the Law on Personal Income Tax and Decree No 65/2013/ND-CP of the Government detailing some Articles of the Law on Income Tax guiding the principles of personal income tax declarations of the individual as follows:

“- Resident having income from salaries, wages, business activities shall file tax declarations if he/she has additional tax payable or overpaid tax amount and requests to get a tax refund or offset the difference against tax of the next period

- Individual having income from insurance brokerage, lottery brokerage, multi-level marketing brokerage shall directly declare tax with tax agencies if he/she is required to file tax declarations.”

Every individual who is required to file tax declarations shall follow the guidance on the procedures, documents in Article 16 of Circular No.156/2013/TT-BTC guiding the implementation on some Articles of The Law on Tax Administration, the Law on amendments to some Articles of the Law on Tax Administration and Circular No.83/2013/ND-CP dated July 22, 2013 of the Government.

According to the above regulations, every individual having incomes above 9 million VND/month (previously is 4 million VND/month) from insurance brokerage, lottery brokerage and multi-level brokerage shall have their taxes withheld under partially progressive tax schedule, the individual with income up to 9 million VND/month is not subject to personal income tax withholding. The individual having additional tax payable or overpaid tax amounts is entitled to get a tax refund or offset the difference against tax of the next period when he/she declares tax.

|

|

BY ORDER OF DIRECTOR GENERAL |

------------------------------------------------------------------------------------------------------

This translation is made by LawSoft and

for reference purposes only. Its copyright is owned by LawSoft

and protected under Clause 2, Article 14 of the Law on Intellectual Property.Your comments are always welcomed