Decision No. 02/2008/QD-NHNN of January 15, 2008, on the amendment, supplement of several accounts in the accounts system of credit institutions issued in conjunction with the Decision No. 479/2004/QD-NHNN of April 29, 2004, the Decision No. 807/2005/QD-NHNN of June 01st, 2005 and the Decision No. 29/2006/QD-NHNN of July 10, 2006 of The Governor of The State Bank. đã được thay thế bởi Circular No. 10/2014/TT-NHNN amendment supplement the Decision No. 479/2004/QD-NHNN và được áp dụng kể từ ngày 01/06/2014.

Nội dung toàn văn Decision No. 02/2008/QD-NHNN of January 15, 2008, on the amendment, supplement of several accounts in the accounts system of credit institutions issued in conjunction with the Decision No. 479/2004/QD-NHNN of April 29, 2004, the Decision No. 807/2005/QD-NHNN of June 01st, 2005 and the Decision No. 29/2006/QD-NHNN of July 10, 2006 of The Governor of The State Bank.

|

THE

STATE BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 02/2008/QD-NHNN |

Hanoi, 15 January 2008 |

DECISION

ON THE AMENDMENT, SUPPLEMENT OF SEVERAL ACCOUNTS IN THE ACCOUNTS SYSTEM OF CREDIT INSTITUTIONS ISSUED IN CONJUNCTION WITH THE DECISION NO. 479/2004/QD-NHNN DATED 29/4/2004, THE DECISION NO. 807/2005/QD-NHNN DATED 01/06/2005 AND THE DECISION NO. 29/2006/QD-NHNN DATED 10/7/2006 OF THE GOVERNOR OF THE STATE BANK

THE GOVERNOR OF THE STATE BANK

- Pursuant to the Law on the

State Bank of Vietnam issued in 1997 and the Law on amendment, supplement of

several articles of the Law on the State Bank of Vietnam issued in 2003;

- Pursuant to the Law on Credit Institutions issued in 1997 and the Law on the

amendment, supplement of several articles of the Law on Credit Institutions

issued in 2004;

- Pursuant to the Law on Accounting issued in 2003;

- Pursuant to the Decree No. 52/2003/ND-CP dated 19/5/2003 of the Government

providing for the functions, duties, authorities and organizational structure

of the State Bank of Vietnam;

Upon the approval of the amendment, supplement of the Accounts System of Credit

Institutions at the Official Dispatch No.16862/BTC-CDKT dated 10/12/2007 of the

Ministry of Finance;

Upon the proposal of the Director of the Finance – Accounting Department,

DECIDES:

Article 1. To cancel some contents in the Accounts System of credit institutions (CIs) issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29/4/2004 and the Decision No. 29/2006/QD-NHNN dated 10/7/2006 of the Governor of the State Bank (SBV) as follows:

1. To cancel some accounts in the Accounts System of CIs issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29/4/2004 of the Governor of SBV:

- Account 312 - Value of working tools in use already charged to expenses;

- Account 921 - Commitment on the guarantee to customers;

- Account 925 - Commitment on the financing to customers.

2. To cancel Paragraph 28 Article 2 of the Decision No. 29/2006/QD-NHNN dated 10/7/2006 of the Governor of the State Bank.

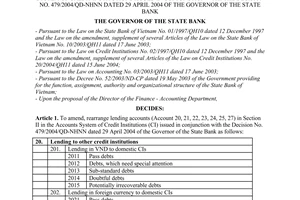

Article 2. To amend, supplement the accounting content of some accounts in the Accounts System of CIs issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29/4/2004, Decision No. 807/2005/QD-NHNN dated 01/06/2005 and the Decision No. 29/2006/QD-NHNN dated 10/07/2006 of the Governor of the SBV as follows:

1. To amend the accounting content on accounts provided for in Article 2 of the Decision No. 807/2005/QD-NHNN dated 01/06/2005 and accounting content on accounts provided for in Paragraph 6 Article 3 of the Decision No. 29/2006/QD-NHNN dated 10/07/2006 of the Governor of the SBV:

1.1. In respect of accounts “Standard debt”:

These accounts shall be used to record amounts (in VND, foreign currencies or gold) which a CI has lent to other CIs, (domestic, foreign) organizations, individuals and classified into group 1 (Standard debt) in accordance with the current provisions on the debt classification.

Debit: - Amounts lent to organizations, individuals, other CIs

- Amounts transferred from other appropriate debit account in accordance with current provisions on debt classification.

Credit: - Amounts collected from organizations, individuals, other CIs

- Amounts transferred to other appropriate debit account in accordance with current provisions on debts classification

- Amounts transferred by the CI to follow up on off-balance sheet account.

Debit balance:

- To reflect borrowings of organizations, individuals, other CIs, which are classified into group 1 (standard debt) in accordance with the current provisions on debts classification.

Detailed accounting:

- To open detailed accounts by each borrowing organization, individual

1.2. In respect of accounts “Debt which needs special attention”

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that a CI has lent to other CIs, (domestic, foreign) organizations, and individuals and classified into group 2 (Debt which needs special attention) in accordance with current provisions on debt classification.

The accounting content of these accounts shall be the same as the accounting content of accounts “Standard debt”.

1.3. In respect of the account “Substandard debt”:

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that a CI has lent to other CIs, (domestic, foreign) organizations, and individuals and classified into group 3 (Substandard debt) in accordance with current provisions on debt classification.

The accounting content of these accounts shall be the same as the accounting content of accounts “Standard debt”.

1.4. In respect of accounts “Doubtful debt”

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that a CI has lent to other CIs, (domestic, foreign) organizations, and individuals and classified into group 4 (Doubtful debt) in accordance with current provisions on debt classification.

The accounting content of these accounts shall be the same as the accounting content of accounts “Standard debt”.

1.5. In respect of accounts “Potentially irrecoverable debt”:

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that a CI has lent to other CIs, (domestic, foreign) organizations, and individuals and classified into group 5 (Potentially irrecoverable debt) in accordance with current provisions on debt classification.

The accounting content of these accounts shall be the same as the accounting content of accounts “Standard debt”.

2. To amend name, accounting contents on some accounts as provided for in Section II of the Accounts Systems of CIs issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29/4/2004 of the Governor of the State Bank as follows:

2.1. To amend the account 311 – Working tools in use

“ Account 311 -Tools, instruments

This account is used to reflect the current value and the increase, decrease of tools and instruments of the CI.

Accounting of this account must comply with some following provisions:

- Accounting of the in, out, inventory of the tools, instruments must be reflected by the real value.

- Apart from the detailed accounts books accounting under the value of tools, instruments, accountant must open a detailed book of the tools, instruments to record, follow up the quantity, value of each type of tools, instruments.

Storekeeper must open the store card to record, follow up the quantity of each type of tools, instruments in line with the establishment of book by the accountant.

- For the tools, instruments delivered for the business activity: they must be recorded, followed up in kind and value on the detailed book which follows up each place of use and person who takes material responsibility.

- For tools, instruments of small value, when delivering for business activity, 100% of their value shall be allocated to the expenses once.

- For tools, instruments delivered for one-off use, which have big value and are used in many accounting periods, then value of the tools, instruments delivered for use shall be charged into the account “Expenses pending for allocation” and gradually allocated to expenses of accounting periods.

Debit: - Value of the tools, instruments stored in.

Credit: - Value of the tools, instruments stored out.

Debit balance: - To reflect the value of tools, instruments in stock.

Detailed accounting: - To open detailed accounts by each group or each type of tools, instruments.”

2.2. To amend accounting content of account 383 – Investment trust, lending in VND

“Account 383 – Investment trust, lending in VND

This account is used to reflect the VND amount that a credit institution transfers to trust undertaking, lending organizations with an amount agreed upon in the Investment trust, lending contract entered into by two parties.

Debit: - The amount transferred to the trust undertaking, lending organizations

Credit: - The amount, which trust undertaking, lending organizations have paid under the contract.

Debit balance:- To reflect the amount that has been transferred to the trust undertaking organizations, but operation of investment trust and lending has not been performed yet.

Detailed accounting: - To open detailed account by each trust undertaking organization, each type of investment trust, lending”.

2.3. To amend the accounting content of account 384 - Investment trust, lending in foreign currency:

“Account 384 - Investment trust, lending in foreign currency

This account is used to reflect the amount in foreign currency that a credit institution transfers to trust undertaking, lending organizations with an amount agreed upon in the Investment trust, lending contract entered into by two parties.

The accounting content of these accounts shall be the same as the accounting content of account 383.

3. To amend some accounting contents of account 833 - Expense for enterprise income tax at paragraph 27 Article 3 of the Decision No. 29/2006/QD-NHNN dated 10/07/2006 of the Governor of the State Bank as follows:

“This account is used to reflect the expense for enterprise income tax of the CI, including the expense for current enterprise income tax and expense for deferred enterprise income tax as a basis for the determination of the business result of the CI in the current year.

Accounting of this account must be performed in compliance with Vietnam Accounting Standard No.17 – Enterprise income tax and following provisions:

1. Expense for enterprise income tax which is charged to this account includes the expense for current enterprise income tax and expense for deferred enterprise income tax upon determining profit (or loss) of a fiscal year.

2. Expense for current enterprise income tax is the payable enterprise income tax amount calculated on the taxable income in the year and the current enterprise income tax rate.

3. Expense for deferred enterprise income tax is the enterprise income tax amount payable in the future, arising from:

- The acknowledgement of the deferred income tax payable in the year

- The return of the deferred income tax assets which were acknowledged from the previous years.

4. Income from the deferred enterprise income tax is the decrease amount of expenses for deferred enterprise income tax, arising from:

- The acknowledgement of the deferred income tax asset in the year

- The return of the deferred income tax assets which were acknowledged from the previous years.”

Article 3. To supplement accounting contents and some accounts into the Accounts System of CIs issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29/4/2004 of the Governor of the State Bank as follows:

1. To supplement the accounting content to Section I – General provisions, as follows:

1.1. To supplement accounting contents to point 3.1 - The opening and use of level III accounts

“3.1.3 – In respect of accounts of following up debts; guarantees, payment acceptance and unconditional irrevocable lending commitments with specific performance time in line with the current provisions on debt classification:

CIs shall be entitled to draw up norms of the above accounts to level II accounts in the statement of accounts attached to the Report on the debt classification sent to the SBV (in file and written form) and the original reporting norms guided by the SBV upon the satisfaction of full conditions provided for at point 3.1.1 and following conditions:

+ Availability of an information technology system qualified for an accurate debt classification by each loan/borrower in compliance with current provisions;

+ Obtaining the written approval by the SBV of the drawing up of norms of the above accounts to level II accounts on the statement of accounts”

1.2. To supplement accounting contents to point 5 – The way to symbolize detailed accounts

“Besides, CIs are authorized to open more detailed accounts upon the requirement of operational management where it is necessary”.

2. To supplement Account 4896 – Specific provisions for off-balance sheet commitments

This account is used to reflect the provisioning and use of specific provisions for guarantee commitment, lending commitment, payment acceptance… of a CI to its customers in order to deal with off-balance sheet credit risks in banking activity in accordance with the current provisions on debt classification.

Credit: - Specific provisions made for the off-balance sheet commitments

Debit: - To settle the risks;

- To return the difference of the made provisions

Credit balance: - To reflect the specific provisions for the current off-balance sheet commitments

Detailed accounting:

- To open detailed accounts by debt groups.

3. To supplement Account 921 – Commitment on borrowing guarantee

“This account is used to reflect the entire amount the CI undertakes to provide borrowing guarantee to organizations and individuals under the signed contract to which the CI has not had to perform the committed obligation.

Account 921 consists of following level III accounts:

9211 – Off-balance sheet commitments classified into group 1 (Standard debt)

9212 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

9213 - Off-balance sheet commitments classified into group 3 (Substandard debt)

9214 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

9215 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

Account 9211 - Off-balance sheet commitments classified into group 1 (Standard debt)

This account is used to charge the amount a CI undertakes to provide borrowing guarantee to organizations, individuals under the signed contract to which the CI has not had to perform the committed obligation and classified by the CI into group 1 (Standard debt) in accordance with the current provisions on debt classification.

Debit: - Amount of borrowing guarantee

- Amount transferred from the appropriate account in accordance with the current provisions on debt classification.

Credit: - Amount transferred to the appropriate account in accordance with the current provisions on debt classification.

- Amount that the CI has completed its obligation of borrowing guarantee or has had to perform its obligation of borrowing guarantee.

Debit balance: - To reflect the remaining amount of the borrowing guarantee to customers which is classified into group 1 (Standard debt) in accordance with the current provisions on debt classification.

Detailed accounting:

- To open detailed account by each customer provided with borrowing guarantee.

Account 9212 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

This account is used to charge the amount a CI undertakes to provide borrowing guarantee to organizations, individuals under the signed contract to which the CI has not had to perform the committed obligation and classified by the CI into group 2 (Debt which needs special attention) in accordance with the current provisions on debt classification.

Debit: - Amount transferred from the appropriate account in accordance with the current provisions on debt classification

Credit: - Amount transferred to the appropriate account in accordance with the current provisions on debt classification.

- Amount that the CI has completed its obligation of borrowing guarantee or has had to perform its obligation of borrowing guarantee.

Debit balance: - To reflect the remaining amount of the borrowing guarantee to customers which is classified into group 2 (Debt which needs special attention) in accordance with the current provisions on debt classification.

Detailed accounting:

- To open detailed account by each customer provided with borrowing guarantee.

Account 9213 - Off-balance sheet commitments classified into group 3 (Substandard debt)

This account is used to charge the amount a CI undertakes to provide borrowing guarantee to organizations, individuals under the signed contract to which the CI has not had to perform the committed obligation and classified by the CI into group 3 (Substandard Debt) in accordance with the current provisions on debt classification.

The accounting content of this account is the same as the accounting content of account “Debt which needs special attention”.

Account 9214 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

This account is used to charge the amount a CI undertakes to provide borrowing guarantee to organizations, individuals under the signed contract to which the CI has not had to perform the committed obligation and classified by the CI into group 4 (Doubtful Debt) in accordance with the current provisions on debt classification.

The accounting content of this account is the same as the accounting content of account “Debt which needs special attention”.

Account 9215 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

This account is used to charge the amount a CI undertakes to provide borrowing guarantee to organizations, individuals under the signed contract to which the CI has not had to perform the committed obligation and classified by the CI into group 5 (Potentially irrecoverable Debt) in accordance with the current provisions on debt classification.

The accounting content of this account is the same as the accounting content of account “Debt which needs special attention”.

4. To supplement Account 922 – Commitment on payment guarantee

This account is used to charge the entire amount a CI undertakes to provide the payment guarantee to organizations, individuals under the signed contract to which the CI has not had to performed its committed obligation.

Account 922 consists of following level III accounts:

9221 – Off-balance sheet commitments classified into group 1 (Standard debt)

9222 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

9223 - Off-balance sheet commitments classified into group 3 (Substandard debt)

9214 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

9225 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

The accounting content of account 922 shall be the same as the accounting content of account 921.

5. To supplement Account 924 – Commitment on irrevocable loan

This account is used to charge the entire amount a CI undertakes to provide unconditionally an irrevocable loan to organizations, individuals under the signed contract to which the CI has not had to perform its committed obligation.

Account 924 consists of following level III accounts:

9241 – Off-balance sheet commitments classified into group 1 (Standard debt)

9242 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

9243 - Off-balance sheet commitments classified into group 3 (Substandard debt)

9244 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

9245 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

The accounting content of account 924 shall be the same as the accounting content of account 921.

6. To supplement Account 925 – Commitment in L/C operation

This account is used to charge the entire amount committed by a CI in the L/C operation to organizations, individuals under the signed contract to which the CI has not had to perform its committed obligation.

Account 925 consists of following level III accounts:

9251 – Off-balance sheet commitments classified into group 1 (Standard debt)

9252 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

9253 - Off-balance sheet commitments classified into group 3 (Substandard debt)

9254 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

9255 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

The accounting content of account 925 shall be the same as the accounting content of account 921.

7. To supplement Account 926 – Commitment on contract performance guarantee

This account is used to charge the entire amount a CI undertakes to provide the contract performance guarantee to organizations, individuals under the signed contract to which the CI has not had to perform its committed obligation.

Account 926 consists of following level III accounts:

9261 – Off-balance sheet commitments classified into group 1 (Standard debt)

9262 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

9263 - Off-balance sheet commitments classified into group 3 (Substandard debt)

9264 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

9265 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

The accounting content of account 926 shall be the same as the accounting content of account 921.

8. To supplement Account 927 – Commitment on bidding guarantee

This account is used to charge the entire amount a CI uses for the bidding guarantee to organizations, individuals under the signed contract to which the CI has not had to perform its committed obligation.

Account 927 consists of following level III accounts:

9271 – Off-balance sheet commitments classified into group 1 (Standard debt)

9272 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

9273 - Off-balance sheet commitments classified into group 3 (Substandard debt)

9274 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

9275 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

The accounting content of account 927 shall be the same as the accounting content of account 921.

9. To supplement Account 928 – Other guarantee commitments

This account is used to charge the entire amount of other guarantee commitments made by a CI to organizations, individuals under the signed contract to which the CI has not had to perform its committed obligation.

Account 928 consists of following level III accounts:

9281 – Off-balance sheet commitments classified into group 1 (Standard debt)

9282 - Off-balance sheet commitments classified into group 2 (Debt which needs special attention)

9283 - Off-balance sheet commitments classified into group 3 (Substandard debt)

9284 - Off-balance sheet commitments classified into group 4 (Doubtful debt)

9285 - Off-balance sheet commitments classified into group 5 (Potentially irrecoverable debt)

The accounting content of account 928 shall be the same as the accounting content of account 921.

Article 4. This Decision shall be effective after 15 days since its publication on the Official Gazette.

Article 5. Director of Administrative Department, Director of the Finance – Accounting Department, Director of the Banking Informatics Technology Department, Head of related units of the State Bank, Manager of State Bank branches in provinces, cities under the Central Government’s management, Chairman of the Board of Directors and General Director (Director) of Credit Institutions shall be responsible for the implementation of this Decision./.

|

|

FOR

THE GOVERNOR OF THE STATE BANK OF VIETNAM |