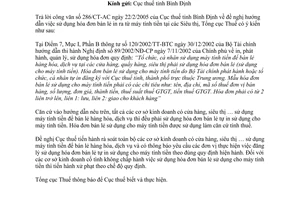

Nội dung toàn văn Official Dispatch No. 981/TCT/PCCS on retail invoices used for cash registers

|

THE

FINANCE MINISTRY |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 981 TCT/PCCS |

Hanoi, April 04, 2005 |

OFFICIAL LETTER

ON RETAIL INVOICES USED FOR CASH REGISTERS AT SUPERMARKETS

To: The Tax Department of Binh Dinh province

In reply to Official Letter No. 286/CT-AC of February 22, 2005, of the Tax Department of Binh Dinh province, requesting guidance on the use of retail invoices printed out from cash registers at supermarkets, the General Department of Taxation gives the following opinion:

Point 7, Section I, Part B of the Finance Ministry's Circular No. 120/2002/TT-BTC of December 30, 2002, guiding the implementation of the Government's Decree No. 89/2002/ND-CP of November 7, 2002, on the printing, issuance, management and use of invoices, states that: "Organizations or individuals that use cash registers in service of retail of goods or services at shops, stalls or supermarkets must use retail invoices (used for cash registers). Retail invoices used for cash registers shall be issued by the Finance Ministry or printed by organizations or individuals themselves and registered with provincial/municipal Tax Departments. A form of retail invoice used for cash registers must contain such elements as the name, address and tax identification number of the seller, quantity, unit price, total money amount, value added tax (VAT) rate, and VAT amount. Each invoice must have at least 2 copies, one to be filed, and the other to be handed to the customer."

Under the above-said guidance, all business establishments which have shops, supermarkets, etc., using cash registers in service of retail of goods or services must use retail invoices printed by business establishments themselves for cash registers. Retail invoices used for cash registers shall serve as a basis for tax calculation.

The Taxation Department of Binh Dinh province is hereby requested to inspect all business establishments which have shops, supermarkets, etc., using cash registers in service of retail of goods or services, and ask such establishments to register the use of retail invoices used printed by establishments for cash registers strictly according to current regulations. Business establishments that intentionally fail to do so shall be sanctioned according to regulations.

The General Department of Taxation hereby notifies the Tax Department of Binh Dinh province thereof for implementation.

|

|

FOR

THE GENERAL DIRECTOR OF TAXATION |