Decision No. 14/2005/QD-BTC, amending the import duty rates of a number of commodities under heading no. 2710 of the preferential import table of rates, promulgated by the Ministry of Finance. đã được thay thế bởi Decision No. 39/2006/QD-BTC of July 28, 2006, promulgating the export tariff and the preferential import tariff. và được áp dụng kể từ ngày 15/09/2006.

Nội dung toàn văn Decision No. 14/2005/QD-BTC, amending the import duty rates of a number of commodities under heading no. 2710 of the preferential import table of rates, promulgated by the Ministry of Finance.

|

THE MINISTER OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 14/2005/QD-BTC |

Hanoi, March 17, 2005 |

DECISION

AMENDING THE IMPORT DUTY RATES OF A NUMBER OF COMMODITIES UNDER HEADING No. 2710 OF THE PREFERENTIAL IMPORT TABLE OF RATES

THE MINISTER OF FINANCE

Pursuant to the Government’s Decree No. 86/2002/ND-CP of

November 5, 2002, defining the functions, obligations, competence and

organizational structures of ministries and ministerial-level agencies;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, obligations, competence and organizational structure of the

Ministry of Finance;

Pursuant to tax brackets specified in the Import Table of Duty rates for the

list of tax-liable commodity groups, issued together with Resolution No.

63/NQ-UBTVQH10 of October 10, 1998, of the Xth National Assembly

Standing Committee, which was amended and supplemented under Resolution No.

399/2003/NQ-UBTVQH11 of June 19, 2003, of the XIth National Assembly

Standing Committee;

Pursuant to Article 1 of the Government’s Decree No. 94/1998/ND-CP of November

17, 1998, detailing the implementation of May 20, 1998 Law No. 04/1998/QH10

Amending and Supplementing a Number of Articles of the Law on Import Duty and

Export Duty;

At the proposal of the director of the Tax Policy Department and the director

of the Price Management Department,

DECIDES:

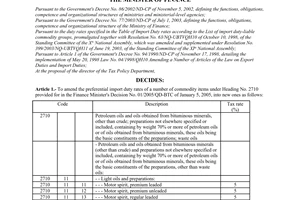

Article 1.- To amend the preferential import duty rates of a number of commodities under Heading No. 2710, specified in the Finance Minister’s Decision No. 11/2005/QD-BTC of February 4, 2005, into new ones as follows:

|

Code |

Description |

Duty rates (%) |

||

|

2710 |

|

|

Petroleum oils and oils obtained from bituminous minerals, other than crude; preparations not elsewhere specified or included, containing by weight 70% or more of petroleum oils or of oils obtained from bituminous minerals, these oils being the basic constituents of the preparations, waste oils - Petroleum oils and oils obtained from bituminous minerals, other than crude; preparations not elsewhere specified or included, containing by weight 70% or more of petroleum oils or of oils obtained from bituminous minerals, these oils being the basic constituents of the preparations, other than waste oils: |

|

|

2710 |

11 |

|

-- Light oils and preparations: |

|

|

2710 |

11 |

11 |

--- Motor spirit, premium leaded |

0 |

|

2710 |

11 |

12 |

--- Motor spirit, premium unleaded |

0 |

|

2710 |

11 |

13 |

--- Motor spirit, regular leaded |

0 |

|

2710 |

11 |

14 |

--- Motor spirit, regular unleaded |

0 |

|

2710 |

11 |

15 |

--- Other motor spirit, leaded |

0 |

|

2710 |

11 |

16 |

--- Other motor spirit, unleaded |

0 |

|

2710 |

11 |

17 |

--- Aviation spirit |

5 |

|

2710 |

11 |

18 |

--- Tetrapropylene |

5 |

|

2710 |

11 |

21 |

--- White spirit |

5 |

|

2710 |

11 |

22 |

--- Low aromatic solvents containing by weight less than 1% aromatic content |

5 |

|

2710 |

11 |

23 |

--- Other solvent spirit |

5 |

|

2710 |

11 |

24 |

--- Naphtha, reformate or other preparations for preparing spirits |

0 |

|

2710 |

11 |

25 |

--- Other light spirits |

0 |

|

2710 |

11 |

29 |

--- Other |

0 |

|

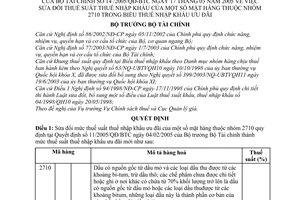

2710 |

19 |

|

-- Other: |

|

|

|

|

|

--- Medium oils and preparations: |

|

|

2710 |

19 |

11 |

---- Lamp kerosene |

0 |

|

2710 |

19 |

12 |

---- Other kerosene, including vaporizing oils |

0 |

|

2710 |

19 |

13 |

---- Aviation turbine fuel (jet fuel) having a flash point of 23oC or higher |

5 |

|

2710 |

19 |

14 |

---- Aviation turbine fuel (jet fuel) having a flash point of less than 23oC |

5 |

|

2710 |

19 |

15 |

---- Normal paraffin |

5 |

|

2710 |

19 |

19 |

---- Other medium oils and preparations |

5 |

|

|

|

|

--- Other: |

|

|

2710 |

19 |

21 |

---- Topped crudes |

5 |

|

2710 |

19 |

22 |

---- Carbon black feedstock oil |

5 |

|

2710 |

19 |

23 |

---- Lubricating oil basestock |

5 |

|

2710 |

19 |

24 |

---- Lubricating oils for aircraft engines |

5 |

|

2710 |

19 |

25 |

---- Other lubricating oil |

10 |

|

2710 |

19 |

26 |

---- Lubricating greases |

5 |

|

2710 |

19 |

27 |

---- Hydraulic brake oil |

3 |

|

2710 |

19 |

28 |

---- Oil for transformer or circuit breakers |

5 |

|

2710 |

19 |

31 |

---- High speed diesel fuel |

0 |

|

2710 |

19 |

32 |

---- Other diesel fuel |

0 |

|

2710 |

19 |

33 |

---- Other fuel oil |

0 |

|

2710 |

19 |

39 |

---- Other |

5 |

|

|

|

|

- Waste oils: |

|

|

2710 |

91 |

00 |

-- Containing polychlorinated biphenyls (PCBs), polychlorinated terphenyls (PCTs) or polybrominated biphenyls (PBBs) |

20 |

|

2710 |

99 |

00 |

- Other |

20 |

Article 2.- This Decision takes effect 15 days after its publication in “CONG BAO” and applies to import goods declarations registered with customs offices as from March 18, 2005.

|

|

FOR THE MINISTER OF FINANCE |