Circular No. 07/2010/TT-NHNN of February 26, 2010, specifying the provision of Vietnam-dong loans at negotiable interest rates by credit institutions to customers đã được thay thế bởi Circular No. 12/2010/TT-NHNN, providing guidance on lending in Vietnamese dong và được áp dụng kể từ ngày 14/04/2010.

Nội dung toàn văn Circular No. 07/2010/TT-NHNN of February 26, 2010, specifying the provision of Vietnam-dong loans at negotiable interest rates by credit institutions to customers

|

THE

STATE BANK OF VIETNAM |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 07/2010/TT-NHNN |

Hanoi, February 26, 2010 |

CIRCULAR

SPECIFYING THE PROVISION OF VIETNAM-DONG LOANS AT NEGOTIABLE INTEREST RATES BY CREDIT INSTITUTIONS TO CUSTOMERS

THE STATE BANK OF VIETNAM

Pursuant to the 1997 Law on

the State Bank of Vietnam and the 2003 Law Amending and Supplementing a Number

of Articles of the Law on the State Bank of Vietnam;

Pursuant to the 1997 Law on Credit Institutions and the 2004 Law Amending and

Supplementing a Number of Articles of the Law on Credit Institutions;

Pursuant to the National Assembly's

Resolution No. 23/2008/NQ-QH12 of November 6, 2008, on the 2009

socio-economic-development plan;

Pursuant to the Government's Decree No. 96/2008/ND-CP of August 26, 2008,

defining the functions, tasks, powers and organizational structure of the State

Bank of Vietnam;

In furtherance of the Prime Minister's directing opinion in the Government

Office's Document No. 627/VPCP-KTTH of January 23, 2009, on the application of

negotiable interest rates by credit institutions;

The State Bank of Vietnam specifies the provision of Vietnam-dong loans at

negotiable interest rates by credit institutions to customers as follows:

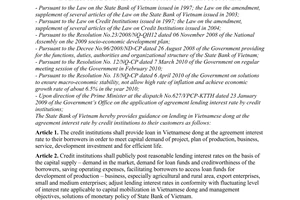

Article 1. Credit institutions may provide Vietnam-dong loans at negotiable interest rates to customers in accordance with laws on the provision of loans by credit institutions to customers and on the basis of capital demand-supply in the market and borrowers' credit ratings, including:

1. Medium- and long-term loans provided to meet demands for production, business, service and development investment capital;

2. Short-, medium- and long-term consumer loans and loans provided through the operation of credit card issuance and use, including loans for house repair or purchase which will be repaid with borrowers' salaries; loans for vehicle purchase; loans for payment of study or healthcare expenses: loans for purchase of household utensils and appliances; loans for payment of expenses for cultural, sports and tourism activities; loans provided in the form of personal overdrafts; and loans provided through the issuance and use of credit cards.

Article 2.

1. Credit institutions shall determine and control credit limits applicable to each customer and each type of Vietnam-dong loans provided at negotiable interest rates in accordance with the law on operational safety ratios and business conditions of credit institutions.

2. Credit institutions shall make monthly reports on the provision of Vietnam-dong loans at negotiable interest rates according to the Appendix to this Circular (not printed herein) and send them to the State Bank of Vietnam.

Article 3.

1. This Circular takes effect on the date of its signing.

2. The following regulations of the State Bank of Vietnam regarding lending interest rates applied by credit institutions to customers are no longer effective: Circular No. 01/2009/TT-NHNN of January 23, 2009, guiding negotiable interest rates applied by credit institutions to consumer loans and loans provided through the operation of credit card issuance and use and documents guiding this Circular; regulations on interest rates on medium-and long-term loans provided to meet demands for production, business, service and development investment capital prescribed in Decision No. 16/ 2008/QD-NHNN of May 16, 2008. on the mechanism for administering the prime interest rate on Vietnam-dong loans.

3. For credit contracts signed before the effective date of this Circular, credit institutions and customers may continue implementing them or modify them to suit this Circular and relevant laws.

Article 4. The Chief of the Office, the director of the Monetary Policy Department and heads of units under the State Bank of Vietnam, directors of provincial-level branches of the State Bank of Vietnam; chairpersons of Boards of Directors and directors general (directors) of credit institutions and customers taking out loans from credit institutions shall implement this Circular. -

|

|

FOR

THE GOVERNOR OF THE STATE BANK |

Name of the Credit institution:……………….

APPENDIX

REPORT ON LENDING IN VIETNAMESE DONG AT AGREEMENT INTEREST RATE

Month…. Year….

|

Lending demand |

Loan outstanding (VND billion) |

Interest rate (%/annum) |

||

|

Common rate |

Lowest rate |

Highest rate |

||

|

I. Medium, long term loan: |

|

|

|

|

|

Of which: |

|

|

|

|

|

1. Loan to capital demands for production, business, service and development investment |

|

|

|

|

|

2. Loan to capital demand of life |

|

|

|

|

|

II. Short term, medium and long term loan to capital demands of life, loan through the operation of issuance and use of credit cards |

|

|

|

|

|

Of which: |

|

|

|

|

|

1. Loan to capital demand of life: |

|

|

|

|

|

- loan for house repair and house purchase, relating to which the source for debt repayment is from the borrowers’ salary |

|

|

|

|

|

- loan for the purchase of means of transport |

|

|

|

|

|

- loan for covering the costs of study and disease treatment |

|

|

|

|

|

- loan for the purchase of family utensils and appliances |

|

|

|

|

|

- loan for covering the costs of cultural, sport, tourism activities |

|

|

|

|

|

- loan in the mode of personal account overdraft |

|

|

|

|

|

2. Loan through the operation of issuance and use of credit card |

|

|

|

|

|

III. The ratio of loan outstanding in VND at agreement interest rate over the total loan outstanding in VND |

|

|

|

|

|

IV. The ratio of loan outstanding in VND to capital demands of life, loan through the operation of issuance and use of credit cards over the total loan outstanding in VND |

|

|

|

|

|

V. The ratio of bad debt of loans in VND at agreement interest rate |

|

|

|

|

|

VI. The ratio of bad debt of loans in VND to capital demands of life, loan through the operation of issuance and use of credit cards |

|

|

|

|

|

|

|

…. date, ……. |

|

Drawer |

Controller |

General Director |

Drawing instructions:

1. To state clearly the full name and contact number of the person in charge of preparation of the report.

2. For the norm of loan outstanding: To totalize the loan outstanding at agreement interest rate of the credit institution’s entire system as of the ending of the reporting month.

3. For the norm of interest rate: To totalize interest rates of loans arising in the reporting month of the credit institution’s entire system.

4. Reporting time: On the 10th of the month consecutively following the reporting month at the latest.

5. Report recipient: Monetary Policy Department – State Bank of Vietnam – 49 Ly Thai To, Hanoi; email: [email protected]; fax: 04 38246953.

6. Any query that may arise during the reporting process should be informed via the following numbers: 04 38246955/38259158.