Nội dung toàn văn Decision No. 16/2009/QD-TTg of January 21st , 2009, issuing tax solutions for implementing the policy on stimulating investment and sales in order to alleviate the economic downturn and relieve hardships for enterprises.

|

THE PRIME MINISTER |

SOCIALIST

REPUBLIC OF VIET NAM

|

|

No. 16/2009/QD-TTg |

Hanoi, January 21st , 2009

|

DECISION

ISSUING TAX SOLUTIONS FOR IMPLEMENTING THE POLICY ON STIMULATING INVESTMENT AND SALES IN ORDER TO ALLEVIATE THE ECONOMIC DOWNTURN AND RELIEVE HARDSHIPS FOR ENTERPRISES

PRIME MINISTER OF THE GOVERNMENT

Pursuant to the Law on Organization of the Government dated

25 December 2001;

Pursuant to Resolution 21/2008/QH12

of the National Assembly dated 8 November 2008 with the estimated State budget for year

2009;

Having considered

the proposal of the Minister of Finance,

DECIDES:

Article 1

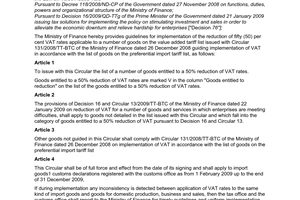

To reduce by fifty per cent (50%) the value added tax rate, as from 1 February 2009 until the end of 31 December 2009, on the following goods and services:

1. Pit [or fossil] coal.

2. Basic chemicals; mechanical engineering products being means of production; the various types of automobiles; automobile components comprising engines, gear boxes, clutches and sections of such goods; ships and boats; the various types of casting moulds; explosive materials; grindstones; artificial plywood; industrial concrete products comprising concrete bridge beams, concrete building beams and frames, concrete piles, concrete electric wire poles, concrete pipe culverts, the various types of concrete boxes, panels and non-standard ready-made reinforced concrete units or parts, and commercial concrete products; tyres and inner tube sets of size 900 - 20 or larger; and neutral glass tubes.

3. Products rolled or cut from ferrous, non-ferrous or precious metal, but excluding imported gold.

4. Automatic data processing machines and their sections and accessories.

5. Cargo handling; dredging of channels, canals, river ports and sea ports; sea rescue activities; transportation comprising transportation of passengers, luggage and cargo, and tourist transportation by air, road, rail and waterway but excluding international transportation.

6. Hotel business; and tourism services in the form of package holiday travel.

7. Printing, but excluding printing of money.

Article 2

To extend by nine (9) months the time for tax payment of the amount of corporate income tax payable in year 2009 on income from the following activities:

1. Manufacture of mechanical engineering products being means of production.

2. Manufacture of building materials comprising the various types of bricks and tiles; and lime and paint.

3. Construction, assembly and installation.

4. Tourism services.

5. Food products business.

6. Fertilizer business.

Article 3

1. Not to collect export duty on exported timber goods produced from imported timber, applicable to customs declarations for export goods registered with the customs office prior to 1 December 2008.

2. To repeal the following Decisions of the Prime Minister of the Government:

- Decision 104/2008/QD-TTg dated 21 July 2008 stipulating the absolute export duty rate applicable to exported rice and fertilizer;

- Decision 119/2008/QD-TTg dated 29 August 2008 stipulating the absolute export duty rate applicable to crude and pure copper ore;

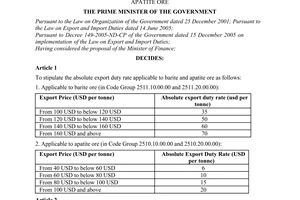

- Decision 129/2008/QD-TTg dated 19 September 2008 stipulating the absolute export duty rate applicable to barium and apatite ore.

Article 4

This Decision shall be of full force and effect as from the date of signing. The Ministry of Finance shall provide guidelines for implementation of this Decision.

Article 5

Ministers, heads of ministerial equivalent bodies, heads of Government bodies and chairmen of people's committees of provinces and cities under central authority shall be responsible for implementation of this Decision.

|

|

PRIME

MINISTER OF THE GOVERNMENT |