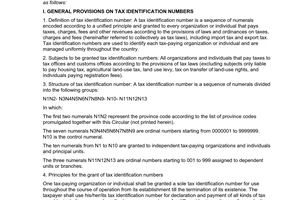

Nội dung toàn văn Official Dispatch No. 4926/TCT-DTNN on grant of tax identification numbers

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 4926/TCT-DTNN |

Hanoi, December 26, 2006 |

OFFICIAL LETTER

ON GRANT OF TAX IDENTIFICATION NUMBERS TO FOREIGN CONTRACTORS

To: Provincial/municipal Tax Departments

The General Department of Taxation has received requests of some provincial/municipal Tax Departments and foreign contractors for guidance on the settlement of problems in the grant of tax identification numbers to, and the declaration and payment of taxes by, foreign contractors that have registered the application of the Vietnamese accounting regime and directly paid taxes to tax authorities. The General Department of Taxation gives the following guidance:

- According to Section I, Part C of the Finance Ministry’s Circular No. 05/2005/TT-BTC of January 11, 2005, guiding the tax regime applicable to foreign organizations without Vietnamese legal person status and foreign individuals doing business or earning incomes in Vietnam, within 15 days from the date of signing a contract, foreign contractors that have applied the Vietnamese accounting regime shall make tax registration with tax authorities of localities where their executive offices are based in order to be granted tax identification numbers.

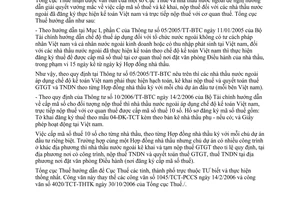

So, according to Circular No. 05/2005/TT-BTC a foreign contractor that applies the Vietnamese accounting regime shall account, declare, pay and finalize value-added tax (VAT) and business income tax (BIT) based on each contract signed with each owner of investment project (each Vietnamese party).

- According to the Finance Ministry’s Circular No. 10/2006/TT-BTC of February 14, 2006, guiding the grant of tax identification numbers to taxpayers, a foreign contractor that applies the Vietnamese accounting regime and directly pays taxes to tax authorities may be granted a 10-digit tax identification number. A dossier of tax identification number registration comprises a tax registration declaration, made according to Form No. 04-DK-TCT enclosed with the List of sub-contractors, if any, and a license for operation in Vietnam.

A 10-digit tax identification number shall be granted to each contractor based on each contract signed between the contractor and the owner of each separate investment project. When, under a contract, the project owner has many works located in different localities, the foreign contractor shall declare and temporarily pay VAT at the prescribed rates in the localities where exist the works, and pay BIT and finalize VAT and BIT in the locality where its executive office is based (where it registers for the grant of tax identification number).

The General Department of Taxation would like to give the above guidance to provincial/municipal Tax Departments for information and compliance. This Official Letter replaces the General Department of Taxation’s Official Letter No. 1045/TCT-PCCS of February 14, 2006, and Official Letter No. 4020/TCT-THTK of October 30, 2006.

|

|

FOR THE GENERAL DIRECTOR OF

TAXATION |