Decision No. 309/1998/QD-NHNN1 of September 10th, 1998, on Decision the rates of lending in US$ by the credit institutions to legal entities, individuals and rates of deposits in US$ by legal entities in credit institutions đã được thay thế bởi Decision No. 243/2000/QD-NHNN1 of August 02, 2000, on the announcement of the US$ interest rate bands as a basis for the determination by credit institutions of lending interest rates for customers và được áp dụng kể từ ngày 05/08/2000.

Nội dung toàn văn Decision No. 309/1998/QD-NHNN1 of September 10th, 1998, on Decision the rates of lending in US$ by the credit institutions to legal entities, individuals and rates of deposits in US$ by legal entities in credit institutions

|

STATE

BANK OF VIETNAM |

SOCIALIST

REPUBLIC OF VIETNAM |

|

No. 309/1998/QD-NHNN1 |

Hanoi, September 10th , 1998 |

DECISION

ON THE RATES OF LENDING IN US$ BY THE CREDIT INSTITUTIONS TO LEGAL ENTITIES, INDIVIDUALS AND RATES OF DEPOSITS IN US$ BY LEGAL ENTITIES IN CREDIT INSTITUTIONS

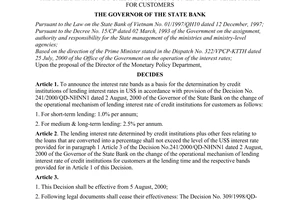

THE GOVERNOR OF THE STATE BANK

Pursuant to the Ordinance on

the State Bank dated 23 May, 1990.

Pursuant to the Decree No. 15 CP dated 2 March, 1993 of the Government on the assignment,

authority and responsibility for State management of ministries and

ministerial-level agencies.

Upon the proposal of the Director of the Economic Research Department.

DECIDES

Article 1. The rates of lending and deposits in US$ applied by credit institutions to legal entities and individuals shall be as follows:

1. The maximum lending rate applied by credit institutions to legal entities and individuals shall be 7.5%/annum;

2. The rates on deposits of legal entities with credit institutions:

- Demand deposits: the maximum rate is 0.5%/annum

- Term deposits up to 6 months: the maximum rate is 3%/annum

- Term deposits of more than 6 months: the maximum rate is 3.5 %

Legal entities mentioned in this Article shall include: economic organizations, State Agencies, arm-forces units, political organizations, social-political organizations, charities and other organizations which meet conditions stipulated in Article 94 of the Civil Code.

The rates stipulated in paragraph 2 of this Article shall be applied to deposits in US$ of legal entities into the accounts with credit institutions, including demand deposit accounts, term deposit accounts, accounts of deposit for special purpose, accounts of margin deposits to secure payment, "Administration for customers" accounts and deposit accounts of foreign organizations.

Article 2. This Decision shall be effective from 11 September, 1998 replacing the maximum rate of lending in US$ as provided for in item 2.1 paragraph 2 Article 1 of the Decision No. 197/QD-NH1 dated 28 June, 1997 and maximum rates of deposit in US$ in Article 2 of the Decision No. 39/1998/QD-NHNN1 dated 17 January, 1998 of the Governor of the State Bank.

Article 3. For the outstanding US$ loans of legal entities and individuals as of 10 September, 1998 carried over and US$ credit contracts entered into prior to 10 September, 1998 but the funds are disbursed after that date, credit institutions and borrowers shall negotiate the adjustment of lending rates in compliance with provisions of the laws and the maximum rates of lending in US$ stipulated in previous decisions and this Decision of the Governor of the State Bank.

Article 4. The Head of Governor office, Head of units in the State Bank Head-office, Chairmen of the Board of Directors and Directors General (Directors) of state-owned commercial Banks, Investment & Development Bank of Vietnam, Housing development bank in the Mekong Delta, joint-stock commercial banks, joint-venture banks, foreign bank branches in Vietnam, Finance companies, People credit Fund, Heads of credit cooperatives, General Managers of State Bank branches in the provinces, cities shall be responsible for the implementation of this Decision.

|

|

FOR

THE GOVERNOR OF THE STATE BANK |