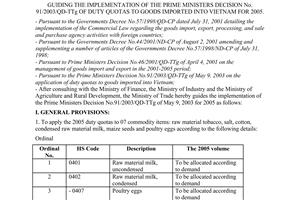

Circular No. 09/2003/TT-BTM of December 15, 2003, on providing guidelines for Decision No. 91/2003/QD-TTg dated May 9, 2003 of the Prime Minister on application of quotas to goods imported to Vietnam in the year of 2004 đã được thay thế bởi Circular No. 10/2004/TT-BTM of December 27, 2004, guiding the implementation of the prime ministers Decision No. 91/2003/QD-TTg of duty quotas to goods imported into Vietnam for 2005. và được áp dụng kể từ ngày 20/01/2005.

Nội dung toàn văn Circular No. 09/2003/TT-BTM of December 15, 2003, on providing guidelines for Decision No. 91/2003/QD-TTg dated May 9, 2003 of the Prime Minister on application of quotas to goods imported to Vietnam in the year of 2004

|

MINISTRY OF

TRADE |

OF

|

|

No. 09/2003/TT-BTM |

Ha Noi, December 15, 2003 |

CIRCULAR

ON PROVIDING GUIDELINES FOR DECISION NO. 91/2003/QD-TTG DATED MAY 9, 2003 OF THE PRIME MINISTER ON APPLICATION OF QUOTAS TO GOODS IMPORTED TO IN THE YEAR OF 2004

Pursuant to Decree No.

57/1998/ND-CP dated July 31, 1998 of the Government providing details for the

implementation of Law on Trading with respect to the export, import, processing

and agency for foreign trading;

Pursuant to Decree No. 44/2001/ND-CP dated August 2, 2001 of the Government on

amendments of and supplement to a number of Articles of Decree 57/1998/ND-Cp

dated July 31, 1998 of the Government;

Pursuant to Decision No. 46/2001/QD-TTg dated April 4, 2001 of the Prime

Minister on the application of quotas to goods imported to Vietnam;

Pursuant to No. 91/2003/QD-TTg dated May 9, 2003 of the Prime Minister on the

application of quotas to goods imported to Vietnam;

After the consultations with the Ministry of Industry and the Ministry of

Agriculture and Rural Development, the Ministry of Trade shall guide the

implementation of Decision No. 91/2003/QD-TTg dated May 9, 2003 of the Prime

Minister with respect to its application for the year of 2004 as follows:

I. General Provisions:

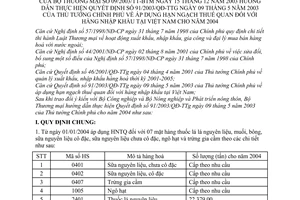

1. As from January 1, 2004, quotas shall be applied for seven types of goods, included: tobacco materials, salt, cotton, milk condensed materials, milk uncondensed materials, corn seed and poultry eggs, as follows:

|

No. |

HS Codes |

Description |

Quantity (in tons) applicable for 2004

|

|

1 |

0401 |

Milk uncondensed materials

|

As applied |

|

2 |

0402 |

Milk condensed materials

|

As applied |

|

3 |

0407 |

Poultry eggs |

As applied

|

|

4 |

1005 |

Corn seed |

As applied

|

|

5 |

2401 |

Tobacco materials

|

22,379.00 |

|

6 |

2501 |

Salt |

200,000.00 |

|

7 |

5201, 5202, 5203 |

Cotton |

As applied |

II. Subjects entitled for quotas

The Ministry of Trade shall grant import permit to business entity that are qualified for import of goods subject to quotas. Particularly, the grant of permit shall be as follows:

1. Tobacco Materials:

Business entities that are already granted with tobacco production license by the Ministry of Industry and are of its requirements of certain quantity of imported tobacco materials to be used for its production of cigarette in conformity with the yearly import plan of the Ministry of Industry

General < span="">

2. Salt:

Business entities having requirements of using salt for its production in conformity with the regulations of the Ministry in charge with its industry.

General

3. Cotton:

Business entities having its business registration certificate of appropriate business lines and are of its requirement of importing cotton.

General

4. Milk condensed materials, milk uncondensed materials, corn seed and poultry eggs:

Business entities having its business registration certificate of appropriate business lines and are of its requirement of importing the aforementioned goods.

III Allocation of Quotas:

1. Basing upon quantity of quotas announces by the Ministry of Trade for the year of 2004 (applicable for goods subject to quotas as stated in Section I and Section II of Chapter 2 of this Circular) and in accordance with the balancing of import result and registered quotas of the business entities, the Ministry of Trade shall determined the issuance import permit for the business entities which are of the category as set out in Section II of this Circular.

2. With respect to goods that quotas shall be granted on an as applied basis, quotas of fixed quantity may be imposed for the following period, the Ministry of Trade shall announce quotas quantity (if any) at least 3 months prior to the application of the same in a separate documents after its consultation with the relevant Ministries and agencies. Principle for imposition of quotas is to be based upon the balance of material requirements and domestic production capacity.

IV. Implementation:

1. Business entities shall present quota-import permit issued by the Ministry of Trade or its authorized agencies to the border-gate customs upon its implementation of import procedures and declare the quantities of goods that are qualified for import tax rate applicable for quotas quantity.

2. All business entities shall report its import status to the Ministry of Trade (in accordance with Form No. 3 attached to this Circular).

Prior to September 30, 2004, business entities must send its report (which shall have a validity of substitution for the third quarter report) to the Ministry of Trade declaring its assessment of import capacity of the complete year, suggestion on increases or decreases of issued quotas or reporting of goods that it is unable to import so that the Ministry of Trade shall allocate the same to other business entities.

3. Business entities that are granted with import permit by the Ministry of Trade may vest other entities to conduct the import in line with the prevailing regulations. It strictly forbids the sale or transfer of quotas.

4. With respect to Business entities that are qualified for import goods that are subject to quotas imposition as stated in Section I of this Circular, should they have not been granted with quotas or already use off the quantities granted under the issued quotas, such entities shall still be entitled to import goods at its own requirement and are not obliged to apply for the Ministry of Trades permit, provided that such imported goods shall be imposed with import tax rates applicable for goods imported over the quotas limitation as provided by the Ministry of Finance.

5. Business entities that are qualified for import goods that are subject to the imposition of quotas as stated in Section I of this Circular have its requirements of application for additional quotas or newly issued quotas for import of materials for the purposes of producing export goods must submit its quotas registration form to the Ministry of Trade for its consideration of issuance of quota-import permit. The registration must be confirmed by the line Ministry (applicable for salt and tobacco) acknowledging the requirement of import materials for production of export goods.

6. 2005 quotas application:

Prior to October 30, 2004, business entities that have its requirement of importing of the aforementioned goods shall sent its quotas registration for the year of 2005 to the Ministry of Trade in accordance with form No. 1 attached to this Circular.

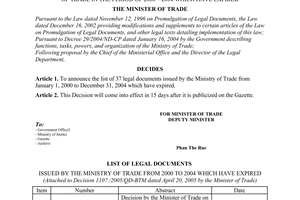

7. This circular shall have a validity of replacing Circular No. 04/2003/TT-BTM dated July 10, 2003 of the Ministry of Trade providing guidelines for the implementation of Decision No. 91/203/QD-TTg dated May 9, 2003 of the Prime Minister.

This circular and the forms thereof may be printed out from the Ministry of Trades web site at www.mot.gov.vn.

This circular shall be in full force and effect after 15 days following its publication on the Official Gazette.

|

|

ON BEHALF OF THE MINISTER OF

TRADE |

FORM NO. 1

QUOTAS REGISTRATION FOR THE YEAR OF 2004

(Attached to Circular No. 09/2003/TT-BTM dated

December 12, 2003 of the Ministry of Trade)

Name of the company: (full name in Vietnamese and name in abbreviation)

1. Tel: Fax:

2. Email:

3. Transaction address:

4. Major Production Address:

5. Business registration certificate No.: Date of issuance:

6. Import Export Code (Customs code):

7. Total labor:

8. Products that use goods imported under quotas as input materials:

9. Actual capacity/engineering capacity:

10. Requirement of goods that are subject to quotas for production (actual capacity/engineering capacity):

of

Freedom - Happiness

............, [date]

No.

Re: Registration

For quotas for [type of goods]

Registration for quotas for the year < span="">

Respectfully to: The Ministry of Trade

Pursuant to Circular No. 09/2003/TT-BTM dated December 15, 2003 of the Ministry of Trade, our company would like to report about the import status of [type of goods] for the period of and register for quotas for the year < span="">

|

Description (HS) |

Detailed information |

Import of 2001 |

Import of 2002 |

2003 |

Registration for quotas for the year of..... |

||

|

Estimate of 2003 |

Quotas granted by the Ministry of Trade for the last five months of the year |

Estimate of import of the last five months of the year in accordance with the MOT license |

|||||

|

Example: tobacco (HS 2401) |

Quantity (tons) |

|

|

|

(clearly state the number, date of the license) |

|

|

|

Value (thousand $) |

|

|

|

|

|

|

|

|

Origination |

|

|

|

|

|

|

|

Our company would like to confirm that the declared information is true and correct, and the company would be hold responsible for all matters arising thereon.

We respectfully request your Ministry to grant quotas-import permit for the year of 2004 for the said goods at the quantity of:....................

Director of the Company

(sign and seal)

Attachments:

1. Business registration certificate (certified true copy).

2. License for production of cigarette (copy signed and responsible by the Director) applicable for the import of tobacco materials.

3. Statement conforming the company use salt for its production in line with the regulations of the line Ministry (original or copy signed and responsible by the Director) applicable for salt;

Note:

- For goods that are not subject to quotas in 2003, the company shall only declare the quantity and value thereof.

- For registration for quotas of 2005, the company shall declare the import for 2004 (actual and estimate of the whole year of 2004).

FORM NO. 2

QUARTERLY, ANNUALLY REPORT AND REGISTRATION

FOR AMENDMENT OF QUOTAS

(Attached to Circular No. 09/2003/TT-BTM dated December 12, 2003 of the

Ministry of Trade)

Name of the company: (full name in Vietnamese and name in abbreviation)

1. Tel: Fax:

2. Email:

3. Transaction address:

4. Major Production Address:

5. Business registration certificate No.: Date of issuance:

6. Import Export Code (Customs code):

7. Total labor:

8. Products that use goods imported under quotas as input materials:

9. Actual capacity/engineering capacity:

10. Requirement of goods that are subject to quotas for production (actual capacity/engineering capacity):

Socialist Republic of Vietnam

Independence Freedom Happiness

............, [date]

No.:.............

Re: Quarterly, annually and registration for amendment of quotas for [type of goods]

Report on Implementation of Quota-Import

(and Registration for Amendment of Quotas)

Respectfully to: The Ministry of Trade

Pursuant to Circular No. 09/2003/TT-BTM dated December 15, 2003, our company would like to report about the implementation of quota-import for the year of ...... (up to the date of report) as follows:

|

Description (HS) |

Detailed Description |

Quotas granted by the Ministry of Trade |

Implementation Results* |

|

|||

|

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

Registration for Amendment (increase or decrease) |

|||

|

example: tobacco (HS 2401) |

Quantity (tons) |

|

|

|

|

|

|

|

Value (Thousand US$) |

|

|

|

|

|

|

|

|

Origination |

|

|

|

|

|

|

|

Note:

* For the last quarters, the quantity and value of each quarter shall be declared (in accordance with the date of customs declaration). The approaching quarter following this report should be left blank or declared with estimated numbers.

Our company would like to confirm that the declared information is true and correct, and the company would be hold responsible for all matters arising thereon.

We would like to request your Ministry to amend the quotas applicable for the said goods as follows (only where the company is of the import requirement).

|

|

Director |