Nội dung toàn văn Decision No. 64/2008/QD-TTg of May 22, 2008, establishing a dot border-gate economic zone, Thua Thien Hue province. and promulgating its operation regulation.

|

THE PRIME

MINISTER |

SOCIALIST

REPUBLIC OF VIET NAM |

|

No. 64/2008/QD-TTg |

Hanoi, May 22.2008 |

DECISION

ESTABLISHING A DOT BORDER-GATE ECONOMIC ZONE, THUA THIEN HUE PROVINCE. AND PROMULGATING ITS OPERATION REGULATION

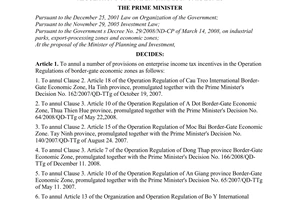

THE PRIME MINISTER

Pursuant to the December 25,

2001 Law on Organization of the Government;

Pursuant to the November 29, 2005 Investment Law;

Pursuant to the Government's Decree No. 29/ 2008/ND-CP of March 14, 2008, on

industrial parks, export-processing zones and economic zones:

At the proposal of the Minister of Planning and Investment and the president of

the People's Committee of Thua Thien Hue province,

DECIDES:

Article 1.- To establish A Dot border-gate economic zone. Thua Thien Hue province.

Article 2.- To promulgate together with this Decision the Operation Regulation of A Dot border-gate economic zone. Thua Thien Hue province.

Article 3.- This Decision takes effect if days after its publication in "CONG BAO.".

Article 4.- Ministers, heads of ministerial-level agencies, heads of government-attached agencies and the president of the People's Committee of Thua Thien Hue province shall implement this Decision.

|

|

THE

PRIME MINISTER |

OPERATION REGULATION

OF A DOT BORDER-GATE ECONOMIC ZONE, THUA THIEN

HUE PROVLNCE

(Promulgated together with the Prime Minister's Decision No. 64/2008/QD-TTg

of May 22. 2008)

Chapter I

GENERAL PROVISIONS

Article 1.- Governing scope

This Regulation provides for the organization and operation of. mechanisms and policies for. and the state management of. A Dot border-gate economic zone. Thua Thien Hue province (below referred to as A Dot zone for short); and rights and obligations of domestic and foreign organizations and individuals engaged in investment and business activities in A Dot zone.

Article 2.- Geographical boundaries of A Dot zone

A Dot zone has a natural land area of 10,184 ha in A Roang. A Dot and Huong Lam communes of A Luoi district. Thua Thien Hue province. It geographical boundaries are identified as follows:

- To the north, it borders on Huong Phong commune of A Luoi district:

- To the south, it borders on the People"s Democratic Republic of Laos along a borderline of 32 km;

- To the east, it borders on Huong Nguyen commune of A Luoi district:

- To the west, it borders on Dong Son commune of A Luoi district.

Article 3.- Establishment and development objectives of A Dot zone

A Dot zone is established and developed for:

1. Further enhancing economic and trade cooperation between the Socialist Republic of Vietnam, the People's Democratic Republic of Laos and neighboring countries.

2. Tapping economic benefits through regional cooperation mechanisms in order to promote socio-economic development in Central Vietnam, contributing to the country's economic development and international integration.

3. Creating an attractive environment for foreign investment: exploiting to the utmost existing advantages: developing production and services; stepping up export and expanding markets.

4. Generating jobs, and promoting the training and improvement of the quality of human resources.

5. Building a mountainous urban center and forming a motive-force economic zone, contributing to strongly promoting economic restructuring of ThuaThien Hue province.

Article 4.- The Government of the Socialist Republic of Vietnam encourages and protects

Vietnamese organizations and individuals of all economic sectors, overseas Vietnamese and foreign investors to invest and do business in A Dot zone in the domains of import, export, temporary import, re-export and transit of goods in accordance with the Agreement on Transit of Goods, bonded warehouses, duty-free shops, fairs, exhibitions, show rooms, import and export production and processing establishments, branches, representative offices, domestic and foreign companies, border-gate marketplaces, socio-economic infrastructure, tourism, as well as financial and banking services according to Vietnamese law and treaties to which Vietnam is a contracting party.

Article 5.- Vietnamese enterprises of all economic sectors and Vietnam-based foreign-invested enterprises established and operating in A Dot zone are governed by. and enjoy incentives specified in. this Regulation, other provisions of Vietnamese law and treaties to which Vietnam is a contracting party.

Article 6.- Apart from entitlements prescribed by Vietnamese law and treaties to which Vietnam is a contracting party, enterprises operating in A Dot zone may:

1. Use socio-economic infrastructure and public-utility works as well as common services provided by infrastructure trading enterprises in A Dot zone and pay service charges as agreed upon.

2. Enjoy incentives specified in this Regulation.

3. Transfer the rights to use land and assets attached to land in the land lease or sublease duration according to law and in line with land use purposes under invested projects. In case of changes in initial investment purposes of a project, the rights to use land and assets attached to land may be transferred only after obtaining approval from a competent agency.

4. Mortgage the value of the rights to use land and assets attached to land in the land lease or sublease duration at credit institutions operating in Vietnam or foreign credit institutions according to law.

Article 7.- A Dot zone shall be developed with the following major sources of capital:

1. Annually, pursuant to the state budget law and investment law, and based on the state budget's balancing capacity, and important socio-technical infrastructure investment projects already approved by competent state agencies and their execution progress, the Ministry of Planning and Investment shall coordinate with the Ministry of Finance and concerned agencies in allocating the central budget's targeted support capital to Thua Thien Hue province for the execution of important socio-technical infrastructure investment projects of A Dot zone.

2. To issue project bonds for major infrastructure construction investment projects playing a pivotal role in the development of A Dot zone according to the law on issuance of bonds for raising investment capital.

3. To prioritize the use of ODA and preferential credit sources for investment in the construction of necessary socio-technical infrastructure and public-utility service works of A Dot zone as well as other technical assistance.

4. To attract investment capital in the forms of BOT, BT and BTO contracts and other forms in accordance with law.

5. To raise capital from land funds according to the land law for investment in the development of common socio-technical infrastructure of A Dot zone.

6. To raise direct investment capital from domestic organizations and individuals, capital advanced by entities that need to use infrastructure and capital of enterprises engaged in building and commercially operating technical infrastructure works.

To expand the form of credit co-financed by credit institutions and raise capital from different sources in other forms in accordance with law.

Chapter II

OPERATION OF THE INDUSTRIAL AND TRADE SUB-ZONE IN A DOT ZONE

Article 8.- A Dot zone embraces an industrial and trade sub-zone, an administrative sub-zone, a border-gate management and control sub-zone, an urban and residential area, a tourist and service sub-zone and an area for agricultural, forestry and fishery development. The size and location of each sub-zone or area are identified in the master plan and detailed planning of A Dot zone.

The industrial and trade sub-zone in A Dot zone (below referred to as the industrial and trade sub-zone) is separated from other functional sub-zones in A Dot zone and the inland by a system of solid fences with gates to ensure concerned functional agencies' control of people, goods and means of transport.

In the industrial and trade sub-zone, there are no permanent residents (even foreigners).

Article 9.- Industrial and trade sub-zone's import and export of goods and services

1. Goods and service exchange relations between the industrial and trade sub-zone and other functional sub-zones in A Dot zone ana the iniand are import and export relations and must comply with Vietnamese lav. on import ana export customs procedures must be carried out for those goods and services according to Vietnamese customs law. Goods and service exchange relations between the industrial and trade sub-zone and foreign parties are regarded as those between foreign parties.

2. Economic organizations operating in the industrial and trade sub-zone may export abroad and import from abroad all goods and services not banned by Vietnamese law.

3. Economic organizations and individuals in A Dot zone and the inland may import from the industrial and trade sub-zone only goods and services not banned from import by Vietnam: and export to the industrial and trade sub-zone goods and services not banned from export by Vietnam.

4. Goods and services imported from abroad into the industrial and trade sub-zone or goods and services exported abroad from the industrial and trade sub-zone are exempt from import and export duties.

5. Goods and services imported from abroad into the industrial and trade sub-zone are not subject to value-added tax.

6. Goods and services in the industrial and trade sub-zone as well as goods and services imported from abroad into the industrial and trade sub-zone are not subject to value-added tax: goods and services brought from other functional sub-zones in A Dot zone and from the inland into the industrial and trade sub-zone enjoy a value-added tax rate of 0%; goods and services brought from the industrial and trade sub-zone into other functional sub-zones in A Dot zone and into inland Vietnam are subject to value-added tax according to current law.

7. Excise tax-liable goods and services produced ana sold in the industrial and trade sub-zone and those imported from abroad and inland Vietnam into the industrial and trade sub-zone are not subject to excise tax. except for automobiles.

8. Excise tax-liable goods and services exported abroad from the industrial and trade sub-zone are no: subject to excise tax.

9. Excise tax-liable goods and services brought from the industrial and trade sub-zone into inland Vietnam are subject to excise tax.

10. For goods produced, processed, reprocessed or assembled in the industrial and trade sub-zone using raw materials or components imported from abroad under current regulations on import management, when being imported into inland Vietnam, import tax shall be paid only for raw materials and components constituting those products or goods. If, when being imported into inland Vietnam, imported raw materials or components are not used, import tax is not required to be paid.

Article 10.- Investment incentive policies

1. All investment projects in the industrial and trade sub-zone enjoy maximum incentives applicable to geographical areas hit by extreme socio-economic difficulties under the Investment Law. the Enterprise Income Tax Law and the Value-Added Tax Law, and other incentives under treaties and multilateral or bilateral trade agreements to which Vietnam has signed or acceded.

2. Investment projects in the industrial and trade sub-zone enjoy exemption from enterprise income tax for four years after taxable incomes are generated; a 50% reduction of payable enterprise income tax amounts for nine subsequent years; and an enterprise income tax rate of 10% for 15 years after investment projects commence business activities.

3. Investment projects on construction of new production lines, expansion of production, technology renewal, environmental improvement or raising of production capacity enjoy exemption from enterprise income tax for increased incomes brought about by investment for up to four years and a 50% reduction of payable tax amounts for up to seven subsequent years.

4. In case legal documents provide for different incentives applicable to the same issue, the incentives specified in the document of higher legal effect apply.

5. In case legal documents promulgated by the same agency provide differently for the same issue, the document issued later applies.

Chapter III

OPERATION OF A DOT ZONE

Article 11.- Entry and exit by people and means of transport and residence in A Dot zone

1. Entry and exit by citizens of the People's Democratic Republic of Laos

a/ Citizens of the People's Democratic Republic of Laos (below referred to as Lao citizens) entering and exiting A Dot zone on their passports are exempt from visas for entry into and exit from Vietnam and may stay in A Dot zone for up to 15 days. If they wish to enter places outside the zone, the entry and exit management agency shall consider and grant them visas at the border gate.

b/ Lao citizens residing in provinces bordering on Thua Thien Hue province may travel through A Dot zone on their border identity cards granted by a Lao competent agency. The maximum duration for their temporary stay in A Dot zone is 15 days.

c/ Lao citizens may enter and exit A Dot zone during the same day with their identity cards granted by a Lao competent agency.

2. Entry, exit, residence and temporary stay in A Dot zone

a/ Foreigners and overseas Vietnamese holding foreign passports who enter to conduct market research, work, invest and do business in A Dot zone and their family members will be granted multiple visas. If they enter to work, invest or do business, they shall be considered for the grant of temporary stay cards with the maximum validity duration of three years.

b/ The Ministry of Public Security and the High Command of Border Guard shall guide the Public Security Service and the Border Guard Command of Thua Thien Hue province in managing entry, exit, residence and temporary stay in A Dot zone.

3. Entry and exit by means of transport

a/ For Laos' and other countries' road and waterway means of transport (below referred to as means of transport) entering A Dot zone, if accompanied by international transportation licenses, those licenses shall be appended with customs seals only, if not. declaration procedures for temporary import for re-export must be carried out.

b/ For Laos' and other countries' means of transport entering and exiting A Dot zone during the same day. only certification of the customs office at the border-gate control station is required, and those means must anchor or park at wharves or lots designated by concerned functional agencies.

Article 12.- Investment in the construction of socio-technical infrastructure

1. The State prioritizes state budget investment capital and preferential credit to support the planning, investment in the development of socioeconomic infrastructure as well as important and necessary service and public-utility works to ensure the operation and development of A Dot zone.

2. The allocation of investment capital to the construction of socio-economic infrastructure as well as service and public-utility works specified in Clause 1 of this Article must comply with the State Budget Law.

3. Apart from the central budget capital, capital of other sources and of different economic sectors and official development assistance (ODA) may be raised for socio-economic infrastructure development.

4. Investment in the construction of socio- economic infrastructure of A Dot zone must not affect the defense zoning plan and posture and the performance of defense tasks at the border gate.

Article 13.- Finance, credit and land of A Dot zone

1. Enterprises of all economic sectors carrying out investment production or business activities in A Dot zone may borrow the State's credit capital as considered by the Vietnam Development Bank according to the Vietnamese Government's current regulations on the State's development investment credit.

2. Goods and service production and trading organization and individuals, foreign-invested enterprises and foreign parties to business ccoperation contracts operating in. A- Dot zone which suffer losses after making finalization with me tax office may carry forward those losses to subsequent years and have them included in their taxable incomes. The maximum duration for carrying forward losses is 5 years.

3. Those who work in A Dot zone and are liable to pay personal income tax as provided for by law enjoy a 50% reduction of payable tax amounts.

4. Domestic and foreign tourists entering the industrial and trade sub-zone may purchase imported goods, and enjoy exemption from import tax. value-added tax and excise tax (if any) for goods brought to inland Vietnam valued at not more than VND 500,000/person/day.

Chapter IV

STATE MANAGEMENT OF A DOT ZONE

Article 14.- Organizational apparatus of the A Dot Zone Management Board

1. The A Dot Zone Management Board shall be established under the Prime Minister's decision at the proposal of the People's Committee of Thua Thien Hue province and the Minister of Home Affairs.

2. The A Dot Zone Management Board is a state management agency under the People's Committee of Thua Thien Hue province, which shall perform the centralized and uniform management of construction investment and economic development activities in the zone according to the Operation Regulation, planning, plan and execution progress approved by competent state agencies.

3. The A Dot Zone Management Board has the legal person status: a national-emblem patterned seal; working office; full-time payroll; administrative and non-business funds: and development investment capital allocated from the state budget under annual plans.

4. The head and deputy heads of the A Dot Zone Management Board shall be appointed by the president of the People's Committee of Thua Thien Hue province.

Article 15.- The A Dot Zone Management Board has the following tasks and powers:

1. To assume the prime responsibility for. and coordinate with functional agencies of Thua Thien Hue province in, formulating a master plan for the People's Committee of Thua Thien Hue province to submit it to the Prime Minister for approval; formulate a detailed planning on functional sub-zones and detailed land use planning and plan in A Dot zone and submit them to the provincial People's Committee for approval: manage, disseminate, guide, examine and inspect the implementation of this Operation Regulation as well as plannings and plans already approved by competent state agencies.

2. To make annual lists of investment projects and plans on capital construction investment capital, including plans to issue project bonds, and submit them to a competent agency for approval and organization of implementation.

3. To grant, modify and revoke business registration certificates: licenses for setting up trade representative offices or branches of foreign organizations and traders: investment certificates: investment incentive certificates; work permits for foreigners or overseas Vietnamese to enter A Dot zone to work and do business, as well as certificates of origin of goods in the zone. To evaluate and approve environmental impact assessment reports or certify registrations of satisfaction of environmental standards: planning certificates or construction licenses of investment projects in the zone as well as other licenses and certificates as authorized by a competent state agency.

4. To set and promulgate price brackets, and submit to a competent authority for decision charge and fee brackets according to law. To directly collect and manage and use charges and fees in accordance with law.

5. To act as a coordinator in solving problems arising in the course of formulating and executing production-business investment projects or carrying out other activities in A Dot zone.

6. To coordinate with the local administration and concerned agencies in ensuring compliance of all activities in A Dot zone with this Operation Regulation as well as plannings and plans already approved by a competent state agency.

7. To manage and use development investment capital sources in A Dot zone and manage state budget-funded construction projects in the zone according to regulations.

8. To formulate industrial, trade-service and tourist investment promotion programs and submit them to the provincial People's Committee for approval, and organize their implementation, introduction, negotiation and investment promotion at home and abroad.

9. To closely coordinate with the Ministry of Defense and the Ministry of Public Security in executing defense and security projects.

10. To regularly report to concerned ministries and branches and the People's Committee of Thua Thien Hue province on the implementation of plannings and plans as well as the formulation and implementation of policies in A Dot zone. Based on annual reviews, to propose and submit to the Prime Minister amendments or supplementations to the policies.

11. To perform tasks of cooperation, development support and management coordination between Thua Thien Hue province and Lao provinces, ensuring compliance of A Dot zone's operation with agreements between the Vietnamese and Lao Governments as well as agreements between Thua Thien Hue province and Lao provinces.

12. To perform other tasks assigned by the People's Committee of Thua Thien Hue province in each period.

Article 16.-The People's Committee of Thua Thien Hue province shall:

1. Formulate a master plan on A Dot zone and submit it to the Prime Minister for approval and approve a detailed planning on functional sub-zones of A Dot zone.

2. To approve a detailed land use planning and plans for A Dot zone: to recover and allocate land to the A Dot Zone Management Board for the construction and development of the zone according to regulations.

3. To set land price brackets and assign the A Dot Zone Management Board to specify levels of land use levy, land rent, land use levy and rent exemption or reduction for each project in order to encourage investment, in case no auction of land use rights or bidding of land-using projects is organized, and approve financial options and prices in case auction of land use rights or bidding of land-using projects is organized.

4. To perform the state management of investment projects in A Do: zone according to the approved planning: to authorize the A Dot Zone Management Board to approve domestic investment projects under its competence and. at the same time, authorize others to manage and inspect domestic and foreign organizations and individuals engaged in goods and service production and trading activities in the zone according to regulations: to submit for approval or approve according to its competence annual lists of development investment projects and development investment capita'; plans of the zone.

5. To promulgate specific incentive and preferential policies compliant with current regulations for prioritizing the recruitment and employment of local laborers: to support job training for local laborers; to create conditions for local laborers to work in A Dot zone's enterprises; to encourage and attract highly professional and skilled laborers from other localities to work in the zone; to support the construction of houses for workers and the construction of resettlement areas: to support investment in the development of socio-economic infrastructure as well as service and public-utility works in accordance with the State Budget Law: to support investment promotion, and compensation and ground clearance for speeding up the investment in and development of the zone.

6. To direct the province's local administrations at all levels and management agencies to coordinate with the A Dot Zone Management Board in conducting compensation and ground clearance and taking measures to assure security and social order and safety creating conditions for A Dot zone's enterprises to operate in a convenient manner.

7. To allocate administrative and non-businessfunds and development investment capital from the budget of Thua Thien Hue province to the A Dot Zone Management Board under annual plans.

8. To direct the province's functional agencies to coordinate with and create conditions for the A Dot Zone Management Board to fully perform the tasks and exercise the powers defined in this Regulation; to coordinate with concerned ministries and branches in organizing and managing the implementation of this Regulation for the rapid and sustainable development of the zone.

9. To reach written agreement with Lao provincial administrations on the principles of cooperation, support and coordination in managing the operation of A Dot zone and Lao provinces in accordance with each country's current laws and in line with the development of cooperative relations between regional countries.

Article 17.- Responsibilities of ministries and branches in the state management of A Dot zone

1. Ministries, ministerial-level agencies, government-attached agencies and the People's Committee of Thua Thien Hue province shall. within the ambit of their functions, tasks and powers, perform branch, domain- and territory-based state management of A Dot zone; authorize and guide the A Dot Zone Management Board to perform some tasks of state management of construction investment, planning, natural resources and environment management, urban management and development, land management, labor, import, export and other domains according to law and this Regulation on the "one-stop shop" principle, aiming to facilitate investment, production and business activities of domestic and foreign organizations and individuals in the zone and satisfy its development investment requirements.

2. For domains not decentralized or authorized to the A Dot Zone Management Board, ministries, ministerial-level agencies and the People's Committee of Thua Thien Hue province shall perform the state management of the zone by setting up their attached units (except for the banking domain) and issue regulations on their coordination with the A Dot Zone Management Board in exercising their assigned competence.

Chapter V

IMPLEMENTATION PROVISION

Article 18.- Other matters related to the operation of organizations and individuals in A Dot zone which are not specified in this Regulation must comply with relevant provisions of the Commercial Law. the Investment Law, the Enterprise Law, the Land Law. other legal documents, and treaties to which Vietnam is a contracting party.