Nội dung toàn văn Decision No. 106/2007/QD-BTC of December 20, 2007 promulgating the export duty schedule and the preferential import duty schedule

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 106/2007/QD-BTC |

Hanoi, December 20, 2007 |

DECISION

PROMULGATING THE EXPORT DUTY SCHEDULE AND THE PREFERENTIAL IMPORT DUTY SCHEDULE

THE MINISTER OF FINANCE

Pursuant to June 14, 2005 Law No. 45/2005/QH11 on Import Duty and

Export Duty;

Pursuant to the National Assembly Standing Committee’s Resolution No. 295/2007/NQ-UBTVQH12

of September 28, 2007, promulgating the Export Duty Schedule according to the

list of dutiable commodity groups and the duty rate bracket for each commodity

group, and the Preferential Import Duty Schedule according to the list of dutiable

commodity groups and the preferential duty rate bracket for each commodity

group;

Pursuant to the National Assembly’s Resolution No. 71/2006/QH11 of November 29,

2006, ratifying the Protocol on the Socialist Republic of Vietnam’s Accession

to the Agreement Establishing the World Trade Organization;

Pursuant to the Government’s Decree No.

149/2005/ND-CP of December 8, 2005, detailing the implementation of the Law on

Import Duty and Export Duty;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, tasks, powers and organizational structure of the Ministry of

Finance;

At the proposal of the Director of the Tax Policy Department,

DECIDES:

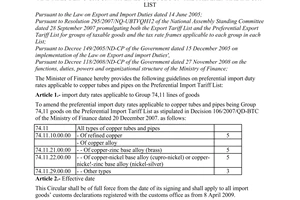

Article 1.- To promulgate together with this Decision the Export Duty Schedule and the Preferential Import Duty Schedule.

Article 2.- Commodity groups eligible for preferential import duty rate reduction for price stabilization continue to enjoy the provisional duty rates specified in Appendix I to this Decision, pending the issuance of a new decision by the Minister of Finance.

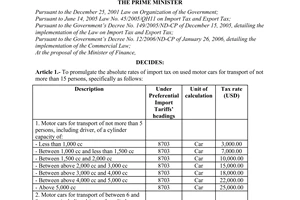

Article 3.- For used cars, the following regulations must be observed:

1. The specific import duty rates set in the Prime Minister’s Decision No. 69/2006/QD-TTg of March 28, 2006, and the Finance Minister’s relevant decisions will apply to cars for transporting 15 or less persons (including the driver) under headings 8702 and 8703.

2. The preferential import duty rate of 150% will apply to cars for transporting 16 or more persons (including the driver) under heading 8702 and cargo trucks of a gross vehicle weight not exceeding 5 tons under heading 8704.

3. The preferential import duty rates exceeding 50% (equal to 1.5 times) the preferential import duty rates applicable to vehicles of the same type specified in the Preferential Import Duty Schedule promulgated together with this Decision will apply to other vehicles under headings 8702, 8703 and 8704.

Article 4.-

This Decision takes effect 15 days after its publication in “CONG BAO” and applies to customs declaration forms of imported and exported goods registered with customs offices from January 1, 2008.

The preferential import duty rates for petroleum and other preparations under subheading 2710.11 (marked * in the import duty rate column in the Preferential Import Duty Schedule) shall be decided by the Minister of Finance in each period.

Preferential import duty rates shall not be specified for CKD component sets of vehicles under headings 8702, 8703 and 8704 (marked ** in the import duty rate column in the Preferential Import Duty Schedule), but import duty shall be imposed on each component or accessory.

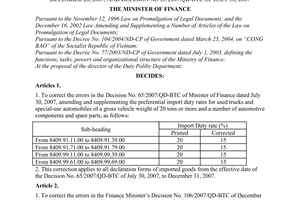

To annul the Finance Minister’s Decision No. 39/2006/QD-BTC of July 28, 2006, promulgating the Export Duty Schedule and the Preferential Import Duty Schedule, and decisions amending and supplementing appellations, codes and import-export duty rates for a number of commodity groups and items in the Export Duty Schedule and the Preferential Import Duty Schedule.

|

|

FOR THE MINISTER OF FINANCE |