Nội dung toàn văn Decision No.211/QD-BTC of February 01, 2008 correcting the finance minister’s Decision No. 106/2007/QD-BTC of December 20, 2007, and Decision No. 65/2007/QD-BTC of July 30, 2007

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No. 211/QD-BTC |

Hanoi, February 01, 2008 |

DECISION

CORRECTING THE FINANCE MINISTER’S DECISION No. 106/2007/QD-BTC OF DECEMBER 20, 2007, AND DECISION No. 65/2007/QD-BTC OF JULY 30, 2007

THE MINISTER OF FINANCE

Pursuant to the November 12, 1996 Law on Promulgation of Legal

Documents; and the December 16, 2002 Law Amending and Supplementing a Number of

Articles of the Law on Promulgation of Legal Documents;

Pursuant to the Decree No. 104/2004/ND-CP of Government dated March 23, 2004,

on “CONG BAO” of the Socialist Republic of Vietnam;

Pursuant to the Decree No. 77/2003/ND-CP of Government dated July 1, 2003,

defining the functions, tasks, powers and organizational structure of the

Ministry of Finance;

At the proposal of the director of the Duty Poliby Department;

DECIDES:

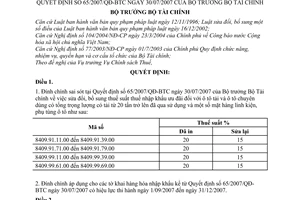

Articles 1.

1. To correct the errors in the Decision No. 65/2007/QD-BTC of Minister of Finance dated July 30, 2007, amending and supplementing the preferential import duty rates for used trucks and special-use automobiles of a gross vehicle weight of 20 tons or more and a number of automotive components and spare parts, as follows:

|

Sub-heading |

Import Duty rate (%) |

|

|

Printed |

Corrected |

|

|

From 8409.91.11.00 to 8409.91.39.00 |

20 |

15 |

|

From 8409.91.71.00 to 8409.91.79.00 |

20 |

15 |

|

From 8409.99.11.00 to 8409.99.39.00 |

20 |

15 |

|

From 8409.99.61.00 to 8409.99.69.00 |

20 |

15 |

2. This correction applies to all declaration forms of imported goods from the effective date of the Decision No. 65/2007/QD-BTC of July 30, 2007, to December 31, 2007.

Article 2.

1. To correct the errors in the Finance Minister’s Decision No. 106/2007/QD-BTC of December 20, 2007, promulgating the Export Duty Schedule and the Preferential Import Duty Schedule, as follows:

|

Sub-heading |

Duty rate (%) |

|

|

Printed |

Corrected |

|

|

2710.19.13.00 |

0 |

15 |

|

2710.19.14.00 |

0 |

15 |

|

To add sub-heading No. 8503.00.19.00 |

5 |

|

2. This correction applies to all declaration forms of imported goods from January 1, 2008.

Article 3.-

This Decision takes effect on the date of its signing.

The Director of the Duty Policy Department, the Director of the Ministry of Finance’s Office, the Heads of units under the Ministry of Finance and concerned units shall implement this Decision.

|

|

FOR THE FINANCE MINISTER |