Decision No. 41/2000/QD-BTC of May 17, 2000, amending and supplementing names and tax rates of a number of commodity groups in the preferential import tariff đã được thay thế bởi Decision No. 110/2003/QD-BTC of July 25, 2003, promulgating the preferential import tariffs. và được áp dụng kể từ ngày 01/09/2003.

Nội dung toàn văn Decision No. 41/2000/QD-BTC of May 17, 2000, amending and supplementing names and tax rates of a number of commodity groups in the preferential import tariff

|

THE MINISTRY OF FINANCE |

SOCIALIST REPUBLIC OF VIET NAM |

|

No: 41/2000/QD-BTC |

Hanoi, May 17, 2000 |

DECISION

AMENDING AND SUPPLEMENTING NAMES AND TAX RATES OF A NUMBER OF COMMODITY GROUPS IN THE PREFERENTIAL IMPORT TARIFF

THE MINISTER OF FINANCE

Pursuant to the Government’s Decree No.15/CP of March 2, 1993 on the tasks,

powers and State management responsibilities of the ministries and

ministerial-level agencies;

Pursuant to the Government’s

Decree No.178/CP of October 28, 1994 on the tasks, powers and organizational

structure of the Ministry of Finance;

Pursuant to the tax rate bracket specified in the Import Tariff applicable to

the list of taxable commodity groups promulgated together with Resolution No.63/NQ-UBTVQH10

of October 10, 1998 of the Xth National Assembly Standing Committee;

Pursuant to Article 1 of the Government’s

Decree No.94/1998/ND-CP of November 17, 1998 detailing the implementation of

the Law Amending and Supplementing a Number of Articles of Export Tax and

Import Tax Law No.04/1998/QH10 of May 20, 1998;

Pursuant to Article 14 of the Prime Minister’s

Decision No.242/1999/QD-TTg of December 30, 1999 on the management of goods

export and import in 2000;

Based on the Prime Minister’s

directions in the Government’s

Official Dispatch No.238/CP-KTTH of March 10, 2000 on the increase of import

tax on a number of commodity items when the import restriction measures are not

applied;

After consulting the concerned ministries and branches and at the proposal of

the General Director of Tax,

DECIDES:

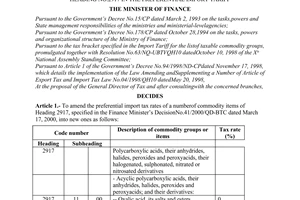

Article 1.- To amend and supplement the names and tax rates of a number of commodity groups specified in the Preferential Import Tariff promulgated together with the Finance Minister’s Decision No.1803/1998/QD-BTC of December 11, 1998 and the lists of amended and supplemented names and tax rates of a number of commodity groups in the Preferential Import Tariff promulgated together with the Finance Minister’s Decision No.29/1999/QD-BTC of March 15, 1999 and Decision No.139/1999/QD-BTC of November 11, 1999, into new ones specified in the list of amended and supplemented names and tax rates of a number of commodity groups in the Preferential Import Tariff promulgated together with this Decision.

Article 2.- This Decision takes effect and applies to import goods declarations already submitted to the customs office as from April 1st, 2000. All previous stipulations which are contrary to this Decision are now annulled.

|

|

FOR THE MINISTER OF FINANCE |

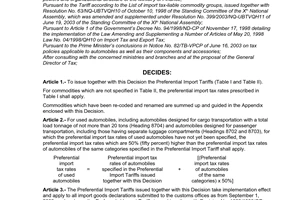

LIST

OF AMENDED AND SUPPLEMENTED NAMES AND TAX

RATES OF A NUMBER OF COMMODITY GROUPS IN THE PREFERENTIAL IMPORT TARIFF

(Promulgated together with the Finance Minister’s Decision No.41/2000/QD-BTC of March 17, 2000)

|

Code number |

Description of commodity groups |

Tax rates (%) |

|||

|

Heading |

Subheading |

|

|||

|

1 |

2 |

3 |

4 |

5 |

|

|

1511 |

Palm oil and its fraction, refined or not, but without changing chemical composition |

||||

|

1511 |

10 |

- Crude oil: |

|||

|

1511 |

10 |

10 |

- - Palm oil |

5 |

|

|

1511 |

10 |

90 |

- - Other |

5 |

|

|

1511 |

90 |

- Other: |

|||

|

1511 |

90 |

10 |

- - Of a kind for manufacture of shortening |

30 |

|

|

1511 |

90 |

90 |

- - Other |

40 |

|

|

2815 |

Sodium hydroxide (caustic soda), potassium

hydroxide; peroxide of sodium or potassium |

||||

|

2815 |

11 |

00 |

- - In solid form |

10 |

|

|

2815 |

12 |

00 |

- - In aqueous solution (soda lye or liquid soda) |

20 |

|

|

2815 |

20 |

00 |

- Potassium hydroxide |

0 |

|

|

2815 |

30 |

00 |

- Peroxide of sodium or potassium |

0 |

|

|

2917 |

Polycarboxylic acids, their anhydrides,

halides, peroxides and peroxyacids; their halogenated, sulphonated, nitrated

or nitrosated derivatives |

||||

|

2917 |

11 |

00 |

- - Oxalic acid, its salts and esters |

0 |

|

|

2917 |

12 |

00 |

- - Adipic acid, its salts and esters |

0 |

|

|

2917 |

13 |

00 |

- - Azelaic acid, its salts and esters |

0 |

|

|

2917 |

14 |

00 |

- - Maleic anhydride |

0 |

|

|

2917 |

19 |

00 |

- - Other |

0 |

|

|

2917 |

20 |

00 |

- Cyclanic, cyclenic or cycloterpenenic

polycarboxylic acids, their anhydrides, halides, peroxides and peroxyacids

and their derivatives |

0 |

|

|

2917 |

31 |

00 |

- - Dibutyl orthophthalates |

0 |

|

|

2917 |

32 |

00 |

- - Dioctyl orthophthalates |

10 |

|

|

2917 |

33 |

00 |

- - Dinonyl or didecyl orthophthalates |

0 |

|

|

2917 |

34 |

00 |

- - Other esters of orthophthalic acids |

0 |

|

|

2917 |

35 |

00 |

- - Phthalic anhydride |

0 |

|

|

2917 |

36 |

00 |

- - Terephthalic acid and its salts |

0 |

|

|

2917 |

37 |

00 |

- - Dimethyl terephthalate |

0 |

|

|

2917 |

39 |

00 |

- - Other |

0 |

|

|

3103 |

Mineral or chemical fertilizers, phosphatic |

||||

|

3103 |

10 |

00 |

- Superphosphates |

10 |

|

|

3103 |

20 |

00 |

- Basic slag (phosphatic slag) |

0 |

|

|

3103 |

90 |

- Other: |

|||

|

3103 |

90 |

10 |

- - Calcined phosphates |

10 |

|

|

3103 |

90 |

90 |

- - Other |

0 |

|

|

3105 |

Mineral or chemical fertilizers, containing two or three of the fertilizing elements of nitrogen, phosphorus and/or potassium; other fertilizers; commodity items of this Chapter in tablets or similar forms or in packages of a gross weight not exceeding 10 kg |

||||

|

3105 |

10 |

00 |

- Commodity items of this Chapter in tablets or similar forms or in packages of a gross weight not exceeding 10 kg |

0 |

|

|

3105 |

20 |

00 |

- Mineral or chemical fertilizers, containing two or three of the fertilizing elements of nitrogen, phosphorus and/or potassium |

5 |

|

|

3105 |

30 |

00 |

- Diammonium hydrogenorthophosphate (diammonium phosphate) |

0 |

|

|

3105 |

40 |

00 |

- Ammonium dihyrogenorthophosphate

(monoammonium phosphate) and mixtures thereof with diammonium

hydrogenorthophosphate (diammonium phosphate) |

0 |

|

|

3105 |

51 |

00 |

- - Containing nitrates and phosphates |

0 |

|

|

3105 |

59 |

00 |

- - Other |

0 |

|

|

3105 |

60 |

00 |

- Mineral or chemical fertilizers containing the two fertilizing elements of phosphorus and potassium |

0 |

|

|

3105 |

90 |

00 |

- Other |

0 |

|

|

3920 |

Other plates, sheets, membranes, foils, tapes, strips, of plastics, unfoamed, and neither reinforced, laminated, supported nor similarly combined with other materials |

||||

|

3920 |

10 |

00 |

- Of polymers of ethylene |

10 |

|

|

3920 |

20 |

00 |

- Of polymers of propylene |

10 |

|

|

3920 |

30 |

00 |

- Of polymers of styrene |

10 |

|

|

- Of polymers vinyl chloride: |

|||||

|

3920 |

41 |

00 |

- - Rigid |

10 |

|

|

3920 |

42 |

00 |

- - Flexible |

20 |

|

|

3920 |

51 |

00 |

- - Of polymethyl methacrylate |

10 |

|

|

3920 |

59 |

00 |

- - Other |

10 |

|

|

- Of polycarbonates, alkyd resins, polyallyl esters or other polyesters: |

|||||

|

3920 |

61 |

- - Of polycarbonates: |

|||

|

3920 |

61 |

10 |

- - - Of a kind for making magnetic tapes |

10 |

|

|

3920 |

61 |

90 |

- - - Other |

10 |

|

|

3920 |

62 |

- - Of polyethylene terephthalate: |

|||

|

3920 |

62 |

10 |

- - - Of a kind for making magnetic tapes |

10 |

|

|

3920 |

62 |

20 |

- - - In membrane form |

5 |

|

|

3920 |

62 |

90 |

- - - Other |

10 |

|

|

3920 |

63 |

- - Of unsaturated polyesters: |

|||

|

3920 |

63 |

10 |

- - - Of a kind for making magnetic tapes |

10 |

|

|

3920 |

63 |

90 |

- - - Other |

10 |

|

|

3920 |

69 |

- - Of other polyesters: |

|||

|

3920 |

69 |

10 |

- - - Of a kind for making magnetic tapes |

10 |

|

|

3920 |

69 |

90 |

- - - Other |

10 |

|

|

3920 |

71 |

- - Of regenerated cellulose: |

|||

|

3920 |

71 |

10 |

- - - Cellophane membranes |

5 |

|

|

3920 |

71 |

90 |

- - - Other |

10 |

|

|

3920 |

72 |

- - Of vulcanized fiber: |

|||

|

3920 |

72 |

10 |

- - - Cellophane membranes |

5 |

|

|

3920 |

72 |

90 |

- - - Other |

10 |

|

|

3920 |

73 |

- - Of cellulose acetate |

|||

|

3920 |

73 |

10 |

- - - Cellophane membranes |

5 |

|

|

3920 |

73 |

90 |

- - - Other |

10 |

|

|

3920 |

79 |

- - Of other cellulose derivatives: |

|||

|

3920 |

79 |

10 |

- - - Cellophane membranes |

5 |

|

|

3920 |

79 |

90 |

- - - Other |

10 |

|

|

3920 |

91 |

00 |

- - Of polyvinyl burytal |

10 |

|

|

3920 |

92 |

00 |

- - Of polyamides |

10 |

|

|

3920 |

93 |

00 |

- - Of amino-resins |

10 |

|

|

3920 |

94 |

00 |

- - Of phenolic resins |

10 |

|

|

3920 |

99 |

- - Of other plastics: |

|||

|

3920 |

99 |

10 |

- - - BOPP membranes |

5 |

|

|

3920 |

99 |

90 |

- - - Other |

10 |

|

|

3923 |

Products used in the conveyance or packing of goods, of plastics; stoppers, lids, caps and other closures of plastics |

||||

|

3923 |

10 |

00 |

- Boxes, cases, crates and the like |

30 |

|

|

3923 |

21 |

- - Of polymers of ethylene: |

|||

|

3923 |

21 |

10 |

- - - Textiled |

40 |

|

|

3923 |

21 |

90 |

- - - Other |

30 |

|

|

3923 |

29 |

- - Of other plastics: |

|||

|

3923 |

29 |

10 |

- - - Textiled |

40 |

|

|

3923 |

29 |

90 |

- - - Other |

30 |

|

|

3923 |

30 |

00 |

- Carboys, bottles, flasks and similar articles |

30 |

|

|

3923 |

40 |

- Spools, cops, bobbins and similar articles: |

|||

|

3923 |

40 |

10 |

- - Used for cinematographic and photographic films or for tapes, films and the like of Headings No.8523 and 8524 |

5 |

|

|

3923 |

40 |

20 |

- - Used for machines of Headings No.8444, 8445 and 8448 |

0 |

|

|

3923 |

40 |

90 |

- - Other |

0 |

|

|

3923 |

50 |

00 |

- Stoppers, lids, caps and other closures |

20 |

|

|

3923 |

90 |

00 |

- Other |

30 |

|

|

4015 |

Articles of apparel and clothing accesories

(including gloves) for all purposes, of vulcanized rubber (except hardened

rubber) |

||||

|

4015 |

11 |

00 |

- - Surgical gloves |

20 |

|

|

4015 |

19 |

00 |

- - Other |

20 |

|

|

4015 |

90 |

- Other: |

|||

|

4015 |

90 |

10 |

- - Of lead-laminated rubber, for protection of users from radioactivity in X-ray photography |

5 |

|

|

4015 |

90 |

90 |

- - Other |

20 |

|

|

4804 |

Paper and kraft paperboard, uncoated, in rolls

or in sheets, except those of Heading No.4802 or 4803 |

||||

|

4804 |

11 |

00 |

- - Unbleached |

30 |

|

|

4804 |

19 |

00 |

- - Other |

30 |

|

|

4804 |

21 |

- - Unbleached: |

|||

|

4804 |

21 |

10 |

- - - Unprinted, used as cement bags |

3 |

|

|

4804 |

21 |

90 |

- - - Other |

15 |

|

|

4804 |

29 |

- - Other: |

|||

|

4804 |

29 |

10 |

- - - Unprinted |

10 |

|

|

4804 |

29 |

20 |

- - - Printed complex paper |

10 |

|

|

4804 |

29 |

90 |

- - - Other |

15 |

|

|

4804 |

31 |

- - Unbleached: |

|||

|

4804 |

31 |

10 |

- - - Insulation kraft paper |

5 |

|

|

4804 |

31 |

90 |

- - - Other |

10 |

|

|

4804 |

39 |

00 |

- - Other |

10 |

|

|

4804 |

41 |

- - Unbleached: |

|||

|

4804 |

41 |

10 |

- - - Insulation kraft paper |

5 |

|

|

4804 |

41 |

90 |

- - - Other |

30 |

|

|

4804 |

42 |

00 |

- - Bleached uniformly throughout the mass and of which more than 95% by weight of the total fiber content consists of wood fibers obtained by a chemical process |

30 |

|

|

4804 |

49 |

00 |

- - Other |

30 |

|

|

4804 |

51 |

- - Unbleached: |

|||

|

4804 |

51 |

10 |

- - - Insulation kraft paper |

5 |

|

|

4804 |

51 |

90 |

- - - Other |

30 |

|

|

4804 |

52 |

00 |

- - Bleached uniformly throughout the mass and of which more than 95% by weight of the total fiber content consists of wood fibers obtained by a chemical process |

30 |

|

|

4804 |

59 |

00 |

- - Other |

30 |

|

|

6114 |

Other garments, knitted or crocheted |

||||

|

6114 |

10 |

00 |

- Of wool or fine animal hair |

50 |

|

|

6114 |

20 |

00 |

- Of cotton |

50 |

|

|

6114 |

30 |

- Of artificial fibers: |

|||

|

6114 |

30 |

10 |

- - Space suits, fire-proof suits, bullet-proof vests |

5 |

|

|

6114 |

30 |

90 |

- - Other |

50 |

|

|

6114 |

90 |

- Of other textile materials: |

|||

|

6114 |

90 |

10 |

- - Space suits, fire-proof suits, bullet-proof vests |

5 |

|

|

6114 |

30 |

90 |

- - Other |

50 |

|

|

6904 |

Ceramic building bricks, flooring blocks, support or filler tiles and the like of ceramic or porcelain |

||||

|

6904 |

10 |

00 |

- Building bricks |

50 |

|

|

6904 |

90 |

00 |

- Other |

50 |

|

|

7013 |

Tableware, kitchen utensils, sanitary ware, office stationery, interior decoration articles or articles for similar purposes of glass(other than those of Heading No.7010 or 7018) |

||||

|

7013 |

10 |

00 |

- Of glass-ceramics |

50 |

|

|

7013 |

21 |

- - Of lead crystal: |

|||

|

7013 |

21 |

10 |

- - - In semi-finished form (cast) |

30 |

|

|

7013 |

21 |

90 |

- - - Other |

50 |

|

|

7013 |

29 |

00 |

- - Other |

50 |

|

|

7013 |

31 |

- - Of lead crystal: |

|||

|

7013 |

31 |

10 |

- - - In semi-finished form (cast) |

30 |

|

|

7013 |

31 |

90 |

- - - Other |

50 |

|

|

7013 |

32 |

00 |

- - Of glass having a linear coefficient of expansion not exceeding 5x10-6 per Kelvin within a temperature range of 0oC to 300oC |

50 |

|

|

7013 |

39 |

00 |

- - Other |

50 |

|

|

7013 |

91 |

- - Of lead crystal: |

|||

|

7013 |

91 |

10 |

- - - In semi-finished form (cast) |

30 |

|

|

7013 |

91 |

90 |

- - - Other |

50 |

|

|

7013 |

99 |

00 |

- - Other |

50 |

|

|

7303 |

00 |

Tubes, pipes and hollow profiles, of cast iron |

|||

|

7303 |

00 |

10 |

- Of a kind from 150 mm to 600 mm in diameter, and from 5 m to 6 m long |

20 |

|

|

7303 |

00 |

90 |

- Other |

3 |

|

|

8432 |

Agricultural, horticultural or forestry machinery for soil preparation or cultivation; sports ground rollers or mowers |

||||

|

8432 |

10 |

00 |

- Ploughs |

15 |

|

|

8432 |

21 |

00 |

- - Disk harrows |

15 |

|

|

8432 |

29 |

00 |

- - Other |

15 |

|

|

8432 |

30 |

00 |

- Seeders, planters and transplanters |

5 |

|

|

8432 |

40 |

00 |

- Manure spreaders or fertilizer distributors |

5 |

|

|

8432 |

80 |

00 |

- Other machinery |

5 |

|

|

8432 |

90 |

00 |

- Parts |

0 |

|

|

8436 |

Other agricultural, horticultural, forestry, poultry-rearing or bee-keeping machinery, including germination plant fitted with mechanical or thermal equipment; poultry incubators and brooders |

||||

|

8436 |

10 |

- Animal feed processing machinery: |

|||

|

8436 |

10 |

10 |

- - Operated by diesel engines |

15 |

|

|

8436 |

10 |

90 |

- - Other |

5 |

|

|

8436 |

21 |

00 |

- - Poultry incubators and brooders |

3 |

|

|

8436 |

29 |

00 |

- - Other |

3 |

|

|

8436 |

80 |

- Other machinery: |

|||

|

8436 |

80 |

10 |

- - Germination plant |

3 |

|

|

8436 |

80 |

90 |

- - Other |

3 |

|

|

8436 |

91 |

00 |

- - Of poultry-keeping machinery, poultry incubators and brooders |

0 |

|

|

8436 |

99 |

00 |

- - Of other machinery |

0 |

|

|

8437 |

Machines for cleaning, sorting or grading seeds, grains or dried leguminous vegetables; machinery used in the milling industry or for the processing of cereals or dried leguminous vegetables, other than farm-type machinery |

||||

|

8437 |

10 |

00 |

- Machines for cleaning, sorting or grading seeds, grains or dried leguminous vegetables |

5 |

|

|

8437 |

80 |

- Other machinery: |

|||

|

8437 |

80 |

11 |

- - - Operated by diesel engines |

15 |

|

|

8437 |

80 |

19 |

- - - Other |

5 |

|

|

8437 |

80 |

91 |

- - - Operated by diesel engines |

15 |

|

|

8437 |

80 |

99 |

- - - Other |

5 |

|

|

8437 |

90 |

00 |

- Parts |

0 |

|

|

8544 |

Insulated (including enamelled or anodised)

wire, cable(including co-axial cable) and other insulated electric

conductors, whether or not fitted with connectors. Optic fiber cable having

every fiber coated, whether or not connected with conductors or fitted with

connectors |

||||

|

8544 |

11 |

- - Of copper: |

|||

|

8544 |

11 |

10 |

- - - Lacquered or enamelled |

10 |

|

|

8544 |

11 |

90 |

- - - Other |

5 |

|

|

8544 |

19 |

- - Of other materials: |

|||

|

8544 |

19 |

10 |

- - - Lacquered or enamelled |

5 |

|

|

8544 |

19 |

90 |

- - - Other |

5 |

|

|

8544 |

20 |

- Co-axial cable and other co-axial electric

conductors: |

|||

|

8544 |

20 |

11 |

- - - Having a cross-section not exceeding 300 mm2 |

15 |

|

|

8544 |

20 |

12 |

- - - Having a cross-section exceeding 300 mm2 but not exceeding 400 mm2 |

5 |

|

|

8544 |

20 |

13 |

- - - Control cable |

10 |

|

|

8544 |

20 |

19 |

- - - Other |

1 |

|

|

8544 |

20 |

21 |

- - - Having a cross-section not exceeding 300 mm2 |

15 |

|

|

8544 |

20 |

22 |

- - - Having a cross-section exceeding 300 mm2 but not exceeding 400 mm2 |

5 |

|

|

8544 |

20 |

23 |

- - - Control cable |

10 |

|

|

8544 |

20 |

29 |

- - - Other |

1 |

|

|

8544 |

30 |

00 |

- Ignition wiring sets and other wiring sets

of a kind used in vehicles, aircraft or ships |

5 |

|

|

8544 |

41 |

- - Fitted with connectors: |

|||

|

8544 |

41 |

10 |

- - - Cables for accumulators |

15 |

|

|

8544 |

41 |

20 |

- - - Telephone cable, telegraph cable, radio station cable, under sea water |

0 |

|

|

8544 |

41 |

30 |

- - - Telephone cable, telegraph cable, radio

station cable, other than those under sea water |

15 |

|

|

8544 |

41 |

41 |

- - - - Insulated with PVC, PE, with a cross-section not exceeding 300 mm2 |

15 |

|

|

8544 |

41 |

49 |

- - - - Other |

1 |

|

|

- - - Other: |

|||||

|

8544 |

41 |

91 |

- - - - Control cable |

10 |

|

|

8544 |

41 |

92 |

- - - - Plastic-coated electric conductors |

15 |

|

|

8544 |

41 |

99 |

- - - - Other |

10 |

|

|

8544 |

49 |

- - Other: |

|||

|

8544 |

49 |

10 |

- - - Telephone cable, telegraph cable, radio station cable, under sea water |

0 |

|

|

8544 |

49 |

20 |

- - - Telephone cable, telegraph cable, radio station

cable, other than those under sea water |

15 |

|

|

8544 |

49 |

31 |

- - - - Insulated with PVC, PE, with a cross-section not exceeding 300 mm2 |

15 |

|

|

8544 |

49 |

39 |

- - - - Other |

1 |

|

|

- - - Other: |

|||||

|

8544 |

49 |

91 |

- - - - Control cable |

10 |

|

|

8544 |

49 |

92 |

- - - - Plastics-coated electric conductors |

15 |

|

|

8544 |

49 |

99 |

- - - - Other |

10 |

|

|

8544 |

51 |

- - Fitted with connectors: |

|||

|

8544 |

51 |

10 |

- - - Telephone cable, telegraph cable, radio station cable, under sea water |

0 |

|

|

8544 |

51 |

20 |

- - - Telephone cable, telegraph cable, radio

station cable, other than those under sea water |

15 |

|

|

8544 |

51 |

31 |

- - - - Insulated with PVC, PE, with a cross-section not exceeding 300mm2 |

15 |

|

|

8544 |

51 |

39 |

- - - - Other |

1 |

|

|

|

|||||

|

8544 |

51 |

91 |

- - - - Control cable |

10 |

|

|

8544 |

51 |

92 |

- - - - Plastic-coated electric conductors |

15 |

|

|

8544 |

51 |

99 |

- - - - Other |

10 |

|

|

8544 |

59 |

- - Other: |

|||

|

8544 |

59 |

10 |

- - - Telephone cable, telegraph cable, radio station cable, under sea water |

0 |

|

|

8544 |

59 |

20 |

- - - Telephone cable, telegraph cable, radio

station cable, other than those under sea water |

15 |

|

|

8544 |

59 |

31 |

- - - - Insulated with PVC, PE, with a cross-section not exceeding 300mm2 |

15 |

|

|

8544 |

59 |

39 |

- - - - Other |

1 |

|

|

8544 |

59 |

91 |

- - - - Control cable |

10 |

|

|

8544 |

59 |

92 |

- - - - Plastic-coated electric conductors |

15 |

|

|

8544 |

59 |

99 |

- - - - Other |

10 |

|

|

8544 |

60 |

- Other electric conductors for a voltage

exceeding 1,000V: |

|||

|

8544 |

60 |

11 |

- - - Insulated with PVC, PE, standing up to a voltage of over1 kV to 35 kV, with a cross-section not exceeding 400mm2 |

15 |

|

|

8544 |

60 |

19 |

- - - Other |

1 |

|

|

- - Other: |

|||||

|

8544 |

60 |

91 |

- - - Telephone cable, telegraph cable, radio station cable, under sea water |

0 |

|

|

8544 |

60 |

92 |

- - - Telephone cable, telegraph cable, radio station cable, other than those under sea water |

15 |

|

|

8544 |

60 |

99 |

- - - Other |

1 |

|

|

8544 |

70 |

- Optic fiber cable: |

|||

|

8544 |

70 |

10 |

- - Telephone cable, telegraph cable, radio station cable, under sea water |

0 |

|

|

8544 |

70 |

20 |

- - Telephone cable, telegraph cable, radio station cable, other than those under sea water |

5 |

|

|

8544 |

70 |

90 |

- - Other |

1 |

|

|

8702 |

Automobiles that can transport 10 persons or more, including driver |

||||

|

8702 |

10 |

- With compression-ignition internal combustion piston engine(diesel or semi-diesel): |

|||

|

8702 |

10 |

10 |

- - Transporting not more than 50 persons, including driver |

100 |

|

|

8702 |

10 |

90 |

- - Other |

60 |

|

|

8702 |

90 |

- Other: |

|||

|

8702 |

90 |

10 |

- - Transporting not more than 50 persons, including driver |

100 |

|

|

8702 |

90 |

90 |

- - Other |

60 |

|

|

+ In CKD1 form, with their body and hull not yet coated with electrostatic paint |

12 |

||||

|

+ In CKD1 form, with their body and hull coated with electrostatic paint |

18 |

||||

|

+ In CKD2 form, with their body and hull not yet coated with electrostatic paint |

5 |

||||

|

+ In CKD2 form, with their body and hull coated with electrostatic paint |

7 |

||||

|

+ In IKD form |

3 |

||||

|

* Component sets for assembling automobiles with between 15 and 24 seats: |

|||||

|

+ In CKD1 form, with their body and hull not yet coated with electrostatic paint |

25 |

||||

|

+ In CKD1 form, with their body and hull coated with electrostatic paint |

30 |

||||

|

+ In CKD2 form |

10 |

||||

|

+ In IKD form |

3 |

||||

|

* Component sets for assembling automobiles with between 10 and 15 seats: |

|||||

|

|

|||||

|

+ In CKD1 form, with their body and hull not yet coated with electrostatic paint |

40 |

||||

|

+ In CKD1 form, with their body and hull coated with electrostatic paint |

45 |

||||

|

+ In CKD2 form |

20 |

||||

|

+ In IKD form |

5 |

||||

|

* Airport passenger transfer vehicles |

0 |

||||

|

8703 |

Automobiles and other motor vehicles principally designed for the transport of persons (other than those of Heading No.8702), including station wagons and racing cars |

||||

|

8703 |

10 |

- Vehicles specially designed for travelling on snow; golf cars and similar kinds of vehicles: |

|||

|

8703 |

10 |

10 |

- - Vehicles for transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

10 |

20 |

- - Vehicles for transporting 9 persons,

including driver |

100 |

|

|

8703 |

21 |

- - Of a cylinder capacity not exceeding 1,000 cm3: |

|||

|

8703 |

21 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

21 |

20 |

- - - Vehicles for transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

21 |

30 |

- - - Vehicles for transporting 9 persons, including driver |

100 |

|

|

8703 |

22 |

- - Of a cylinder capacity exceeding 1,000 cm3 but not exceeding 1,500 cm3: |

|||

|

8703 |

22 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

22 |

20 |

- - - Vehicles for transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

22 |

30 |

- - - Vehicles for transporting 9 persons, including driver |

100 |

|

|

8703 |

23 |

- - Of a cylinder capacity exceeding 1,500 cm3 but not exceeding 3,000 cm3: |

|||

|

8703 |

23 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

23 |

20 |

- - - Vehicles for transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

23 |

30 |

- - - Vehicles for transporting 9 persons |

100 |

|

|

8703 |

24 |

- - Of a cylinder capacity exceeding 3,000 cm3: |

|||

|

8703 |

24 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

24 |

20 |

- - - Vehicles for transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

24 |

30 |

- - - Vehicles for transporting 9 persons,

including driver |

100 |

|

|

8703 |

31 |

- - Of a cylinder capacity not exceeding 1,500 cm3: |

|||

|

8703 |

31 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

31 |

20 |

- - - Vehicles transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

31 |

30 |

- - - Vehicles transporting 9 persons, including driver |

100 |

|

|

8703 |

32 |

- - Of a cylinder capacity exceeding 1,500 cm3 but not exceeding 2,500 cm3: |

|||

|

8703 |

32 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

32 |

20 |

- - - Vehicles transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

32 |

30 |

- - - Vehicles transporting 9 persons, including driver |

100 |

|

|

8703 |

33 |

- - Of a cylinder capacity exceeding 2,500 cm3: |

|||

|

8703 |

33 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

33 |

20 |

- - - Vehicles transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

33 |

30 |

- - - Vehicles transporting 9 persons, including driver |

100 |

|

|

8703 |

90 |

- Other: |

|||

|

8703 |

90 |

10 |

- - - Ambulances |

0 |

|

|

8703 |

90 |

20 |

- - - Vehicles transporting not more than 8 persons, including driver |

100 |

|

|

8703 |

90 |

30 |

- - - Vehicles transporting 9 persons,

including driver + Money carrying vehicles + Funeral procession vehicles + In CKD1 form of Heading No.8703 with their body and hull not yet coated with electrostatic paint + In CKD1 form of Heading No.8703 with their body and hull coated with electrostatic paint + In CKD2 form of Heading No.8703 + In IKD form of Heading No.8703 |

100 0 0 40 45 20 5 |

|

|

8704 |

Motor vehicles for cargo transport |

||||

|

8704 |

10 |

00 |

- Tippers, dump trucks designed for use in

narrow roads and alleys |

100 |

|

|

8704 |

21 |

00 |

- - G.v.w not exceeding 5 tons |

100 |

|

|

8704 |

22 |

- - G.v.w exceeding 5 tons but not exceeding 20 tons: |

|||

|

8704 |

22 |

10 |

- - - Exceeding 5 tons but not exceeding 10 tons |

60 |

|

|

8704 |

22 |

20 |

- - - Exceeding 10 tons but not exceeding 20 tons |

30 |

|

|

8704 |

23 |

- - G.v.w exceeding 20 tons: |

|||

|

8704 |

23 |

10 |

- - - G.v.w exceeding 20 tons but not exceeding 50 tons |

10 |

|

|

8704 |

23 |

90 |

- - - Other |

0 |

|

|

8704 |

31 |

00 |

- - G.v.w not exceeding 5 tons |

100 |

|

|

8704 |

32 |

- - G.v.w exceeding 5 tons: |

|||

|

8704 |

32 |

10 |

- - - G.v.w exceeding 5 tons but not exceeding 10 tons |

60 |

|

|

8704 |

32 |

20 |

- - - G.v.w exceeding 10 tons but not exceeding 20 tons |

30 |

|

|

8704 |

32 |

30 |

- - - G.v.w exceeding 20 tons but not exceeding 50 tons |

10 |

|

|

8704 |

32 |

90 |

- - - Other |

0 |

|

|

8704 |

90 |

- Other: |

|||

|

8704 |

90 |

10 |

- - G.v.w not exceeding 5 tons |

100 |

|

|

8704 |

90 |

20 |

- - G.v.w exceeding 5 tons but not exceeding 10 tons |

60 |

|

|

8704 |

90 |

30 |

- - G.v.w exceeding 10 tons but not exceeding 20 tons |

30 |

|

|

8704 |

90 |

40 |

- - G.v.w exceeding 20 tons but not exceeding 50 tons |

10 |

|

|

8704 |

90 |

90 |

- - Other |

0 |

|

|

* Assembling component sets of vehicles of a tonnage not exceeding 5 tons: |

|||||

|

+ In CKD1 form, with their body and hull not yet coated with electrostatic paint |

15 |

||||

|

+ In CKD1 form, with their body and hull coated with electrostatic paint |

20 |

||||

|

+ In CKD2 form, with their body and hull not yet coated with electrostatic paint |

7 |

||||

|

+ In CKD2 form, with their body and hull coated with electrostatic paint |

10 |

||||

|

+ In IKD form |

3 |

||||

|

* Assembling component sets of vehicles of a tonnage exceeding 5 tons but not exceeding 20 tons: |

|||||

|

+ In CKD1 form, with their body and hull not yet coated with electrostatic paint |

7 |

||||

|

+ In CKD1 form, with their body and hull coated with electrostatic paint |

12 |

||||

|

+ In CKD2 form, with their body and hull not yet coated with electrostatic paint |

3 |

||||

|

+ In CKD2 form, with their body and hull coated with electrostatic paint |

5 |

||||

|

+ In IKD form |

1 |

||||

|

* Vehicles designed for transporting frozen goods |

10 |

||||

|

* Vehicles designed for transporting garbage |

0 |

||||

|

* Vehicles designed for transporting money |

10 |

||||

|

* Tank cars, vehicles designed for transporting acids, vehicles designed for transporting bituminous gases |

10 |

||||

|

* Concrete mixer-dumpers |

10 |

||||

|

8712 |

00 |

Bicycles and other cycles (including tricycles), not motorized |

|||

|

8712 |

00 |

10 |

- Racing bicycles |

5 |

|

|

8712 |

00 |

20 |

- Other bicycles (including bicycles for children, other than children�s toy bicycles of Heading No.9501) |

80 |

|

|

8712 |

00 |

90 |

- Other |

80 |

|

|

9402 |

Medical, surgical, dental or veterinary furniture (for example: operating tables, examination tables, hospital beds with mechanical fittings, dentists� chairs); barbers� chairs and the like, having rotating as well as both reclining and elevating movements; parts thereof |

||||

|

9402 |

10 |

- Dentists� chairs, barbers� chairs or the like and parts thereof: |

|||

|

9402 |

10 |

10 |

- - Dentists� chairs |

0 |

|

|

9402 |

10 |

90 |

- - Other |

40 |

|

|

9402 |

90 |

- Other: |

|||

|

9402 |

90 |

10 |

- - Medical, surgical, dental or veterinary furniture and parts thereof |

0 |

|

|

9402 |

90 |

20 |

- - Furniture for checking tickets and luggage at airports and stations and parts thereof |

0 |

|

|

9402 |

90 |

90 |

- - Other and parts thereof |

40 |

|