Circular No. 128/2003/TT-BTC of December 22, 2003, guiding the implementation of the Government’s Decree No. 164/2003/ND-CP of December 22, 2003 detailing the implementation of the Law on enterprise Income Tax đã được thay thế bởi Circular No. 134/2007/TT-BTC of November 23, 2007 guiding the implementation of The Government’s Decree No. 24/2007/ND-CP of February 14, 2007, detailing the implementation of The Law on enterprise income tax và được áp dụng kể từ ngày 18/12/2007.

Nội dung toàn văn Circular No. 128/2003/TT-BTC of December 22, 2003, guiding the implementation of the Government’s Decree No. 164/2003/ND-CP of December 22, 2003 detailing the implementation of the Law on enterprise Income Tax

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 128/2003/TT-BTC |

Hanoi, December 22, 2003 |

CIRCULAR

GUIDING THE IMPLEMENTATION OF THE GOVERNMENT’S DECREE NO. 164/2003/ND-CP OF DECEMBER 22, 2003 DETAILING THE IMPLEMENTATION OF THE LAW ON ENTERPRISE INCOME TAX

Pursuant

to the Law on Enterprise Income Tax passed on June 17, 2003 by the XIth

National Assembly;

Pursuant to the Government’s Decree No. 164/2003/ND-CP of December 22, 2003

detailing the implementation of the Law on Enterprise Income Tax;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003 defining

the functions, tasks, powers and organizational structure of the Ministry of

Finance;

The Ministry of Finance hereby guides the implementation as follows:

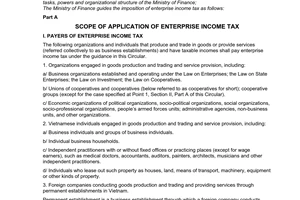

A. SCOPE OF APPLICATION OF THE ENTERPRISE INCOME TAX

I. ENTERPRISE INCOME TAX PAYERS

The following organizations and individuals that produce and trade in goods or provide services (referred collectively to as business establishments) and have taxable incomes shall have to pay enterprise income tax:

1. Organizations engaged in goods production and trading and/or service provision:

1.1. State enterprises established and operating under the Law on State Enterprises.

1.2. Enterprises established and operating under the Law on Enterprises.

1.3. Foreign-invested enterprises and foreign parties to business cooperation contracts under the Law on Foreign Investment in Vietnam.

1.4. Foreign companies and foreign organizations doing business in Vietnam not under the Law on Foreign Investment in Vietnam.

1.5. Economic organizations of political organizations, socio-political organizations, social organizations, socio-professional organizations, people’s armed forces units; administrative agencies, non-business units, that organize the goods production and trading and/or service provision.

1.6. Cooperatives and cooperative groups.

1.7. Other organizations engaged in goods production and trading and/or service provision.

2. Vietnamese individuals engaged in goods production and trading and/or service provision, including:

2.1. Business individuals and groups of business individuals.

2.2. Individual business households.

2.3. Independent practitioners with or without fixed offices or occupation-practicing places, who are business subjects (except for wage earners) and must register for payment of enterprise income tax with tax offices, such as: medical doctors, lawyers, accountants, auditors, painters, architects, musicians and other independent practitioners.

2.4. Individuals who lease such property as houses, land, transport means, machinery, equipment or other kinds of property.

3. Foreigners doing business in Vietnam or having incomes generated in Vietnam, regardless of whether their business activities, including: asset leasing, capital lending, technology transfer, consultancy, marketing, advertising, etc., are conducted in Vietnam or in foreign countries.

4. Foreign companies conducting business activities through their resident establishments in Vietnam.

Resident establishments are business establishments through which foreign companies conduct some or all of their income-generating business operations in Vietnam. Foreign companies’ resident establishments take the following principal forms:

4.1. Branches, executive offices, factories, workshops, goods forwarding warehouses, transport means, mines, oil and gas fields, natural resource exploration and exploitation sites or equipment and facilities used for the natural resource exploration;

4.2. Construction sites; construction, installation or assembly works; activities of supervision of construction, construction, installation or assembly works;

4.3. Establishments providing services, including consultancy services provided by their employees or other objects;

4.4. Agents of overseas companies;

4.5. Representatives in Vietnam in the following cases:

- They are competent to sign contracts in the names of their overseas companies;

- They are incompetent to sign contracts in the names of their overseas companies but regularly conduct the goods delivery or service provision in Vietnam.

In cases where the double taxation avoidance agreements signed by the Socialist Republic of Vietnam otherwise provide for resident establishments, the provisions of such agreements shall apply.

II. SUBJECTS NOT LIABLE TO PAY ENTERPRISE INCOME TAX

The following subjects are not liable to pay enterprise income tax:

1. Cooperatives and cooperative groups engaged in agricultural production and having incomes from cultivation, husbandry or aquaculture products.

2. Peasant households and individuals engaged in agricultural production and having incomes from cultivation, husbandry or aquaculture products, except for peasant households and individuals engaged in large-scale commodity production and having high incomes from cultivation, husbandry or aquaculture products.

Enterprise income tax shall not temporarily be collected from peasant households and individuals engaged in large-scale commodity production and having high incomes from cultivation, husbandry or aquaculture products pending the Government’s regulations.

B. BASES FOR ENTERPRISE INCOME TAX CALCULATION

Bases for enterprise income tax calculation are taxable incomes in the tax calculation period and tax rates

I. TAXABLE INCOMES:

Taxable incomes in the tax calculation period include taxable income from production, trading and service activities and other taxable incomes, including taxable incomes from overseas production, trading and service activities.

Tax calculation period is determined according to the calendar year. In cases where business establishments apply a fiscal year other than the calendar year, the tax calculation period shall be determined according to the applied fiscal year. The first tax calculation period for newly set up business establishments and the last tax calculation period for business establishments undergoing transformation, ownership conversion, merger, division, dissolution or bankruptcy shall be determined in compatibility with the accounting period prescribed by the accounting legislation.

Taxable income in the tax calculation period is determined according to the following formula:

|

Taxable income in the tax calculation period |

= |

Turnover for calculating taxable income in the tax calculation period |

- |

Reasonable expenses in the tax calculation period |

+ |

Other taxable incomes in the tax calculation period |

After determining taxable income according to the above formula, business establishments may subtract the losses carried forward from the previous tax calculation periods before determining payable enterprise income tax amounts according to the regulations.

In cases where a double taxation avoidance agreement which the Socialist Republic of Vietnam has signed otherwise provides for the method of determining taxable income for resident establishments, the provisions of such agreement shall apply.

II. TURNOVER FOR CALCULATING TAXABLE INCOME

1. Turnover for calculating taxable income is determined as follows:

Turnover for calculating the taxable income is the total proceeds from the goods sale or service provision, including price subsidies, surcharges and additional amounts earned by business establishments, regardless of whether such sums have been collected or not.

Turnover for calculating the taxable income is specifically determined for business establishments paying value added tax by different methods as follows:

1.1. For business establishments paying value added tax by method of tax deduction, it is the turnover exclusive of value added tax.

For example: Business establishment A is a subject paying value added tax by the tax deduction method. Its added value invoices shall include the following details:

Sale price: VND 100,000

VAT (10%): VND 10,000

Payment price: VND 110,000

The turnover for calculating taxable income shall be VND 100,000

1.2. For business establishments paying value added tax calculated directly on added values, it is the turnover inclusive of value added tax.

For example: Business establishment B is a subject paying value added tax calculated directly on added values. Its goods sale invoices are only inscribed with the sale price of VND 110,000 (the tax-inclusive price).

The turnover for calculating taxable income shall be VND 110,000.

2. Time of determining the turnover for calculating taxable income is identified as follows:

2.1. For goods, it is the time of transferring ownership right over goods or issuing sale invoices.

2.2. For services, it is the time of completing services or issuing sale invoices.

3. Turnover for calculating the taxable income in some cases is determined as follows:

3.1. For goods sold by mode of installment payment, it shall be determined according to the sale price paid in lump sum, excluding deferred payment interests.

In cases where the payment under the installment purchase-sale contracts lasts through many tax calculation periods, the turnover shall be the amount receivable from the purchaser in the tax calculation period excluding deferred payment interest within the time limit prescribed in the contracts.

The determination of expenses for goods sold and purchased with installment payment shall comply with the principle of conformity with turnover.

3.2. For goods and services made and used by business establishments for exchange; presented as gifts or donation; equipment or rewards for laborers, it shall be calculated according to the sale prices of goods and services of the same or similar kinds on the market at the time of exchange; presentation or donation; equipping or giving rewards to laborers.

3.3. For goods and services made for self-use by business establishments in service of the production or business process, such as: electricity, products made for use as fixed assets, self-made capital construction works, it shall be the production costs of such products.

3.4. For goods processing activities, it shall be earnings from the processing, including remuneration, expenses for fuel, power, auxiliary materials and other expenses in service of the goods processing.

3.5. For business establishments acting as agents or consignment sale agents to sell goods at the prices prescribed by business establishments being the principals or consignors, it shall be the enjoyable commissions.

3.6. For property leasing activities, it shall be the rent collected in each period according to the leasing contracts.

In cases where the lessees pay rents in advance for several years, the turnover for calculating taxable income shall be determined in conformity with the determination of expenses of business establishments.

Depending on the conditions for the determination of reasonable expenses, business establishments may choose either of the following two methods of determining turnover for calculating taxable income:

- Rent determined for each year is equal to (=) turnover being the advanced amount divided by (:) the number of years for which the rent is advanced.

- The rent advanced for many years.

Particularly, business establishments and individuals that have not yet applied the prescribed accounting, invoice and voucher regimes, have been engaged in property leasing activities and received rents advanced by the lessees for many years, the turnover for calculating taxable income shall be the total rents received.

In cases where a business establishment, in the tax preference duration, chooses the method of determining the turnover for calculating the taxable income to be the whole rent advanced by the lessee for many years, the taxable income eligible for tax exemption or reduction shall be equal to (=) the total taxable income divided by (:) the number of years for which the lessee advances rent and multiplied by (x) the number of years of tax exemption or reduction.

3.7. For activities of providing loans, collecting deposit interests or revenues from financial leasing operations, it shall be the interests receivable in the period and determined as follows:

- Receivable interests on over-due debts not included in turnover. Credit institutions must monitor such interests outside the accounting balance sheets and shall account them into their professional operation revenues when they are collected.

- Receivable interests on undue loans already included in turnover, which remain unpaid by customers after 90 days or are determined irrecoverable though the time limit of 90 days has not yet expired, shall be excluded from the turnover for calculating taxable income. The credit institutions shall monitor such reducible turnover amount outside the accounting balance sheet and account it into their professional operation revenues when it is collected.

3.8. For air transport, it shall be the total sum received from the transport of passengers, luggage and cargos, regardless of whether such sum has been collected or not. The time of determining the turnover for calculating taxable income shall be the time when the transport service is completed.

3.9. For electricity selling activities, it shall be the sum inscribed in the added value invoices. The time of determining the turnover for calculating taxable income shall be the last day the electricity meter figures are recorded in electricity bills.

For example: An electricity bill is recorded with electricity meter figures counted from December 5 to January 5. The turnover of such bill shall be calculated for January.

For other activities such as telephone charge, supply of clean water..., the turnover for calculating the taxable income shall be determined as for electricity sale.

3.10. For insurance and reinsurance business activities, it shall be the receivable amounts being original premiums, expertise agent charge, charge for reinsurance, reinsurance commissions and other revenues.

3.11. For business cooperation contracts in form of product sharing, the turnover for calculating the enterprise income tax shall be determined as follows:

- Goods-selling prices inscribed in sale invoices, for goods sold in the Vietnamese market.

- FOB prices at export border-gates, for export goods.

III. REASONABLE EXPENSES ALLOWED TO BE SUBTRACTED FOR CALCULATING THE TAXABLE INCOMES

Reasonable expenses related to taxable incomes in the tax calculation period are determined as follows:

1. Expenses for depreciation of fixed assets used in goods production and trading and/or business provision.

1.1. Fixed assets which are allowed to be depreciated into reasonable expenses must meet the following conditions:

a/ They are used in production and business.

b/ They are accompanied with enough invoices, vouchers and other lawful papers evidencing that they are owned by business establishments.

c/ They must be managed, monitored and accounted in accounting books of business establishments under the current management, book-keeping and cost accounting regime.

1.2. The fixed asset depreciation level is regarded as reasonable expenses under decisions of the Finance Minister on regime of fixed asset management, use and depreciation.

Business establishments which apply the straight-line depreciation method with high economic efficiency may make rapid depreciation which, however, must not be two times faster than the straight-line depreciation method, in order to quickly renew their technologies. Fixed assets involved in business activities, which are eligible for rapid depreciation, include machinery and equipment; measuring and testing devices; transport equipment and means; managerial tools; animals and perennial tree gardens. When carrying out the rapid depreciation, business establishments must guarantee they operate profitably.

1.3. Fixed assets which have been completely depreciated but are still used in the production and business shall not continue to be depreciated.

2. Expenses for raw materials, materials, fuels, energy and goods used in goods and/or service production and business related to the turnover and taxable incomes in a given period shall be calculated according to the reasonable material wastage norms and the actual ex-warehousing prices.

2.1. The reasonable material wastage norms shall be elaborated and decided by the directors or owners of business establishments. For business establishments having managing boards, the general directors shall elaborate material wastage norms and submit them to the managing boards for approval. At the year-end, the business establishments shall have to make settlement of materials, analyze the situation of implementation of the material wastage norms and report at the requests of the tax offices.

For all cases of material or goods loss, the value of lost materials or goods must not be regarded as reasonable expenses.

2.2. Prices of actually ex-warehoused materials and goods

Prices of actually ex-warehoused materials and goods for business establishments paying value added tax by deduction method are the VAT-exclusive prices of materials and goods purchased from outside and services related thereto; as for business establishments paying value added tax by direct method or for goods or service production and business activities not subject to value added tax, the prices of actually ex-warehoused materials and goods shall include value added tax on materials and goods purchased from outside and services related thereto.

Prices of actually ex-warehoused materials and goods include:

a/ For materials and goods purchased from outside:

- The purchase prices of domestic materials and goods, including: the purchase prices inscribed in the invoices of sellers, plus (+) expenses for collection, purchase, transport, loading/unloading, preservation, insurance cost, warehouse and storing yard rents, sorting and recycling charges.

- The purchase prices of imported materials and goods are payment prices, plus (+) import tax, special consumption tax and surcharges prescribed by the State (if any), plus (+) transport freight, loading/unloading, preservation and insurance charges, warehouse and storing yard rents. The payment prices for imported materials and goods are determined as follows:

+ According to actually paid prices if the business establishments declare import tax calculation prices under the foreign trade contracts higher than the actually paid prices.

+ According to the prices declared for import tax calculation if the business establishments declare import tax calculation prices under the foreign trade contracts lower than the actually paid prices.

b/ For self-made materials, it shall be the prices of actually ex-warehoused materials plus actual expenses arising in the self-making process.

c/ For materials processed by outsiders, it shall be the prices of actually ex-warehoused materials delivered to the processors plus (+) processing costs, transport freight and loading/unloading charges.

Business establishments which purchase goods and materials, hire the processing of materials and goods from outside and hire the transport, loading/unloading, preservation of materials and goods must have invoices and vouchers according to the prescribed regime.

In cases where business establishments purchase products made of rattan, bamboo, rush, coconut fiber, palm leaves, etc., from peasants who directly made them; purchase handicraft and fine-art articles from non-business artisans; purchase soil, stone, sand, cobble from people who exploit such products by themselves; purchase discarded materials from direct collectors and a number of services of non-business individuals, without invoices and vouchers according to the prescribed regime, they may draw up lists thereof on the basis of payment vouchers of goods sellers or service providers (according to the set form, not printed herein). Enterprise directors shall approve the payments according to the lists and be accountable before law for the accuracy and truthfulness of the lists.

3. Expenses for salaries, wages and assorted allowances; mid-shift meal allowances provided for by the Labor Code.

3.1. Expenses for salaries of business establishments include salaries, wages and allowances to be paid to laborers according to the provisions of the Labor Code. Expenses for salaries are determined according to each type of business establishments as follows:

a/ For State enterprises: Expenses for salaries to be paid to laborers are determined on the basis of current legal documents guiding the regime of salaries, wages and allowances according to the provisions of the Labor Code.

b/ For other business establishments: Expenses for salaries to be paid to laborers shall be based on labor contracts or collective labor agreements.

Each year, business establishments shall have to register with the tax agencies their total salary fund to be paid in the year, bases and methods for elaborating the total salary fund, and concurrently submit enterprise income tax declarations (made according to the set form not printed herein).

3.2. Expenses for mid-shift meal allowances shall be decided by the directors or owners of business establishments to be suitable with production and business efficiency, but must ensure that the monthly payment level for each laborer must not exceed the minimum salary level provided for by the State for State employees. Particularly, expenses for laborers’ food rations for some special branches and occupations shall comply with the documents guiding the implementation of the Labor Code.

4. Expenses for scientific and technological research (excluding part of funding supported by the State or superior management agencies); rewards for innovations and technical modifications which bring about business efficiency; expenses for training labors according to the prescribed regime; expenses for healthcare within business establishments; supports for schools established under the State’s permits, and the payment of such expenses must be made with invoices and vouchers according to the prescribed regime.

5. Expenses for services purchased from outside:

5.1. Electricity, water, telephone charges; stationery expenses; charges for hiring auditors; legal consultancy charges; expenses for purchase of asset insurance, human accident insurance; hiring the designing, establishment and protection of trademarks.

5.2. Expenses for hiring fixed asset repair:

For particular fixed assets with regular repairs, business establishments may deduct in advance repair expenses according to estimates into production or business costs. If the actual repair expenses are larger than the deducted amounts according to estimates, the business establishments may additionally account the difference into their expenses. In cases where the actually paid amounts are smaller than the deducted amounts according to estimates, they shall account expense reductions in the year.

5.3. Expenses for procuring assets other than fixed assets such as expenses for purchase and use of technical documents, invention patents, technology transfer licenses, trademarks, etc., shall be gradually distributed into business expenses.

5.4. Rents for fixed assets operating under rent contracts. In cases where the fixed asset rents are paid in lump sum for many years, such rents shall be gradually distributed into production or business expenses according to the number of years of fixed asset use.

5.5. Charges for services purchased from outside by principal contractors, including those paid for sub-contractors (if any).

5.6. Working mission allowances, including: travel fares, accommodations or lodging rents.

5.7. Travel allowances for annual leaves as provided for by the Labor Code.

5.8. Expenses for services purchased or hired from outside in direct service of goods production or service provision activities with vouchers and invoices according to the prescribed regime.

6. Payments:

6.1. Payments for female laborers, including:

a/ Expenses for job re-training of female laborers in cases where their former jobs are no longer suitable and they need to shift to other jobs under the development planning of the business establishments.

Such expenses include: school fee (if any) + rank and grade salary difference (guaranteeing the payment of 100% of salary for trainees).

b/ Expenses for salaries and allowances (if any) for teachers of nurseries and kindergartens organized and managed by business establishments. The number of teachers shall be determined according to the norms prescribed by the education and training system.

c/ Expenses for organizing an additional health check, in a year, such as examination of occupational, chronic or gynecological diseases, for female laborers.

d/ Expenses for allowances for female laborers after their first or second childbirth: The allowance level must not be higher than VND 300,000 for business establishments located in cities, district townships and provincial towns, and VND 500,000 for business establishments located in geographical areas being under exceptionally difficult socio-economic conditions specified in the Appendix enclosed with the Government’s Decree No. 164/2003/ND-CP of December 22, 2003 in order to help the female laborers partly ease their post-natal hardship.

e/ Over-time allowances for female laborers who, for objective reasons, do not take leaves for breast-feeding their children according to the prescribed regime but stay working for the business establishments, shall be paid according to the current regime.

For business establishments engaged in production, construction or transport activities involving large number of female laborers, if they conduct separate accounting and monitoring of actual payments for female laborers specified above, they shall be entitled to enterprise income tax reduction under the guidance at Point 7.3, Section III, Part E of this Circular.

6.2. Expenses for labor protection devices or outfits.

Expenses for labor protection devices shall be the actual payments. Expenses for procuring attires in replacement of labor protection outfits shall be the actual payments but must not exceed VND 500,000/person/year.

6.3. Expenses for protection of business establishments.

6.4. Deductions for payment into social and medical insurance funds, trade unions funding; expenses for support funding for activities of the Party organizations and mass organizations at the business establishments; contributions for creating managerial expenditure sources for superior levels and contributions to funds of associations and societies according to the prescribed regime.

7. Payments of interests on capital borrowed for goods production or service provision from banks, credit institutions and/or economic organizations at the actual interest rates under borrowing contracts. Payments of interests on loans from other subjects at the actual interest rates at the time of signing borrowing contracts, which must not exceed 1.2 times the lending interest rate at the same time of commercial banks having transactions with the business establishments.

Expenses for payment of interests on loans for contribution of legal capital or charter capital shall not be accounted by the business establishments into reasonable expenses for determining the taxable incomes.

8. Deductions for setting up reserves for the price decrease of unsold goods, bad debts or price decrease of securities or setting up reserve funds for job-loss supports under the Finance Ministry’s guidance.

9. Severance allowances for laborers according to the current regime.

10. Expenses for the sale of goods or services, including: expenses for preservation, packaging, transport, loading/unloading, rent of warehouses and storing yards, product and goods warranty.

11. Expenses for advertisement, marketing, sales promotion, guest reception, festivities, transactions, external relations, brokerage commissions, expenses for conferences and other types of expenses shall be the actual payment amounts but must not exceed 10% of the total of the reasonable expense amounts specified in Clauses 1 thru 10 of this Section. For trading business activities, the reasonable expenses for determining control level shall not include cost prices of goods sold.

12. Payable taxes, charges and land rents related to the goods production and service provision (excluding enterprise income tax), including:

12.1. Export tax.

12.2. Input value added tax on export goods and services ineligible for tax deduction and reimbursement as prescribed. Input value added tax beyond the prescribed duration for declaration and deduction.

12.3. Special consumption tax for domestic goods and services, which are subject to special consumption tax.

12.4. License tax.

12.5. Natural resource tax.

12.6. Agricultural land use tax; housing and land tax.

12.7. Land rents

12.8. Charges and fees actually paid by the business establishments into the State budget according to the law provisions on charges and fees.

13. Business management expenses allocated by overseas companies to their resident establishments in Vietnam according to the proportion of the turnover of the resident establishments in Vietnam to the total turnover of their overseas companies, including turnovers of resident establishments in other countries. The allocation formula shall be as follows:

|

|

= |

|

x |

|

|

Business management expenses allocated by the overseas company to its resident establishments in Vietnam |

Total turnover of resident establishments in Vietnam |

Total business management expense of the overseas company in the tax calculation period |

||

|

Total turnover of the overseas company, including turnovers of resident establishments in other countries in the tax calculation period |

Overseas companies’ resident establishments in Vietnam which have not yet applied the prescribed accounting, invoice and voucher regimes and pay tax by declaration mode must not account into their reasonable expenses the business management expenses allocated by their overseas companies.

14. Reasonable expenses for insurance business, construction lottery business, securities trading and some special business activities shall comply with the specific guiding documents of the Finance Ministry.

IV. AMOUNTS WHICH MUST NOT BE ACCOUNTED INTO THE REASONABLE EXPENSES

1. Salaries and remunerations paid by business establishments which fail to strictly observe the labor contract regime prescribed by the labor legislation, except for case of hired piece-work laborers.

2. Salaries and wages of owners of private enterprises, members of partnerships, masters of business households, business individuals. Remunerations paid to founding members and members of managing boards of limited liability companies and joint-stock companies, who do not personally take part in administering the goods production and/or service provision.

3. Advance deductions to cover expenses but actually not spent, such as: expenses for repair of fixed assets; expenses for products, goods and construction work warranty and other advance deductions.

4. Expenses without invoices or vouchers according to the prescribed regime or with unlawful vouchers.

5. Fines for violations of traffic law, violations of the business registration, overdue debts, fines for violations of the accounting and statistical regimes, fines for tax-related administrative violations and other fines.

6. Expenses not related to turnover and taxable income, such as: expenditures on capital construction investment; financial supports for mass organizations, social organizations and localities; expenses for charity purpose and other expenses not related to turnover and taxable income.

7. Expenses covered by other funding sources:

7.1. Non-business expenses.

7.2. Illness, pregnancy and maternity allowances.

7.3. Allowances for regular and unexpected difficulties.

7.4. Other expenses covered by other funding sources.

8. Other unreasonable expenses.

V. OTHER TAXABLE INCOMES

Other taxable incomes in a given tax calculation period include:

1. Differences between the purchase and sale of securities.

2. Income from activities related to industrial property rights or copyright.

3. Other incomes from the asset ownership or use right.

4. Income from asset transfer or liquidation. This income is determined equal to (=) the turnover generated from the asset transfer or liquidation minus (-) the remaining value of transferred or liquidated assets and expenses related to the asset transfer or liquidation.

5. Income from the transfer of land use or land rent right.

The method of determining income from the transfer of land use or land rent right as well as the tax thereon is guided in Part C of this Circular.

6. Interests on deposits, loans or deferred payment for goods sold.

7. Profits earned from the sale of foreign currencies, foreign exchange rate margins.

8. Year-end balances of the reserves for price decrease of goods left in stock, bad debts or price decrease of securities.

9. Bad debts, which were written off from the accounting books but are now recovered.

10. Payable debts with unidentified creditors.

11. Received fines for breaches of economic contracts, after subtracting the paid fine amounts.

12. The previous years’ omitted incomes from activities of goods production or service provision, which are now discovered.

13. Incomes received from overseas goods production and/or service provision activities.

The determination of incomes received from overseas goods production and/or service provision activities, which are subject to enterprise income tax shall be based on the double taxation avoidance agreements which the Socialist Republic of Vietnam has signed.

Regarding incomes received from goods production and/or service provisions in foreign countries which the Socialist Republic of Vietnam has not yet signed double taxation avoidance agreements, the taxable incomes shall be the incomes before income tax is paid overseas. After determining the enterprise income tax amounts to be paid under the Enterprise Income Tax Law, the income tax amounts already paid overseas shall be subtracted for paying tax into the State budget. The tax amounts already paid overseas and allowed to be subtracted must not exceed the payable enterprise income tax amounts under the Enterprise Income Tax Law.

Example 1: Business establishment A receives an income of VND 800 million from overseas. Such income is the remainder after an income tax amount of VND 200 million has been paid under the foreign laws.

The income proportion received from overseas by business establishment A to be taxed under Vietnam’s Enterprise Income Tax Law shall be as follows:

[(VND 800 million + VND 200 million) x 28%] = VND 280 million.

Because it has paid the income tax of VND 200 million overseas, business establishment A shall only have to pay:

VND 280 million – VND 200 million = VND 80 million.

Example 2: Business establishment B receives an income of VND 798 million from overseas. But such income is the remainder after an income tax amount of VND 342 million has been paid under the foreign laws.

The enterprise income tax on the overseas income shall be calculated according to the Enterprise Income Tax Law as follows:

(VND 798 million + VND 342 million) x 28% = VND 319.2 million.

After determining the payable tax amount for its overseas income, business establishment B shall only be allowed to subtract the tax amount already paid overseas equal to that calculated under the Enterprise Income Tax Law which is VND 319.2 million. In other words, business establishment B shall not have to pay enterprise income tax for the above-said income received from overseas.

14. Incomes related to the sale of goods and provision of services not included in turnovers, such as: reward for quick unloading of cargos from ships, tips for food and drink catering or hotel services, after subtracting expenses for generation of such incomes.

15. Incomes from activities of contribution of shares, contribution of capital to joint ventures or economic cooperation at home. In cases where the received incomes are incomes divided from after-tax income from activities of contribution of shares, contribution of capital to joint ventures or economic cooperation, the business establishment receiving such incomes shall not have to pay enterprise income tax.

16. Income from the sale of discarded materials and faulty products after subtracting expenses for collecting and selling them.

17. Gifts and donations in kind or in cash.

18. Other incomes.

Business establishments which have their turnovers, expenses and taxable incomes in foreign currencies must convert them into Vietnam dong at the average transaction exchange rates on the inter-bank foreign currency market, announced by the State Bank of Vietnam at the time such turnovers and taxable incomes are generated and expenses arise, except otherwise provided for by law. Foreign currencies having no exchange rate with Vietnam dong shall be converted through a foreign currency having exchange rate with Vietnam dong.

VI. ENTERPRISE INCOME TAX RATES

Enterprise income tax rates shall be as follows:

1. The enterprise income tax rate applicable to business establishments shall be 28%.

For construction lottery business activities, the enterprise income tax shall be paid at the rate of 28%, with the income remainder shall be remitted into the State budget after subtracting deducible amounts, amounts for setting up funds prescribed by the Finance Ministry.

2. Tax rate applicable to each specific business establishments which conducts the prospection, exploration and/or exploitation of oil, gas and/or other precious and rare natural resources shall be between 28% and 50%, suitable to each investment project or each business establishment.

Business establishments having investment projects for prospection, exploration and/or exploitation of oil, gas and/or other precious and rare natural resources must send their investment projects’ dossiers to the Finance Ministry, so that the latter shall consider and consult opinions of the concerned ministries and branches, then submit them to the Prime Minister for decision on specific tax rate for each project.

C. DETERMINATION OF TAXABLE INCOME AND INCOME TAX ON LAND USE OR LAND RENT RIGHT TRANSFER

Taxable income and income tax on land use or land rent right transfer are determined as follows:

I. TAXABLE OBJECTS

Income from activities of transferring land use or land rent right by organizations dealing in goods and/or services (called business organizations for short) shall be subject to tax on income from land use or land rent right transfer in the following cases:

1. Cases of land use right transfer:

1.1. Transfer of the right to use land without infrastructures or architectural works thereon.

1.2. Transfer of the right to use land with infrastructures thereon.

1.3. Transfer of the right to use land with architectural works thereon.

1.4. Transfer of the right to use land with infrastructures and architectural works thereon.

2. Cases of land rent right transfer:

2.1. Transfer of the right to rent land without infrastructures or architectural works thereon.

2.2. Transfer of the right to rent land with infrastructures thereon.

2.3. Transfer of the right to rent land with architectural works thereon.

2.4. Transfer of the right to rent land with infrastructures and architectural works thereon.

II. CASES OF LAND USE RIGHT OR LAND RENT RIGHT TRANSFER NOT SUBJECT TO TAX ON INCOME FROM LAND USE RIGHT OR LAND RENT RIGHT TRANSFER

1. The competent State agencies assign or lease land to business organizations according to the provisions of the Land Law.

2. Business organizations return land to the State or have their land recovered by the State according to the provisions of law.

3. Business organizations sell their workshops together with the transfer of the land use right or land rent right for relocation under plannings.

4. Business organizations contribute capital with land use right for production or business cooperation with domestic and foreign organizations and individuals according to law provisions.

5. Business organizations transfer their land use right or land rent right due to division, separation, merger or bankruptcy.

6. Owners of private enterprises transfer the land use right in cases of inheritance or divorce according to law provisions; transfer the land use right between husbands and wives, parents and children, grandparents and paternal or maternal grandchildren or between blood siblings.

7. Business organizations donate their land use right to the State or other organizations for construction of cultural, medical, physical training or sport works; transfer the land use right for charity purposes to social policy beneficiaries.

III. TAX PAYERS

Tax payers are business organizations having incomes from the transfer of land use right or land rent right.

Business households and individuals having incomes from the transfer of land use right or land rent right shall not pay tax on income from land use right or land rent right transfer under the guidance in this Circular but pay income tax on high income earners.

IV. TAXABLE INCOME

Taxable income is determined equal to the turnover for calculating the taxable income minus expenses for land use right or land rent right transfer.

1. Turnover for calculating taxable income from land use right or land rent right transfer shall be determined according to the actual transfer prices between business organizations which transfer land use right or land rent right and land use right transferees at the time of land use right transfer.

1.1. Actual transfer prices are determined as follows:

a/ According to the invoiced price

In cases where the invoiced prices are lower than the amounts actually received by the land use right or land rent right transferors, the actual transfer prices shall be the amounts actually received by the land use right or land rent right transferors.

In cases where the invoiced prices or the actually received amounts are lower than the prices set by the People’s Committees of the provinces or centrally-run cities, the transfer prices shall be determined according to the prices set by the provincial/municipal People’s Committees.

b/ According to the auction-winning price in case of auctions of land use right or land rent right

1.2. Turnover for calculating taxable income in some cases shall be determined as follows:

a/ For cases where the land use right or land rent right is transferred together with infrastructure on land, it shall be the total received amount, including amount for transfer of ownership right over such infrastructure and rent of infrastructure on land.

b/ For cases where the land use right or land rent right is transferred together with infrastructure or architectural works on land, it shall be the received amount, excluding proceeds from the assignment or sale of such architectural works on land. If business organizations cannot separate the proceeds from the assignment or sale of the architectual works on land, the turnover for calculating taxable income shall include such proceeds.

2. Expenses for land use right or land rent transfer:

2.1. Expenses for acquiring land use right or land rent right include:

a/ Cost of land subject to right transfer is determined as follows:

- For land assigned by the State with the collection of land use levy or land rent, it shall be amounts in the State’s vouchers on collection of land use levy or land rent.

- For land with the use right or rent right transferred from other organizations or individuals, it shall be the prices inscribed in contracts and lawful vouchers on payment of money upon receipt of land use right.

- For business organizations which exchange their works for the State’s land, it shall be the value of exchanged works.

- For business organizations which have won land use right auctions, it shall be the auction-winning prices.

- For cases where a limited liability company or joint stock company transfers its right to use or rent land originating from the joint-venture capital contribution, it shall be the value according to the capital contribution record of the managing board.

- For land of business establishments with the land use right received without lawful papers; inherited under the civil legislation; given as gift or donated with its cost price unidentifiable, such cost price shall be determined according to the prices of land categories decided by the People’s Committees of the provinces or centrally-run cities on the basis of the land price bracket promulgated by the Government at the time of receiving the land use right.

In cases where business organizations transfer the land use right originating from the reception of land use right without lawful papers; inherited under the civil legislation; given as gift or donated before 1994, its cost price shall be determined according to the prices of land categories prescribed in 1994 by the People’s Committees of the provinces or centrally-run cities on the basis of the land price bracket promulgated by the Government in Decree No. 87/CP of August 17, 1994.

b/ Expenses for payment of compensations for land-related damage already cleared or not yet cleared into land use levy or land rent.

c/ Expenses for payment of compensations for cash crop and vegetable damage.

d/ Expenses in support of the relocation of graves and tombs.

e/ Expenses in support of the resettlement.

f/ Other expenses in support of the ground clearance.

g/ Law-prescribed charges and fees related to the granting of land use right.

Those expenses for payment of compensations or supports mentioned in this Item 2.1, if without invoices or vouchers, shall be put on the lists clearly stating the names and addresses of the receivers; compensation or support amounts; signatures of money receivers and certifications of administrations of wards or communes where the people eligible for compensations or supports reside.

2.2. Expenses for soil revamp, ground leveling.

2.3. Expenses for investment in the construction of such infrastructures as roads, power lines, water supply and drainage systems, post and telecommunications facilities, etc.

2.3. Other expenses related to the land use right or land lease right transfer.

2.5. Expenses specified in Section III, Part B of this Circular (if any).

In cases where an organization is engaged in different business lines, the general expenses specified in this Item 2.5 shall be allocated according to the ratio of the turnover from land use right or land rent right transfer to the total turnover of such business organization.

For cases where the turnover for calculating the taxable income includes that from architectural works on land, the expenses shall be determined to be inclusive of the value of such architectural works on land.

V. RATES OF

TAX ON INCOMES FROM LAND USE RIGHT OR LAND RENT RIGHT TRANSFER

1. The tax rate applicable to incomes from land use right or land rent right

transfer shall be 28%.

2. After calculating income tax at the tax rate of 28%, the remaining income shall be subject to income surtax according to the following graduated tax brackets:

Graduated tax brackets

|

Grades |

Ratios of remaining incomes to expenses |

Tax rates |

|

1 |

Up to 15% |

0% |

|

2 |

Between over 15% and 30% |

10% |

|

3 |

Between over 30% and 45% |

15% |

|

4 |

Between over 45% and 60% |

20% |

|

5 |

Over 60% |

25% |

For example: Tax calculation turnover for land with transferred use right: VND 170 million; total expense for land use right transfer: VND 50 million. Taxable income shall be (=) VND 120 million (VND 170 million – VND 50 million). Tax on income from land use right transfer shall be determined as follows:

- Enterprise income tax at the common tax rate: VND 120 million x 28% = VND 33.6 million.

- For the remaining income: VND 86.4 million (VND 120 million – VND 33.6 million) surtax shall be paid according to the following graduated tax brackets:

Unit: VND million

Grades |

Taxable amounts |

Tax rates |

Tax amounts |

|

1 |

50 x 15% = 7.5 |

0% |

0 |

|

2 |

(50 x 30%) – 7.5 = 7.5 |

10% |

0.75 |

|

3 |

(50 x 45%) – (50 x 30%) = 7.5 |

15% |

1.125 |

|

4 |

(50 x 60%) – (50 x 45%) = 7.5 |

20% |

1.5 |

|

5 |

86.4 – (50 x 60%) = 56.4 |

25% |

14.1 |

|

|

Total |

|

17.475 |

Total amount of payable tax on income from land use right transfer shall be VND 33.6 million + VND 17.475 million = VND 51.075 million.

VI. THE PREFERENTIAL TAX RATES, TAX EXEMPTION AND REDUCTION UNDER THE GUIDANCE IN SECTION E OF THIS CIRCULAR SHALL NOT APPLY TO INCOMES FROM LAND USE RIGHT OR LAND RENT RIGHT TRANSFER

VII. THE PROCEDURES FOR DECLARATION AND PAYMENT OF TAX ON INCOME FROM LAND USE RIGHT OR LAND RENT RIGHT TRANSFER

1. Business organizations shall transfer the land use right or land rent right and concurrently transfer the ownership right over architectures or infrastructures on land shall have to carry out the procedures for transferring the land use right or land rent right together with the architectures or infrastructures on land according to the provisions of the land legislation.

2. Procedures for tax declaration and payment:

2.1. For business establishments which do not regularly conduct the land use right or land rent right transfer:

a/ Within five working days after receiving cadastral data sent by the land use right registries, the tax offices directly managing the taxation shall have to notify such to the business establishments engaged in the activities of land use right or land rent right transfer, requesting them to declare their turnover, expenses and taxable incomes as well as payable income tax on land use right transfer.

b/ Within 15 working days after receiving notices on tax declaration from the tax offices, the business establishments engaged in the activities of land use right or land rent right transfer shall have to make tax declarations according to the set form (not printed herein) and submit them to the tax offices directly managing the taxation.

c/ Basing themselves on the data on the tax declarations, the tax offices shall check out, consider and determine tax obligations; then notify the business establishments of the amounts of income tax on land use right or land rent right transfer, which are payable or non-payable for cases of land use right or land rent right transfer not subject to tax. The tax payment time limit inscribed in the tax notices shall be 15 days after the issuance of such notices. The land use right registries shall grant land use right certificates only when there are vouchers on payment of income tax on the land use right or land rent right transfer by business establishments, or tax-non-payment certificates of the tax offices.

d/ Business organizations shall have to separately settle amounts of income tax on land use right or land rent right transfer. In cases where the tax amounts paid when the procedures for granting land use right are carried out are smaller than the payable tax amounts according to the enterprise income tax settlement declarations (made according to the set form, not printed herein), the business organizations shall have to pay deficit tax amount into the State budget within 10 days after submitting their tax settlement declarations. In cases where the paid tax amounts are larger than the payable tax amounts according to the tax settlement declarations, the overpaid tax amount shall be cleared against the deficit amounts of enterprise income tax on other business activities or cleared against the payable enterprise income tax amount of the subsequent period. In cases where the land use right or land rent right transfer activities suffer losses, the business organizations may transfer such losses into taxable incomes from land use right or land rent right transfer activities of subsequent years according to regulations.

2.2. For organizations dealing in houses, land, infrastructures and architectures on land:

They shall declare, pay and settle tax under the guidance in Part D of this Circular. In cases where their land use right or land rent right transfer activities suffered losses, such losses shall be transferred into incomes from land use right or land rent right transfer in subsequent years.

Business organizations shall carry out the procedures for land use right or land rent right transfer after their tax settlements are examined by the tax offices.

Upon receiving cadastral data sent by the land use right registries, the tax offices which directly manage the organizations dealing in houses, land, infrastructures and architectures on land shall have to certify the areas of land subject to the land rent right or land lease right transfer, for which tax has been paid, so that the land use right registries shall grant land use right certificates.

D. TAX REGISTRATION, DECLARATION, PAYMENT AND SETTLEMENT

I. REGISTRATION OF ENTERPRISE INCOME TAX

Business establishments shall make enterprise income tax registration as follows:

1. Business establishments shall have to register enterprise income tax together with the registration for payment of value added tax.

2. Business establishments, when registering tax, must clearly state their attached units with independent cost-accounting as well as dependent book-entry accounting units. All units attached to the business establishments which conduct independent cost-accounting or dependent book-entry accounting shall have to register tax with the tax offices of localities where they are located.

3. Independent cost-accounting units attached to business establishments are obliged to separately declare, pay and settle tax. Book-entry accounting units dependent to principal business establishments shall only register tax in localities, they are not obliged to declare and pay tax in localities; while the principal business establishments are obliged to declare, pay and settle tax on their own business operations and business operations of their dependent book-entry accounting units.

II. DECLARATION OF ENTERPRISE INCOME TAX

1. Business establishments shall have to declare enterprise income tax and submit enterprise income tax declarations made according to the set form (not printed herein) to the tax offices directly managing them on the 25th of January every year or the 25th of the month following the ending month of the tax calculation period at the latest, for business establishments applying a fiscal year other than the calendar year.

Bases for making tax declaration for a year are the results of the goods production and/or service provision of the previous year and business capability of the subsequent year.

The newly set up business establishments shall determine by themselves their turnovers, expenses, taxable incomes, payable tax amounts for the whole year or for each quarter and take initiative in declaring tax with the tax offices no later than the 25th of the month following the month when they are granted business registration certificates.

2. After receiving tax declarations, the tax offices shall have to inspect and consider the tax declarations by business establishments. If in their declarations, the business establishments fail to declare or unclearly declare bases for determining tax amounts to be temporarily paid for the whole year, the tax offices may request the business establishments to explain such bases. In cases where the business establishments fail to explain or prove the bases inscribed in their declarations, the tax offices shall fix the tax amounts to be temporarily paid for the whole year or each quarter, then notify them to the business establishments for implementation.

The fixation of temporarily paid tax amounts is made as follows:

- Fixing taxable income of the whole year on the basis of estimated turnover of the year and the ratio of taxable income to the turnover of the previous year.

- Fixing taxable income of the whole year on the basis of taxable income of a business establishment engaged in the same business line and having equivalent business scale.

Particularly for overseas companies’ resident establishments in Vietnam, besides the above-said tax fixing methods, the tax offices may apply measures for determining taxable incomes as follows:

|

Taxable income of the resident establishment in Vietnam in the tax calculation period |

= |

Total turnover of the resident establishment in Vietnam in tax calculation period |

- |

Total income of the overseas company in the tax calculation period |

|

Total turnover of the overseas company in the tax calculation period |

Overseas companies shall have to produce to tax offices books and accounting reports already certified by independent auditing organizations to serve as basis for calculating taxable incomes of their resident establishments in Vietnam.

In cases where business establishments disagree with the taxable income levels set for them, they may lodge complaints to superior tax offices or initiate lawsuits at courts as prescribed by law. Pending the handling thereof, business establishments shall still have to pay tax at the set tax levels.

3. For business establishments whose goods production or service provision results in the first six month of the year see big changes which may lead to the 20%-plus increase or decrease of temporarily paid tax amount already declared with the tax offices, they shall have to compile complete dossiers to request the adjustment of tax amounts to be temporarily paid for the whole year as well as tax amount to be temporarily paid for the last two quarters, then submit them to the tax offices directly managing them no later than the 30th of July each year.

A dossier requesting the adjustment of the tax amounts to be temporarily paid for the whole year and each quarter comprises:

- A written request for adjustment of the tax amount to be temporarily paid for the whole year, clearly stating reasons for adjustment, the tax amount already temporarily paid for the first six months and that to be paid for the last six months.

- The financial statement for the first six months, including: the accounting balance sheet, the report on results of business operations, the explanation of the financial statement made according to the form prescribed by the accounting legislation.

After considering the requesting dossiers of business establishments, the tax office directly managing them shall notify such business establishments of the adjusted tax amounts to be temporarily paid for the whole year and the remaining tax amount to be paid in the last two quarters or reason(s) for non-acceptance of the enterprises’ requests by August 25 of the year at the latest.

4. If business establishments fail to submit the enterprise income tax declarations, the tax offices shall issue notices to urge the submission thereof. Until the end of the 25th of March, if business establishments still fail to submit their tax declarations, the tax offices shall fix the tax amounts to be temporarily paid for the whole year or each quarter under the guidance at Point 2 of this Section and notify them to the business establishments for implementation.

5. Business establishments which have not yet fully applied the accounting, invoice and voucher regime shall make the monthly, quarterly or annual tax declarations together with the declaration of value added tax. Bases for declaring payable tax amounts shall be the ratio of taxable income to turnover and the tax rate, specifically as follows:

5.1. Business establishments, which have not yet fully applied the accounting, invoice and voucher regime but have sold goods or provided services with invoices or vouchers shall have to declare their turnovers and calculate monthly payable tax as follows:

Enterprise income tax equal to (=) Turnover x Ratio (%) of taxable income to turnover x Tax rate.

5.2. Business households and individuals that have not yet applied the accounting, invoice and voucher regime and make tax declaration according to turnover shall have their payable enterprise income tax amounts fixed by the tax offices according to the formula in Item 5.1 of this Point.

The fixation of turnover for calculating taxable income must comply with the prescribed procedures and be made in an open and democratic manner.

The General Department of Tax shall guide the Tax Departments in determining the ratio (%) of taxable income to turnover for use as a basis for calculating enterprise income tax, which must be suitable to each business line and ensure the harmony among the localities in the country.

6. For foreign business organizations and individuals that have no resident establishments in Vietnam but earn income in Vietnam, Vietnamese organizations and individuals, when paying income to such foreign organizations and individuals, shall have to declare and withhold enterprise income tax according to its ratio (%) to the total amount paid to foreign organizations and individuals, prescribed by the Finance Ministry in suitability with each business line.

7. Business establishments shall have to purchase, sell, exchange and account the value of goods and services at market prices in the production and business process.

III. PAYMENT OF ENTERPRISE INCOME TAX

Business establishments shall pay enterprise income tax as follows:

1. Business establishments shall temporarily pay tax amounts quarterly according to their enterprise income tax declarations or the tax amounts fixed by the tax offices in full and on time into the State budget. The tax payment time limit is the last day of the last month of each quarter.

The tax payment date for business establishments shall be determined as follows:

- For business establishments paying tax by account transfers via banks or other credit institutions, the tax payment date shall be the date when banks or other credit institutions sign the papers on tax payment into the State budget;

- For business establishments paying tax in cash, the tax payment date shall be the date when the Treasury receives tax amounts or the tax offices issue tax receipts.

2. Business establishments having not yet fully applied the accounting, invoice and voucher regime shall pay tax according to the tax offices’ notices together with value added tax.

3. Vietnamese organizations and individuals that pay income to foreign business organizations and individuals without resident establishments in Vietnam shall have to deduct the enterprise income tax amounts and remit them into the State budget within the time limit prescribed by the Finance Ministry in suitability with each business line but must not exceed 15 days after paying the foreign organizations and individuals. Vietnamese organizations and individuals that fail to deduct tax amounts of foreign organizations and individuals shall, apart from paying tax on the latter’s behalf, be fined for tax-related administrative violations according to the current regime.

4. Business establishments engaged in shipment trading must declare and pay enterprise income tax on each shipment at the tax offices of the places where they purchase their goods before transporting them away.

5. Enterprise income tax shall be paid in Vietnam dong.

IV. SETTLEMENT OF ENTERPRISE INCOME TAX

The annual tax settlement shall be made as follows:

1. Upon the end of each tax calculation period, business establishments shall have to make tax settlement with the tax offices according to the set form (not printed herein), except for case of fixing the percentage of taxable income on turnover.

1.1. Business establishments shall have to fill in all items in tax settlement declarations.

1.2. The enterprise income tax settlement shall be made according to the tax calculation period being the calendar year (which begins on January 1 and ends on December 31 of the same year).

In cases where business establishments are allowed to apply the tax calculation period being a fiscal year other than the calendar year, the tax settlement shall comply with such fiscal year.

Business establishments undergoing enterprise transformation or ownership conversion (including assignment, sale, contracting or lease of State enterprises), merger, consolidation, division, separation, dissolution or bankruptcy shall have to make tax settlements with the tax offices up to the time the decisions on enterprise transformation, ownership conversion, merger, consolidation, division, separation, dissolution or bankruptcy are issued by competent agencies.

For business establishments being joint ventures of many other business establishments, when having dissolution or bankruptcy decisions and suffering from losses, such losses shall be distributed to each business establishment joining the joint ventures. The business establishments joining the joint ventures may incorporate the loss amounts distributed from the joint ventures in their own business results when making tax settlement.

2. Business establishments shall be responsible for the accuracy and truthfulness of their enterprise income tax settlement declarations. In cases where the tax offices inspect and detect that the data in the business establishments’ enterprise income tax settlement declarations are contrary to regulations, the business establishments shall, apart from fully paying tax, be fined for tax-related administrative violations.

Business establishments which inherit assets from business establishments subject to enterprise transformation or ownership conversion (including assignment, sale, contracting or lease of State enterprises), division, separation, merger or consolidation shall have to pay deficit tax amounts and fines (if any) owed by the latter.

3. Business establishments shall have to submit their enterprise income tax settlement declarations to the tax offices directly managing them within 90 days after the end of the calendar year or the fiscal year.

For business enterprises undergoing enterprise transformation or ownership conversion (including assignment, sale, contracting or lease of State enterprises), merger, division, separation, dissolution or bankruptcy, the time limit for submitting their tax settlement declarations shall be 45 days after the competent agencies issue decisions thereon.

4. Business establishments shall have to pay deficit tax amounts according to their tax settlement declarations within 10 days after submitting such declarations to the tax offices. If after 10 days the business establishments still fail to pay deficit tax amount, they shall, apart from paying fully such deficit tax amount, be fined for late tax payment.

5. If the business establishments, after submitting their enterprise income tax settlement declarations to the tax office, detect errors in some data which must be adjusted, they shall:

5.1. If the time limit for submitting tax settlement declarations has not yet expired, be allowed to submit adjusted tax settlement declarations in replacement of those already submitted to the tax offices.

5.2. If the time limit for submitting tax settlement declarations has expired, but the 10-day time limit for paying deficit tax amount according to the tax settlement declarations has not yet expired, submit the adjusted tax settlement declarations in replacement of those already submitted to the tax offices and pay tax according to the adjusted tax settlement declarations, and at the same time pay fines for acts of late tax settlement declaration submission.

5.3. In cases where they submit the adjusted tax settlement declarations after the expiry of the 10-day time limit for paying deficit tax amount according to the already submitted tax settlement declarations, they shall, apart from paying deficit tax amount according to the adjusted tax settlement declarations, have to pay fines for acts of late declaration submission and late tax payment.

6. The examination of enterprise income tax settlements at the business establishments shall be decided by the heads of the tax offices directly managing such establishments or by the heads of superior tax offices.

The tax offices may re-determine purchase prices, sale prices according to the domestic and overseas market prices, expenses, taxable incomes and other elements in order to collect correctly and fully enterprise income tax if they detect that such purchase prices, sale prices, expenses, taxable incomes and other elements declared by the business establishment are not consistent with the market prices and actually arising expenses.

The determination of purchase prices and sale prices of goods and services according to domestic and overseas market prices, expenses and taxable incomes in order to ensure the correct and full collection of enterprise income tax shall comply with specific guiding documents of the Finance Ministry.

Business establishments shall have to abide by written records on inspection by the competent tax offices.

7. Business establishments which do not submit tax settlement declarations shall have to pay the tax amounts fixed by the tax offices.

E. TASKS, POWERS AND RESPONSIBILITIES OF TAX OFFICES

Tax offices shall have the following tasks, powers and responsibilities:

1. To guide business establishments in implementing the regime of tax registration, declaration and payment strictly according to regulations.

2. To notify business establishments in the following cases where:

2.1. They fail to submit enterprise income tax declarations, enterprise income tax settlement declarations within the prescribed time limit.

2.2. They fail to pay tax within the prescribed time limit or underpay tax.

In their notices, tax offices must clearly inscribe the tax amounts not yet paid by the business establishments and the fines for late payment.

2.3. They fail to fully comply with the accounting, invoice and voucher regimes or to pay tax according to tax notices. Tax payment notices must be sent to the business establishments at least 3 working days before the tax payment deadline. Past the time limit prescribed in the notices, if the business establishments still fail to pay tax, the tax offices shall issue second notices. The tax offices must clearly inscribe in the second notices the tax amounts not yet paid by the business establishments and fines for late payment.

3. To supervise and inspect the tax declaration, payment and settlement of business establishment, in order to ensure the strict law observance

Tax offices shall have to examine and classify tax settlement declarations in order to organize the examination and inspection.

The General Department of Tax shall promulgate the criteria for classifying enterprise income tax settlement declarations in order to conduct examination and inspection, and prescribe procedures for examining and inspecting business establishments.

4. To handle tax-related administrative violations and settle tax-related complaints.

5. To request business establishments to supply accounting books, invoices, vouchers and other dossiers and documents related to the tax calculation and payment; to request credit institutions, banks and other concerned organizations and individuals to supply documents related to the tax calculation and payment by business establishments.

6. To keep and use data and documents supplied by business establishments and other subjects according to the prescribed regime.

7. To fix taxable incomes for calculating the enterprise income tax for business establishments in the following cases:

7.1. They fail to implement or improperly implement the accounting, invoice and voucher regimes.

7.2. They fail to declare or improperly declare the bases for tax calculation or fail to prove bases already stated in tax declarations at the requests of the tax offices.

7.3. They refuse to present accounting books, invoices, vouchers and necessary documents related to the enterprise income tax calculation.

7.4. They conduct business activities without business registration.

F. ENTERPRISE INCOME TAX EXEMPTION AND REDUCTION

I. CONDITIONS FOR ENJOYING ENTERPRISE INCOME TAX PREFERENCES

Investment projects which satisfy the following conditions shall be entitled to enjoy the enterprise income tax preferences:

1. Investing in the branches, lines and/or domains specified in List A of the Appendix to the Government’s Decree No. 164/2003/ND-CP of December 22, 2003 detailing the implementation of the Law on Enterprise Income Tax (called branches, lines and domains A for short).

2. Investing in branches, lines and/or domains not banned by law and employing an annual average labor force (referred to laborer-intensive for short) of at least:

- 100 persons for urban areas of grades 1 and 2;

- 20 persons for geographical areas where investment is encouraged specified in List B or List C promulgated together with the Government’s Decree No. 164/2003/ND-CP of December 22, 2003 detailing the implementation the Law on Enterprise Income Tax;

- 50 persons for other geographical areas.

3. Geographical areas where investment is encouraged and eligible for enterprise income tax preferences include:

3.1. Geographical areas with difficult socio-economic conditions specified in List B of the Appendix to the Government’s Decree No. 164/2003/ND-CP of December 22, 2003 detailing the implementation the Law on Enterprise Income Tax (called geographical areas B for short).

3.2. Geographical areas with exceptionally difficult socio-economic conditions specified in List C of the Appendix to the Government’s Decree No. 164/2003/ND-CP of December 22, 2003 detailing the implementation the Law on Enterprise Income Tax (called geographical areas C for short).

II. PREFERENTIAL TAX RATES AND DURATION FOR APPLICATION OF PREFERENTIAL TAX RATES

1. Preferential tax rates:

1.1. The tax rate of 20% shall apply to cooperatives established in the geographical areas other than geographical areas B or C; business establishments newly set up under investment projects in branches, lines and/or domains A.

1.2. The tax rate of 20% shall apply to business establishments newly set up under investment projects in geographical areas B.

1.3. The tax rate of 15% shall apply to cooperatives established in the geographical areas B; business establishments newly set up under investment projects in branches, lines and/or domains A, which are executed in geographical areas B.

1.4. The tax rate of 15% shall apply to business establishments newly set up under investment projects in geographical areas C.

1.5. The tax rate of 10% shall apply to cooperatives established in geographical areas C; business establishments newly set up under investment projects in branches, lines and/or domains A, which are executed in geographical areas C.

Business establishments which have projects for investment in goods production or service provision subject to different preferential tax rates shall have to separately account income from each investment project. In cases where they cannot separately account income from each investment project, they shall have to pay tax at the highest tax rate currently applied to them.

2. The durations for application of the preferential tax rates are as follows:

2.1. The tax rate of 10% shall be applied for 15 years after cooperatives and business establishments newly set up under investment projects commence their business operations;

2.2. The tax rate of 15% shall be applied for 12 years after cooperatives and business establishments newly set up under investment projects commence their business operations;

2.3. The tax rate of 20% shall be applied for 10 years after business establishments newly set up under investment projects commence their business operations;

After the durations for enjoying the preferential tax rates prescribed at this Point, cooperatives and business establishments newly set up under investment projects shall have to pay enterprise income tax at the tax rate of 28%.

III. ENTERPRISE INCOME TAX EXEMPTION AND REDUCTION LEVELS AND DURATIONS

1. Business establishments newly set up under investment projects and relocated business establishments shall enjoy the tax exemption and reduction as follows: