Decision No. 807/2005/QD-NHNN of June 1, 2005, on the amendment, supplement of several accounts in the accounts system of credit institutions issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29 April 2004 of the Governor of the State Bank đã được thay thế bởi Circular No. 10/2014/TT-NHNN amendment supplement the Decision No. 479/2004/QD-NHNN và được áp dụng kể từ ngày 01/06/2014.

Nội dung toàn văn Decision No. 807/2005/QD-NHNN of June 1, 2005, on the amendment, supplement of several accounts in the accounts system of credit institutions issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29 April 2004 of the Governor of the State Bank

|

THE

STATE BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 807/2005/QD-NHNN |

Hanoi, June 1, 2005 |

DECISION

ON THE AMENDMENT, SUPPLEMENT OF SEVERAL ACCOUNTS IN THE ACCOUNTS SYSTEM OF CREDIT INSTITUTIONS ISSUED IN CONJUNCTION WITH THE DECISION NO. 479/2004/QD-NHNN DATED 29 APRIL 2004 OF THE GOVERNOR OF THE STATE BANK

THE GOVERNOR OF THE STATE BANK

- Pursuant to the Law on the

State Bank of Vietnam No. 01/1997/QH10 dated 12 December 1997 and the Law on

the amendment, supplement of several Articles of the Law on the State Bank of

Vietnam No. 10/2003/QH11 dated 17 June 2003;

- Pursuant to the Law on Credit Institutions No. 02/1997/QH10 dated 12 December

1997 and the Law on the amendment, supplement of several Articles of the Law on

Credit Institutions No. 20/2004/QH11 dated 15 June 2004;

- Pursuant to the Law on Accounting No. 03/2003/QH11 dated 17 June 2003;

- Pursuant to the Decree No. 52/2003/ND-CP dated 19 May 2003 of the Government

providing for the function, assignment, authority and organizational structure

of the State Bank of Vietnam;

- Upon the proposal of the Director of the Finance - Accounting Department,

DECIDES:

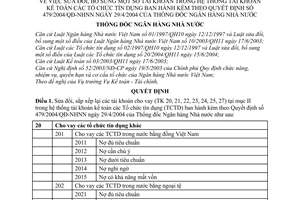

Article 1. To amend, rearrange lending accounts (Account 20, 21, 22, 23, 24, 25, 27) in Section II in the Accounts System of Credit Institutions (CI) issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29 April 2004 of the Governor of the State Bank as follows:

|

20. |

Lending to other credit institutions |

||

|

|

201. |

Lending in VND to domestic CIs |

|

|

|

|

2011 |

Pass debts |

|

|

|

2012 |

Debts, which need special attention |

|

|

|

2013 |

Sub-standard debts |

|

|

|

2014 |

Doubtful debts |

|

|

|

2015 |

Potentially irrecoverable debts |

|

|

202. |

Lending in foreign currency to domestic CIs |

|

|

|

|

2021 |

Pass debts |

|

|

|

2022 |

Debts, which need special attention |

|

|

|

2023 |

Sub-standard debts |

|

|

|

2024 |

Doubtful debts |

|

|

|

2025. |

Potentially irrecoverable debts |

|

|

203 |

Lending in foreign currency to foreign CIs |

|

|

|

|

2031 |

Pass debts |

|

|

|

2032. |

Debts, which need special attention |

|

|

|

2033 |

Sub-standard debts |

|

|

|

2034 |

Doubtful debts |

|

|

|

2035 |

Potentially irrecoverable debts |

|

|

205 |

Discount, rediscount of commercial papers and other valuable papers |

|

|

|

|

2051 |

Pass debts |

|

|

|

2052 |

Debts, which need special attention |

|

|

|

2053 |

Sub-standard debts |

|

|

|

2054 |

Doubtful debts |

|

|

|

2055 |

Potentially irrecoverable debts |

|

|

209 |

Provisions for risks |

|

|

|

|

2091 |

Special provisions |

|

|

|

2092 |

General provisions |

|

21 |

Lending to domestic economic organizations, individuals |

||

|

|

211 |

Short-term lending in VND |

|

|

|

|

2111 |

Pass debts |

|

|

|

2112 |

Debts, which need special attention |

|

|

|

2113 |

Sub-standard debts |

|

|

|

2114 |

Doubtful debts |

|

|

|

2115 |

Potentially irrecoverable debts |

|

|

212. |

Medium-term lending in VND |

|

|

|

|

2121 |

Pass debts |

|

|

|

2122 |

Debts, which need special attention |

|

|

|

2123 |

Sub-standard debts |

|

|

|

2124 |

Doubtful debts |

|

|

|

2125 |

Potentially irrecoverable debts |

|

|

213 |

Long-term lending in VND |

|

|

|

|

2131 |

Pass debts |

|

|

|

2132 |

Debts, which need special attention |

|

|

|

2133 |

Sub-standard debts |

|

|

|

2134 |

Doubtful debts |

|

|

|

2135 |

Potentially irrecoverable debts |

|

|

214 |

Short-term lending in foreign currency and gold |

|

|

|

|

2141 |

Pass debts |

|

|

|

2142 |

Debts, which need special attention |

|

|

|

2143 |

Sub-standard debts |

|

|

|

2144 |

Doubtful debts |

|

|

|

2145 |

Potentially irrecoverable debts |

|

|

215 |

Medium-term lending in foreign currency and gold |

|

|

|

|

2151 |

Pass debts |

|

|

|

2152 |

Debts, which need special attention |

|

|

|

2153 |

Sub-standard debts |

|

|

|

2154 |

Doubtful debts |

|

|

|

2155 |

Potentially irrecoverable debts |

|

|

216 |

Long-term lending in foreign currency and gold |

|

|

|

|

2161 |

Pass debts |

|

|

|

2162 |

Debts, which need special attention |

|

|

|

2163 |

Sub-standard debts |

|

|

|

2164 |

Doubtful debts |

|

|

|

2165 |

Potentially irrecoverable debts |

|

|

219 |

Provisions for risks |

|

|

|

|

2191 |

Specific provisions |

|

|

|

2192 |

General provisions |

|

22 |

Discount of commercial papers and valuable papers for domestic economic organizations, individuals |

||

|

|

221 |

Discount of commercial papers and valuable papers denominated in VND |

|

|

|

|

2211 |

Pass debts |

|

|

|

2212 |

Debts, which need special attention |

|

|

|

2213 |

Sub-standard debts |

|

|

|

2214 |

Doubtful debts |

|

|

|

2215 |

Potentially irrecoverable debts |

|

|

222 |

Discount of commercial papers and valuable papers denominated in foreign currency |

|

|

|

|

2221 |

Pass debts |

|

|

|

2222 |

Debts, which need special attention |

|

|

|

2223 |

Sub-standard debts |

|

|

|

2224 |

Doubtful debts |

|

|

|

2225 |

Potentially irrecoverable debts |

|

|

229 |

Provisions for risks |

|

|

|

|

2291 |

Specific provisions |

|

|

|

2292 |

General provisions |

|

23 |

Finance leasing |

||

|

|

231 |

Finance leasing in VND |

|

|

|

|

2311 |

Pass debts |

|

|

|

2312 |

Debts, which need special attention |

|

|

|

2313 |

Sub-standard debts |

|

|

|

2314 |

Doubtful debts |

|

|

|

2315 |

Potentially irrecoverable debts |

|

|

232 |

Finance leasing in foreign currency |

|

|

|

|

2321 |

Pass debts |

|

|

|

2322 |

Debts, which need special attention |

|

|

|

2323 |

Sub-standard debts |

|

|

|

2324 |

Doubtful debts |

|

|

|

2325 |

Potentially irrecoverable debts |

|

|

239 |

Provisions for risks |

|

|

|

|

2391 |

Specific provisions |

|

|

|

2392 |

General provisions |

|

24 |

Guarantee |

||

|

|

241 |

Payments made in lieu of customers in VND |

|

|

|

|

2411 |

Pass debts |

|

|

|

2412 |

Debts, which need special attention |

|

|

|

2413 |

Sub-standard debts |

|

|

|

2414 |

Doubtful debts |

|

|

|

2415 |

Potentially irrecoverable debts |

|

|

242 |

Payments made in lieu of customers in foreign currency |

|

|

|

|

2421 |

Pass debts |

|

|

|

2422 |

Debts, which need special attention |

|

|

|

2423 |

Sub-standard debts |

|

|

|

2424 |

Doubtful debts |

|

|

|

2425 |

Potentially irrecoverable debts |

|

|

249 |

Provisions for risks |

|

|

|

|

2491 |

Specific provisions |

|

|

|

2492 |

General provisions |

|

25 |

Lending by funds financed, entrusted for investment |

||

|

|

251 |

Lending in VND with funds directly financed by International Organizations |

|

|

|

|

2511 |

Pass debts |

|

|

|

2512 |

Debts, which need special attention |

|

|

|

2513 |

Sub-standard debts |

|

|

|

2514 |

Doubtful debts |

|

|

|

2515 |

Potentially irrecoverable debts |

|

|

252 |

Lending in VND with funds financed by the Government |

|

|

|

|

2521 |

Pass debts |

|

|

|

2522 |

Debts, which need special attention |

|

|

|

2523 |

Sub-standard debts |

|

|

|

2524 |

Doubtful debts |

|

|

|

2525 |

Potentially irrecoverable debts |

|

|

253 |

Lending in VND with funds financed by other organizations, individuals |

|

|

|

|

2531 |

Pass debts |

|

|

|

2532 |

Debts, which need special attention |

|

|

|

2533 |

Sub-standard debts |

|

|

|

2534 |

Doubtful debts |

|

|

|

2535 |

Potentially irrecoverable debts |

|

|

254 |

Lending in foreign currency with funds directly financed by International Organizations |

|

|

|

|

2541 |

Pass debts |

|

|

|

2542 |

Debts, which need special attention |

|

|

|

2543 |

Sub-standard debts |

|

|

|

2544 |

Doubtful debts |

|

|

|

2545 |

Potentially irrecoverable debts |

|

|

255 |

Lending in foreign currency with funds financed by the Government |

|

|

|

|

2551 |

Pass debts |

|

|

|

2552 |

Debts, which need special attention |

|

|

|

2553 |

Sub-standard debts |

|

|

|

2554 |

Doubtful debts |

|

|

|

2555 |

Potentially irrecoverable debts |

|

|

256 |

Lending in foreign currency with funds financed by other organizations, individuals |

|

|

|

|

2561 |

Pass debts |

|

|

|

2562 |

Debts, which need special attention |

|

|

|

2563 |

Sub-standard debts |

|

|

|

2564 |

Doubtful debts |

|

|

|

2565 |

Potentially irrecoverable debts |

|

|

259 |

Provisions for risks |

|

|

|

|

2591 |

Specific provisions |

|

|

|

2592 |

General provisions |

|

27 |

Other credit facility for domestic economic organizations, individuals |

||

|

|

271 |

Lending with specific funds |

|

|

|

|

2711 |

Pass debts |

|

|

|

2712 |

Debts, which need special attention |

|

|

|

2713 |

Sub-standard debts |

|

|

|

2714 |

Doubtful debts |

|

|

|

2715 |

Potentially irrecoverable debts |

|

|

272 |

Lending for debts repayment |

|

|

|

|

2721 |

Pass debts |

|

|

|

2722 |

Debts, which need special attention |

|

|

|

2723 |

Sub-standard debts |

|

|

|

2724 |

Doubtful debts |

|

|

|

2725 |

Potentially irrecoverable debts |

|

|

273 |

Lending for investment in the capital construction under the States plan |

|

|

|

|

2731 |

Pass debts |

|

|

|

2732 |

Debts, which need special attention |

|

|

|

2733 |

Sub-standard debts |

|

|

|

2734 |

Doubtful debts |

|

|

|

2735 |

Potentially irrecoverable debts |

|

|

275 |

Other lending |

|

|

|

|

2751 |

Pass debts |

|

|

|

2752 |

Debts, which need special attention |

|

|

|

2753 |

Sub-standard debts |

|

|

|

2754 |

Doubtful debts |

|

|

|

2755 |

Potentially irrecoverable debts |

|

|

279 |

Provisions for risks |

|

|

|

|

2791 |

Special provisions |

|

|

|

2792 |

General provisions |

Article 2. The accounting contents on accounts stipulated in Article 1:

1. In respect of accounts Pass debts

These accounts shall be used to record amounts (in VND, foreign currencies or gold) which CI lent to other (domestic, foreign) CIs, economic organizations, individuals, including:

- Current debts that CI assesses as fully and timely recoverable, both principals and interests;

- Debts, both principals and interests of which have been fully paid under the restructured period and after stipulated term, the CI assesses as fully and timely recoverable, both principals and interests in accordance with the restructured period;

- Debts that the CI assesses under the qualitative method as fully and timely recoverable, both principals and interests;

Debit: - Amounts lent to organizations, individuals

Credit: - Amounts recovered from organizations, individuals

- Amounts transferred into appropriate debit account in accordance with current provisions on debts classification

Debit balance:

- To reflect borrowing debts of organizations, individuals which are standard under current provisions on debts classification

Detailed accounting:

- To open detailed accounts by each borrowing organization, individual

2. In respect of accounts Debts, which need special attention

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that a CI has lent to other (domestic, foreign) CIs, economic organizations, and individuals, including:

- Debts that are overdue for a period of less than 90 days

- Debts with restructured repayment term, which are still current under the restructured repayment term;

- Remaining debts of a single customer who has at least a debt classified to a more risky debt group corresponding with the risk levels;

- Debts (including current debts and debts with restructured repayment term, which are still current under the restructured repayment term) that CI has sufficient basis to assess the repayment ability of customers to be deteriorating and are classified to a more risky debt group corresponding with the risk levels;

- Debts, which the CI assesses under the qualitative method as fully recoverable, both principals and interests, but there are signs that customers repayment ability is deteriorating.

Debit: - Amounts lent to organizations, individuals

Credit: - Amounts recovered from organizations, individuals

- Amounts transferred into appropriate debit account in accordance with current provisions on debts classification

Debit balance:

- To reflect borrowing debts of organizations, individuals which need special attention under current provisions on debts classification

Detailed accounting:

- To open detailed accounts by each borrowing organization, individual

3. In respect of accounts Sub-standard debts

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that a CI has lent to other (domestic, foreign) CIs, economic organizations, and individuals, including:

- Debts that are overdue for a period of 90 to 180 days;

- Debts with restructured repayment term, which are overdue for a period of less than 90 days;

- Remaining debts of a single customer who has at least a debt classified to a more risky debt group corresponding with the risk levels;

- Debts (including current debts and debts with restructured repayment term, which are still current under the restructured repayment term) that CI has sufficient basis to assess the repayment ability of customers to be deteriorating and are classified to a more risky debt group corresponding with the risk levels;

- Debts, which the CI assesses under the qualitative method as timely irrecoverable, both principals and interests. A part of principals and interests of these debts are assessed to be likely impaired.

The accounting content of these accounts shall be the same as the accounting content of accounts debts, which need special attention

4. In respect of accounts Doubtful debts

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that CI lent to other (domestic, foreign) CIs, economic organizations, and individuals, including:

- Debts that are overdue for a period of 181 to 360 days;

- Debts with restructured repayment term, which are overdue for a period of 90 to 180 days under the restructured repayment term;

- Remaining debts of a single customer who has at least a debt classified to a more risky debt group corresponding with the risk levels;

- Debts (including current debts and debts with restructured repayment term, which are still current under the restructured repayment term) that CI has sufficient basis to assess the repayment ability of customers to be deteriorating and are classified to a more risky debt group corresponding with the risk levels;

- Debts, which the CI assesses under the qualitative method as highly impaired.

The accounting content of these accounts shall be the same as the accounting content of accounts debts, which need special attention

5. In respect of accounts Potentially irrecoverable debts

These accounts shall be used to record amounts (in VND, foreign currencies or gold) that CI lent to other (domestic, foreign) CIs, economic organizations, and individuals, including:

- Debts that are overdue for a period of more than 360 days;

- Debts with restructured repayment term, which are overdue for a period more than 180 days under the restructured repayment term;

- Remaining debts of a single customer who has at least a debt classified to a more risky debt group corresponding with the risk levels;

- Debts (including current debts and debts with restructured repayment term, which are still current under the restructured repayment term) that CI has sufficient basis to assess the repayment ability of customers to be deteriorating and are classified to more risky debt group corresponding with the risk levels;

- Debts, which the CI assesses under the qualitative method as irrecoverable and lost.

The accounting content of these accounts shall be the same as the accounting content of accounts debts, which need special attention

6. Accounts Provisions for risks shall consist of following level III accounts:

- Specific provisions

- General provisions

These accounts shall be used to reflect the provisioning and use of provisions to deal with credit risks in the banking activity of CIs in accordance with current provisions on debts classification.

Credit: - Amounts of provisions to be set up and charged to expenses

Debit:- Use of provisions to deal with credit risks

- To return the excessive difference of provisions which have been set up under provisions

Credit balance:

- To reflect current amount of provisions at the end of the period.

Detailed accounting:

- In respect of account Specific provisions: to open detailed accounts by groups of borrowing debts

- In respect of account General provisions: to open a detailed account

Article 3. Procedures for conversion, settlement of data from old accounts into new accounts: to verify, inventory, assess the balances on old accounts to classify and transfer them to respective new accounts (that have been amended, rearranged in accordance with Article 1 of this Decision)

Article 4. To supplement, amend several accounts and accounting contents of accounts in Section II, III in the Accounts System of CIs issued in conjunction with the Decision No. 479/2004/QD-NHNN dated 29 April 2004 of the Governor of the State Bank of Vietnam as follows:

1. To supplement account 134 VND Deposits in foreign country

This account shall be used to record VND amounts that CI deposits at other CIs in foreign country

Account 134 consists of following level III accounts:

1341. Demand deposits

1342. Time deposits

1343. Deposits for special purposes

Debit: - Amounts deposited at other CIs in foreign country

Credit: - Amounts withdrawn

Debit balance:

- To reflect amounts that CI is depositing at other CIs in foreign country

Detailed accounting:

- To open detailed accounts by each other CI in foreign country that receives deposits

2. To supplement the following level III account to the account 151 Investment securities ready to sell

1513. Investment in the Government securities

This account shall be used to reflect the current value and the change of the Government securities (except for the Government Bills), which are issued by the State Treasury of Vietnam and invested by the CI. This account is used to record securities, which are held for investment purpose and ready to sell, not purchased and sold regularly but can be sold at any time if deemed to be beneficial (CI must issue internal regulation relating to this matter, unless otherwise provided for by applicable laws).

The accounting principle and contents of this account shall be the same as the account 151 (stipulated in the Decision No. 479/2004/QD-NHNN dated 29 April 2004).

3. To supplement the following level III account to the account 152 Investment securities kept until the date of maturity

1523. Investment in the Government securities

This account shall be used to reflect the current value and the change of the Government securities (except for the Government Bills), which are issued by the State Treasury of Vietnam and invested by the CI. This account shall be used to record securities, which are held for investment purpose until the maturity date (where the payment is made).

The accounting principle and contents of this account shall be the same as the account 151 (stipulated in the Decision No. 479/2004/QD-NHNN dated 29 April 2004).

4. To supplement the following level III account to the account 489 Provisions for other risks

4895. General provisions for commitments issued

This account shall be used to reflect the provisioning and use of general provisions for guarantee commitments, loan commitments, acceptances, etc issued by the CI to customers to deal with credit risks in the banking activity in accordance with current provisions on debts classification.

The accounting content of this account shall be the same as the accounting content of the account Provisions for risks stipulated in paragraph 6, Article 2 of this Regulation.

5. To amend account 9019 as follows:

9019. Notes suspected of fake, faked notes, destroyed notes pending disposal

The account 9019 Notes suspected of fake, faked notes, destroyed notes pending disposal shall be used to record all kinds of notes suspected of fake, faked notes, destroyed notes pending disposal which are preserved at CIs.

Receipt:

- Amount of notes suspected of fake, faked notes, destroyed notes pending disposal, which are stored in

Delivery:

- Amount of notes suspected of fake, faked notes, destroyed notes, which have been disposed

Remaining:

- To reflect notes suspected of fake, faked notes, destroyed notes pending disposal, which are being preserved in the store of CIs.

Detailed accounting:

- To open a detailed account for each type of notes suspected of fake, faked notes, destroyed notes and persons who are responsible for the preservation.

6. To supplement to the accounting content of the account 9114 Foreign currency not qualified for circulation pending disposal as follows:

This account shall be used to record all foreign currencies that are suspected of fake, faked, destroyed (cut out, corrected, torn) pending disposal.

7. To supplement the following level accounts to the account 981 Lending, investment under the trust undertaking contract as follows:

9811. Pass debts

9812. Debts, which need special attention

9813. Sub-standard debts

9814. Doubtful debts

9815. Potentially irrecoverable debts

CIs that accept the trust for lending shall base on the financial status, the debt repayment ability of customers to carry out classification of loans made by trusted fund sources (the trustee shall not be subject to any lending risk) in accordance with current provisions on debts classification and state in respective level III accounts mentioned above; At the same time, at once give a notice to the Trusting Party (the Third Party) of the financial status, the debt repayment ability of customers for its debts classification and risk provisioning in accordance with current provisions.

8. To supplement the following level III accounts to the account 982 Lending under the co-financing contract as follows:

9821. Pass debts

9822. Debts, which need special attention

9823. Sub-standard debts

9824. Doubtful debts

9825. Potentially irrecoverable debts

Coordinating CIs shall base on the financial status, the debt repayment ability of customers to carry out classification of loans made by co-financing fund sources and state in respective level III accounts mentioned above; At the same time, at once give notice to members participating in loan syndication (the Third party) of the financial status, the debt repayment ability of customers for the debts classification and risk provisioning by the Capital Contributor in accordance with current provisions.

Article 5. This Decision shall be effective after 15 days since its publication in the Official Gazette.

Article 6. The Director of the Administrative Department, the Director of the Finance Accounting Department and Heads of units of the State Bank of Vietnam, General Managers of the State Bank's branches in provinces, cities under the central Governments management, Chairpersons of the Board of Directors and General Directors (Directors) of Credit Institutions shall be responsible for the implementation of this Decision.

|

|

FOR

THE GOVERNOR OF THE STATE BANK |