Decision No. 11/2005/QD-BTC, amending the import duty rates of a number of commodity items under heading no. 2710 in the Preferential Import Tariffm promulgated by the Ministry of Finance. đã được thay thế bởi Decision No. 39/2006/QD-BTC of July 28, 2006, promulgating the export tariff and the preferential import tariff. và được áp dụng kể từ ngày 15/09/2006.

Nội dung toàn văn Decision No. 11/2005/QD-BTC, amending the import duty rates of a number of commodity items under heading no. 2710 in the Preferential Import Tariffm promulgated by the Ministry of Finance.

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 11/2005/QD-BTC |

Hanoi, February 4, 2005 |

DECISION

AMENDING THE IMPORT DUTY RATES OF A NUMBER OF COMMODITY ITEMS UNDER HEADING No. 2710 IN THE PREFERENTIAL IMPORT TARIFF

THE MINISTER OF FINANCE

Pursuant to the Government's Decree No. 86/2002/ND-CP of

November 5, 2002, defining the functions, obligations, competence and

organizational structures of ministries and ministerial-level agencies;

Pursuant to the Government's Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, obligations, competence and organizational structure of the

Ministry of Finance;

Pursuant to the duty rates specified in the Table of Import Duty rates according

to the List of import duty-liable commodity groups, promulgated together with

Resolution No. 63/NQ-UBTVQH10 of October 10, 1998, of the Standing Committee of

the Xth National Assembly, which was amended and supplemented under

Resolution No. 399/2003/NQ-UBTVQH11 of June 19, 2003, of the Standing Committee

of the XIth National Assembly;

Pursuant to Article 1 of the Government's Decree No. 94/1998/ND-CP of November

17, 1998, detailing the implementation of May 20, 1998 Law No. 04/1998/QH10

Amending a Number of Articles of the Law on Export Duties and Import Duties;

At the proposal of the director of the Tax Policy Department,

DECIDES:

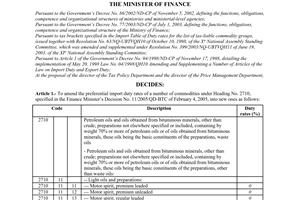

Article 1.- To amend the preferential import duty rates of a number of commodity items under Heading No. 2710 provided for in the Finance Minister's Decision No. 01/2005/QD-BTC of January 5, 2005, into new ones as follows:

|

Code |

Description |

Tax rate (%) |

||

|

2710 |

|

|

Petroleum oils and oils obtained from bituminous minerals, other than crude; preparations not elsewhere specified or included, containing by weight 70% or more of petroleum oils or of oils obtained from bituminous minerals, these oils being the basic constituents of the preparations; waste oils |

|

|

|

|

|

- Petroleum oils and oils obtained from bituminous minerals (other than crude) and preparations not elsewhere specified or included, containing by weight 70% or more of petroleum oils or of oils obtained from bituminous minerals, these oils being the basic constituents of the preparations, other than waste oils: |

|

|

2710 |

11 |

|

- - Light oils and preparations: |

|

|

2710 |

11 |

11 |

- - - Motor spirit, premium leaded |

5 |

|

2710 |

11 |

12 |

- - - Motor spirit, premium unleaded |

5 |

|

2710 |

11 |

13 |

- - - Motor spirit, regular leaded |

5 |

|

2710 |

11 |

14 |

- - - Motor spirit, regular unleaded |

5 |

|

2710 |

11 |

15 |

- - - Other motor spirit, leaded |

5 |

|

2710 |

11 |

16 |

- - - Other motor spirit, unleaded |

5 |

|

2710 |

11 |

17 |

- - - Aviation spirit |

10 |

|

2710 |

11 |

18 |

- - - Tetrapropylene |

10 |

|

2710 |

11 |

21 |

- - - White spirit |

5 |

|

2710 |

11 |

22 |

- - - Solvents containing by weight less than 1% aromatic content |

5 |

|

2710 |

11 |

23 |

- - - Other solvents |

5 |

|

2710 |

11 |

24 |

- - - Naphtha, reformate and other preparations for preparing spirits |

5 |

|

2710 |

11 |

25 |

- - - Other light oil |

5 |

|

2710 |

11 |

29 |

- - - Other |

0 |

|

2710 |

19 |

|

- - Other: |

|

|

|

|

|

- - - Medium oils (with average boiling range) and preparations: |

|

|

2710 |

19 |

11 |

- - - - Lamp kerosene |

0 |

|

2710 |

19 |

12 |

- - - - Other kerosene, including vaporizing oil |

0 |

|

2710 |

19 |

13 |

- - - - Aviation turbine fuel (jet fuel) having a flash point not below 23oC |

10 |

|

2710 |

19 |

14 |

- - - Aviation turbine fuel (jet fuel) having a flash point below 23oC |

10 |

|

2710 |

19 |

15 |

- - - - Normal paraffin |

5 |

|

2710 |

19 |

19 |

- - - - Other medium oils and preparations |

5 |

|

|

|

|

- - - Other: |

|

|

2710 |

19 |

21 |

- - - - Topped crudes |

5 |

|

2710 |

19 |

22 |

- - - - Carbon black feedstock oil |

5 |

|

2710 |

19 |

23 |

- - - - Lubricating oil basestock |

5 |

|

2710 |

19 |

24 |

- - - - Lubricating oils for aircraft engines |

5 |

|

2710 |

19 |

25 |

- - - - Other lubricating oil |

10 |

|

2710 |

19 |

26 |

- - - - Lubricating geases |

5 |

|

2710 |

19 |

27 |

- - - -Hydraulic brake fluid |

3 |

|

2710 |

19 |

28 |

- - - - Oil for transformers or circuit breakers |

5 |

|

2710 |

19 |

31 |

- - - - High speed diesel fuel |

0 |

|

2710 |

19 |

32 |

- - - - Other diesel fuel |

0 |

|

2710 |

19 |

33 |

- - - - Other fuel oils |

0 |

|

2710 |

19 |

39 |

- - - - Other |

5 |

|

|

|

|

- Waste oils: |

|

|

2710 |

91 |

00 |

- - Containing polychlorinated biphenyls (PCBs), polychlorinated terphenyls (PCTs) or polybrominated biphenyls (PBBs) |

20 |

|

2710 |

99 |

00 |

- Other |

20 |

Article 2.- This Decision takes effect 15 days after its publication in "CONG BAO" and applies to import goods declarations registered with customs offices as from February 6, 2005.

|

|

FOR THE MINISTER OF FINANCE |