Nội dung toàn văn Decision No. 13/2008/QD-BTC of March 11, 2008 amending preferential import tax rates for motorcars for the transport of persons in the preferential import tariff

|

THE

MINISTRY OF FINANCE |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 13/2008/QD-BTC |

Hanoi, March 11, 2008 |

DECISION

AMENDING PREFERENTIAL IMPORT TAX RATES FOR MOTORCARS FOR THE TRANSPORT OF PERSONS IN THE PREFERENTIAL IMPORT TARIFF

THE MINISTER OF FINANCE

Pursuant to June 14, 2005 Law

No. 45/2005/QH11 on Import Tax and Export Tax;

Pursuant to the National Assembly Standing Committee’s Resolution No. 295/2007/NQ-UBTVQH12

of September 28, 2007, promulgating the Export Tariff according to the list of

taxable commodity groups and the tax rate bracket for each commodity group, and

the Preferential Import Tariff according to the list of taxable commodity

groups and the preferential tax rate bracket for each commodity group;

Pursuant to the Government’s Decree No. 149/2005/ND-CP of December 8, 2005,

detailing the implementation of the Law on Import Tax and Export Tax;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, tasks, powers and organizational structure of the Ministry of

Finance;

At the proposal of the director of the Tax Policy Department,

DECIDES:

Article 1.- To amend preferential import tax rates for motorcars for the transport of persons prescribed in the Finance Minister’s Decision No. 106/2007/QD-BTC of December 20, 2007, into new ones specified in the list attached to this Decision.

Article 2.- This Decision takes effect and applies to declarations of imported goods registered with customs offices 15 days after its publication in “CONG BAO.”[1]

|

|

FOR THE

MINISTER OF FINANCE |

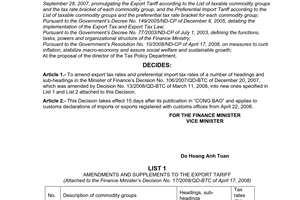

LIST

OF

AMENDED IMPORT TAX RATES OF A NUMBER OF COMMODITY ITEMS IN THE PREFERENTIAL

IMPORT TARIFF

(Attached to the Finance Minister’s Decision No. 13/2008/QD-BTC of March 11,

2008)

|

Code |

Description |

Tax

rate |

|||

|

87.02 |

Motorcars for the transport of 10 or more persons, including the driver |

||||

|

8702 |

10 |

- With compression-ignition internal combustion piston engine (diesel or semi-diesel): |

|||

|

- - CKD: |

|||||

|

8702 |

10 |

11 |

00 |

- - - Of a gross weight not exceeding 6 tons |

** |

|

8702 |

10 |

12 |

00 |

- - - Of a gross weight exceeding 6 tons but not exceeding 18 tons |

** |

|

8702 |

10 |

13 |

00 |

- - - Of a gross weight exceeding 18 tons but not exceeding 24 tons |

** |

|

8702 |

10 |

14 |

00 |

- - - Of a gross weight exceeding 24 tons |

** |

|

- - Other: |

|||||

|

8702 |

10 |

21 |

- - - Of a gross weight not exceeding 6 tons: |

||

|

8702 |

10 |

21 |

10 |

- - - - Buses designed specially for use in airports, for the transport of 30 or more persons |

5 |

|

8702 |

10 |

21 |

90 |

- - - - Other |

70 |

|

8702 |

10 |

22 |

- - - Of a gross weight exceeding 6 tons but not exceeding 18 tons: |

||

|

8702 |

10 |

22 |

10 |

- - - - Buses designed specially for use in airports, for the transport of 30 or more persons |

5 |

|

8702 |

10 |

22 |

90 |

- - - - Other |

70 |

|

8702 |

10 |

23 |

- - - Of a gross weight exceeding 18 tons but not exceeding 24 tons: |

||

|

8702 |

10 |

23 |

10 |

- - - - Buses designed specially for use in airports, for the transport of 30 or more persons |

5 |

|

8702 |

10 |

23 |

90 |

- - - - Other |

70 |

|

8702 |

10 |

24 |

- - - Of a gross weight exceeding 24 tons: |

||

|

8702 |

10 |

24 |

10 |

- - - - Buses designed specially for use in airports, for the transport of 30 or more persons |

5 |

|

8702 |

10 |

24 |

- - - Of a gross weight exceeding 24 tons: |

||

|

8702 |

10 |

24 |

10 |

- - - - Buses designed specially for use in airports, for the transport of 30 or more persons |

5 |

|

8702 |

10 |

24 |

90 |

- - - - Other |

70 |

|

8702 |

90 |

- Other: |

|||

|

- - Buses designed specially for use in airports, for the transport of 30 or more persons: |

|||||

|

8702 |

90 |

11 |

00 |

- - - CKD |

** |

|

8702 |

90 |

19 |

00 |

- - - Other |

5 |

|

- - Other: |

|||||

|

8702 |

90 |

91 |

00 |

- - - CKD |

** |

|

8702 |

90 |

99 |

00 |

- - - Other |

70 |

|

87.03 |

Motorcars and other motor vehicles principally designed for the transport of persons (other than those of heading 87.02), including station wagons and racing cars |

||||

|

8703 |

10 |

- Vehicles specially designed for traveling on snow; golf cars and similar vehicles: |

|||

|

8703 |

10 |

10 |

00 |

- - Golf cars, including golf buggies |

70 |

|

8703 |

10 |

90 |

00 |

- - Other |

70 |

|

- Other vehicles, with spark-ignition internal combustion piston engine: |

|||||

|

8703 |

21 |

- - Of a cylinder capacity not exceeding 1,000 cc: |

|||

|

8703 |

21 |

10 |

00 |

- - - Small racing cars |

70 |

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans): |

|||||

|

8703 |

21 |

21 |

00 |

- - - - CKD |

** |

|

8703 |

21 |

29 |

00 |

- - - - Other |

70 |

|

8703 |

21 |

30 |

00 |

- - - Other, CKD |

** |

|

8703 |

21 |

90 |

- - - Other: |

||

|

8703 |

21 |

90 |

10 |

- - - - Hearses |

10 |

|

8703 |

21 |

90 |

20 |

- - - - Prison vans |

10 |

|

8703 |

21 |

90 |

90 |

- - - - Other |

70 |

|

8703 |

22 |

- - Of a cylinder capacity exceeding 1,000 cc but not exceeding 1,500 cc: |

|||

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans): |

|||||

|

8703 |

22 |

11 |

00 |

- - - - CKD |

** |

|

8703 |

22 |

19 |

00 |

- - - - Other |

70 |

|

8703 |

22 |

20 |

00 |

- - - Other, CKD |

** |

|

8703 |

22 |

90 |

- - - Other: |

||

|

8703 |

22 |

90 |

10 |

- - - - Ambulances |

10 |

|

8703 |

22 |

90 |

20 |

- - - - Hearses |

10 |

|

8703 |

22 |

90 |

30 |

- - - - Prison vans |

10 |

|

8703 |

22 |

90 |

90 |

- - - - Other |

70 |

|

8703 |

23 |

- - Of a cylinder capacity exceeding 1,500 cc but not exceeding 3,000 cc: |

|||

|

8703 |

23 |

10 |

00 |

- - - Ambulances |

10 |

|

8703 |

23 |

20 |

00 |

- - - Hearses |

10 |

|

8703 |

23 |

30 |

00 |

- - - Prison vans |

10 |

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), CKD: |

|||||

|

8703 |

23 |

41 |

00 |

- - - - Of a cylinder capacity of under 1,800 cc |

** |

|

8703 |

23 |

42 |

00 |

- - - - Of a cylinder capacity of between 1,800 cc and under 2,000 cc |

** |

|

8703 |

23 |

43 |

00 |

- - - - Of a cylinder capacity of between 2,000 cc and under 2,500 cc |

** |

|

8703 |

23 |

44 |

00 |

- - - - Of a cylinder capacity of 2,500 cc or more |

** |

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), other: |

|||||

|

8703 |

23 |

51 |

00 |

- - - - Of a cylinder capacity of under 1,800 cc |

70 |

|

8703 |

23 |

52 |

00 |

- - - - Of a cylinder capacity of between 1,800 cc and under 2,000 cc |

70 |

|

8703 |

23 |

53 |

00 |

- - - - Of a cylinder capacity of between 2,000 cc and under 2,500 cc |

70 |

|

8703 |

23 |

54 |

00 |

- - - - Of a cylinder capacity of 2,500 cc or more |

70 |

|

- - - Other motor vehicles, CKD: |

|||||

|

8703 |

23 |

61 |

00 |

- - - - Of a cylinder capacity of under 1,800 cc |

** |

|

8703 |

23 |

62 |

00 |

- - - - Of a cylinder capacity of between 1,800 cc and under 2,000 cc |

** |

|

8703 |

23 |

63 |

00 |

- - - - Of a cylinder capacity of between 2,000 cc and under 2,500 cc |

** |

|

8703 |

23 |

64 |

00 |

- - - - Of a cylinder capacity of 2,500 cc or more |

** |

|

- - - Other: |

|||||

|

8703 |

23 |

91 |

00 |

- - - - Of a cylinder capacity of under 1,800 cc |

70 |

|

8703 |

23 |

92 |

00 |

- - - - Of a cylinder capacity of between 1,800 cc and under 2,000 cc |

70 |

|

8703 |

23 |

93 |

00 |

- - - - Of a cylinder capacity of between 2,000 cc and under 2,500 cc |

70 |

|

8703 |

23 |

94 |

00 |

- - - - Of a cylinder capacity of 2,500 cc or more |

70 |

|

8703 |

24 |

- - Of a cylinder capacity exceeding 3,000 cc: |

|||

|

8703 |

24 |

10 |

00 |

- - - Ambulances |

10 |

|

8703 |

24 |

20 |

00 |

- - - Hearses |

10 |

|

8703 |

24 |

30 |

00 |

- - - Prison vans |

10 |

|

8703 |

24 |

40 |

00 |

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), CKD |

** |

|

8703 |

24 |

50 |

00 |

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), other |

70 |

|

8703 |

24 |

60 |

00 |

- - - - Other, CKD |

** |

|

8703 |

24 |

90 |

00 |

- - - Other |

70 |

|

- Other motor vehicles, with compression-ignition internal combustion piston engine (diesel or semi-diesel): |

|||||

|

8703 |

31 |

- - Of a cylinder capacity not

exceeding |

|||

|

8703 |

31 |

10 |

00 |

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), CKD |

** |

|

8703 |

31 |

20 |

00 |

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), other |

70 |

|

8703 |

31 |

30 |

00 |

- - - Other, CKD |

** |

|

8703 |

31 |

90 |

- - - Other: |

||

|

8703 |

31 |

90 |

10 |

- - - - Ambulances |

10 |

|

8703 |

31 |

90 |

20 |

- - - - Hearses |

10 |

|

8703 |

31 |

90 |

30 |

- - - - Prison vans |

10 |

|

8703 |

31 |

90 |

90 |

- - - - Other |

70 |

|

8703 |

32 |

- - Of a cylinder capacity exceeding 1,500 cc but not exceeding 2,500 cc: |

|||

|

8703 |

32 |

10 |

00 |

- - - Ambulances |

10 |

|

8703 |

32 |

20 |

00 |

- - - Hearses |

10 |

|

8703 |

32 |

30 |

00 |

- - - Prison vans |

10 |

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), CKD: |

|||||

|

8703 |

32 |

41 |

00 |

- - - - Of a cylinder capacity

not exceeding |

** |

|

8703 |

32 |

49 |

00 |

- - - - Other |

** |

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), other: |

|||||

|

8703 |

32 |

51 |

00 |

- - - - Of a cylinder capacity

not exceeding |

70 |

|

8703 |

32 |

59 |

00 |

- - - - Other |

70 |

|

- - - Other, CKD: |

|||||

|

8703 |

32 |

61 |

00 |

- - - - Of a cylinder capacity

not exceeding |

** |

|

8703 |

32 |

69 |

00 |

- - - - Other |

** |

|

- - - Other: |

|||||

|

8703 |

32 |

91 |

00 |

- - - - Of a cylinder capacity not exceeding 2,000 cc |

70 |

|

8703 |

32 |

99 |

00 |

- - - - Other |

70 |

|

8703 |

33 |

- - Of a cylinder capacity exceeding 2,500 cc: |

|||

|

8703 |

33 |

10 |

00 |

- - - Ambulances |

10 |

|

8703 |

33 |

20 |

00 |

- - - Hearses |

10 |

|

8703 |

33 |

30 |

00 |

- - - Prison vans |

10 |

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), CKD: |

|||||

|

8703 |

33 |

41 |

00 |

- - - - Of a cylinder capacity exceeding 2,500 cc but not exceeding 3,000 cc |

** |

|

8703 |

33 |

42 |

00 |

- - - - Of a cylinder capacity exceeding 3,000 cc |

** |

|

- - - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), other: |

|||||

|

8703 |

33 |

51 |

00 |

- - - - Of a cylinder capacity exceeding 2,500 cc but not exceeding 3,000 cc |

70 |

|

8703 |

33 |

52 |

00 |

- - - - Of a cylinder capacity exceeding 3,000 cc |

70 |

|

8703 |

33 |

60 |

00 |

- - - - Other, CKD |

** |

|

8703 |

33 |

90 |

00 |

- - - Other |

70 |

|

8703 |

90 |

- Other: |

|||

|

8703 |

90 |

10 |

00 |

- - Ambulances |

10 |

|

8703 |

90 |

20 |

00 |

- - Hearses |

10 |

|

8703 |

90 |

30 |

00 |

- - Prison vans |

10 |

|

- - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), CKD: |

|||||

|

8703 |

90 |

41 |

00 |

- - - Of a cylinder capacity not exceeding 1,800 cc |

** |

|

8703 |

90 |

42 |

00 |

- - - Of a cylinder capacity exceeding 1,800 cc but not exceeding 2,000 cc |

** |

|

8703 |

90 |

43 |

00 |

- - - Of a cylinder capacity exceeding 2,000 cc but not exceeding 2,500 cc |

** |

|

8703 |

90 |

44 |

00 |

- - - Of a cylinder capacity exceeding 2,500 cc |

** |

|

- - Motorcars (including station wagons, SUVs and sport cars, but excluding vans), other: |

|||||

|

8703 |

90 |

51 |

00 |

- - - Of a cylinder capacity of less than 1,800 cc |

70 |

|

8703 |

90 |

52 |

00 |

- - - Of a cylinder capacity of 1,800 cc or more but less than 2,000 cc |

70 |

|

8703 |

90 |

53 |

00 |

- - - Of a cylinder capacity of 2,000 cc or more but less than 2,500 cc |

70 |

|

8703 |

90 |

54 |

00 |

- - - Of a cylinder capacity exceeding 2,500 cc |

70 |

|

8703 |

90 |

60 |

00 |

- - Other, CKD |

** |

|

8703 |

90 |

90 |

00 |

- - Other |

70 |