Decision No. 67/2006/QD-BTC of December 05, 2006, revising export duty rates for a number of commodity groups in the export table of rates. đã được thay thế bởi Decision No. 106/2007/QD-BTC of December 20, 2007 promulgating the export duty schedule and the preferential import duty schedule và được áp dụng kể từ ngày 07/02/2008.

Nội dung toàn văn Decision No. 67/2006/QD-BTC of December 05, 2006, revising export duty rates for a number of commodity groups in the export table of rates.

|

THE

MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 67/2006/QD-BTC |

Hanoi, December 05, 2006 |

DECISION

REVISING EXPORT DUTY RATES FOR A NUMBER OF COMMODITY GROUPS IN THE EXPORT TABLE OF RATES

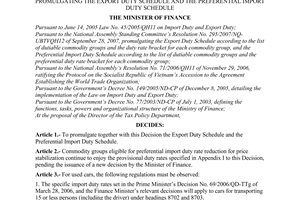

THE MINISTER OF FINANCE

Pursuant to June 14, 2005 Law

No. 45/2005/QH11 on Import Duty and Export Duty;

Pursuant to Resolution No. 977/2005/NQ-UBTVQH11 of December 13, 2005, of the

National Assembly Standing Committee, promulgating the Export Table of rates

according to the List of dutiable commodity groups and the duty rate bracket

for each commodity group, and the Preferential Import Table of ratess according

to the List of dutiable commodity groups and the preferential duty rate bracket

for each commodity group;

Pursuant to the Government’s Decree No. 86/2002/ND-CP of November 5, 2002,

defining the functions, obligations, competence and organizational structures

of ministries and ministerial-level agencies;

Pursuant to the Government’s Decree No. 77/2003/ND-CP of July 1, 2003, defining

the functions, obligations, competence and organizational structure of the

Ministry of Finance;

Pursuant to Article 11 of the Government’s Decree No. 149/2005/ND-CP of December

8, 2005, detailing the implementation of the Law on Import Duty and Export

Duty;

At the proposal of the director of the Tax Policy Department,

DECIDES:

Article 1.- To revise the export duty rates for a number of commodity groups specified in the Export Table of rates promulgated together with the Finance Minister’s Decision No. 39/2006/QD-BTC of July 28, 2006, into new duty rates specified in the revised list of export duty rates for a number of commodity groups in the Export Table of rates promulgated together with this Decision.

Article 2.- This Decision takes effect and applies to exports customs declarations registered with customs offices 15 days after its publication in “CONG BAO.”

|

|

FOR

THE MINISTER OF FINANCE |

REVISED LIST

OF

EXPORT DUTY RATES FOR A NUMBER OF COMMODITY GROUPS IN THE EXPORT TABLE OF RATES

(Promulgated together with the Finance Minister’s Decision No.

67/2006/QD-BTC of December 5, 2006)

|

No. |

Description |

Heading/Subheading |

Tax rate (%) |

|||

|

1 |

Iron ores and concentrates, including roasted iron pyrites |

|

|

|

|

|

|

1.1 |

- Iron ores and concentrates, other than roasted iron pyrites: |

|

|

|

|

|

|

1.1.1 |

- - Non-agglomerated |

2601 |

11 |

00 |

00 |

10 |

|

1.1.2 |

- - Agglomerated |

2601 |

12 |

00 |

00 |

5 |

|

1.2 |

- Roasted iron pyrites |

2601 |

20 |

00 |

00 |

5 |

|

2 |

Manganese ores and concentrates, including ferrous manganese ores and concentrates with a manganese content of 20% or more, calculated on the dry weight |

2602 |

00 |

00 |

00 |

10 |

|

3 |

Copper ores and concentrates |

2603 |

00 |

00 |

00 |

10 |

|

4 |

Nickel ores and concentrates |

|

|

|

|

|

|

4.1 |

- Crude |

2604 |

00 |

00 |

00 |

10 |

|

4.2 |

- Refined |

2604 |

00 |

00 |

00 |

5 |

|

5 |

Cobalt ores and concentrates |

|

|

|

|

|

|

5.1 |

- Crude |

2605 |

00 |

00 |

00 |

10 |

|

5.2 |

- Refined |

2605 |

00 |

00 |

00 |

5 |

|

6 |

Aluminum ores and concentrates |

|

|

|

|

|

|

6.1 |

- Crude |

2606 |

00 |

00 |

00 |

10 |

|

6.2 |

- Refined |

2606 |

00 |

00 |

00 |

5 |

|

7 |

Lead ores and concentrates |

2607 |

00 |

00 |

00 |

10 |

|

8 |

Zinc ores and concentrates |

2608 |

00 |

00 |

00 |

10 |

|

9 |

Tin ores and concentrates |

|

|

|

|

|

|

9.1 |

- Crude |

2609 |

00 |

00 |

00 |

10 |

|

9.2 |

- Refined |

2609 |

00 |

00 |

00 |

5 |

|

10 |

Chromium ores and concentrates |

|

|

|

|

|

|

10.1 |

- Crude |

2610 |

00 |

00 |

00 |

10 |

|

10.2 |

- Refined |

2610 |

00 |

00 |

00 |

5 |

|

11 |

Tungsten ores and concentrates |

2611 |

00 |

00 |

00 |

10 |

|

12 |

Uranium or thorium ores and concentrates |

|

|

|

|

|

|

12.1 |

- Uranium ores and concentrates: |

|

|

|

|

|

|

12.1.1 |

- - Crude |

2612 |

10 |

00 |

00 |

10 |

|

12.1.2 |

- - Refined |

2612 |

10 |

00 |

00 |

5 |

|

12.2 |

- Thorium ores and concentrates: |

|

|

|

|

|

|

12.2.1 |

- - Crude |

2612 |

20 |

00 |

00 |

10 |

|

12.2.2 |

- - Refined |

2612 |

20 |

00 |

00 |

5 |

|

13 |

Molybdenum ores and concentrates |

|

|

|

|

|

|

13.1 |

- Roasted |

2613 |

10 |

00 |

00 |

5 |

|

13.2 |

- Other |

2613 |

90 |

00 |

00 |

10 |

|

14 |

Titanium ores and concentrates |

|

|

|

|

|

|

14.1 |

- Ilmenite ores and concentrates |

2614 |

00 |

10 |

00 |

10 |

|

14.2 |

- Other |

2614 |

00 |

90 |

00 |

10 |

|

15 |

Niobium, tantalum, vanadium or zirconium ores and concentrates |

|

|

|

|

|

|

15.1 |

- Zirconium ores and concentrates: |

|

|

|

|

|

|

15.1.1 |

- - Crude |

2615 |

10 |

00 |

00 |

10 |

|

15.1.2 |

- - Refined |

2615 |

10 |

00 |

00 |

5 |

|

15.2 |

- Other: |

|

|

|

|

|

|

15.2.1 |

- - Niobium: |

|

|

|

|

|

|

15.2.1.1 |

- - - Crude |

2615 |

90 |

10 |

00 |

10 |

|

15.2.1.2 |

- - - Refined |

2615 |

90 |

10 |

00 |

5 |

|

15.2.2 |

- - Other: |

|

|

|

|

|

|

15.2.2.1 |

- - - Crude |

2615 |

90 |

90 |

00 |

10 |

|

15.2.2.2 |

- - - Refined |

2615 |

90 |

90 |

00 |

5 |

|

16 |

Precious metal ores and concentrates |

|

|

|

|

|

|

16.1 |

- Silver ores and concentrates: |

|

|

|

|

|

|

16.1.1 |

- - Crude |

2616 |

10 |

00 |

10 |

10 |

|

16.1.2 |

- - Refined |

2616 |

10 |

00 |

90 |

5 |

|

16.2 |

- Other: |

|

|

|

|

|

|

16.2.1 |

- - Crude |

2616 |

90 |

00 |

10 |

10 |

|

16.2.2 |

- - Refined |

2616 |

90 |

00 |

90 |

5 |

|

17 |

Other ores and concentrates |

|

|

|

|

|

|

17.1 |

Antimony ores and concentrates: |

|

|

|

|

|

|

17.1.1 |

- - Crude |

2617 |

10 |

00 |

10 |

10 |

|

17.1.2 |

- - Refined |

2617 |

10 |

00 |

90 |

5 |

|

17.2 |

- Other: |

|

|

|

|

|

|

17.2.1 |

- - Crude |

2617 |

90 |

00 |

10 |

10 |

|

17.2.2 |

- - Refined |

2617 |

90 |

00 |

90 |

5 |

|

18 |

Coal; briquettes, ovoids and similar solid fuels manufactured from coal |

2701 |

|

|

|

10 |

|

19 |

Lignite, whether or not agglomerated, excluding jet |

2702 |

|

|

|

10 |

|

20 |

Peat (including peat litter), whether or not agglomerated |

2703 |

|

|

|

10 |

|

21 |

Coke and semi-coke of coal, of lignite or of peat, whether or not agglomerated; retort carbon |

2704 |

|

|

|

10 |

|

22 |

Ferrous waste and scrap (excluding turnings, shavings, milling waste, sawdust, filings, trimmings and stampings, whether or not pressed into blocks or packed in bales, bars or bundles) |

7204 |

|

|

|

33 |

|

23 |

Copper waste and scrap (excluding turnings, shavings, milling waste, sawdust, filings, trimmings and stampings, whether or not pressed into blocks or packed in bales, bars or bundles) |

7404 |

00 |

00 |

00 |

40 |

|

24 |

Nickel waste and scrap (excluding turnings, shavings, milling waste, sawdust, filings, trimmings and stampings, whether or not pressed into blocks or packed in bales, bars or bundles) |

7503 |

00 |

00 |

00 |

40 |

|

25 |

Unwrought aluminum |

7601 |

|

|

|

5 |

|

26 |

Aluminum waste and scrap (excluding turnings, shavings, milling waste, sawdust, filings, trimmings and stampings, whether or not pressed into blocks or packed in bales, bars or bundles) |

7602 |

00 |

00 |

00 |

40 |

|

27 |

Lead waste and scrap (excluding turnings, shavings, milling waste, sawdust, filings, trimmings and stampings, whether or not pressed into blocks or packed in bales, bars or bundles) |

7802 |

00 |

00 |

00 |

40 |

|

28 |

Tin waste and scrap (excluding turnings, shavings, milling waste, sawdust, filings, trimmings and stampings, whether or not pressed into blocks or packed in bales, bars or bundles) |

8002 |

00 |

00 |

00 |

40 |

|

29 |

Waste and scrap of other base metals, of cermets and articles thereof (excluding turnings, shavings, milling waste, sawdust, filings, trimmings and stampings, whether or not pressed into blocks or packed in bales, bars or bundles) |

8101 to 8113 |

40 |

|||